MicroStockHub/iStock via Getty Images

Introduction

When last discussing ONEOK (NYSE:OKE) following the second quarter of 2022, my previous article explained the good and the bad of higher natural gas prices in light of the booming operating conditions following the Russia-Ukraine war. Now that the year is quickly coming to an end and their third-quarter results have been released, this time around the focus is upon their outlook for the year ahead and excitingly, it seems that 2023 is shaping up great for dividend fans, as discussed within this follow-up analysis.

Coverage Summary & Ratings

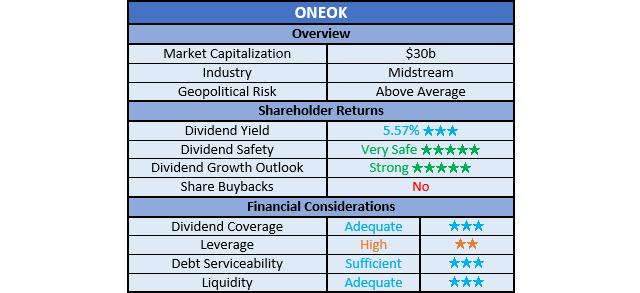

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and, importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

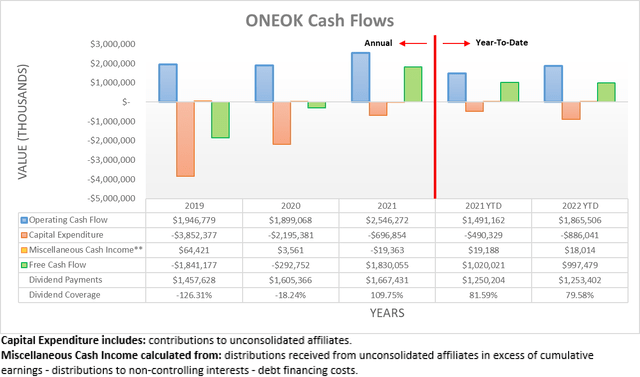

After enjoying an impressive start to 2022 in the first and second quarters, it was positive to see their operating cash flow maintaining this strength throughout the third quarter. Accordingly, their result during the first nine months now lands at $1.866b and thus an impressive one-quarter higher year-on-year versus their previous result of $1.491b during the first nine months of 2021. Similar to the first half of 2022, on the surface their resulting free cash flow of $997.5m only provided weak coverage of 79.58% to their accompanying dividend payments of $1.253b, although once again, this was negatively impacted by working capital movements.

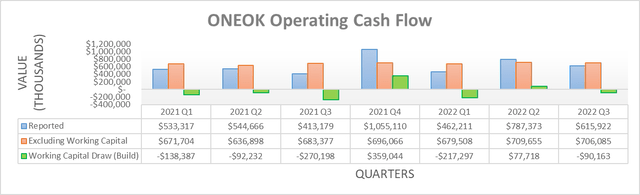

When viewing their operating cash flow on a quarterly basis, it becomes easier to view the individual moving parts affecting their reported results during 2022. If zooming into the third quarter, they saw a working capital build of $90.2m hindering their reported operating cash flow, thereby aggregating to a net build of $229.7m across the first nine months. If excluded, their underlying operating cash flow would have been $2.096b, along with their underlying free cash flow that would have been $1.227b. Since the latter of which is immaterially different to their dividend payments of $1.253b, it means that on an underlying basis, their coverage is adequate.

Notwithstanding the positivity of seeing another set of impressive results, the bigger topic this time is their outlook for 2023, especially as 2022 is almost over. So far they have only released generalized guidance for 2023 but thankfully, they are very positive given the already impressive base they are building upon from 2022, as per the commentary from management included below.

“Key drivers for our 2023 outlook of a more than 10% increase compared with our 2022 midpoints to exceed $4 billion in adjusted EBITDA…”

“…you would expect CapEx to maybe come down a little bit in ’23”

-ONEOK Q3 2022 Conference Call.

Despite only being generalized and not exact detailed guidance so far, these initial signs are still very positive, especially for dividend fans. In theory, the 10%+ growth they forecast for adjusted EBITDA should translate comparably into their operating cash flow given the positive correlation between the two, which was normally the case throughout recent years. If applied against their underlying result of $2.096b during the first nine months of 2022, it would see their operating cash flow increase by circa $210m.

Meanwhile, their generalized guidance for capital expenditure indicates that it should be either broadly flat or if anything, actually down slightly during 2023 compared to 2022. There are few more powerful combinations for higher dividends than this situation, as this obviously lifts their free cash flow but importantly, it does not stem from dramatically lower investments. This not only helps in the short-term but also in the medium to long-term by making further growth to their operating cash flow possible. Once again utilizing their underlying free cash flow of $1.227b during the first nine months of 2022 as a basis point, a circa $210m increase would represent a circa 17% boost. Given their existing adequate coverage, this would provide ample scope to fund higher dividends, if so desired.

Even though free cash flow is the most important factor, at least in my eyes, I would consider the will of management is also the next most important factor. When asked about the outlook for higher dividends during their third quarter of 2022 conference call, their response implies such a decision is likely forthcoming during 2023, despite their language otherwise being indirect, as per the commentary from management included below.

“With our positive earnings growth indications for 2023, our payout ratio and our debt-to-EBITDA metrics are indicating that we are going to have more flexibility to execute on one or more of the capital allocation levers that are going to be available to us to create that value for our shareholders as we progress through 2023.”

-ONEOK Q3 2022 Conference Call (previously linked).

Even though it remains to be seen exactly if they will increase their dividends and if so, the extent they are increased, their very positive free cash flow outlook for 2023 makes such a move increasingly more probable. In my view, it seems reasonable to expect a dividend increase of between 5% and 10% but either way, it seems for the first time in around three years, higher dividends are finally on the horizon.

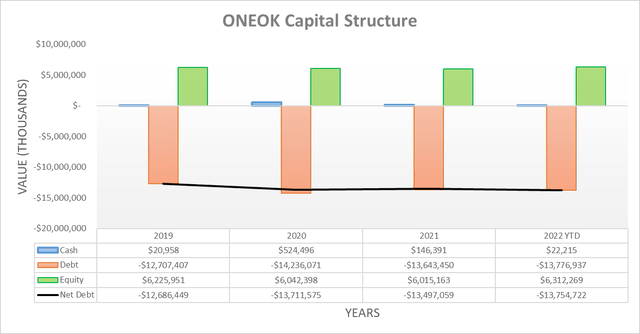

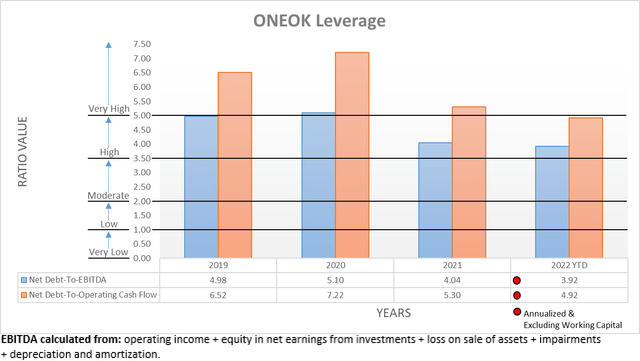

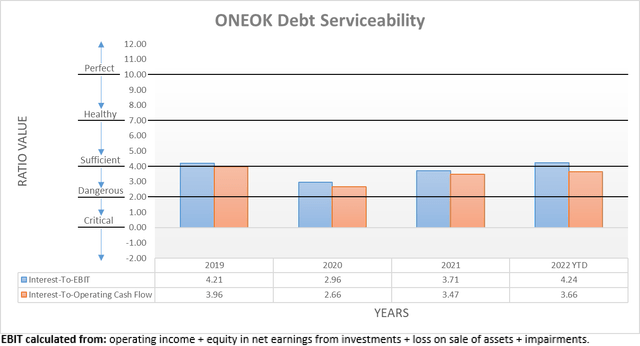

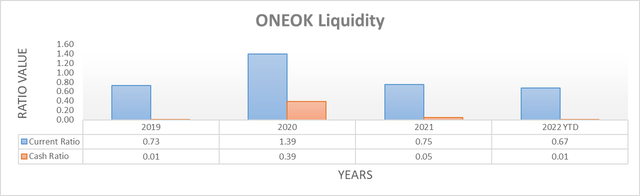

Due to the very large size and steady nature of the company, unsurprisingly, their capital structure was effectively unchanged following the third quarter of 2022. Their net debt increased ever-so-slightly to $13.755b versus its previous level of $13.633b following the second quarter, which was another effect of their accompanying $90.2m working capital build. Whilst their cash balance saw a noticeable decrease to $22.2m versus $135.8m across these same two points in time, realistically, this is a business-as-usual fluctuation for a very large company and thus no concern. As a result, it would be redundant to reassess their leverage, debt serviceability or liquidity in detail after merely one quarter since conducting the previous analysis, especially as the purpose of this analysis was their outlook for 2023.

The three relevant graphs are still included below to provide context for any new readers, which shows their respective net debt-to-EBITDA and net debt-to-operating cash flow broadly holding steady at 3.92 and 4.92, thereby remaining within the high territory on both accounts. Meanwhile, their debt serviceability remains sufficient with interest coverage of 3.66 when compared against their operating cash flow and whilst this increases to a healthy 4.24 if compared against their EBIT, I prefer to judge on the worse side. Elsewhere, their liquidity is still adequate, despite their current ratio dropping to 0.67 and accompanying cash ratio of only 0.01 following the business-as-usual fluctuation within their cash balance and debt maturities. If interested in further details regarding these topics, please refer to my previously linked article.

Conclusion

I have not necessarily been their biggest fan in the past years, often skeptical of their dividend growth potential, but I will always give credit where due and in this case, they have outperformed my expectations. Since they should see materially higher operating cash flow during 2023 without any accompanying increase to their capital expenditure, it creates a powerful combination for higher dividends, something that I imagine many of the dividend fans sitting on their shareholder registry will enjoy. Concurrently, I now believe that upgrading to a buy rating is appropriate versus my previous hold rating.

Notes: Unless specified otherwise, all figures in this article were taken from ONEOK’ SEC filings, all calculated figures were performed by the author.

Be the first to comment