Zinkevych

A Quick Take On OneWater Marine

OneWater Marine (NASDAQ:ONEW) went public in early 2020, raising approximately $55 million in gross proceeds from the sale of its Class A common stock.

The firm sells recreational boats, related parts and accessories, and financial and other services.

Management has reduced expectations of strong growth as the company faces the potential of a macroeconomic slowdown and continued inventory challenges ahead.

I’m on Hold for ONEW in the near term.

OneWater Marine Overview

Buford, Georgia-based OneWater was formed in 2006 after the merger of Singleton Marine and Legendary Marine, and operates dozens of recreational boat retail stores in the US, consisting of dealer groups in 10 states across the Southeast, Gulf Coast, Mid-Atlantic and Northeast.

Management is headed by Founder, CEO and Director Austin Singleton, who has served in various positions from the fuel dock to the service department, the sales department, and as general manager.

Other sources of company revenue include finance and insurance products, repair and maintenance services, as well as parts and accessories.

OneWater has relationships with dozens of manufacturers covering numerous brands.

OneWater Marine’s Market & Competition

According to a 2018 market research report by the National Marine Manufacturers Association, sales of new powerboats grew by 4% in 2018 to 280,000 – the highest since 2007 – and are projected to increase by an additional 3-4% in 2019.

The recreational boat industry contributed an estimated $170.3 billion to the US economy in 2018, marking a growth of $49 billion since its last report in 2012.

Total annual US sales of recreational boats, marine products, and services were estimated at $41 billion in 2018, and a positive outcome in 2019 would mark the 7th year of consecutive growth.

The main factors driving the forecasted market growth are the economic growth over the past decade and consumers seeking out boating as a way to spend quality time with family and friends outdoors.

OneWater Marine’s Recent Financial Performance

-

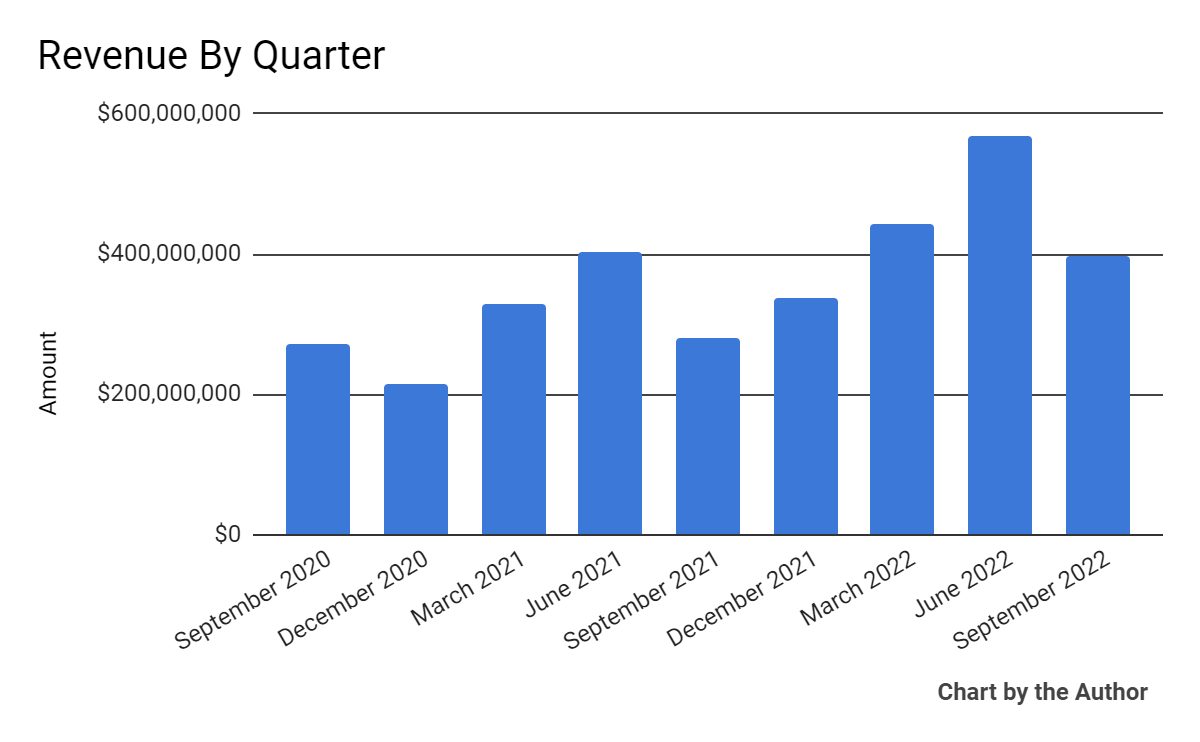

Total revenue by quarter has risen per the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

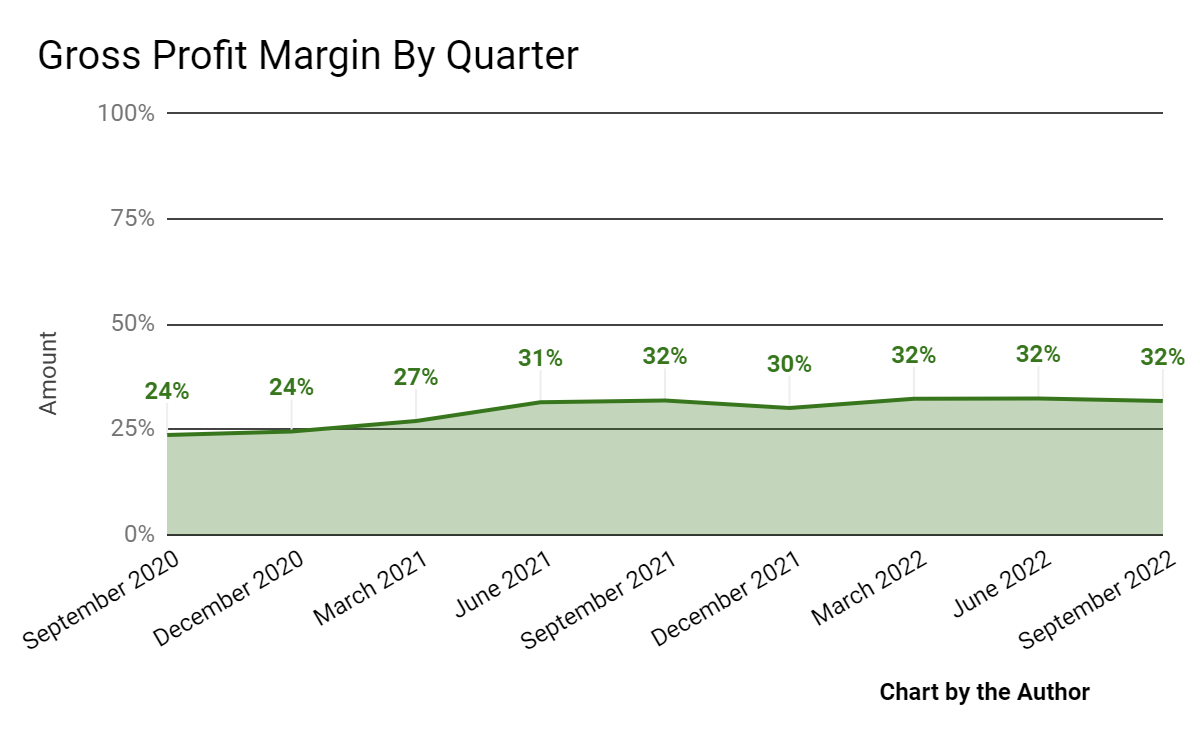

Gross profit margin by quarter has trended higher in recent quarters:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

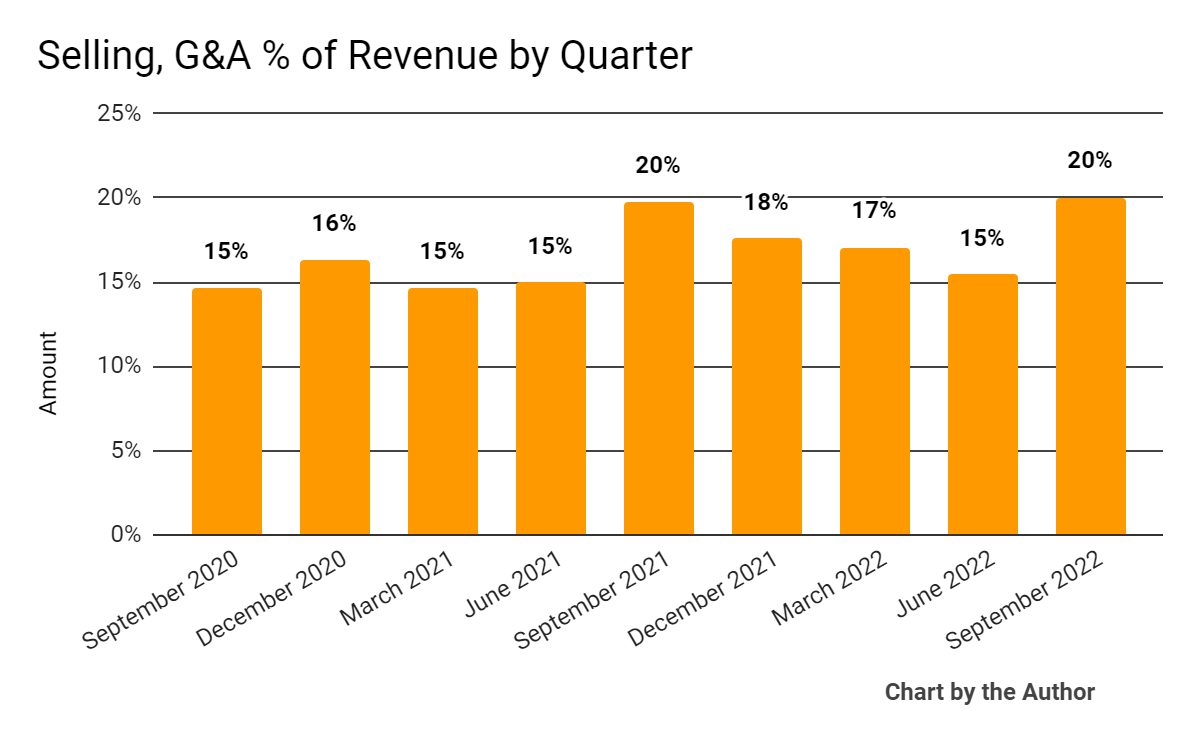

Selling, G&A expenses as a percentage of total revenue by quarter have increased slightly in some quarters recently:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

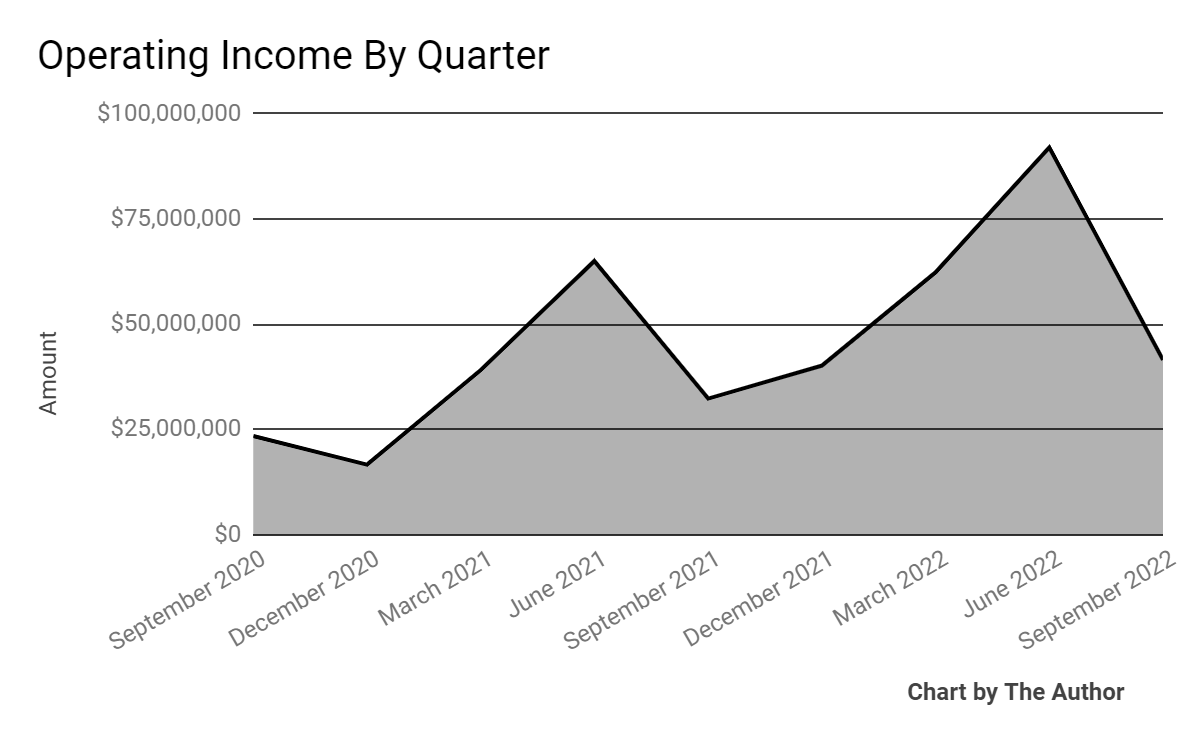

Operating income by quarter has been trending higher as the chart shows below:

9 Quarter Operating Income (Seeking Alpha)

-

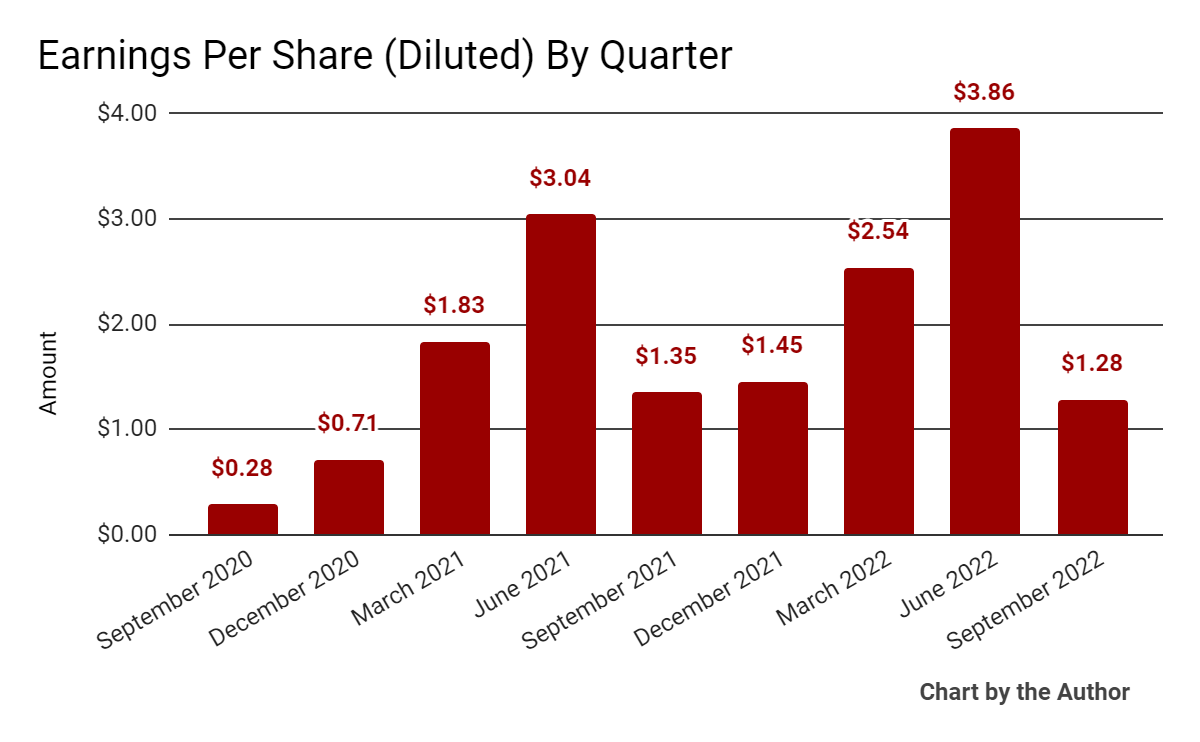

Earnings per share (Diluted) have been relatively volatile:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

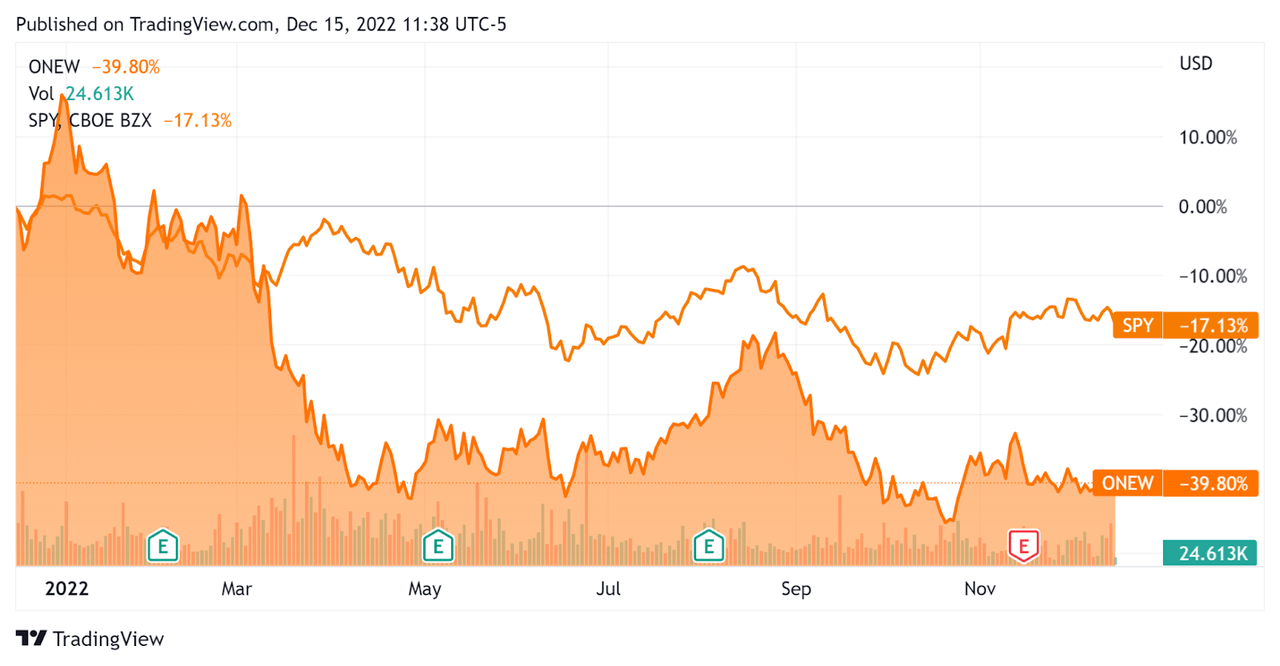

In the past 12 months, ONEW’s stock price has fallen 39.8% vs. the U.S. S&P 500 index’s drop of around 17.1%, as the chart below indicates:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For OneWater Marine

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

0.8 |

|

Enterprise Value / EBITDA |

5.2 |

|

Revenue Growth Rate |

42.1% |

|

Net Income Margin |

7.5% |

|

GAAP EBITDA % |

14.4% |

|

Market Capitalization |

$502,876,192 |

|

Enterprise Value |

$1,309,404,670 |

|

Operating Cash Flow |

$68,351,000 |

|

Earnings Per Share (Fully Diluted) |

$9.13 |

(Source – Seeking Alpha)

Commentary On OneWater Marine

In its last earnings call (Source – Seeking Alpha), covering FQ4 2022’s results, management highlighted the effects of Hurricane Ian on its stores, closing three of them as a result.

The company also faces supply chain issues, but management has seen some pockets of easing in this regard and expects further improvement throughout 2023.

ONEW has also benefited from higher-margin service offerings as well as parts and other sales and has put its apparently sophisticated inventory management tools to good use. Gross profit margin has improved in recent quarters.

As to its financial results, quarterly revenue rose 42% year-over-year, with new boat sales increasing 22% despite the effects of the hurricane at the close of the quarter.

SG&A as a percentage of total revenue was flat year-over-year but has been trending slightly higher while operating income had been improving sequentially until this quarter.

Earnings per share were down compared to the same period in 2021.

For the balance sheet, the firm finished the quarter with $42.1 million in cash and equivalents and total borrowings and debt of $688.3 million.

Looking ahead, management expects a previously ‘robust demand environment to moderate to more traditional seasonal cycles’ and for same-store sales to rise by ‘low to mid-single digits despite the ongoing inventory challenges.’

Regarding valuation, the market is valuing ONEW at an EV/EBITDA multiple of 5.2x, having brought down the company’s valuation markedly in recent quarters.

The primary risk to the company’s outlook is a slowdown in customer demand if a feared recession impacts the U.S. in 2023, as many economists expect.

A potential upside catalyst to the stock could include a ‘short and shallow’ downturn early in 2023 with a return to tepid growth later in the year.

For now, though, the future for ONEW looks a bit gloomy as management expects a slowdown ahead.

I’m on Hold for OneWater in the near term.

Be the first to comment