270770

Gold and silver did their jobs as stores of value in 2022. As of December 20, the S&P 500, the most diversified stock market index, was nearly 20% lower since December 31, 2021. Gold at the $1818 level was only 0.70% lower, and silver at $24.17 was up 3.5% since the end of 2021.

Considering the price action in bonds and currency markets, gold and silver have held up well. The nearby U.S. 30-Year Treasury bond futures closed 2021 at 159-31 and were below the 129 level on December 20, 2022. Moreover, the Fed Funds Rate was at zero to 25-basis points at the end of last year, and the recent 50-point increase put the short-term rate at 4.25% to 4.50%, with most Fed officials forecasting it to rise to over 5% in 2023.

The U.S. dollar index closed 2021 at 95.593 and was 8.5% higher at 103.700 on December 20, 2022, after reaching a two-decade high of 114.745 in September. Higher interest rates and a stronger U.S. dollar are typically bearish for the precious metals. While gold and silver are on either side of unchanged in 2022, they have outperformed stocks and many other asset prices, providing investors with a safe harbor. I expect that trend to continue in 2023, given the state of the geopolitical landscape and the bullish fundamentals for the leading precious metals. Moreover, the convictions of some top precious metals traders in 2022 serve as a stern warning that regulators and prosecutors will not tolerate market manipulation.

Silver tends to magnify the price action in the gold market. I favor buying silver on price weakness, and the Ultra Silver ETF product (NYSEARCA:AGQ) is a short-term tool that provides leverage for silver’s price action.

Guilty as charged – Sentencing next

On December 9, the U.S. Department of Justice announced another in a series of convictions on federal charges of a former JPMorgan precious metals trader, Christopher Jordan. The press release stated:

Jordan was convicted of wire fraud affecting a financial institution. He is scheduled to be sentenced at a later date and faces a maximum penalty of 30 years in prison. A federal district court judge will determine any sentence after considering the U.S. Sentencing Guidelines and other statutory factors.

Four other former JPMorgan precious metals traders were previously convicted in related cases. In August 2022, Gregg Smith and Michael Nowak were convicted after trial in the Northern District of Illinois of wire fraud affecting a financial institution, commodities fraud, attempted price manipulation, and spoofing. In October 2018, John Edmonds pleaded guilty in the District of Connecticut to one count of commodities fraud and one count of conspiracy to commit wire fraud, commodities fraud, price manipulation, and spoofing. In August 2019, Christian Trunz pleaded guilty in the Eastern District of New York to one count of conspiracy to engage in spoofing and one count of spoofing. Smith, Nowak, Edmonds, and Trunz are awaiting sentencing.

After a presentence investigation by the U.S. Probation Department, the next step for those convicted is sentencing. In August 2021, a federal jury convicted Edward Bases and John Pacillo, former precious metals traders at another institution, on similar charges. The pair will face sentencing next month:

UPDATE – A sentencing hearing for defendants Edward Bases and John Pacilo previously set for December 13, 2022 has been reset for January 26 2023 at 1:00 p.m.

A federal judge sentenced two other former precious metals traders, James Vorley and Cedric Chanu, to one year and one day in prison for similar offenses. The traders who await sentencing will likely face longer stints in federal prison.

The convictions mean that regulators and the authorities will not stand for illegal trading activities in the precious metals or other markets. JPMorgan paid an unprecedented $920 million to settle charges against the institution. The bottom line is traders will think more than twice before stepping over the line, and institutions will increase their compliance activities and surveillance. Hopefully, the convictions and fines will clean up the markets and make them a level playing field for participants.

The silver-gold ratio says prices are going higher

Silver has long attracted the most speculative activity in the precious metals arena. Silver is far less expensive than gold, and it tends to outperform gold on the upside and underperform when precious metals prices move to the downside. The silver market experienced its share of controversy in the late 1970s with the attempt by Nelson and Bunker Hunt to corner the silver market. After the COMEX Board of Governors instituted a liquidation-only rule in the silver market, the metal’s price plunged, turning the brothers’ large fortune into a much smaller one. Silver has a long history of attempted price manipulation and volatility, and the precious metal has an even longer history as a means of exchange.

In around 3,200 BCE, the first Egyptian Pharoah, Menes, declared that two and one-half parts silver equal one part gold, which could be the first time the silver-gold ratio appeared. In modern times, the ratio has traded at a far higher level.

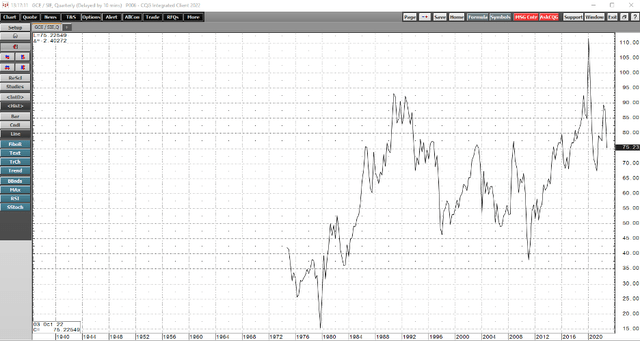

The Long-Term Silver Gold Ratio Chart (CQG)

The quarterly chart highlights that the ratio of gold’s price divided by silver’s price has traded at a median between sixty and seventy ounces of silver value in each ounce of gold value since the 1970s. Above 70 silver has been inexpensive compared to gold, and below 60 silver has been more historically costly than the precious yellow metal. A falling ratio tends to be bullish for gold and silver prices, while trending higher often occurs during corrections or bear markets. As the chart shows, the ratio fell to lows in 1980 and 2011 when silver prices were on either side of $50 per ounce. The short-term chart displays a bearish path of least resistance in the price relationship, which is a bullish sign for silver’s price.

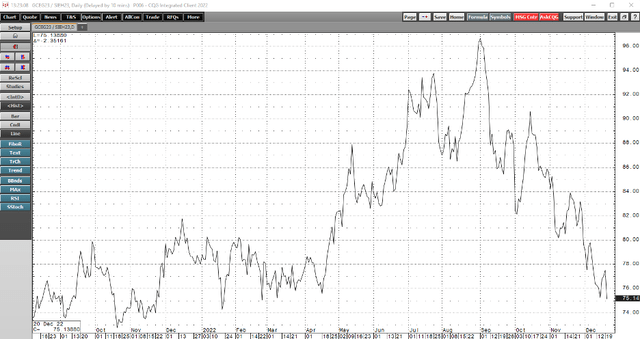

The Short-Term Silver Gold Ratio Chart (CQG)

The chart illustrates the relationship between February COMEX gold futures divided by March COMEX silver futures fell from 96.6:1 on September 1 to the 75.1:1 level on December 20. The ratio has made lower highs and lower lows over the past months as the more volatile and speculative silver market has outperformed gold, which could be a bullish sign for both precious metals.

Bullish silver fundamentals

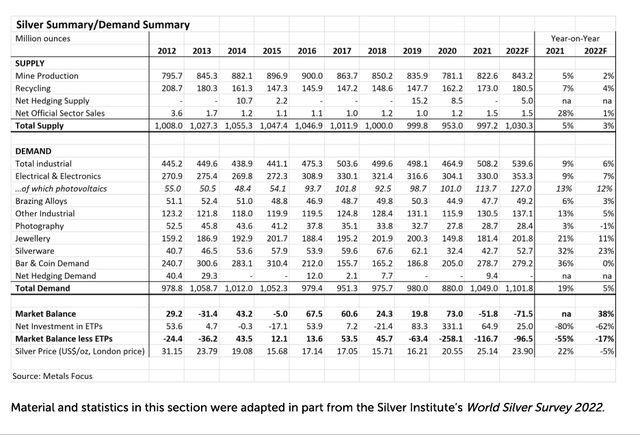

In a recent article on Seeking Alpha, Stephen Gardner highlighted a Silver Institute report that 2022 silver demand has outpaced supply by roughly 2%.

Silver Supply and Demand Fundamentals (The Silver Institute)

The chart shows the increase in demand for photovoltaics or the silver necessary for solar panels. While Goldman Sachs calls copper “the new oil” because of increasing requirements for EVs, wind turbines, and other green energy initiatives, silver is also critical for the greener energy path.

Sentiment will drive silver’s price

Silver’s role as a speculative metal often makes the industrial supply and demand fundamentals take a backseat to sentiment. Investment demand is the critical factor driving silver’s price each year. When trend-following traders and investors flock to the silver market, the price tends to experience the most significant moves.

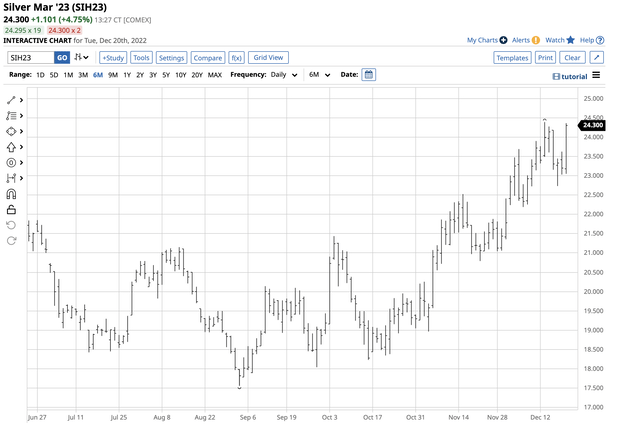

March COMEX Silver Futures Chart (Barchart)

The short-term March silver futures chart shows a bullish trend of higher lows and higher highs since September 1, when March silver futures fell to $17.56 per ounce. The most recent high on December 13 was $24.39, a 28% rise from the September 1 low. On December 20, March silver was sitting near the recent peak at $24.30 per ounce. The current upside targets on the continuous futures contract stand at the March 2022 $27.32 high, the May 2021 $28.68 high, and the February 2021 $30.16 multi-year peak. A move above the February 2021 high would be a technical breakout, with the next target at the 2012 $35.09 and $37.48 resistance levels. In 2011, nearby silver futures reached $49.52; in 1980, the all-time high was at $50.36 per ounce.

AGQ on price weakness could be the optimal approach

If silver is preparing to explode higher in 2023, buying on price corrections and dips will be the optimal approach to the market, as even the most aggressive bull markets rarely move in straight lines. Silver has a lot going for it as we head into the New Year as inflation remains at multi-decade highs, industrial requirements are rising, and sentiment has turned bullish. Meanwhile, silver’s outperformance compared to a host of other assets is a testament to its fortitude and could cause a herd of trend-following buyers and investors to flock to the silver market over the coming weeks and months.

The most direct route to a risk position in the silver is via the physical market for bars and coins. The COMEX futures provide an alternative as they have a delivery mechanism. However, futures are leveraged and margined instruments with a high-risk profile.

The iShares Silver Trust (SLV) is a liquid silver ETF product that does an excellent job tracking the metal’s price. Meanwhile, the Ultra Silver ETF (AGQ) provides double leverage to the volatile metal. AGQ’s fund profile states:

AGQ Fund Profile (Seeking Alpha)

At $32.94 on December 20, AGQ had nearly $396 million in assets under management. AQG trades an average of 1.147 million shares daily and charges a 0.95% management fee. March silver futures rose 28% from September 1 through December 13.

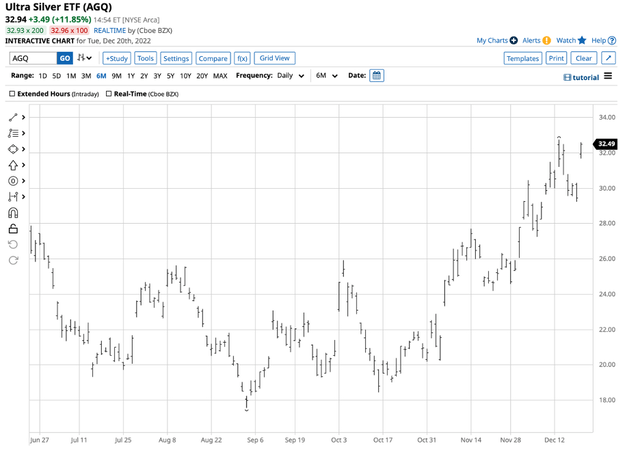

Chart of AGQ ETF Product (Barchart)

Over the same period, AGQ moved from $17.56 to $32.94 per share, or 87.6%. AGQ delivered over three times the percentage move as the silver futures market. AGQ’s leverage makes it a product that is only appropriate for short-term long-risk positions. If silver moves lower or remains stable, the ETF will lose value as it suffers from time decay.

I’m bullish on silver’s prospects for 2023. AGQ is silver on steroids and could be the optimal leveraged tool to participate in the silver market if the price is preparing to explode higher in the coming year.

Be the first to comment