Thinkhubstudio/iStock via Getty Images

Investment Thesis

Evolent Health (NYSE:EVH) is a health care administrator platform that is growing at a mid-30s% CAGR. Surprisingly, the business is only priced at 2x this year’s revenues.

However, once we look under the hood, we see a business that isn’t likely to become profitable for a while. But does this matter? Particularly given its low multiple to sales valuation?

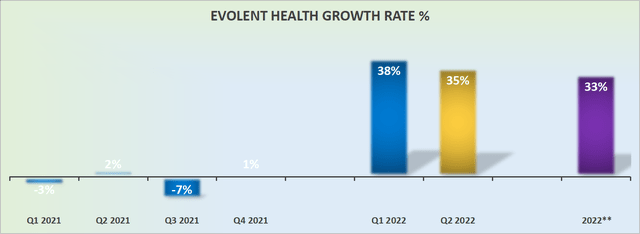

Evolent Health’s Revenue Growth Rates Jump Higher

Author’s calculations, not including IPG acquisition

Throughout 2021 Evolent Health consistently divested assets. This made its overall GAAP revenues shown above look unappetizing. That being said, keep in mind that Evolent’s revenue excluding revenue from divested assets was up 36.7% y/y in 2021.

In that light, its revenue growth rates in 2022 don’t appear all that surprising. It’s not that the core business went from negative growth rates last year, to mid-30s% CAGR this year. It’s more of a steady as-it-goes story.

Moreover, the guidance above doesn’t include its recent acquisition of IPG which management believes may close before its Q2 results are reported in early August.

IPG is assumed to be on a path to $140 million of revenues in 2022. Once IPG’s financials are added to Evolent Health’s, rather than Evolent growing at $1.2 billion, as it previously guided for, Evolent Health will now most likely guide for approximately $1.3 billion.

This would put Evolent Health on track to grow by 40% y/y in 2022. That would be a very different sort of growth rate, at least compared with its reporting GAAP revenue in 2021.

Evolent Health’s Near-Term Prospects

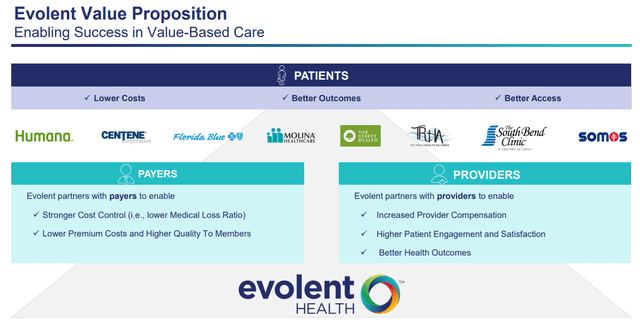

Evolent Health describes itself as the ”original value-based care company” in the US.

Evolent believes that it can improve the cost and quality of care by realigning the business between payers and providers. During a recent conference call, Evolent describes itself as a go-between platform for payers and providers.

That payers in the health system want low payouts, while providers are typically incentivized towards higher costs solutions. The two sides of the equation are not aligned, and Evolent aligns both sides towards common goals.

Evolent’s goal is to move payers away from traditional fee-for-service (”FFS”) reimbursements toward value-based care, which Evolent declares would lower expenses to payers.

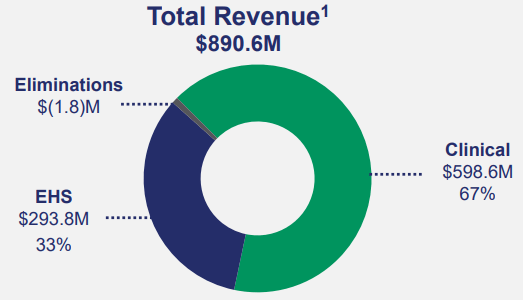

Simply put, Evolent is an administrative platform with two main segments, Clinical and Evolent Health Services.

Evolent June presentation

As you can see above, as of Q1 2022, nearly 70% of the business comes from its Clinical Solutions.

This side of it is particularly alluring, as it’s growing at mid-40s% CAGR as of Q1 2022. Furthermore, the acquisition of IPG will be added to this segment, providing its Clinical Health segment with a boost in inorganic growth rates.

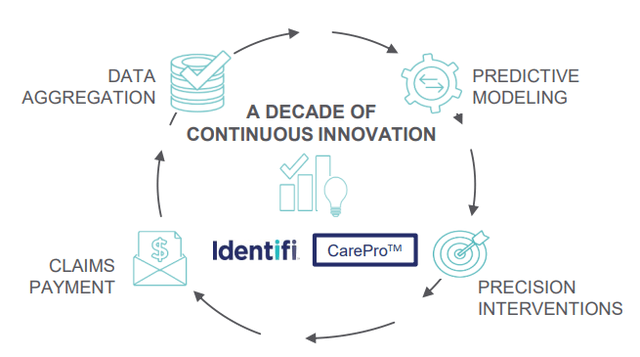

Evolent’s Clinical Solutions platform looks through a payer’s plan and uses data to identify which patients are likely to be the most expensive patients.

Once those patients have been identified what sort of intervention measures would bring down the running cost of having that patient. It could be a suggestion for a home visit by a health care professional or a phone call from a nurse.

In essence, there are options suggested to be preventive rather than remedial, with the latter obviously being more costly.

Next, we’ll turn our focus to Evolent’s profitability.

Profitability Profile in Focus

Before getting stuck into its profit margins, let’s spend a moment on Evolent’s financial position.

After Evolent closes its IPG acquisition, its balance sheet will be leveraged to 2.9x EBITDA. This is a very high level of leverage. There’s no getting around this fact. Particularly as we enter a higher interest rate environment.

By my estimates, Evolent’s balance sheet will have a net debt position of $320 million once the acquisition of IPG is closed.

Furthermore, Evolent will be diluting shareholders by approximately $125 million to fund its IPG acquisition.

Next, Evolent describes itself as being EBITDA profitable, however, the business is certainly not cash flow positive. In fact, Evolent notes that the business is very capex light while failing to make a point to investors that it capitalizes a significant amount of its expenses.

EVH Stock Valuation – Difficult to Value

At the most superficial level, Evolent’s stock is priced at close to 2x this year’s revenues. However, once we get beyond its revenue line, there are countless pesky costs that detract from its top line, leaving its profitability profile in meaningfully negative territory.

Meanwhile, Evolent highlights to investors that its EBITDA is profitable, noting that it’s already at high single digits of EBITDA margins.

Presently, I don’t see a clear path to how this business can reach ”clean” profitability for some time.

The Bottom Line

Evolent Health aims to tackle the waste in health care in the US by aligning payers and providers under common goals. Its Clinical Solutions segment is the crown jewel of the business.

However, the one thing that puts me off from endorsing this business is that its financials show a business that isn’t profitable, even though its management team touts the business’s profitability as part of the investment thesis.

All that being said, at 2x this year’s sales, isn’t the fact that it’s not profitable already factored in many times over into its share price? Perhaps it could be.

Be the first to comment