KanawatTH/iStock via Getty Images

With inflation at multi-decade highs, rapidly tightening monetary policy and the specter of a recession on the horizon, Bitcoin (BTC-USD) is facing the toughest macro environment in its short history. On top of this, losses in the crypto industry could result in financial contagion and forced liquidation of assets. Inflation will likely need to moderate before Bitcoin can move higher, but there is a real risk that an extended period of weak returns will dampen enthusiasm for the asset class.

Inflation

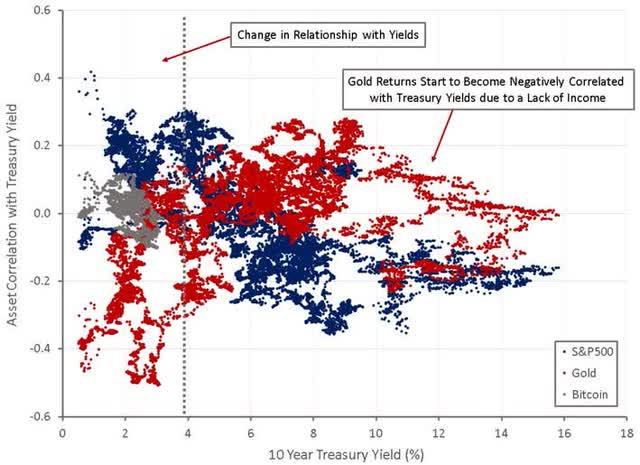

Part of Bitcoin’s attractiveness to many investors was based on a lazy narrative that Bitcoin was an inflation hedge due to its fixed supply. Bitcoin has historically behaved more like a risk-on asset though, and hence it is no surprise that it has performed poorly as inflation has increased and monetary policy tightened. A return to low and stable inflation will likely be necessary before Bitcoin can find a bottom and potentially increase in price again.

The dependence of Bitcoin on macro conditions is discussed in more detail here.

Figure 1: Asset Correlation with Treasury Yields (source: Created by author using data from The Federal Reserve and blockchain.com)

Recession

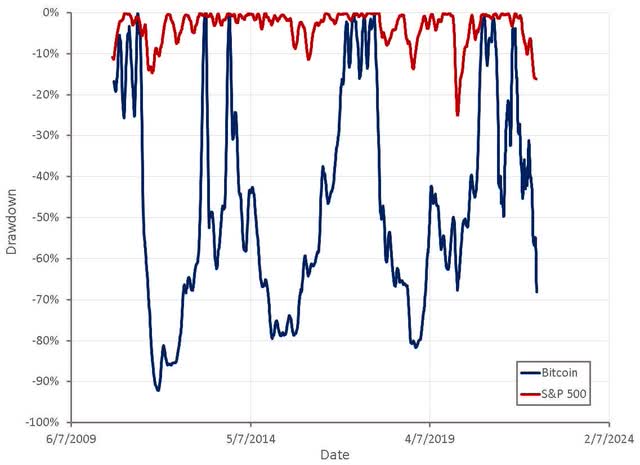

Bitcoin’s correlation with equities has historically shown a tendency to increase during periods of turmoil. It is therefore not surprising that Bitcoin’s price has dropped over the past 6 months as equity indices have declined. Even if inflation drops, there is a risk that a recession could drag Bitcoin significantly lower. Leading indicators of economic conditions will likely need stabilize before Bitcoin finds a bottom.

Figure 2: Bitcoin and S&P 500 Drawdowns (source: Created by author using data from Yahoo Finance)

Financial Contagion

There have been a number of high-profile incidents in crypto markets (including Terra (LUNC-USD), Celsius (CEL-USD) and 3AC) over the last few months, which have created a risk of financial contagion. The impact of these events is not fully known and there is a risk that losses will continue to cascade in coming months. Bitcoin is unlikely to escape unscathed from any turmoil that is created by this.

Terra – Terra is a blockchain network that specializes in stablecoin creation and Luna (LUNA-USD) is the native cryptocurrency of the Terra Ecosystem. TerraUSD (UST-USD) was a USD stablecoin that was backed by Luna rather than fiat currencies. UST’s peg was broken last month, resulting in a death spiral as Terra tried to re-establish the UST peg, causing the value of Luna to plummet.

Celsius – Celsius offers users high yields on deposits which they lend to other institutions to generate profits. Celsius recently halted withdrawals, stating they need time to stabilize liquidity and operations. Celsius has an estimated 500,000 users and as much as 8 billion USD in deposits is frozen.

Staked Ether – stETH is a token that represents a unit of ether that has been staked and is meant to be worth the same as ether. Users withdrawing funds have created liquidity issues and over the past few weeks, stETH has been trading at a widening discount to ether.

3AC – 3AC is one of the largest and most influential hedge funds in the crypto space. There have been suggestions that 3AC has had difficulty meeting margin calls in recent weeks as crypto prices have declined and 3AC is reportedly exploring asset sales or rescue by another firm. Liquidation of 3AC positions may have contributed to the decline in crypto prices over the past week. 3AC had over 3 billion USD worth of cryptocurrencies under management as of April.

None of these developments are particularly surprising, as DeFi often entails large risks which only become apparent during a downturn, a similar situation some fintech companies now find themselves in.

There is also concern amongst many that Tether remains a ticking time bomb that will eventually cause issues as well. This is a difficult issue to assess given the opaqueness of Tether, but it is possible they have incurred losses on some of their investments in recent months. Whether Tether is fully backed is somewhat immaterial, the question is how much Tether would need to be redeemed before they run out of assets. While there has been a decline in Tether’s market cap in recent months, this figure would likely have to drop a lot further before causing problems.

Maturing Asset

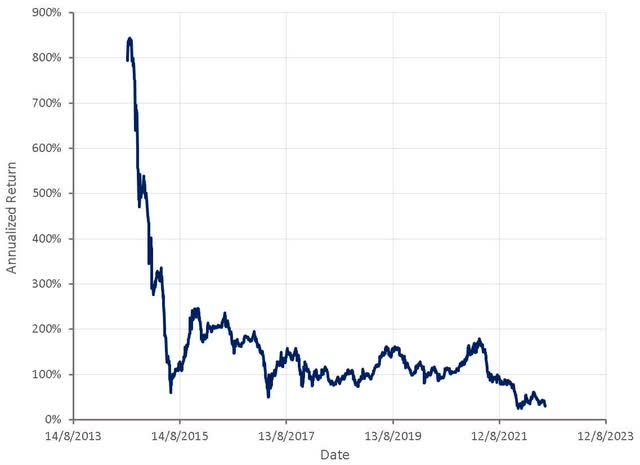

Bitcoin is now in a unique position due to the combination of tightening monetary policy, financial contagion in crypto markets and moderating returns as the crypto asset class matures. Bitcoin has historically proven attractive as a vehicle for speculative investments, but with fairly modest returns over the past 5 years, there is a risk that belief in Bitcoin begins to breakdown. In addition, Bitcoin’s correlation with risk assets has repeatedly increased during times of duress, which undermines the narrative that Bitcoin provides diversification. Once markets settle and macro conditions improve there will still be the question of where demand will come from to drive the next Bitcoin bull market.

Figure 3: Bitcoin’s Annualized Returns over the Preceding 4 Years (source: Created by author using data from blockchain.com)

Valuation

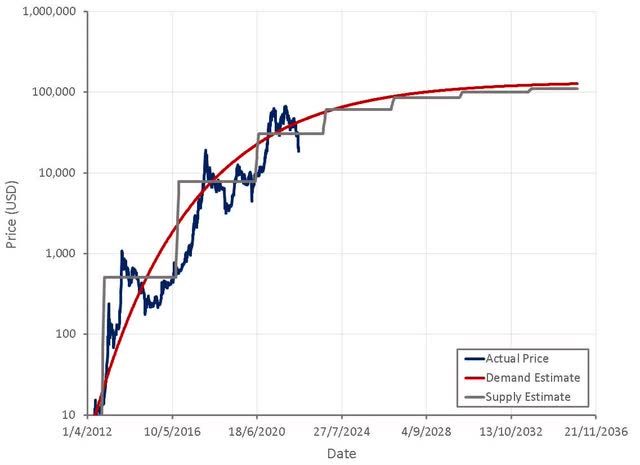

As an asset that does not produce any cash flows, Bitcoin’s value is subjective and difficult to estimate in any rigorous manner. Supply and demand models both explain Bitcoin’s past performance reasonably well, although may be less useful for prediction going forward if there is a macro regime change.

These models are discussed in more detail here.

Figure 4: Bitcoin Value Estimates (source: Created by author using data from blockchain.com)

Conclusion

From a price perspective, Bitcoin is now more appealing than it has been for several years, but given the headwinds it faces this is still a risky entry point. Until the macro environment becomes more favorable, Bitcoin is likely to face continued price pressure. Even under more benign conditions, it is not clear where the next wave of demand will come from. The environmental impact of proof-of-work is generating more criticism and with many other leading blockchains utilizing proof-of-stake, Bitcoin risks losing appeal amongst institutional investors for ESG reasons. The long-term sustainability of Bitcoin’s security model is also likely to draw more attention in coming years.

Be the first to comment