We Are/DigitalVision via Getty Images

Investment Thesis

ON Semiconductor (NASDAQ:ON) has unfortunately tumbled from its recent high, once it is evident that the inflation rate remained elevated at 8.3% in August against pre-pandemic levels and the Fed’s mandate of 2%. The Feds, consequently, are hell-bent on aggressive rate hikes through 2023, potentially bringing forth the unwanted recession. With the projected terminal rate of 4.6% by 2023, it is likely that we will see another 75 basis point hike in November, with things moderating in January 2023 with a 50 basis point hike. Combined with its exposure to the ongoing semi-market weakness, it seems that ON may see more pain in the short term.

On the other hand, ON has an ace card in its silicon carbide technology, on top of its growing exposure in the automotive and industrial markets, whose demand has remained robust despite the destruction of personal devices earlier. In the meantime, the stock market’s potential support level may be determined by the release of the September CPI in early October. The S&P 500 Index has already plunged by -23.96% YTD, breaking its previous June lows to Mr. Market’s chagrin. Nonetheless, we are starting to see some optimism around the corner, with the S&P 500’s plunge moderating. The winds of change may have begun.

In building a bullish case for ON, we expect the market to slowly upgrade its valuation, currently at P/E 12.94x, nearer to market leaders such as NVIDIA (NVDA) at 35.61x and Advanced Micro Devices (AMD) at 15.17x. The latter two’s dominance in data centers, PCs, and GPUs ( amongst others ) has catapulted them to global success and inflated valuations of 72.98x and 72.17x previously. However, despite the drastic correction thus far, it is apparent that Mr. Market has been very partial to these market darlings as well, similarly to Tesla (TSLA).

Assuming a mean target P/E of 21x and EPS of $6.89 by FY2025, and thus, a price target of $144.69, the ON stock is downright a steal at current levels, with massive potential for growth. This is significantly aided by the booming industrial, automotive, and green energy applications, which may eclipse the maturing data center market over the coming few years. We shall see, since we expect the company to also secure more output capacity from its existing foundry partners due to the destruction of demand in the personal devices segment. Thereby, boosting the growth of its top and bottom lines in the intermediate term.

ON Continues To Benefit From The Auto Boom – Though Mr. Market Is Cautious

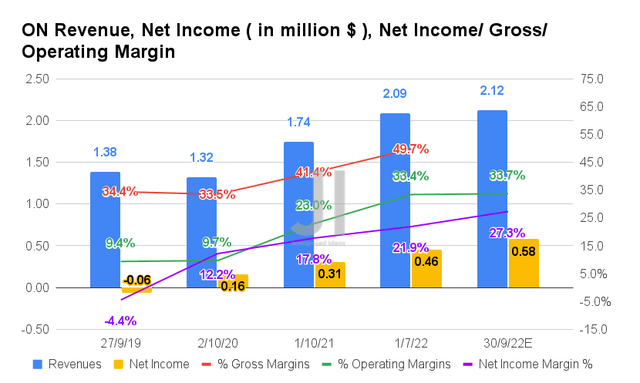

For its upcoming FQ3’22 earnings call, ON is expected to report revenues of $2.12B and operating margins of 33.7%, representing a minimal increase of 1.43% and 0.3 percentage points QoQ, respectively. Otherwise, massive YoY growth of 21.83% and 10.7 percentage points, respectively.

Naturally, this will boost ON’s profitability, with net incomes of $0.58B and net income margins of 27.3% in the next quarter, indicating QoQ growth of 26.08% and 5.4 percentage points, respectively. Otherwise, a tremendous increase of 87.09% and 9.5 percentage points YoY, respectively.

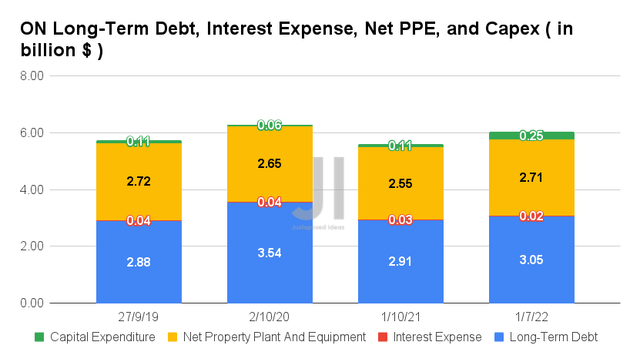

It is also evident that ON is aggressively re-investing in the business over the last twelve months (LTM), with $732.3M of capital expenditure, indicating an eye-popping increase of 270.32% sequentially. Naturally, this has boosted the growth of its net PPE assets to $2.71B in FQ2’22, representing an increase of 4.71% YoY.

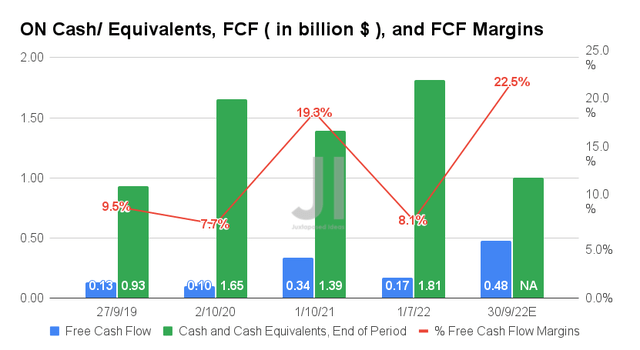

In the meantime, ON would be looking at long-term debt maturity of $155.1M due 2023 and $500M due 2024, with the rest well staggered through 2028. Nonetheless, investors have nothing to worry about, given ON’s massive $1.81B in cash and equivalents reported on its balance in FQ2’22.

For FQ3’22, ON is expected to report improved Free Cash Flow (FCF) generation of $0.48B with an FCF margin of 22.5%, representing impressive QoQ growth of 282.35% and 14.4 percentage points, respectively. Otherwise, still an excellent increase of 41.17% and 3.2 percentage points YoY, respectively. Thereby, further fortifying the company’s liquidity and growth during the economic downturn ahead.

Mr. Market May Potentially Upgrade Its Estimates Through 2025

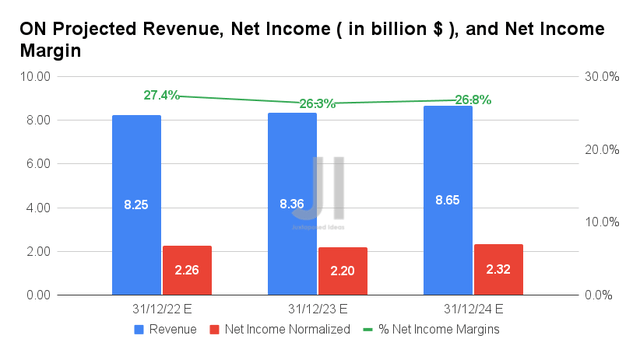

Over the next three years, ON is expected to report revenue and net income growth at a CAGR of 8.73% and 32.38%, respectively. Its net income margins are also expected to improve drastically, from 3.8% in FY2019, to 15% in FY2021, and finally to a stellar projected 26.8% by FY2024. It is evident that Mr. Market is cautiously optimistic about its forward execution, since these numbers represent a notable upgrade by 3.51% in estimates since our previous article in July 2022.

However, we are even more confident, given the massive unmet demand in the automotive market ahead, with the global electric vehicle market projected grow tremendously at a CAGR of 18.2%, from $163.01B to $823.75B by 2030. General Motors (GM) is still screaming immense global chip tightness in FQ2’22, with 95K vehicles worth approximately $5.7B (based on the Average Transaction Prices (ATP) of $60K for trucks and SUVs ) produced in North America, being undelivered due to missing components. Ford (F) similarly reported up to 45K vehicles impacted by parts supply in its early FQ3’22 report, potentially worth up to $2.25B ( based on ATP of $50K ).

Therefore, it made perfect sense that ON is aggressively expanding its capacity for Silicon Carbide output by 3-fold for 2022, with over $1B in revenue by 2023, while accelerating its long-term supply agreements to over $4B in annual sales through 2025. The latter’s 53.84% QoQ increase from $2.6B in supply agreements since FQ1’22 signifies one of the many reasons for a bullish case indeed. Therefore, it is not overly optimistic to assume that we may see another 10% upgrade in ON’s forward estimates, especially since there will be continued growth in its supply agreements through 2023.

While gross margins will remain a headwind, these are temporary at best, since the management has guided massive improvements by the end of 2023. Furthermore, the projected gross margin of up to 50% for a chip foundry and designer is already impressive during these inflationary environments, compared to pure play designers such as NVDA at 60.5% and AMD at 50.8% in the last twelve months. ON’s guidance remains excellent in comparison to pure foundries, such as Taiwan Semiconductor Manufacturing Company Limited (TSM), at 55% over the same period. Do not discount this monster!

Meanwhile, ON is expected to report FY2022 revenues of $8.25B, net incomes of $2.26B, and net income margins of 27.4%, representing impressive YoY growth of 22.58%, 226%, and 12.4 percentage points, respectively. It is no wonder then that the stock had rallied by 20.49%, from $63.66 pre-FQ2’22-earnings to its peak at $76.71. Unfortunately, all of those gains have also been thoroughly digested by now, given the market’s worsening pessimism and the recessionary fears.

In the meantime, we encourage you to read our previous article on ON, which would help you better understand its position and market opportunities.

- ON Semiconductor: Ready For Takeoff – Do Not Ignore The Next Giant

So, Is ON Stock A Buy, Sell, or Hold?

ON 5Y EV/Revenue and P/E Valuations

ON is currently trading at an EV/NTM Revenue of 3.46x and NTM P/E of 12.94x, higher than its 5Y EV/Revenue mean of 2.47x though lower than its 5Y P/E mean of 16.10x. The stock is also trading at $64.29, down -16.26% from its 52 weeks high of $76.78, though at a premium of 53.51% from its 52 weeks low of $41.88. Consensus estimates remain bullish about ON’s prospects, given their price target of $75.94 and a 18.12% upside from current prices.

ON 5Y Stock Price

Nonetheless, given the recent spike in late July, ON stock is currently trading above its historical 100-day moving average of $61.19 and 200-day of $60.72. Combined with the worsening bear market and the global sell-off thus far, we reckon that there will be more retracement ahead in the short term. Mr. Market will seek to punish again at the slightest sign of negativity or pessimism, lending to the stock’s short-term volatility.

Otherwise, given the multiple positive catalysts, we are more likely to see a sustained sideways action through the next few months, before sustainably rallying as the rate hikes taper by early 2023. Therefore, investors with higher risk tolerance and long-term trajectory may consider nibbling at these times of maximum pain, given the stock’s excellent returns over the decade. However, one should also be willing to ride out the storm over the next few months, while holding on to their conviction buys. Good luck all.

Be the first to comment