photoschmidt

Investment Thesis

Despite its stellar margins in the Network segment thus far, Warner Bros. Discovery’s (NASDAQ:WBD) recovery prospects remain tentative over the next few quarters, due to its lack of overall profitability and massive debts. In contrast, Walt Disney Company (NYSE:NYSE:DIS) is expected to record excellent expansion in profitability, given its strong IP portfolio and the robust demand for theme parks. Naturally, it is also assuming that Bob Iger from DIS, as with David Zaslav from WBD, are able to successfully turn around the sinking and highly unprofitable streaming market.

Depending on the individual investors’ risk tolerance level, both stocks will still be relatively volatile, with little prospects for sustainable stock recoveries during the worsening macroeconomics. On the other hand, DIS and NFLX are expected to launch their ad-supported tiers by Q4’22, thereby, potentially boosting their financial performance in the short term. WBD has already reported notable success in that segment, recording 10.41% QoQ growth in advertising dollars from D2C by FQ3’22. Thereby, highlighting the potential in their stock re-ratings, assuming the Fed’s earlier pivot naturally.

How Does Their Financial Performance Compare?

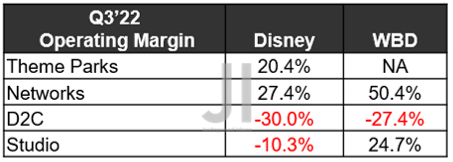

DIS & WBD Revenue By Segment

With a mixed report card and declining profitability, it is no wonder that DIS plummeted by -13.16% on 9 November 2022. Though its theme park has propped its financial performance QoQ, other segments have dragged down sentiments, especially with the reduced advertising revenue from ESPN and Hulu. Its D2C segment has also underperformed, due to the FX headwinds and higher subscription growth from lower-priced markets, despite the 14.6M subscriber adds in the quarter.

DIS’ Theme Parks continue to execute brilliantly, with massive top-line contributions thus far. This is probably attributed to the raised multi-day pass prices by 6% in February 2022, due to the robust pent-up demand post-reopening cadence. A further hefty increase of up to 12% is expected for most categories by early 2023, easing some of the company’s D2C pain.

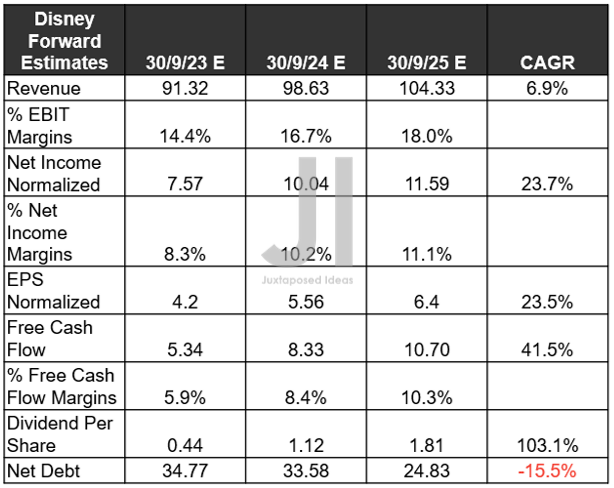

DIS & WBD Operating Margin

S&P Capital IQ

Meanwhile, DIS’s D2C segment continues to underperform, with EBIT margins of -30% in the last quarter, with WBD similarly reporting an abysmal -27.4%. It truly begs the question of how the global streaming leader, Netflix (NFLX), is able to remain profitable with EBIT margins of 19.3% at the same time, despite its current lack of advertising revenue against DIS at $3.53B and WBD at $2.04B. Maybe that is why NFLX is able to still boast an excellent market cap of $128.16B and premium NTM P/E valuations of 30.29x at the time of writing, despite the tragic -52.01% correction since November 2021.

Given the massive shift in consumer behavior post-pandemic, DIS’s theatrical releases are underwhelming as well. The Marvel excitement has waned after hitting the peak with Doctor Strange in the Multiverse of Madness early this year. The latter has reported an exemplary $955.7M in the global box office, with others struggling to break the $500M mark.

Black Panther has had moderate successes thus far with $550M in global box office sales by the second week against production costs of $250M, though indicating another underperformance against the original at $704M and $200M, respectively. Assuming that a similar malaise hits Avatar, the company may report less than the original box office at $2.92B against gargantuan reported production costs of $2B. Thereby, triggering more headwinds for the company’s performance indeed.

On the other hand, WBD has shown promising QoQ growth thus far, with a 4.1% in D2C revenue and nearly 3M subscription growth. We expect a potential boost ahead, given the pulled-forward HBO Max/Discovery+ streaming service by spring 2023. The management has also guided raised subscription prices for HBO Max next year, potentially improving its top-line and margin expansion then.

Despite the FX headwinds, the WBD management has also raised its merger synergy savings to $3.5B over the next few years, with a notable -11% reduction in operating expenses by FQ3’22 and the guidance of up to -20% by FQ4’22. Therefore, we may see WBD report break-even operating margins over the next few quarters, pointing to the management’s excellent operating efficiencies in this uncertain economic environment. Its Stock-Based Compensation has been comparatively conservative at $0.25B over the last two quarters as well, compared to DIS’ at $0.52B at the same time.

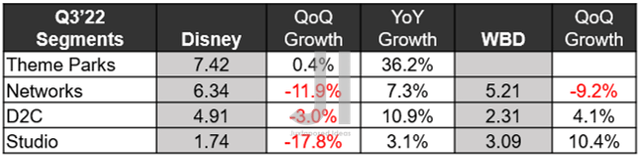

DIS Projected Revenue, Net Income (in billion $) %, EBIT %, EPS, FCF %, Dividends, and Net Debts

S&P Capital IQ

In the meantime, DIS’ top and bottom line growth remains exemplary despite the rising interest rates and inflation, projected to expand by 10.4% and 18.8% YoY in FY2023, respectively, pointing to the robust demand for its offerings. Theme park experiences continue to be the backbone of the company, accounting for 34.69% of its revenues in the last twelve months, especially aided by the raised ticket prices thus far. This trend is expected to sustain over the next few years, boosting its revenue CAGR to 6.9% and EPS CAGR to 23.5%, against pre-pandemic levels of 7.7%/0.3% and hyper-pandemic levels of 5.9%/-15.1%, respectively.

The improvement in DIS’s margins is impressive as well, from EBIT/ net income/ FCF margins of 21.4%/13.8%/1.6% in FY2019, to 14.7%/7.8%/1.3% in FY2022, and finally to 18%/11.1%/10.3% by FY2025, despite the impact of the unprofitable D2C streaming. Thereby, it is not surprising to see market analysts projecting a reinstatement in its dividends by FY2023, with an estimated moderation in its net debts from $45.21B at the start of the pandemic to $24.83B by FY2025. With the consensus price target of $126.50, the DIS stock may potentially witness a 37.80% upside from these 2014 blood-bath levels.

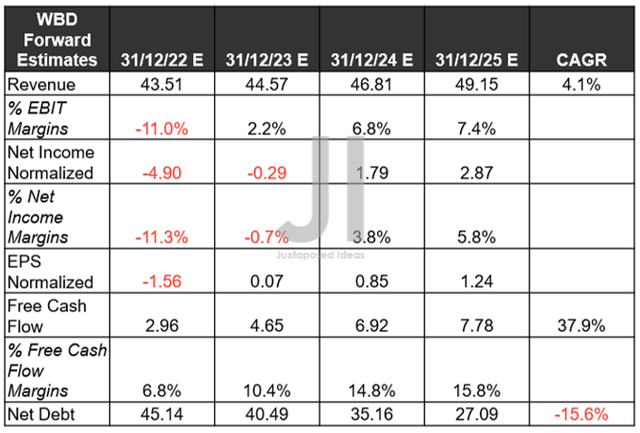

WBD Projected Revenue, Net Income ( in billion $ ) %, EBIT %, EPS, FCF %, and Net Debts

On the other hand, WBD is not expected to report GAAP profitability until FY2024, though with impressive FCF generation from FY2022 onwards at a CAGR of 37.9% over the next few years. The improvement in its profitability is stellar as well, to EBIT margins of 7.4% by FY2025, net income of 5.8%, and FCF of 15.8%. Assuming so, the company would be able to remarkably pay down its massive net debts from peak levels of $53.19B in FQ2’22 to $27.09B by FY2025, indicating an impressive 50% reduction.

In the long term, we expect to see the WBD stock moderately recover from these peak recessionary fears, potentially nearing the consensus estimate’s price target of $17.60 with a 63.42% upside from current levels. Furthermore, given its lower market cap and poorer valuations compared to its peers, the stock could potentially outperform DIS and NFLX by the end of the decade, given the latters’ baked-in premium.

We encourage you to read our previous article, which would help you better understand its position and market opportunities.

- Disney: Despite The Recession, Donald Is Too Feisty

So, Is DIS Stock A Buy, Sell, or Hold?

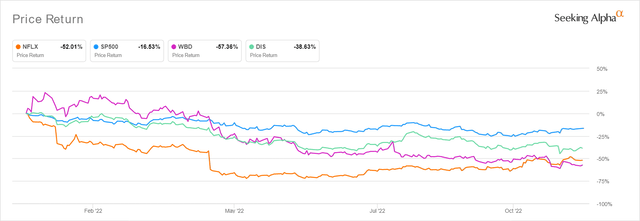

DIS & WBD YTD Stock Price

It is apparent that the upbeat October CPI reports have boosted both stocks, despite their relatively underperforming Q3’22 earning calls. DIS has recorded a decent 11.04% recovery by now, with WBD performing relatively better with a 12.03% rally, after a tragic -26.29% plunge post-earnings call. Depending on how the upcoming Feds meeting in December turns out, we may see sustained optimism ahead. 75.8% of analysts are already predicting a 50 basis point hike then, indicating a speculative pivot similar to the Bank of Canada’s recent moderation, despite the raised terminal rate to over 6%.

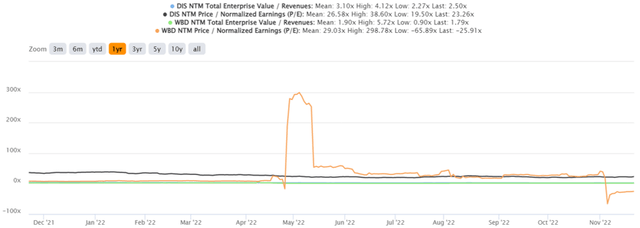

DIS & WBD YTD EV/Revenue and P/E Valuations

Therefore, it is not surprising to see both stocks recovering moderately, trading above their previous rock-bottom valuations. DIS is currently trading at an EV/NTM Revenue of 2.50x and NTM P/E of 23.26x, lower than its YTD mean of 3.10x and 26.58x, respectively, however, improved from its recent lows of 2.27x and 19.50x. On the other hand, WDB is still trading optimistically near its YTD means at EV/NTM Revenue of 1.79x and NTM P/E of -25.91x, in line with its YTD EV/Revenue mean of 1.9x though elevated compared to its YTD P/E mean of 29.03x.

As a result, we cautiously rate DIS as a speculative buy for investors with long-term trajectories. Recovery would eventually arrive, once the macroeconomics strengthens, streaming turns profitable, and market sentiments improve. Patience for now and hold through the storm. Meanwhile, those hoping for a WBD acquisition by Bob Iger would likely be disappointed, due to the controversy surrounding the previous Century Fox purchase. Furthermore, DIS would be hard-pressed to handle another massive debt load, since Bob Chapek allegedly was fired over the disappointing FQ4’22 performance and minimal profitability thus far. We’ll see.

Be the first to comment