Pgiam/iStock via Getty Images

After several years of depressed interest rates, the Fed is in the process of raising interest rates aggressively in an effort to cool the economy and thus restore inflation to its long-term target of 2%. This policy provides a strong tailwind to banks, especially Cullen/Frost Bankers (CFR), which generates most of its earnings from its net interest income. However, the stock is currently trading at a price-to-earnings ratio of 16.3, which is much higher than the average price-to-earnings ratio of most banks. Therefore, investors should probably wait for a better entry point.

Business overview

Cullen/Frost Bankers operates approximately 157 branches and 1,650 ATMs in Texas metropolitan areas, where it serves individuals and local businesses. The bank offers consumer and commercial loans, investment management services as well as other services and generates most of its earnings from its net interest income, i.e., the difference between the interest it charges on its loans and the interest it pays on its deposits.

Cullen/Frost Bankers enjoys strong business momentum, primarily thanks to the favorable environment of rising interest rates. Interest rates remained near all-time low levels between 2008 and 2021 but the Fed is raising them aggressively this year in order to keep inflation under control.

The benefits from high interest rates were evident in the latest earnings report of Cullen/Frost Bankers. In the third quarter, its net interest income grew 41% over the prior year’s quarter thanks to 4% growth of loans but mostly thanks to the expansion of net interest margin from 2.5% to 3.0%. As a result, the bank grew its earnings per share 57%, from $1.65 to an all-time high of $2.59, and exceeded the analysts’ estimates by an impressive $0.37.

Cullen/Frost Bankers has beaten the analysts’ estimates for 10 consecutive quarters. This is a testament to its sustained business momentum and the solid execution of management. Not only does the bank benefit from rising interest rates, but it also enjoys strong growth in its consumer banking business. It grew its consumer loans 16% in the third quarter, primarily thanks to real estate products, with management stating that it has not noticed any signs of fatigue in this division. Thanks to the ideal business conditions that Cullen/Frost Bankers is facing right now, it is expected by analysts to grow its earnings per share 28% this year, from $6.76 to an all-time high of $8.66.

Moreover, Cullen/Frost Bankers is trying to grow its footprint by opening new branches in its operating areas. It has opened more than 40 new branches in Houston over the last eight years and is likely to continue to expand for many more years. As the bank has a total of only 157 branches, it seems to have ample room for future growth.

It is also important to note that Cullen/Frost Bankers has a consistent performance record. During the last decade, the company has grown its earnings per share at a 6.4% average annual rate. It incurred a marginal decline in its bottom line in 2013, 2015 and 2019 and a material decline in 2020 due to the pandemic. However, it has always managed to recover strongly after every decline. Thanks to its consistent performance record and the aforementioned tailwinds, Cullen/Frost Bankers is likely to remain on its growth trajectory for many more years. Analysts seem to agree on this view, as they expect the bank to grow its earnings per share by 10% per year on average over the next two years.

Dividend

Cullen/Frost Bankers has an exceptional dividend growth record for a financial stock. To be sure, the bank has raised its dividend for 29 consecutive years. It has grown its dividend at a 5.5% average annual rate over the last decade and at a 7.6% average annual rate over the last five years. Given its solid payout ratio of 44% and its reliable growth trajectory, the bank is likely to continue raising its dividend meaningfully for many more years.

As banks are highly vulnerable to recessions, there are extremely few financial stocks that can match the dividend growth streak of Cullen/Frost Bankers. It is also remarkable that this bank kept raising its dividend during the Great Recession, the worst financial crisis of the last 90 years, in which most banks incurred severe losses and cut their dividends. This is a testament to the prudent business strategy of Cullen/Frost Bankers, which relies on maintaining high asset quality metrics in order to remain resilient to economic downturns.

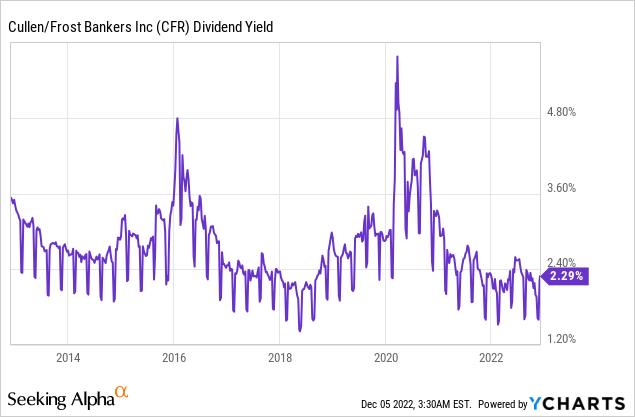

On the other hand, Cullen/Frost Bankers is currently offering a dividend yield of only 2.2%.

This is a nearly 10-year low dividend yield for this stock, signaling that the stock is probably fully valued around its current price.

Valuation

Cullen/Frost Bankers is currently trading at a price-to-earnings ratio of 16.3. This is slightly higher than the 10-year average price-to-earnings ratio of 15.7 of the stock. It is also significantly higher than the current earnings multiple of most financial stocks. To provide a perspective, the median earnings multiple of the financial sector is 10.4 right now.

On the one hand, the rich valuation of Cullen/Frost Bankers can be attributed to its strong business momentum and its promising growth prospects. On the other hand, as the valuation of the stock is much richer than the average valuation of its sector, it is reasonable to assume that the market has already priced a great portion of future growth in the stock.

Final thoughts

Cullen/Frost Bankers enjoys solid growth in its consumer banking business while it is ideally positioned to benefit from rising interest rates. As a result, it is on track to post record earnings per share in 2022 and 2023. However, the market has already appreciated the virtues of this high-quality bank and hence the stock has a premium valuation right now. As long as Cullen/Frost Bankers continues to enjoy strong business momentum, its stock is likely to remain richly valued. On the other hand, whenever the bank faces an unexpected headwind, it will probably have material downside risk. Overall, investors should wait for a better entry point, probably around the technical support of $115-$120.

Be the first to comment