Justin Sullivan/Getty Images News

Oracle (NYSE:ORCL) recently reported a good start to the year and hosted a positive investor day, demonstrating their strength in Cloud. With Q1 earnings, revenue came in line with expectations, though margins were a little soft, leading to a slight EPS miss.

With the company’s investor day, the company displayed their recent Cloud strength over the past few quarters and their goal of becoming one of the top cloud infrastructure providers in the market. While this goal may be achievable over the coming years, the company will need to consistently execute and demonstrate ongoing strength.

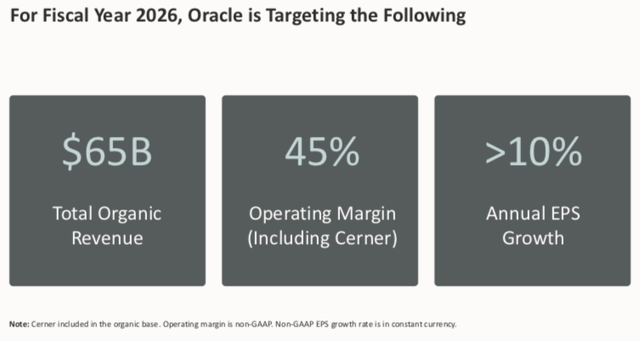

Oracle also provided some long-term financial targets during their investor day, including revenue reaching $65 billion in 2026 with operating margin of 45% and EPS growing 10%+ per year.

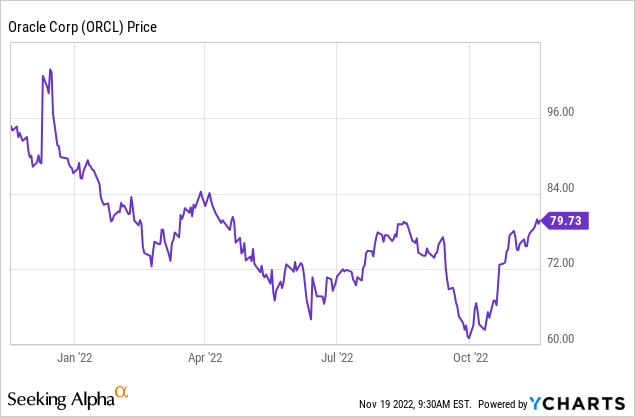

While the stock had been under considerable pressure for most of the year, Oracle has benefited from a relief rally over the past few weeks. In general, the market has rebounded a bit recently, and Oracle had the benefit of hosting a rather positive investor day, which has helped push the stock higher.

However, I believe the company may have some ongoing headwinds which may limit the potential upside over the coming quarters. Yes, the company’s financial targets for 2026 are positive and encouraging, but there are some moving pieces that make me a little cautious.

On top of the challenging macro environment, I believe the integration of Cerner may take some time to play out and margins may be pressured a bit. In addition, this acquisition may limit Oracle’s share repurchases, which they have historically been a serial repurchaser, helping drive EPS growth.

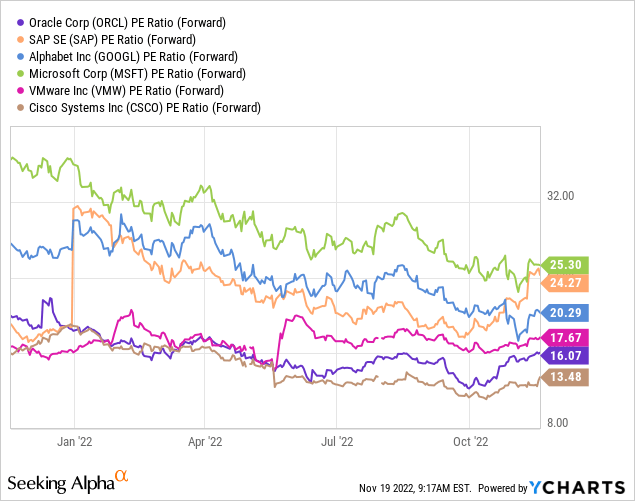

With the stock trading at 16x forward EPS, I believe there could be some longer-term upside, but given the many moving pieces near-term, I remain on the sidelines for now.

Financial Review and Outlook

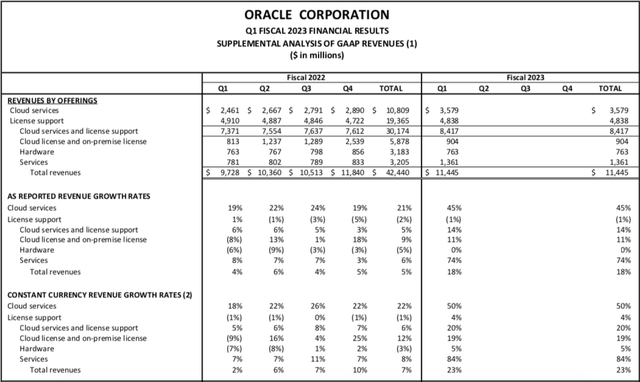

During Q1, the company reported revenue of $11.45 billion, which grew 18% yoy and 23% in constant-currency. And while revenue was only in line with consensus expectations, Cloud Services revenue was particularly strong, growing 50% yoy in constant-currency. It should also be noted that this was the company’s first quarter that they owned Cerner, which is why the company’s reported growth seems much stronger.

Oracle

Not surprisingly, License Support revenue continued to slowly decline, down 1% yoy this past quarter, which is similar to the past several quarters of slow declines.

From a profitability standpoint, the company reported non-GAAP operating income of $4.5 billion, representing a margin of 39%, which is down from the 45% margin in the year-ago period. Yes, some of this margin contraction was due to the broader macro challenges, but the Cerner acquisition also had some margin impact.

Nevertheless, the company reported EPS of $1.03, which was a few pennies below expectations, largely due to the lower than expected margin.

Oracle

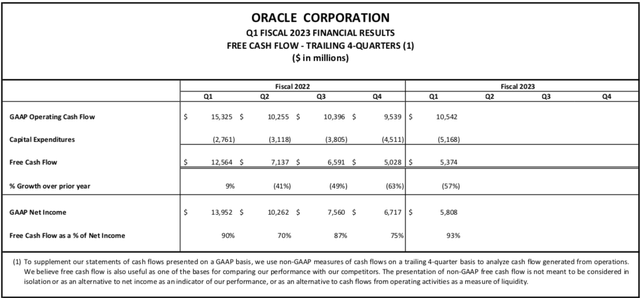

On a positive note, Oracle reported free cash flow of $5.4 billion during the quarter, and while this was down 57% yoy from the year-ago period, FCF conversion continues to remain healthy. During the quarter, FCF reflected 93% of net income, which was actually an improvement from the 90% in the year-ago period. Over time, I believe the company will continue to improve their FCF, which can help instill additional investor confidence.

In the past, Oracle has relied quiet heavily on share repurchases, consistently repurchasing billions of dollars’ worth of shares a quarter. However, Oracle just completed the $27 billion acquisition of Cerner, which may slowdown the company’s share repurchases for quite some time.

Investor Day Review

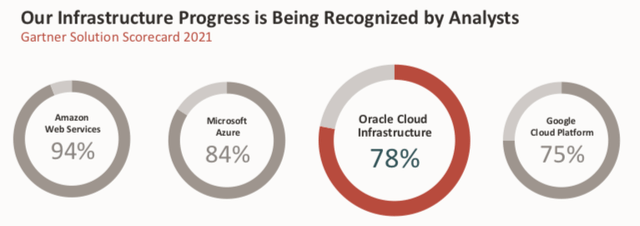

Oracle also recently hosted an analyst day, with the company taking a deeper dive into their cloud business, which grew 50% constant-currency last quarter. During the presentation, the company demonstrated how they could be positioned to become one of the top cloud vendors in the PaaS and IaaS market.

Oracle

According the Gartner, Oracle Cloud Infrastructure scored a 78% on their scorecard, which actually came in slightly above Google Cloud Platform. Historically, investors have viewed the three large cloud players as AWS, Azure, and GCP. However, Oracle is working to demonstrate their cloud platform is just as powerful and efficient. While cloud is still <15% of Oracle’s infrastructure business, there remains a long runway of growth ahead of them, which the company will need to execute on before investors give them the benefit of the doubt.

Oracle

Oracle also provided financial targets for 2026, as seen in the chart above. Based on these targets, this reflects revenue growth of 12% per year, which includes Cerner in the organic base. This does reflect an acceleration of growth, however, both Cloud and Cerner are growing faster than the core Oracle, which means revenue growth should naturally accelerate over time as they become a bigger part of revenue mix.

Additionally, operating margins are expected to reach 45% and while this is quite high relative to industry averages, Oracle is already at 42%. Yes, it’s great to see operating margin improvement, however, it appears there is somewhat limited upside to margin expansion over the coming years.

Valuation

At the end of September, the stock was down around 30% year to date. After presenting a positive investor and providing 2026 financial targets, the stock has actually been up 30% since then, bringing the year to date return to only down 10%.

Oracle has also been a beneficiary of investors rotating out of fast-growth, high-valuation companies and in favor of more defensive, FCF positive companies. Given Oracle’s rather consistent financial performance, it’s not surprising that investors have built positions in the company.

Currently, Oracle trades at just over 16x forward EPS and while this is on the lower-end of some large cap technology companies, that multiple is above the broader market’s valuation.

Nevertheless, the company’s 2026 financial target of 10%+ EPS growth sheds a positive light on growth potential over the coming years. I do believe the company could see their valuation expand over the coming quarters, this will likely be driven by ongoing execution, specifically around Cloud infrastructure and their recent Cerner acquisition.

For now, I remain on the sidelines for a few reasons, though I do believe the company presents a great long-term investment. First, the challenging macro picture does not appear to be clearing up near-term. The USD continues to be strong, which increasingly hurts global companies such as Oracle. Second, while the Cloud infrastructure opportunity is attractive, I believe Oracle will need to continue to execute on this strategy before their valuation reaps the benefit.

Additionally, the company’s recent acquisition of Cerner comes with some risks. In addition to paying $27 billion for the company, Oracle now has increased debt on their balance sheet, which could impact their ability to repurchase shares. Oracle has been a consistent share repurchases, often repurchasing billions of dollars of shares a quarter, which may be put on hold for the time being.

Overall, I believe the company presents a good long-term opportunity, though. remain on the sidelines for now given the many moving parts.

Be the first to comment