Mlenny

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on September 16th, 2022.

RiverNorth/DoubleLine Strategic Opportunity Fund (OPP) fund is coming close to finishing up its latest rights offering. It was announced on August 11th, 2022. The subscription period expires on September 23rd, 2022. Stanford Chemist recently wrote up more details on the deal itself, so I won’t go over topics we’ve already touched on.

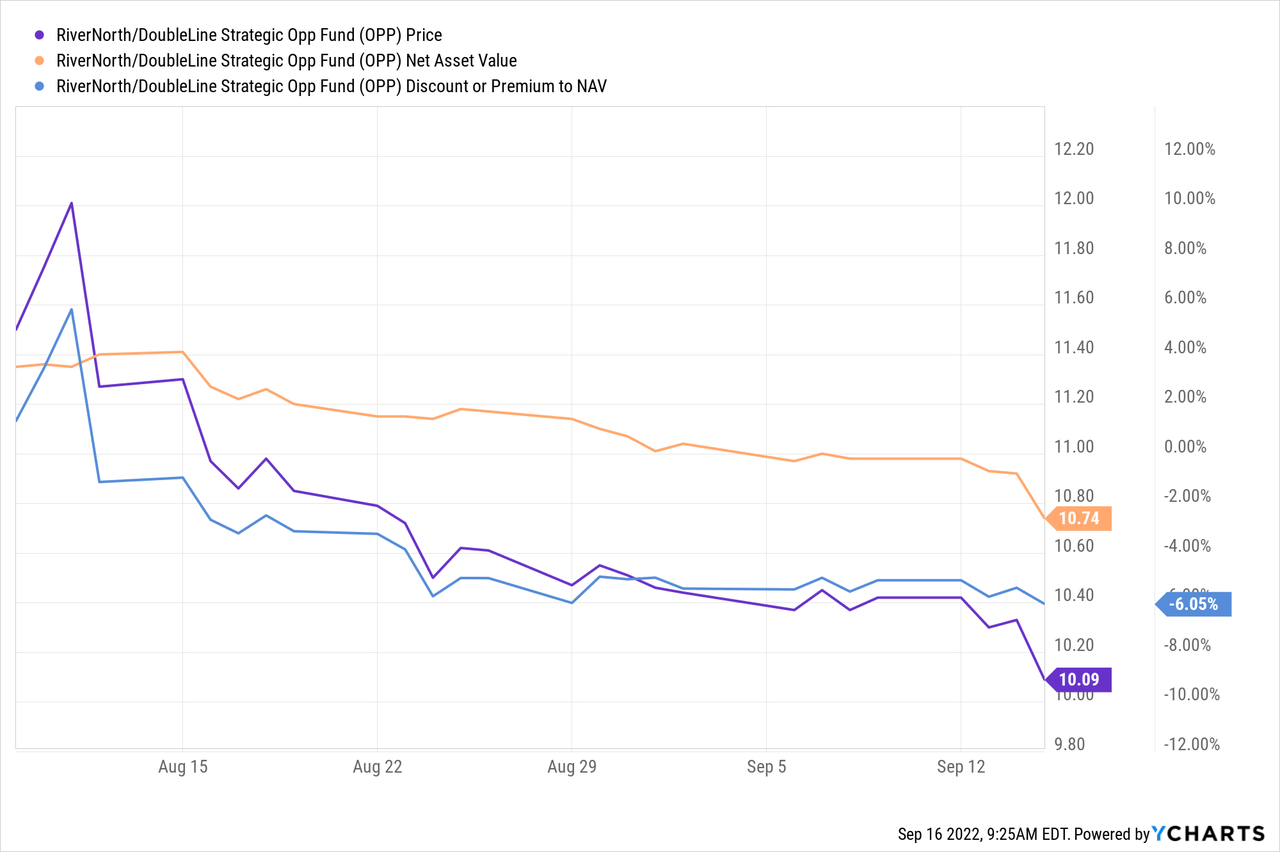

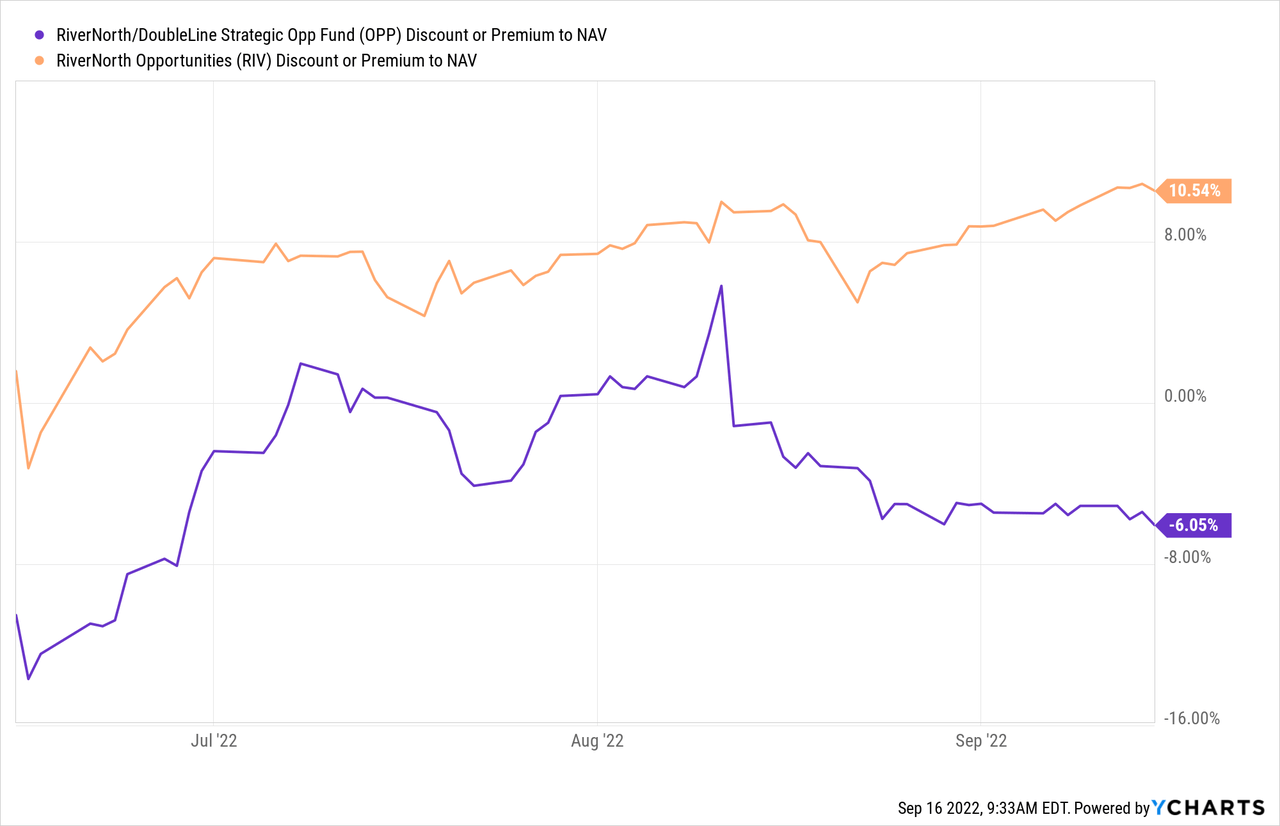

Since the fund announced the rights offering, we saw the usual collapse in the share price. It went from a premium to a discount, which is a pretty regular occurrence.

YCharts

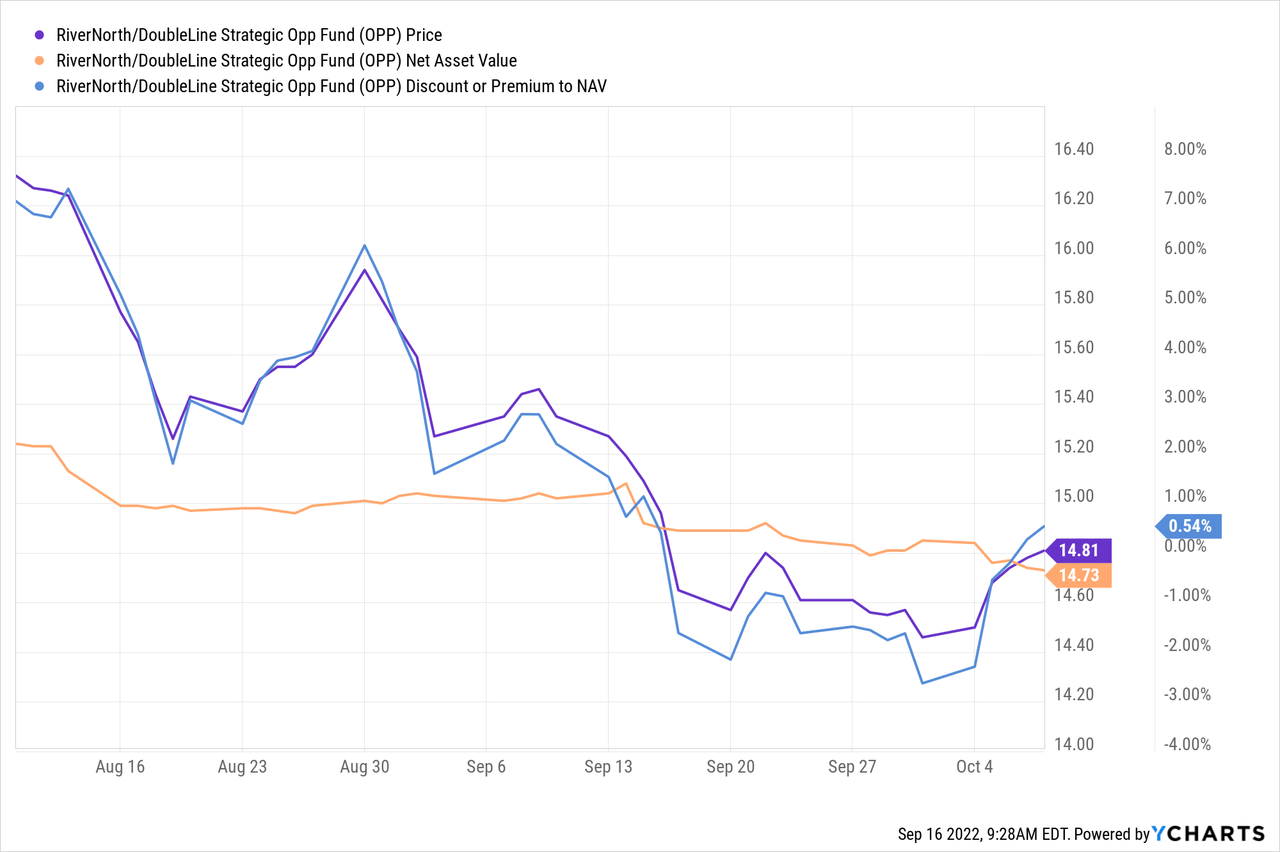

Interestingly, this rights offering was announced almost a year after the previous rights offering. On August 13th, 2021, was when the press release was posted. Again, Stanford Chemist has a post that recapped the rights offering in greater detail. I’m looking more at the price action of the offering because it will be relevant for its sister fund.

We see that the fund went from a premium to a discount through the rights offering. It did pop back up to a premium shortly after the rights offering was over, though.

YCharts

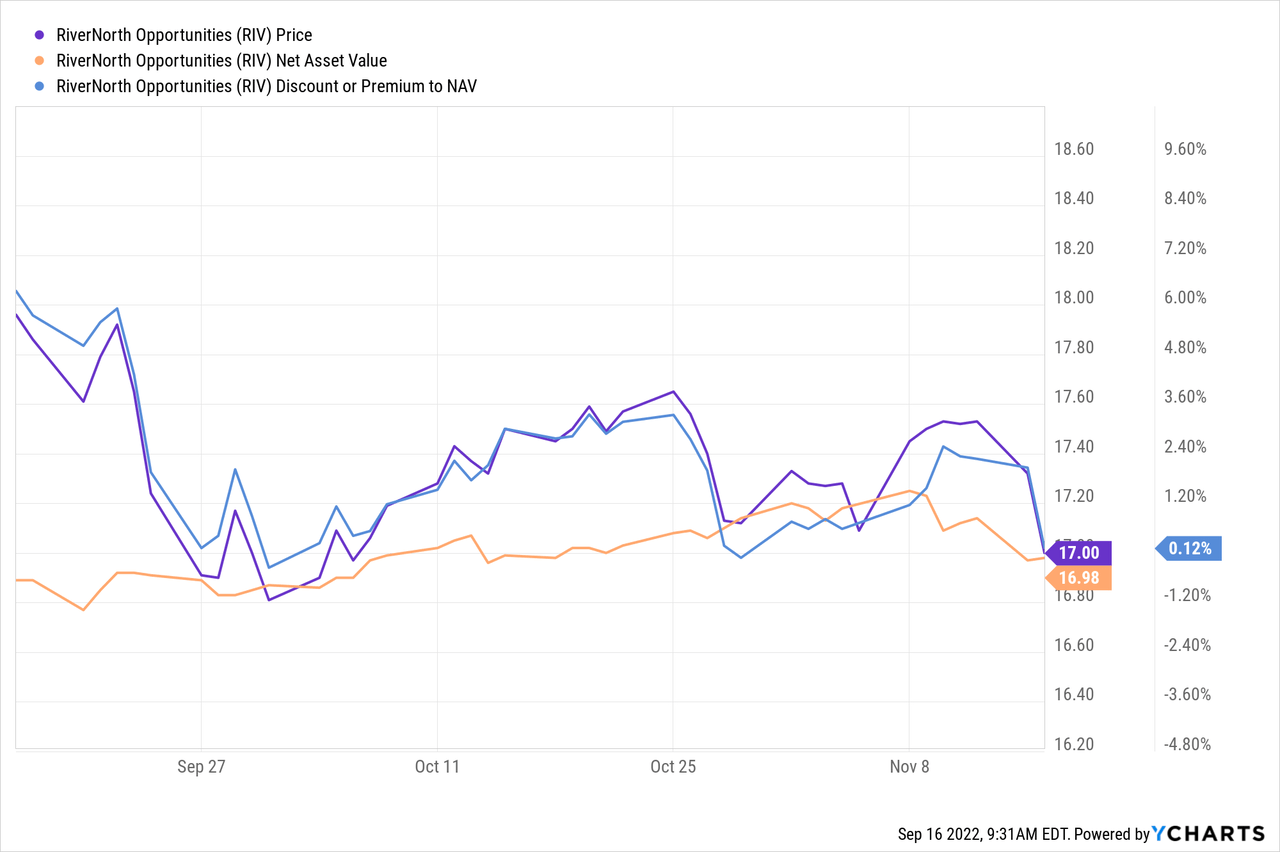

This is where it starts to matter for RiverNorth Opportunities Fund (NYSE:RIV). They launched a rights offering shortly before OPP’s rights offering finished up. In 2021, the press release was posted on September 22nd, 2021. Stanford Chemist posted more on the details of that offering, too.

The important part here is that the fund, similar to OPP, had its valuation pushed lower through these offerings. There is some market volatility that plays a role too. However, it is a pretty clear trend lower after a rights offering is launched. That’s why our first move would be to sidestep the offering altogether.

YCharts

This remains even more relevant because RIV is currently trading at a sharply higher premium while OPP is at its discounted price while going through this rights offering. Again, market volatility is picking up especially hard at this time, which is also having a further impact. Still, it seems to be presenting a clear signal for holders of RIV to be considering a swap to OPP at this time. At least for the short term until a rights offering is potentially announced.

YCharts

It is important to remember that a rights offering isn’t guaranteed to be announced. They are always subject to the approval of the Board and the managers of the fund. However, RIV is running at quite the premium, so I suspect the managers will be encouraged to trigger the offering.

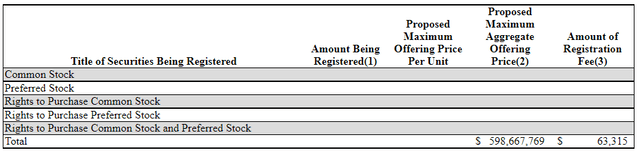

Additionally, they already have the N-2 filed from earlier this year. An N-2 isn’t always the most helpful filing because it is simply a form saying that new shares can be created. It can be through a rights offering of common shares, but it can also be an at-the-market offering, secondary offering or even an offering of preferred stock. Given the fund’s history, a rights offering is certainly on the table, in my opinion.

RIV N-2 Filing (RiverNorth)

The Fund may offer, from time to time, up to $598,667,769 aggregate initial offering price of (i) shares of common stock, $0.0001 par value per share (“Common Shares”), (ii) shares of preferred stock (“Preferred Shares”), (iii) subscription rights to purchase Common Shares, Preferred Shares or both (“Rights”) and/or (iv) any follow-on offering (“Follow-on Offering” and together with the Common Shares, Preferred Shares, and Rights, “Securities”) in one or more offerings in amounts, at prices and on terms set forth in one or more supplements to this Prospectus (each a “Prospectus Supplement”). Follow-on Offerings may include offerings of Common Shares, offerings of Preferred Shares, offerings of Rights, and offerings made in transactions that are deemed to be “at the market” as defined in Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), including sales made directly on the New York Stock Exchange or sales made to or through a market maker other than on an exchange. You should read this Prospectus and any related Prospectus Supplement carefully before you decide to invest in the Securities.

The Fund may offer Securities (1) directly to one or more purchasers, (2) through agents that the Fund may designate from time to time or (3) to or through underwriters or dealers. The Prospectus Supplement relating to a particular offering of Securities will identify any agents or underwriters involved in the sale of Securities, and will set forth any applicable purchase price, fee, commission or discount arrangement between the Fund and agents or underwriters or among underwriters or the basis upon which such amount may be calculated. The Fund may not sell Securities through agents, underwriters or dealers without delivery of this Prospectus and a Prospectus Supplement. See “Plan of Distribution.”

I think that while it isn’t certain, it would be a safer bet to swap from RIV to OPP, at least until the valuations become more in line with each other – in whatever way that may happen.

RIV Basics

- 1-Year Z-score: 2.12

- Premium: 10.54%

- Distribution Yield: 14.20%

- Expense Ratio: 1.91% (including leverage expenses)

- Leverage: 27.76%

- Managed Assets: $256 million

- Structure: Perpetual

RIV has an investment objective of “total return consisting of capital appreciation and current income.”

To achieve the objective, RIV “employs a tactical asset allocation strategy primarily comprised of both closed-end funds and exchange-traded funds. RiverNorth implements an opportunistic investment strategy designed to capitalize on the inefficiencies in the closed-end fund space while simultaneously providing diversified exposure to several asset classes.”

OPP Basics

- 1-Year Z-score: -1.06

- Discount: 6.05%

- Distribution Yield: 17.58%

- Expense Ratio: 1.93% (including leverage expenses)

- Leverage: 36.50%

- Managed Assets: $396.6 million

- Structure: Perpetual

OPP’s investment objective is “to provide current income and overall total return.” To achieve this, they utilize an approach utilizing RiverNorth and DoubleLine, investing in separate sleeves of the portfolio.

They do this by “RiverNorth determining which portion of the Fund’s assets is allocated to each strategy based on market conditions. The Fund may allocate between 10% and 35% of its Managed Assets to the Tactical CEF Income Strategy and 65% to 90% of its Managed Assets in the Opportunistic Income Strategy.”

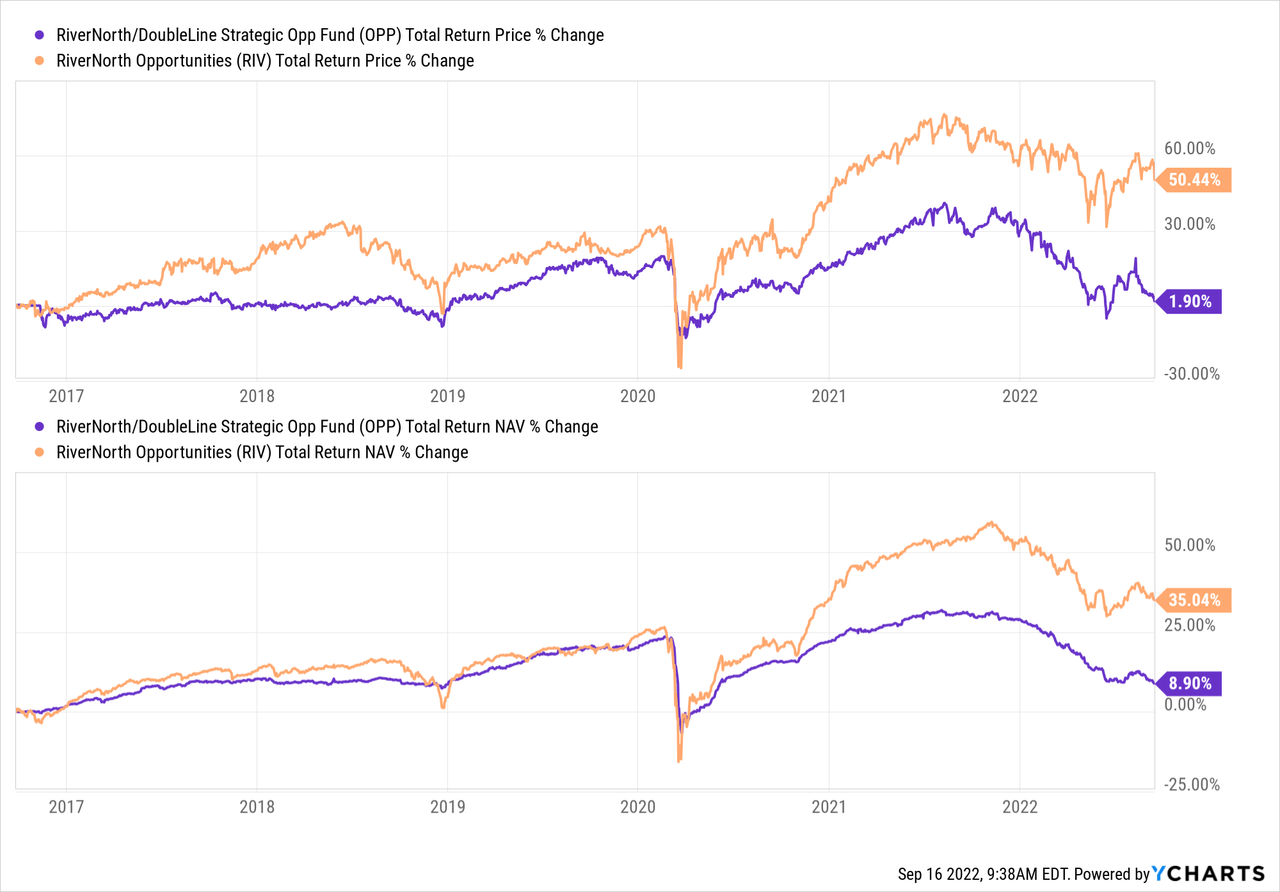

Performance Risk

I would also point out that the performance difference between these funds is quite immense. OPP has significantly underperformed RIV over the longer term. That being said, neither fund has produced excellent results. This is unfortunate, too, because I have a lot of respect for the RiverNorth folks. They provide valuable resources and take advantage of activism from Saba and Bulldog. It just has not translated into strong performance for these funds.

YCharts

The divergence in performance between these funds is significant because they are quite different funds. OPP invests the majority of its assets in debt instruments. RIV takes a much more balanced approach, investing across fixed-income and equity investments. So while this switch probably shouldn’t be seen as a long-term replacement, it could be a shorter-term opportunity to take advantage of.

Both funds are leveraged, so that creates further volatility. Their leverage is through preferred offerings that can give them greater flexibility during sell-offs. They are more resistant to having to deleverage. OPP has (OPP.PA) paying a 4.375% yield and (OPP.PB) paying a 4.75% yield. For RIV, there is (RIV.PA) paying a pretty significant 6% yield.

This would be on top of both funds investing in other CEFs, where those funds themselves will be leveraged too.

Distribution Policy

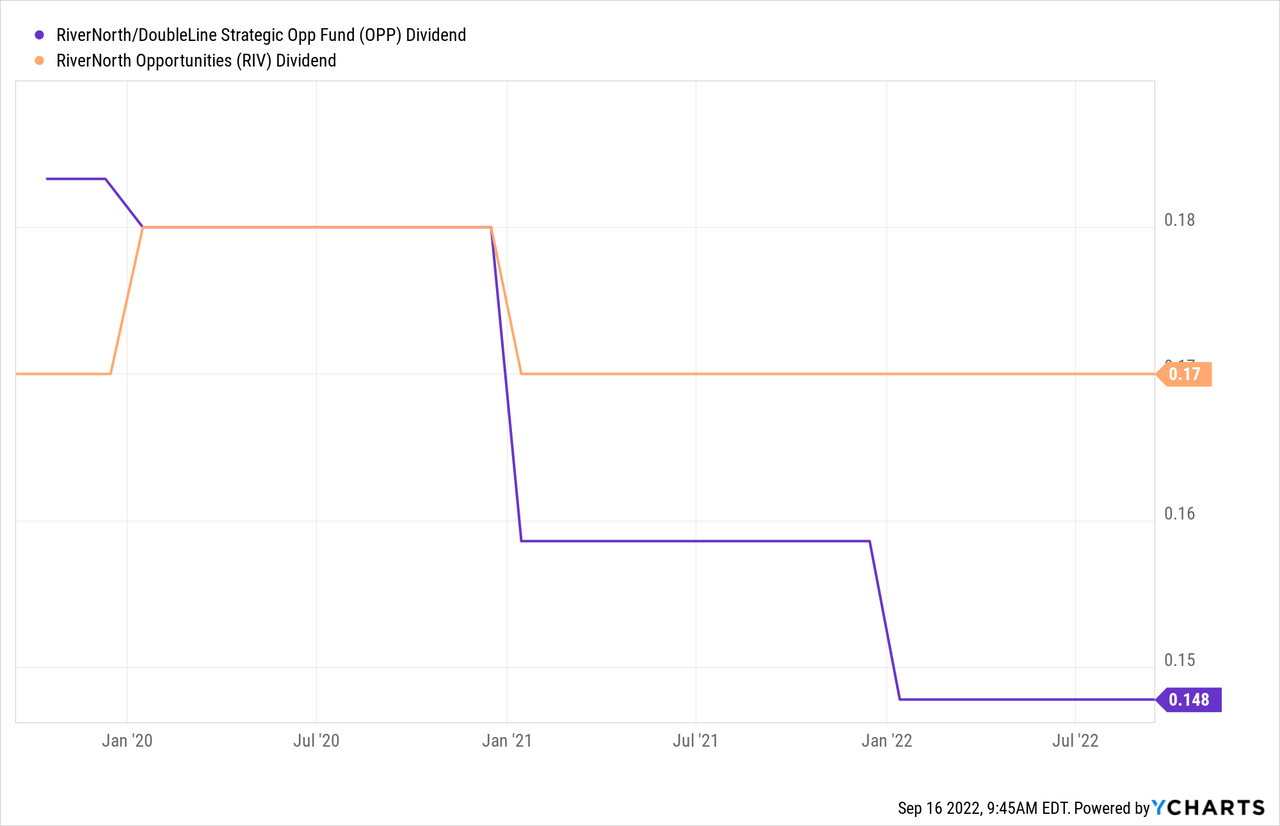

I’d also make one final note on the funds, and that’s on each of the funds’ distribution policies. They both implemented a managed distribution plan of 12.5% that gets reset annually. The poorer performance in OPP is seen with the trend of lowering distributions over the last few years. RIV has been better able to maintain due to the higher performance.

YCharts

That being said, both funds are looking at a healthy slashing of the distributions heading into 2023 if something serious doesn’t change. OPP is running a NAV distribution of 16.51%. The current monthly distribution works out to $0.1478, but if based on the latest closing NAV (without counting the dilution from the latest RO) would be adjusted to ~$0.1119.

RIV has held up a bit better again on a YTD basis, so the current NAV distribution comes to 15.69%. That’s still well ahead of where the 12.5% target is. Therefore, if it were reset today, it would go from a monthly $0.17 to ~$0.1354.

Conclusion

OPP is going through its rights offering, which could mean RIV is next up on deck for their own rights offering. This creates an opportunity where RIV investors could sidestep this potential rights offering before it is officially announced by moving over to OPP for now. Of course, a rights offering isn’t guaranteed. It would be a significant boost to this tactical trade working out, but it also makes sense based on valuation, even if a rights offering doesn’t take place.

Another risk in this trade would be simply the overall market volatility. Every bit of news seems to send the markets lower and lower. That’s always an inherent risk for anything related to investing, but is more acutely apparent at this time.

Be the first to comment