JimVallee

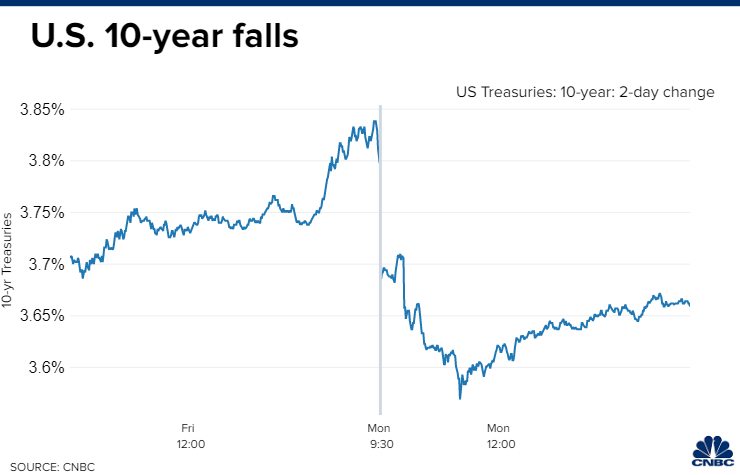

My outlook for a stock market recovery during the fourth quarter started off on the right foot yesterday, as the major market averages soared across the board to begin October. A plunge in long-term interest rates instigated the renewed enthusiasm for risk assets with the 10-year Treasury yield falling from last week’s high of 4% to 3.65%. The 2-year yield has also come off its high of 4.3% to fall as low as 4.0% before settling at 4.1%. Lower yields warrant higher stock values, but they also suggest a pivot in Fed policy may be coming sooner than the consensus expects.

Finviz

I have been an outlier this year in my call that the Fed would not raise short-term rates as high as markets expect on the basis that the rate of inflation will fall in the year ahead as rapidly as it rose last year. Understandably, Fed rhetoric has been designed to lower inflation expectations and suppress enthusiasm for risk assets, but rhetoric and action are not the same thing. The bond market was reflecting as much as 165 basis points of additional rate hikes after the Fed raised rates by 75 basis points last month, but that expectation has been curtailed to just 125 as of yesterday. The consensus is starting to recognize that the seeds planted for lower prices next year are already starting to sprout.

CNBC

The Fed will most assuredly increase rates at its next meeting in November, but I suspect it will be a smaller increase of just 50 basis points, which may also be the final increase for this rate hike cycle. Signs that the rate of economic growth has slowed dramatically by then should be glaringly apparent, particularly in the housing market, along with a more established downtrend in prices. The Fed is likely to “pivot” to a wait-and-see mode with respect to its rate policy, allowing 350-375 basis points of tightening to fully filter through the economy.

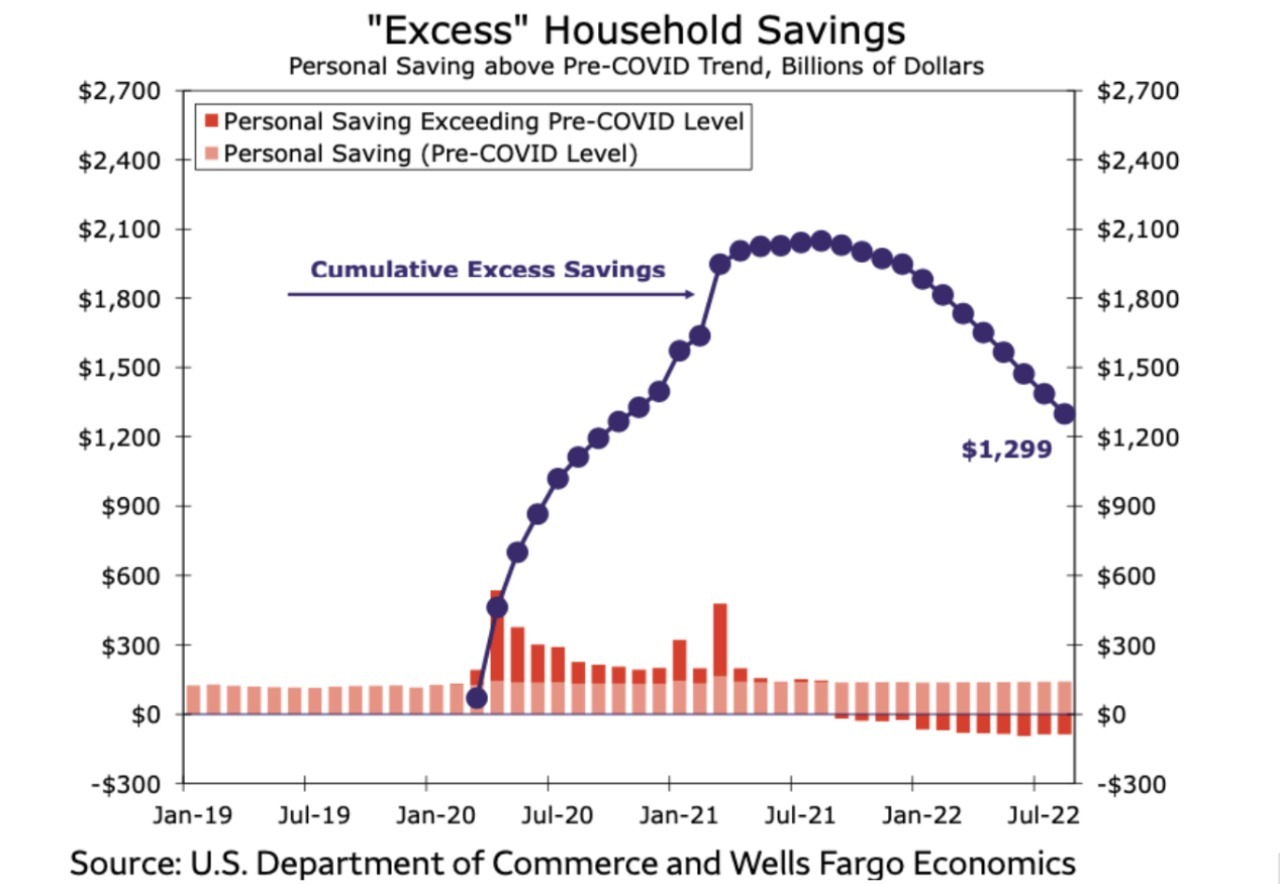

At the same time, indications that growth is slowing, like the one we saw in yesterday’s ISM manufacturing index, will keep recession fears elevated. Still, I see a resilient consumer keeping this expansion afloat. Despite a significant drawdown in the more than $2 trillion in savings accumulated from the fiscal stimulus measures that followed the pandemic, consumers still have approximately $1.3 trillion to help ride out this period of elevated prices. That should be a sufficient buffer until next summer when the rate of inflation falls closer to the Fed’s target.

Yahoo Finance

While yesterday’s rally was impressive from the standpoint of breadth and quality, I am not convinced that we won’t see more volatility leading up to the midterm election. Technical indicators were extremely oversold and investor positioning overly bearish at the end of the third quarter, so we were long overdue for a major reversal. We had one yesterday and it is bleeding into today, but we need several more to break the back of bearish sentiment and convince the consensus that a new uptrend has begun.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment