Jezperklauzen/iStock via Getty Images

US technology conglomerate Block’s (NYSE:SQ) share price has suffered massively from the YTD sell-down as it has dropped 80% from pandemic highs of ~$277/share. In addition to macroeconomic headwinds/ongoing Fed rate hikes, the business has been impacted by the dropping Bitcoin price, pushing down the company’s cryptocurrency trading revenues. Upon announcing earnings in Q2’22, the company slashed July’s gross purchase volume (GPV) guidance – another factor behind the stock price weakness.

However, despite the market’s negative sentiment, Block’s operating business has held up fairly well so far and despite the revenue slump, gross margins have stayed stable at 33%-34% this year.

Excluding the impact from crypto and BNPL segment, the two other SQ segments – Cash App and Square – have shown strong growth this year. Whereas, with the acquisition of Afterpay completed in Jan’22, SQ is not only well-positioned to compete in the Buy-Now-Pay-Later (BNPL) market but will also be able to “close the loop” between Square and Cash App ecosystems. BNPL expansion has already proceeded with integrations in other regions, including Canada and the UK.

The company is also cutting costs and is getting somewhat prepared to head into a potential recession. Liquidity should not be an issue, at least in the near term.

So overall, despite the ongoing issues and shaky macro outlook, SQ stock currently presents an interesting (yet risky) bet for the recovery of tech stocks. And there is a way to own it much cheaper than buying it on the open market.

ThinkSmart

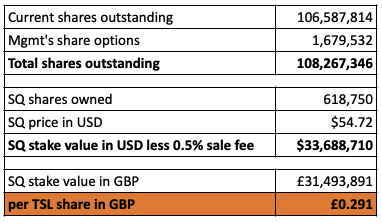

ThinkSmart is a London AIM-listed company which is basically a holding company for 618,750 SQ shares, currently worth around £32m. Last month, ThinkSmart has agreed to be acquired by its Chair/CEO/Founder Ned Montarello (owns 29%). TSL shareholders will receive net proceeds from the company’s stake in Block that is about to be sold. At current SQ prices, the consideration amounts to £0.29/share and offers a 17% upside. That upside/gain can then be recycled into your personal SQ stake.

The offer will have to be approved by a simple majority of independent TSL shareholders (in number) + 75% of total votes cast. Aside from Montarello, the remaining insiders own 12% shares and support this transaction. It’s not yet clear whether they will be considered as an ‘interested party’, however, I expect the shareholder approval to pass easily. Consideration is expected to reach accounts in Nov’22, so the timeline is quite short.

TSL’s SQ Stake (Author’s calculations)

TSL received its SQ shares earlier this year after it sold a 6.5% stake in buy-now-pay-later operator Clearpay to Afterpay in exchange for Afterpay’s stock. Shortly after, Afterpay got acquired by SQ. TSL management vaguely promised return of capital a few times but offered no clear details and did not elaborate on future plans for the company. Due to this uncertainty, TSL used to trade at an average 30% discount to its SQ stake.

Eventually, management decided the market is putting too big of a discount on the SQ stake, and in May ’22 announced a strategic review, that culminated in the current take-private transaction. Montarello has set up a good deal for himself – he is essentially getting TSL’s balance sheet (around £1m net cash) + the remaining operating business for free.

The chances of Montarello walking away from this transaction seem slim.

Likewise, I expect TSL shareholders to be supportive as there is very limited further upside in trying to push for a better offer:

- Previously, TSL traded at a large 30% discount to SQ stake.

- Current consideration comes only at a minor discount to TSL NAV.

- Shareholders, who want to continue having exposure to SQ, can easily do so by acquiring shares directly after the transaction proceeds are received.

Risks

The puzzling part of this transaction is the timeline for the monetization of SQ stake. Scheme booklet dispatch and shareholder meeting are expected in October. The scheme record/implementation date is expected shortly after that (October/November) at which point TSL shares will get delisted. Only after that TSL intends to dispose of SQ shares with a distribution of the proceeds expected in November. It is not clear why management would sell SQ shares only after the implementation date and not before. The stake could also get easily liquidated today. Naturally, this raises the question of whether management can somehow screw shareholders once the shares are delisted. Their recent track record is a bit spotty – Clearpay was sold at a lower valuation than expected, and communication after the sale was quite vague, causing a very wide discount to NAV. Having said that, management still owns a stake of over 40% and has a history of large capital returns (£25m in 2019-2021 + £2.5m last month). Most importantly, of course, the bidco will be under a contractual obligation to sell and distribute SQ shares following scheme implementation. Any unexpected issues will likely be followed by shareholder lawsuits, and that should prevent any value destruction.

I am also not 100% certain whether the distribution will be classed as the return of capital or dividends and in turn the tax treatment for the receiving shareholders. The last distribution in Jul’22 is mostly classed as the return of capital.

Conclusion

As SQ share price has clearly suffered amid macroeconomic/industry headwinds, a contrarian investor might consider the stock amid the recent stock price weakness given potential BNPL business expansion. Interestingly, there is currently an opportunity to own SQ at a discount to even currently depressed prices in the form of ThinkSmart shares.

Be the first to comment