Zoran Zeremski/iStock via Getty Images

Moving iMage (NYSE:MITQ) is a supplier to movie theaters, especially smaller and medium-sized ones, which comprise 70% of its revenue. It works mostly on a project basis including a host of third-party products, good for two-thirds of revenues. The company had a tough time during the pandemic:

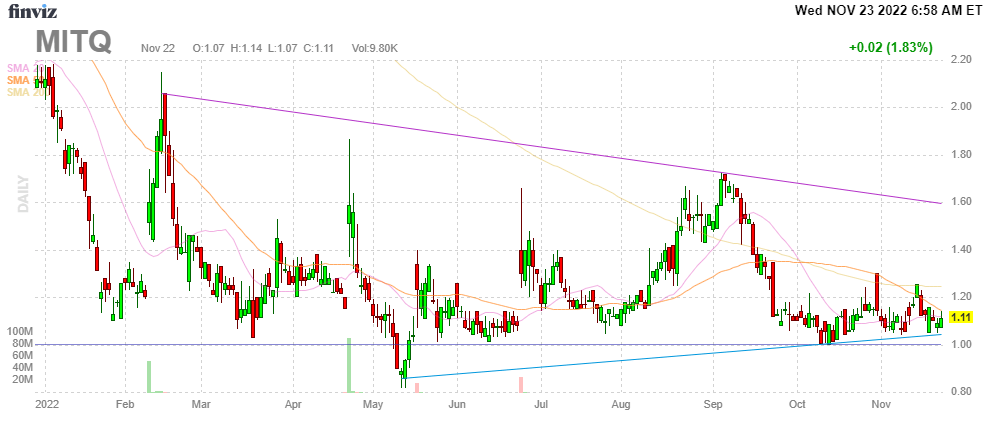

FinViz

But moviegoing is back and the company has a number of tailwinds:

- Recovery from the pandemic

- Upgrade cycle of technology that is in the early innings

- US government grants that are used for upgrades and refurbishing

- The shift towards more own products

- The introduction of new, higher-margin products

- A shift beyond movie theaters

- Expansion overseas

- M&A

The $16B government grants came from the CARES Act through a program called the Shuttered Venue Operations Grant, or SVOG which has paid out $14.6B, $2.5B of which has gone to movie theaters.

This can be used for refurbishing and upgrading to enhance the moviegoing experience. Many theaters are doing that, adding in-house bars, lounges, restaurants, and even breweries, as well as in-cinema dining, which is the fastest-growing part of the market.

Things seem to come together with the technology upgrade cycle kicking in. The company participated in some 17K cinema screens in the previous upgrade cycle. A

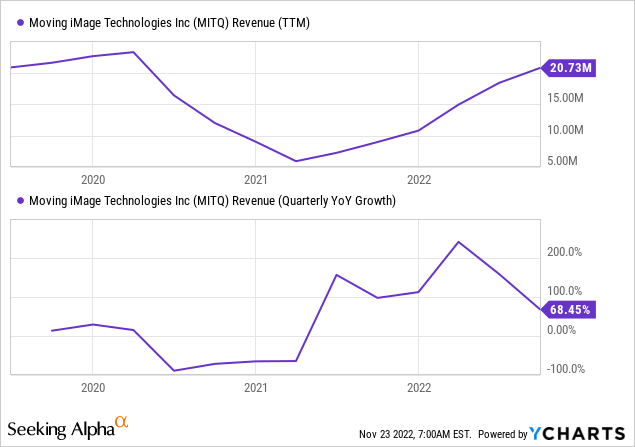

Add to that the government grants, the recovery from the pandemic, and the new models for movie theaters and all looks to be hitting at once:

But growth, and more especially gross margin improvement is also coming from a product mix shift towards more of its own produced goods. They have 50+ of these like the market-leading Caddy line (cupholders etc.) and the acquired USL product line. From the IR presentation:

High hopes accompany a trio of new products that have yet to be introduced or have just been introduced:

- CineQC, a sophisticated SaaS platform for the management of theaters and venues. It produces producing recurring revenues and scored a significant customer win with National Amusements. There isn’t something comparable in the industry, so this can have legs.

- MITranslator, opening cinemas to 70M+ of non-English speaking audiences, is yet to be released.

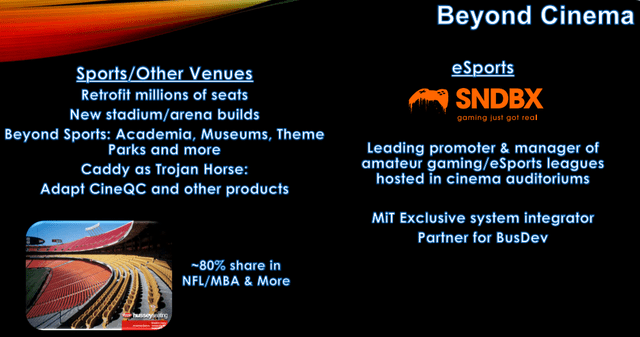

- Esports with Sandbox where iMage serves as an exclusive technology provider is especially interesting for theaters with excess capacity.

CineQC seems especially promising as there isn’t anything comparable on the market and it’s a SaaS product likely to produce very high gross margins. One can gauge its capabilities from the PR:

CineQC SaaS platform utilizes secure Near-field communication (NFC) “Area Tags” to link places, people, smart equipment and time with roles, responsibilities and tasks. Using NFC-enabled tablets, users are alerted to engage with specific Area Tags. Once scanned, the appropriate checklists and equipment controls are presented to each particular user or user group. The CineQC platform provides customizable checklists, equipment telemetry and incident documentation with centralized custom reports that enable quality assurance, staff management, inventory control and back-office analytics. Additionally, the platform enables remote access to control audio, video, lighting and HVAC systems in auditoriums, kitchens, lobbies and perimeters through an intuitive user interface. As a result, CineQC provides both operational excellence and litigation mitigation in one software system.

Esports, which the company is launching in cooperation with Sandbox also hasn’t been launched yet but this too is arriving soon (Q4CC):

are in the process of signing theater operators to host these leagues with their excess theater capacity… Each theater will require one complete system that consists of six gaming cards and production card, so the potential here for initial sales and then refreshed sales overtime as new consoles and technologies advance. And the initial interest has been extremely high, because Sandbox closes deals, we expect to receive orders shortly.

Management claims there is high interest in these products and these can also be introduced in markets beyond movie theaters:

The Caddy products, which have a market-leading role in movie theaters, is a prime candidate for establishing positions in stadiums, arenas and other venues, where it already has an 80% share in markets such as the NFL, MLB, NBA, and NHL.

But it works the other way around as well as the strong relationship that Caddy has with many stadium and arena owners and operators can be leveraged to sell other products, especially CineQC, from the Q4CC:

While the core Caddy products have yet to recover, we see a greater opportunity to leverage our Caddy product line strong position in sports stadiums and arenas as a touch point for fan interaction. In development, we have potentially disruptive new digital products and services that we hope to be trialing by the end of fiscal 2023… Another longer term opportunity would also leverage Caddy strong relationship with stadiums and arenas, their operators.

Then there is international growth, which is promising especially for the three new products, eSports, CineQC, and the translator, all three have already garnered strong interest abroad, according to management.

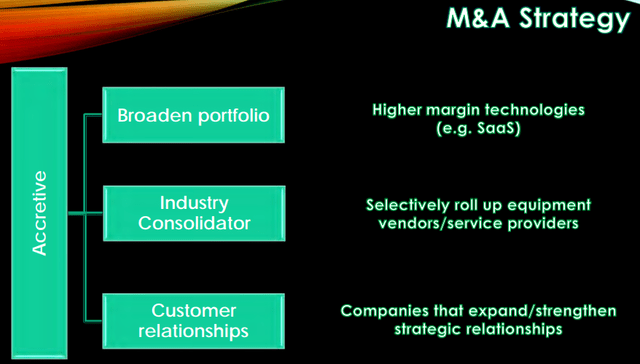

M&A could add to the company’s line-up, like the USL line products acquired last April. Management sees three rationales for M&A:

Financials

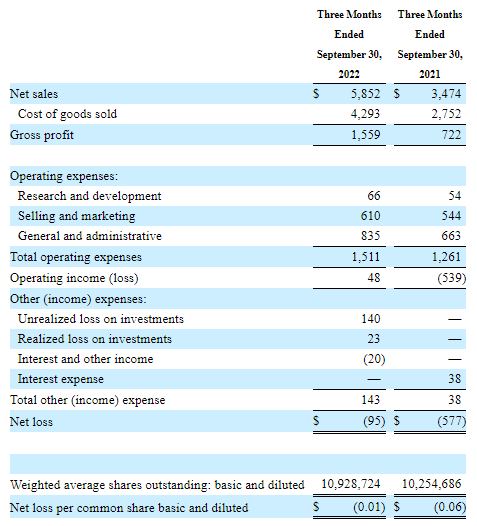

Things are progressing with a 69% revenue growth in Q1/23, from the 10-Q:

MITQ 10-Q

The company is basically breakeven already. What is notable is the gross margin expansion of 580bp to 26.6% with gross profits rising 116% to $1.6M, almost twice as fast as revenue growth. Mix shift is the main driver here:

- Projects (roughly two-thirds of revenue); gross margin in the mid-teens as much of these are pass-through cost of FF&E (Furniture, Fixtures, and Equipment)

- Installation services; gross margins in the mid-20s

- Technology products; margins in the high-teens, low 20s

- Proprietary manufacturing products (Caddy, USL and the new products); gross margins of 35%-55%

- The CineQC SaaS product is likely to obtain much higher margins than all of the above.

From management (Q1CC):

For example, in Q1, in addition to USL, we also saw strength due to the technological upgrade cycle for servers and screens. Over time, as our CineQC SaaS platform becomes a larger contributor, we release our MiTranslator. And as other products in development come to market, we expect this to shift more significantly away from FF&E.

OpEx is rising much slower than revenues, with OpEx rising just 19.8% in Q1/23 y/y so apart from gross margin expansion there is also a good deal of operational leverage.

Management expects all three (revenue growth, gross and operational margin expansion) to continue this year and sees FY23 revenue rising 20%-28% to $22M-$23.5M with EPS between $0.04-$0.08, with gross margin expanding to the mid to high 20s on mix shift toward higher margin products like the USL products, Caddy products later in the year and eSports and CineQC.

There was a strong hint that this guidance could be increased in Q2 as the company has more data on the market acceptance of the new products, on which much of the growth, but especially margin expansion depends.

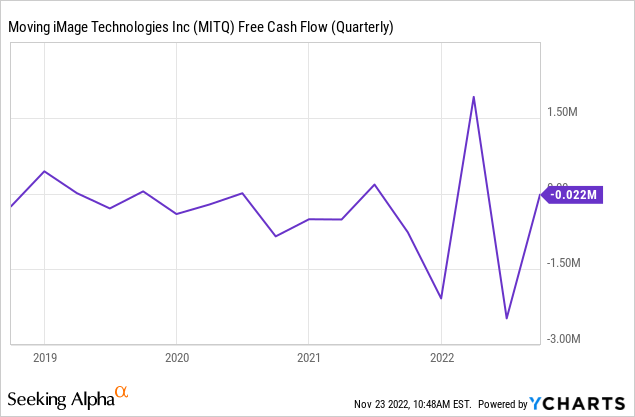

Except for Q2/FY22 and Q4/FY22, cash bleed is basically zero:

There was cash bleed before, but this was largely the effect of the pandemic, from the 10-K:

Net cash used in operating activities was $3.39 million for year ended June 30, 2022, due primarily to the operating loss combined with an increase in accounts receivable, an increase in inventory, offset by an increase in customer deposits.

The operating loss is all but gone and revenues have recovered from the pandemic.

The company had $6.8M in cash and equivalents and no debt at the end of Q1, which gives them a long runway on present cash generation and one would expect the company’s cash generation to improve on the back of rising revenues, gross margin expansion, and a great deal of operational leverage.

However, introducing new products and entering new markets requires funds, so this is an area that investors should keep an eye on. Management seems to think there are no worries here as they are set to reactivate its share buyback program after the blackout period expires.

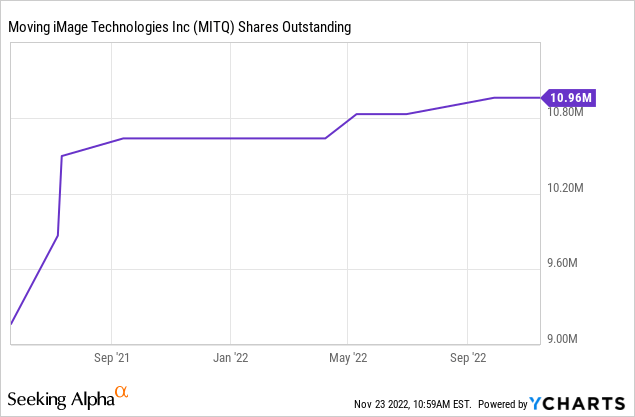

Since the IPO in mid-2021 when the company was struggling with the effects of the pandemic, there hasn’t been much in terms of dilution either:

Valuation

We’re already in fiscal Q2/23 so based on the midpoint of guidance ($23M revenue and $0.06 EPS), it can’t be said that the shares are expensive. With 11.1M shares outstanding (fully diluted) the market cap is just $12.2M and the shares sell at an FY23 EV/S of 0.23x. That seems ridiculously low to us.

Risk

It could all go somewhat slower if the economy slumps into a recession and revenue growth slows down, and/or new products disappoint. But we’d argue that much of this would be priced in, given the low valuation of the shares.

Conclusion

There are good reasons to be optimistic about the shares. Growth is likely to be brisk given the various tailwinds, and because it’s combined with margin expansion on a product-mix shift and operational leverage, profit growth should be considerably faster.

Additionally the shares are very modestly priced especially on a sales multiple and add to that a share buyback program, and we see higher prices ahead. It might take quite a bit of patience though. Guidance could also be increased at the Q2CC.

Be the first to comment