KvitaJan/iStock via Getty Images

In the most recent quarter, Oaktree Specialty Lending Corporation (NASDAQ:OCSL) maintained strong credit quality, and the business development company covered its dividend with adjusted net investment income.

Oaktree Specialty Lending is a high-quality business development firm with no non-accruals, and the stock trades at a small premium to net asset value.

Oaktree Specialty Lending recently increased its quarterly dividend by 6% to $0.18 per share, resulting in a 10.1% dividend yield (based on regular dividends).

OCSL, in my opinion, is a very appealing, high-quality BDC stock that passive income investors can purchase right now.

First Lien-Focused Investment Portfolio And Unmatched Credit Quality

The core strength of Oaktree Specialty Lending is its First Lien-focus, which ensures that the business development company’s portfolio consists primarily of the safest debt. First-lien debt is typically highly secured, and Oaktree’s ten-year credit management experience assists the business development firm in selecting the lowest credit risk available.

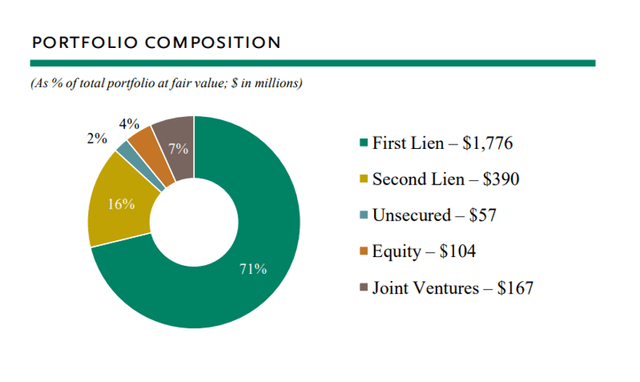

The company’s investment portfolio contained 71% First Lien debt and 16% Second Lien debt, for a total secured Lien investment percentage of 87%. The remaining 13% of the investment portfolio, valued at $2.5 billion as of September 30, was invested in Joint Ventures, Equity, and Unsecured Debt.

Portfolio Composition (Oaktree Specialty Lending Corp)

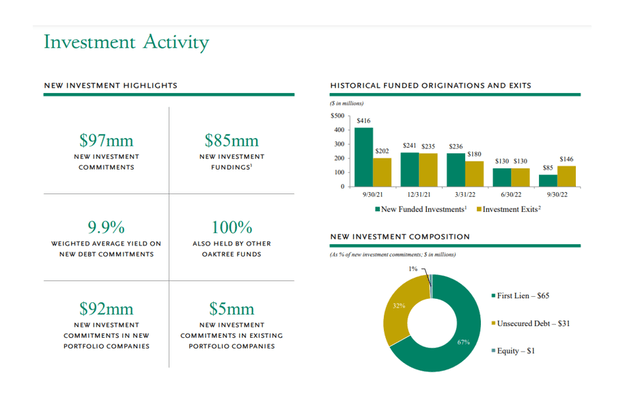

In the most recent quarter, Oaktree Specialty Lending made $97 million in new investment commitments and funded $85 million in new investments. Net new investment fundings fell from $130 million in the previous quarter, but the business development company has plenty of investment opportunities.

The September quarter saw 67% of new investments in First Liens and 32% in Unsecured Debt. Only 1% was allocated to equity, and no funds were invested in second liens.

Investment Activity (Oaktree Specialty Lending Corp)

The most notable feature of Oaktree Specialty Lending’s portfolio is that the BDC had zero non-accrual investments, which is an incredible accomplishment given that even best-in-class BDCs such as Ares Capital Corporation (ARCC) have some investments that are not performing as expected.

Dividend Covered By Net Investment Income

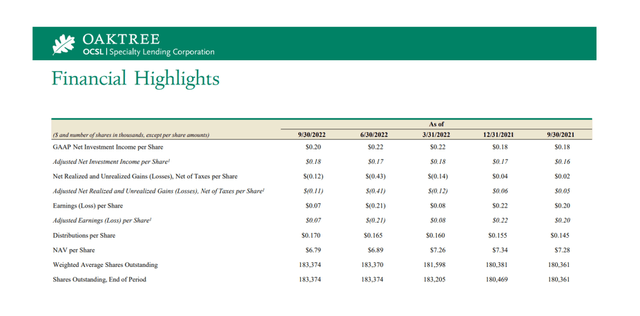

In the quarter ending 30 September, 2022, Oaktree Specialty Lending earned $0.18 per share in adjusted net investment income, and the business development company paid out a quarterly distribution of $0.17 per share.

The pay-out ratio in the September quarter was 94%, compared to a dividend pay-out ratio of 93% over the previous twelve months.

Oaktree Specialty Lending increased its quarterly dividend by 6% to $0.18 per share due to strong portfolio performance.

The BDC also declared a $0.14 per share special dividend to be paid on December 30, 2022, to distribute excess portfolio income.

Oaktree Specialty Lending’s stock yields 10.1% with the new regular dividend payment. The dividend yield, including the special dividend, is 12.1%.

Financial Highlights (Oaktree Specialty Lending Corp)

The Valuation Reflects A High Margin Of Safety

In the quarter ending 30 September, 2022, Oaktree Specialty Lending’s net asset value remained stable at $6.79 per share. The NAV fell by $0.10 per share QoQ, primarily due to $0.11 per share in unrealized investment losses caused by credit spread widening.

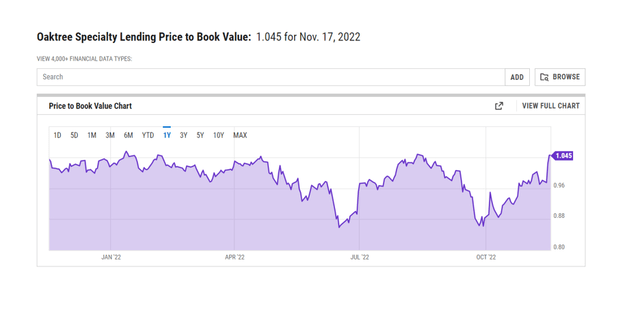

The BDC’s stock is thus trading at a 5% premium to net asset value, despite the fact that the company has excellent credit quality with zero non-accruals.

Why Oaktree Specialty Lending Could See A Lower Stock Price

A rise in non-accruals could be a game changer for the business development company, but in my opinion, this is unlikely.

Although Oaktree Specialty Lending has a well-managed debt portfolio, a recession could result in a minor increase in problem loans. In this case, Oaktree Specialty Lending’s stock may begin to trade at a greater discount to its net asset value.

Overall, I am very pleased with the way the business development company is run, and I believe the quarterly dividend of $0.18 per share is sustainable.

My Conclusion

Oaktree Specialty Lending is a superior business development firm. With zero non-accruals in its portfolio, the company has exemplary credit quality, which attests to the BDC’s senior management team’s credit management experience.

The dividend is covered by adjusted net investment income, and the stock is trading at a very reasonable valuation multiple given the underlying debt portfolio’s quality.

In my opinion, the 10.1% dividend yield is one of the best BDC yields available for passive income investors in the sector, and I continue to recommend the stock.

Be the first to comment