Jae Young Ju

Investment Thesis

ON Semiconductor Corporation (NASDAQ:ON) stock has been battered since the start of 2022, impacted by the ongoing semi bear market. However, onsemi’s exposure to the fast-growing and more resilient industrial and automotive segments has helped ON outperform its broad semi peers YTD.

Notwithstanding, we remain concerned that onsemi may still be impacted by the broad semi slowdown if inventories start to build up due to possible double ordering. Furthermore, it’s highly challenging for onsemi to have clear visibility over its customers’ supply chains to detect such double ordering challenges.

In addition, the consensus estimates suggest that onsemi’s revenue and profitability growth has likely peaked in FY21, and gross margins could also be nearing their peak. Therefore, we believe investors need to be prepared for how a broad slowdown in its end markets could impact its operating model, coupled with the rising recessionary risks.

Our price action analysis suggests that ON could still be mired in a distribution phase. A double top bull trap in March 2022 could have ended its bullish bias, as further buying upside consistently failed.

Therefore, we believe the market could still be pricing in for a steeper decline in ON if it’s unable to retake its bullish bias.

Accordingly, we rate ON as a Hold for now. We urge investors to be patient and wait for a more attractive entry point to improve the potential for outperformance.

onsemi’s Exposure To Automotive And Industrial Likely Shielded It From Semi Weakness

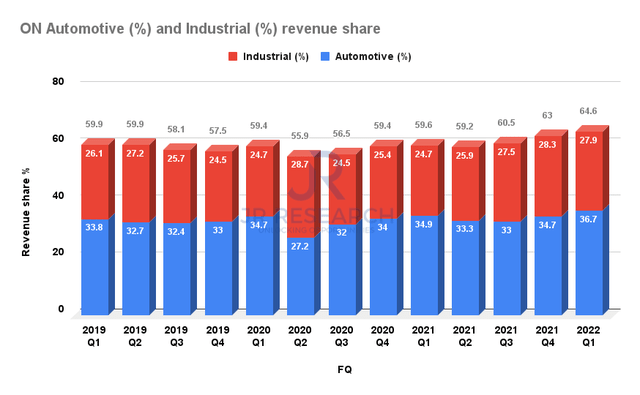

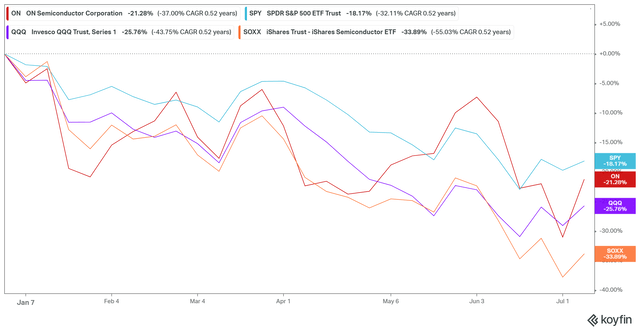

onsemi automotive and industrial revenue share % (Company filings) ON YTD performance % (koyfin)

Semi stocks have been hammered in 2022, so the decline in ON should not be surprising. Notwithstanding, its strong focus on automotive and industrial has likely shielded it from further weakness compared to its broad semi peers.

onsemi reported a revenue share of 64.6% from automotive and industrial in FQ1. Furthermore, the growth in these segments has also been growing markedly over the past three years.

As a result, ON posted a YTD return of -21.28%, well ahead of the iShares Semiconductor ETF’s (SOXX) -33.89%.

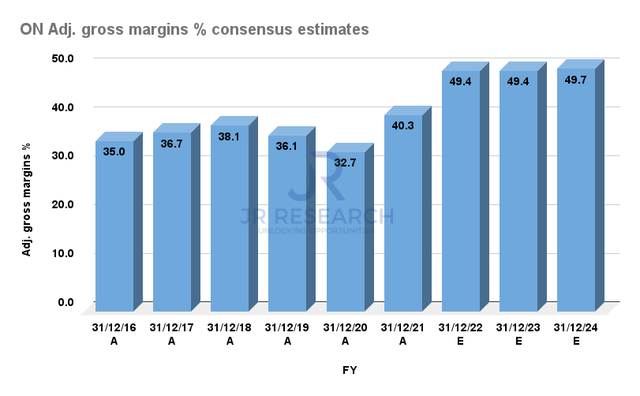

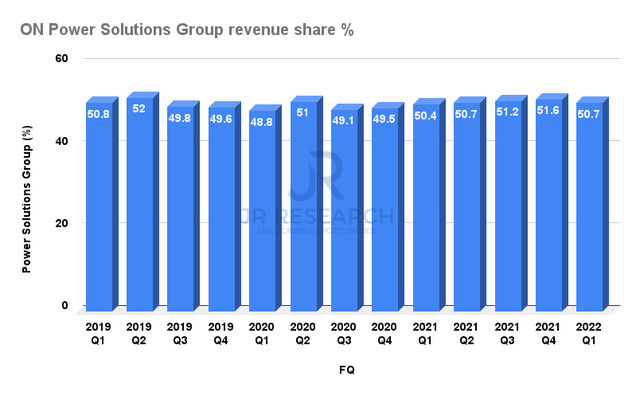

onsemi adjusted gross margins % consensus estimates (S&P Cap IQ) onsemi power solutions revenue share % (Company filings)

onsemi’s revenue has also been driven primarily by its power solutions group, which has consistently accounted for an average of 50% in revenue share.

Furthermore, the company’s recent transformation of moving out of margins-dilutive segments has been instrumental in its improved profitability. As a result, the consensus estimates suggest it could post an adjusted gross margin of 49.4% in FY22.

It’s also at the top-end of the “milestone range” of management’s 48%-50% guidance. Furthermore, the Street (generally bullish) is also confident that onsemi could continue to maintain its robust gross margins, helping to sustain its profitability profile.

But, ON Semiconductor’s Growth Could Slow Markedly From Here

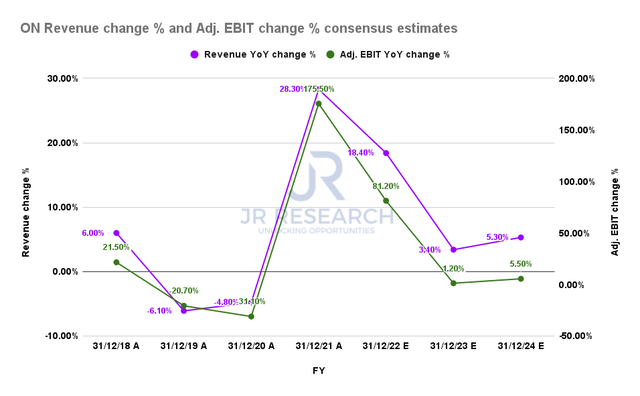

onsemi revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

However, the consensus estimates point to peak growth in its revenue and adjusted EBIT in FY21. Notably, they are projected to fall markedly through FY24, as the Street is not convinced that onsemi could escape unscathed. BofA (BAC) also articulated in a recent note (edited):

Semiconductor downturns happen every three-to-four years, and we could be due for another one. Tighter global monetary policy, geopolitical turmoil, and consumer weakness is likely to pressure chip demand in the second half of 2022 and 2023. However, unit weakness could be cushioned by richer non-consumer mix, robust pricing, expanding content, and constrained supply. (The Fly)

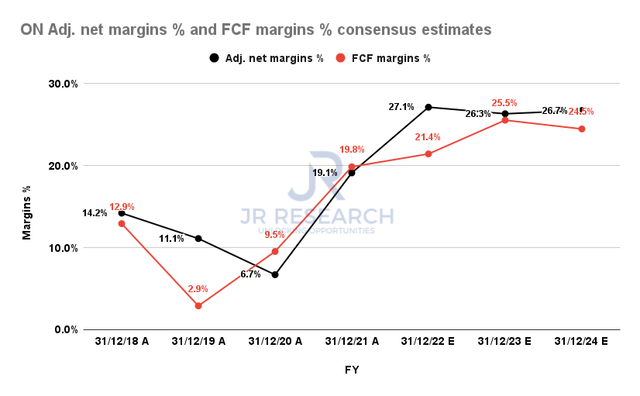

onsemi adjusted net margins % and FCF % consensus estimates (S&P Cap IQ)

However, onsemi’s profitability margins are still estimated to remain robust, in line with its gross margins expectations. Moreover, given the current tight chip inventory around automotive applications and onsemi’s transitions to margin-accretive solutions, we believe the projection is credible.

However, it’s critical for investors to note that its margins are not expected to improve much further from FY22 as growth slows markedly. Therefore, the company could be pressured to extract higher operating efficiencies if a broad semi slowdown impacts its operating model.

ON Stock’s Valuation Could Fall Further

| Stock | ON |

| Current market cap | $23.23B |

| Hurdle rate [CAGR] | 12% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 8% |

| Assumed TTM FCF margin in CQ4’26 | 24% |

| Implied TTM revenue by CQ4’26 | $12.86B |

ON reverse cash flow valuation model. Data source: S&P Cap IQ, author

ON last traded at an NTM FCF yield of 7.68% (Vs. 5Y mean of 7.32%). Therefore, ON has consistently traded at a much lower FCF multiple than the market’s average. Notwithstanding, ON has outperformed the market over the past five and ten years, notching a 5Y and 10Y total return CAGR of 30.18% and 22.65%, respectively.

However, our valuation model indicates that such outperformance is unlikely to be repeated. Note that ON formed a double top bull trap (significant rejection of buying momentum) in March 2022 at an FCF yield of 5.7%. At its June/July bottom, the market rejected further selling momentum at a yield of about 8.8%.

Therefore, we believe it’s appropriate to apply an FCF yield of 8% in our model. We also applied a market-perform hurdle rate of 12% (lower than ON’s 5Y and 10Y CAGR) and derived a TTM revenue target of $12.86B by CQ4’26. As a result, we believe that onsemi could miss our revenue target based on the revised consensus estimates.

Therefore, we believe the market could likely be pricing in further weakness in ON before a sustained bottom can be seen. As such, the market could be asking for higher FCF yields to compensate for potential underperformance.

Is ON Stock A Buy, Sell, Or Hold?

We rate ON as a Hold for now.

We believe that investors need to consider the risks of a broad semi slowdown that could significantly impact onsemi’s revenue and profitability growth. Also, the company seems to be operating at peak gross margins, which is a cause for concern.

Our valuation model indicates that ON seems overvalued at the current levels and could underperform the market. Therefore, we urge investors to be patient when considering adding exposure.

Be the first to comment