ClarkandCompany

Both online and offline retail companies have taken a significant hit in recent months as US consumer retail spending has slipped. E-commerce stocks, such as Etsy (NASDAQ:ETSY), fell faster during the beginning of 2022 as the sharp rise in interest rates lowered the discounted value of its expected future cash flow. Growth-oriented stocks with higher “P/E” valuation typically carry much more extensive exposure to interest rate changes due to the “DCF effect.” Of course, high-valuation growth stocks like ETSY were also weakened this year as many speculative retail investors looked to take profits following the bubble created in 2020.

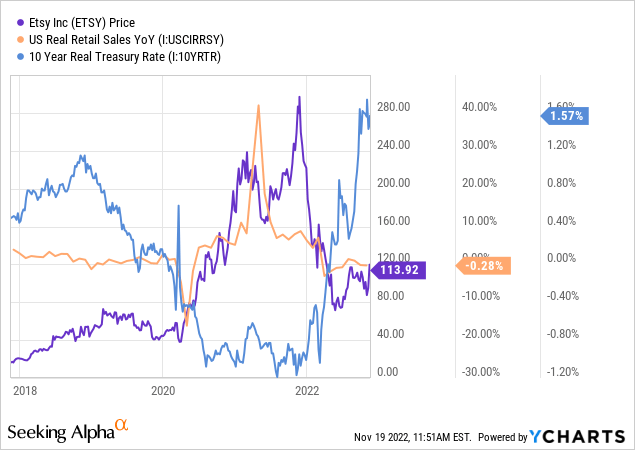

Etsy is facing a “double-whammy” since it is a retail-oriented growth stock; its expected future cash flows and the discounted value of those cash flows are declining simultaneously. These two trends are illustrated clearly by the relationship between ETSY’s value, real retail sales growth, and the 10-year “real” (or after-inflation) Treasury rate. See below:

The stock soared in 2020 as real interest rates plummeted on the Fed’s QE program and rate cuts and were further boosted by a considerable rise in real retail sales growth. In the middle of last year, real retail sales peaked while the real interest rate reached a bottom, signaling the top in ETSY’s price bubble. Since 2022 began, real retail sales have reversed while interest rates have risen, negatively impacting ETSY’s fair valuation and its expected earnings.

In my view, real interest rates are likely now near the top of their cyclical range and are likely to remain flat or decline (if the Federal Reserve pivots even slightly). Given this, I do not expect most growth-oriented stocks to underperform other stocks simply due to changes in valuation, as we saw earlier this year. ETSY trades at a forward “P/E” of 27X today, which still seems high, but far below the 60X+ level from earlier this year. That said, weak consumption outlooks and surveys reveal negative purchase frequency trends particularly large for Etsy, implying it may see sales decline over the coming year. ETSY has also attracted more short-sellers with a higher short-interest level of 9.8%. Accordingly, bullish and bearish factors are facing the stock that I believe will cause it to experience significant volatility over the coming months, with holiday sales a major potential catalyst.

Etsy and the Short-Term Economic Outlook

Etsy is undoubtedly a long-term growth company, so, understandably, many investors do not consider short-term earnings risks to the firm. Etsy’s market capitalization is less than 1.5% of that of Amazon. Though Amazon has a much larger total addressable market (particularly considering its non-retail business), Etsy has significant long-term growth potential. The company projects its total addressable market at $100B, though its annual sales are only $2.5B so far. Still, if it achieved $100B in sales at a 5-10% margin (or $5-10B in income), it would likely be worth at least $50-$100B or 250-600% more than it is today.

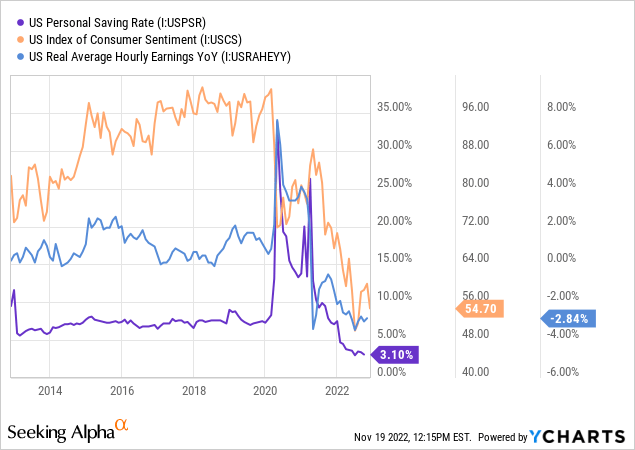

That projection is a “best case scenario” for Etsy, given it can grow into its TAM by keeping competition at bay and, more importantly, financial survival until then. I believe Etsy is likely to face the most significant economic test since its inception over the next two years due to changes in conditions. Real retail sales are slowing, but I suspect they will fall much more dramatically in 2023 as falling real incomes drive consumer sentiment and savings far lower. See below:

Leading economic consumption demand data is historically abysmal today. Many people continue to spend but have far less capacity to do so and are starting to pull back due to underlying inflation. While many analysts continue to paint a pretty picture for holiday sales, economic data and trends in many retail companies, such as Target, clearly illustrate a challenging environment. In the short run, I believe Etsy will report a few quarters of sales and earnings well-below current expectations. Items sold on Etsy are typical of the “higher quality, higher cost” variety (compared to Amazon, Walmart, etc.) since individual craftspeople make many. As such, Etsy could see a more significant hit due to the “luxury price impact” as some people look for cheaper alternatives.

Of course, the increasingly negative economic trend is not necessarily bad for Etsy from a long-term perspective. For one, I believe the recessionary dynamic may bring a few older department-store retailers (1,2,3) into liquidation or extensive downsizing, increasing the competitive advantage for e-commerce. Secondly, economic downturns give companies a need to “clean house” and improve operating efficiency, benefiting their long-term potential. Overall, while a sizeable retail spending decline could hurt Etsy’s value temporarily, I believe it may prove bullish in the long run as it would likely favorably alter the retail industry’s competitive landscape. On that note, a rise in unemployment and layoffs may also indirectly benefit Etsy by encouraging more people to look to create items and sell them on the platform.

Why Etsy May Grow Faster Than Expected

The current consensus estimates for Etsy project an EPS of ~$4.1 for both 2022 and 2023, followed by a rise to $6.5 by 2026. Sales growth estimates assume the firm will raise its revenue from $2.5B this year to $4.1B by 2026 and $7.8B by 2031, achieving a YoY growth pace of around 10-17%. If these projections prove accurate, ETSY would seem a bit overvalued today, only having a long-term forward “P/E” of 17.6X using 2026 EPS estimates. In my view, for ETSY to be a worthwhile long opportunity, the company will need to achieve a more dramatic growth rate over the coming years. Indeed, the company has achieved much faster sales and EPS growth in the past three years than are projected; however, that may be assuming the one-off boost from 2020’s shift does not persist.

Given my economic outlook, I believe Etsy may see its EPS shrink in 2023 as sales slow and people reduce discretionary spending on higher-cost items. However, 2023 may be akin to 2020 as negative headwinds for department-store retailers cause market share to shift favorably to Etsy. Further, the value of Etsy’s “pro-human” business model may be immense as more buyers shift preference toward small businesses where higher quality, unique, handmade items can be found.

The high inflation rate, and related supply-chain woes, are somewhat favorable to Etsy from a competitive perspective. Many of its sellers are domestic and lack a strong dependence on global supply chains (subject to fuel costs, geopolitical strife, etc.). If, for example, the US-China trade relationship breaks down further, Amazon sellers would likely be far more exposed than Etsy as more Amazon items are produced in China.

Additionally, as manufacturer input prices rise (raw materials), the price of all consumer items will increase. Lower-margin “cheaper” sellers would need to raise prices faster than higher-margin “quality” sellers to maintain the same net profit. For example, a rise in textile prices is less problematic for a handmade high-end dress producer than for a lower-end “factory” one because the higher-end producer likely spends less on material inputs and more on labor than the lower-end one. The price gap between factory-made and handmade items would decline as material input costs rise. This point is subtle but could prove highly favorable to Etsy in the long run.

The Bottom Line

The chief long-term risk I see is that Etsy’s managers fail to maintain its “handmade” brand value by allowing more mass-produced items onto its platform. This is a long-standing concern regarding the company. Although allowing more “Amazon-like” sellers on the platform could boost profits temporarily, I believe doing so would jeopardize the company’s core attractive qualities – a platform for small craftspeople looking to sell unique items.

At the end of the day, Etsy is an online platform with few physical assets, so a loss of consumer or seller trust could make it worthless and easily expose it to competitive alternatives. Etsy is a public company, and, in my view, publicly traded firms have a bad habit of pursuing short-term profits over long-term value. At this point, I do not believe Etsy is likely to take that path, but I would be attentive to popular buyer and seller sentiment regarding the firm in case it shifts negatively.

In my view, these qualitative and quantitative factors could fuel Etsy’s long-term growth. The increasingly likely economic headwinds could impair its profits in 2023 but may improve its potential as its competitive advantage grows. For now, I am officially neutral on the stock since I suspect it may decline temporarily as holiday sales and 2023 outlooks disappoint amid headwinds. That said, even at its current price, it seems ETSY will rise in value over the long run as its addressable market is far more significant than its existing sales and is backed by numerous positive qualitative long-term growth factors.

Be the first to comment