jetcityimage

Last time, when we initiated to cover Nissan Motor Co. (OTCPK:NSANY) with a publication called “show me the story“, our conclusive paragraph was based on the next supportive catalysts – dividend payment reestablishment and positive free cash flow evolution.

Where we are now?

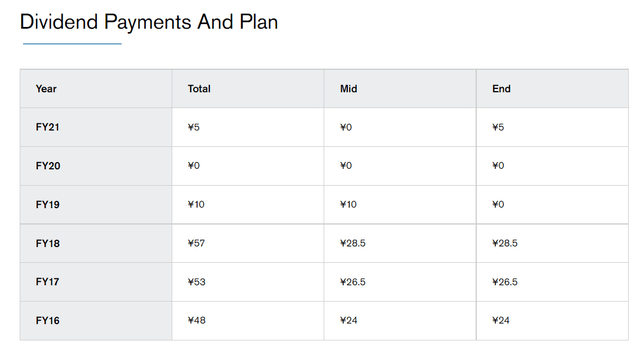

The dividend payment was restarted at a much lower rate than the pre-COVID-19 level; however, this shows some support at the investor community level. At Nissan’s today stock price, the company is yielding 1%.

Nissan Motor dividend restarts

Source: Nissan Motor Co corporate website

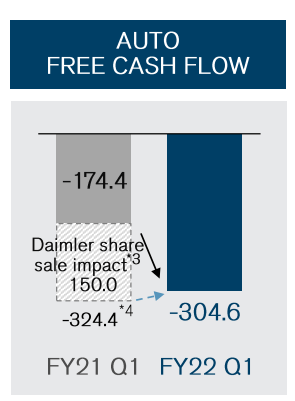

Looking at the free cash flow evolution, Nissan was still in negative territory, but we should report that if we adjust for the Daimler sale impact, FCF evolution was better compared to last year’s results. Numbers in hand, cash flow was totally offset by higher working capital requirements, and thanks to a specific question in the Q&A, it appears that the management is confident it will achieve positive numbers.

Nissan FCF evolution

Source: Nissan Motor Co Q1 results

Why are we still confident?

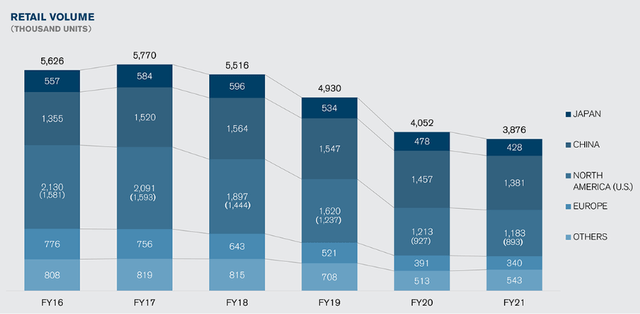

Well, here at the Lab, we have a few reasons. It has been more than twenty years since the yen weakened over 140 against the US dollar. This is going to be a boon for Japanese companies, which unlike most of the world’s equity markets also enjoy the expansive monetary policy of its central bank. At the aggregate level, this support has not been sufficient to ward off the blows of the complex macroeconomic scenario, but it has reduced its impact. Indeed, since January, the Nikkei 225 has lost almost 9% versus the double-digit reductions of other stock exchanges in developed countries. This will certainly support exporter companies such as Nissan. Looking at the details, the company has just a small fraction of its total sales in its home country. Japanese retail volume accounts for approximately 11% of the company’s total sales. Thanks to a positive FX evolution, Nissan might see stronger sales, especially in the US. Here at the Lab, we cover many car automakers, lower vehicle production has been offset by higher selling prices. However, we believe this is not sustainable.

Source: Nissan Motor Co corporate website

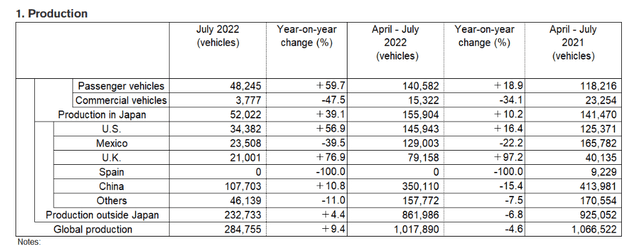

Nissan production, sales, and exports for July 2022

Source: Nissan Production report

Aside from the three investment recaps already mentioned in our first article, we believe that the Wall Street consensus is not in line with the company’s guidance. In Q1, cross-checking the numbers, Nissan delivered a result of 30% above the average estimates. Despite logistic constraints and semiconductor shortages, profits are ahead of targets as Nissan is consistently pushing forward with its business restructuring plan to improve top-line sales and lower its fixed costs. The company’s production is progressively recovering, and EV sales are moving on. In addition, related to our point 3), Nissan just announces a new acquisition of Vehicle Energy Japan to support its all-solid-state battery technology development for Alliance 2030.

Conclusion and Valuation

The dividend was restored and FCF should turn positive in H2. Despite the positive results, Nissan left unchanged its outlook due to raw material inflationary pressure and ongoing macro challenges. Once again, Nissan’s Price to Book value is lower than its historical average, and someone might see that as a good entry point coupled with a compelling valuation. However, we reiterate our neutral rating, preferring other investments within the sector, firstly Volkswagen (OTCPK:VWAGY) and then Ferrari (RACE).

Source: Nissan Motor Co Q1 results

Be the first to comment