jxfzsy/iStock via Getty Images

Ginkgo Bioworks (NYSE:DNA) specializes in discovering molecules, processes, or strains with commercial value. That also includes engineering organisms to create customer value. In other words, Ginkgo is a biology engineering company. The company wants to build a platform for cell programming. The simplified idea is that cells are the printers of the physical world, capable of manipulating atoms.

The company designs cell programs to generate outputs of biological products like therapy molecules, food ingredients, and chemicals. The advantage is the ability to scale to a level where it becomes cost competitive to produce through biology. For instance, there are petroleum-derived chemicals that the industry might replace through cell organisms programmed by Ginkgo. The potential of this technology is amazing.

It is possible to engineer microbes to fixate Nitrogen in plants’ roots, thus decreasing the need for artificial fertilizers. Or, we can even produce Hydrogen from microbes, which is more promising than energy-intensive electrolysis.

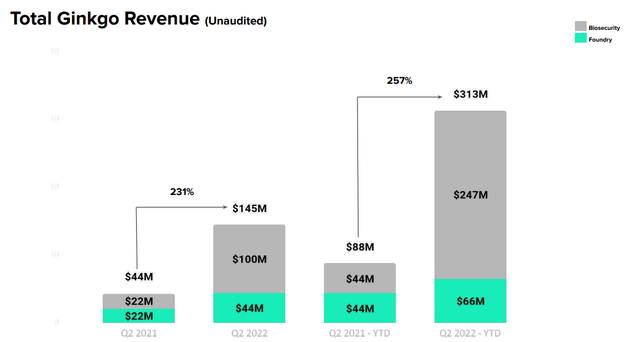

The applications are endless. For instance, the biosecurity line of business skyrocketed in 2021. Most of this is thanks to the Covid virus and the need for passive monitoring of wastewater and air.

Ginkgo’s revenue spurt is impressive. However, I believe that it won’t be the last we’ll see. Why am I so optimistic? Well, the company seems to be in a position to rapidly take advantage of global problems by offering engineered solutions for them. DNA engineering might be the solution to a lot of our energy problems. The twentieth century marked our control over chemical reactions of existing rich energy resources, similarly, the twenty-first century might witness the start of our control over biology to replenish our energy resources. Microbes engineered to enhance hydrogen production might be the viable way to produce hydrogen instead of water electrolysis.

Ginkgo’s platform

So, what is the advantage of Ginkgo? Its platform. Ok, I guess you keep hearing this argument many times but let’s do a deep dive on this one. Two assets are the foundation of the company’s platform: Foundry and Codebase.

The Foundry is where the company designs, writes, and inserts the DNA into the cells. Foundry includes software and automation tools used in this engineering process, facilitating testing and iterating. According to the management, the output has increased three times annually, while the costs have decreased by 50% per year.

The codebase is the database of biological assets (cells and code) that the company is constantly growing, and it can leverage for future projects, improving the odds of success. Together these two assets should improve with scale and, in turn, drive more scale.

Rationale for investing

As Stanley Druckenmiller says, the market is not about what is happening now but what might happen in 18 months. In my opinion, in the next year and a half, there is a big chance of the developed world facing a shortage of food supplies due to the war ramifications.

Nowadays, the largest threatened product group is nitrogen-based fertilizers. The production derives from the Haber-Bosch process, which involves mixing the nitrogen in the air with hydrogen at high temperatures and pressure to produce ammonia. The supply chain from Russia, Ukraine, and Byelorussia is already unreliable. Additionally, Polish producers are halting fertilizer production due to natural gas prices.

An energy crisis coupled with a food security crisis is a recipe for disaster. I’m not very optimistic about the impact on the developed world. However, if there is hope to solve these problems, I think it must come from mastering biology.

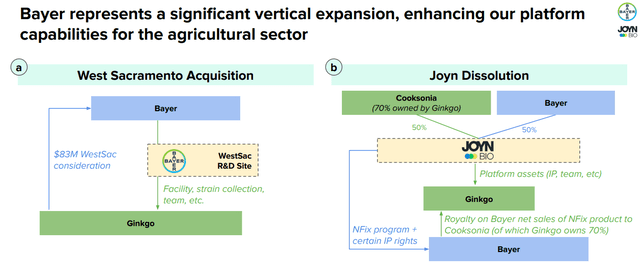

Joyn Bio, the joint venture formed between Ginkgo and Bayer to develop ag biologicals, is a good example of this pursuit. Bayer was interested in testing Ginkgo’s synthetic biology capabilities in the agricultural field. One of the most interesting highlights is the nitrogen-fixing program.

The joint venture dissolved in the first half of 2022, but the partnership will remain. Both companies will split the Joyn Bio assets, with Ginkgo getting research assets (IP, intellectual rights, research staff). The product concepts will go to Bayer, which will commercialize them. There are some nuances. One of them is that Ginkgo will receive royalties on Bayer’s net sales of the Nitrogen-fixer program that Bayer will commercialize. Ginkgo is buying the West Sacramento research site owned by Bayer (83 million in cash or stock).

In my opinion, this deal can be huge for Ginkgo. First, the company will have a solid foot in the agricultural biologicals market through Bayer. Bayer already has a retail footprint in that market, which means it has the scale to commercialize the Nitrogen-fixer program. Second, the company will be adding resources to develop other agricultural solutions, which I believe will be in demand during the following years. In my opinion, revenues coming from the ag bio business might have a huge impact in the medium term, akin to the effect of the covid vaccine on Moderna. If those royalties materialize, the company might cash in enough revenues to finance the next round of growth.

Company development

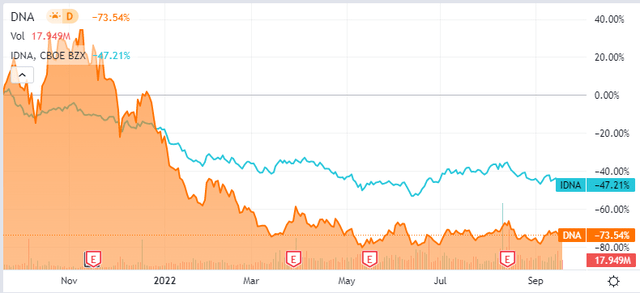

Be as it may, the company is perceived as a biotech startup and treated as such. As you can see by comparing Ginkgo’s price performance against the iShares Genomics Immunology and Healthcare ETF (IDNA), the company has underperformed the IDNA by 26% in the previous year.

One interpretation is that investors see the company as a cash-burning machine in a scenario of economic winter and liquidity contraction. In my opinion, this couldn’t be further from the truth. The company seems to hemorrhage cash when you look at the bottom line, but the cash flow shows a more benign situation.

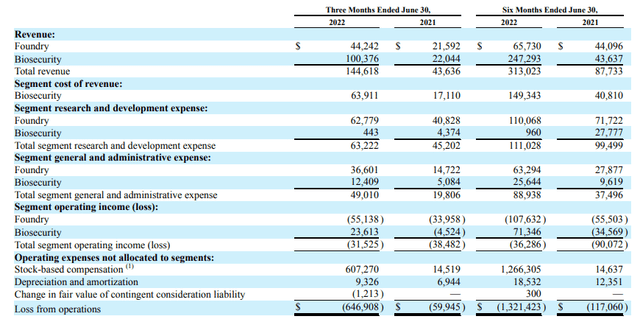

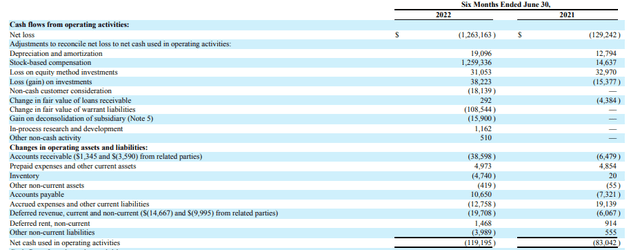

Ginkgo Bioworks Ginkgo Bioworks

The 1.3 billion dollar loss becomes much less sensational when you check that the operating cash flow was just a loss of $120 million. The main component of the income statement loss is stock-based compensation which explains the difference between the two metrics.

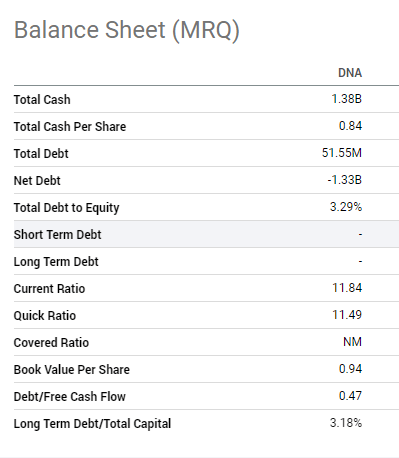

The result is that, unlike many other tech companies, Ginkgo has been capable of maintaining a solid balance sheet. The current ratio is more than 10, which is a good indicator that Ginkgo is in great shape to navigate the liquidity contraction.

Seeking Alpha

Investor Takeaway

Ginkgo has a couple of underlying trends going in its favor. First, the energy constraints in Europe open an opportunity for ag bio. Second, the macro scenario is daunting at a time when most tech companies have burned through lots of reserves, but not Ginkgo.

The natural gas constraints might be the catalyst for commercial adoption of the nitrogen-fixing program. That, in turn, could yield royalties to Ginkgo. The increase in revenues would come at no extra cost for the company and could significantly contribute to the company reaching the 1 billion revenue watermark. If that happens, a couple of chain reactions could get on course. First, the 21% short interest in the stock could get squeezed, sending the price to sales multiples higher. Second, the extra revenues will help the company finance the younger branches of the company’s R&D.

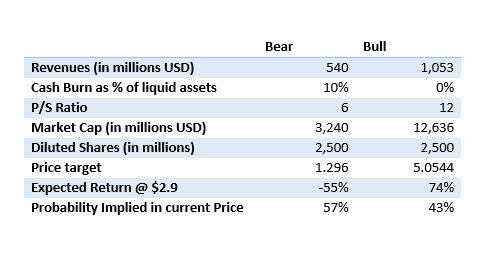

We can see what’s implicit in the stock price by designing two scenarios, one bear and one bull. The bull scenario consists of revenue growth rates close to 25% during the next three years, corresponding to a spurt in the ag bio business. The cash burn diminishes to zero inflating the P/S ratio to 12. In the bear scenario, the revenue does not grow, and the cash burn will be 10% of the current liquid assets. That will result in a 6 P/S ratio. In both scenarios, the shares outstanding increase to 2.5 billion shares.

Author Computations

This simplistic model shows us that there might be asymmetry in the risk/return profile of this asset. I think the probability implied in the current price in this model should be more favorable to the Bull scenario because the current shortage in the industrial fertilizer market makes it more likely for the ag bio programs to generate revenue in the medium term.

The bullish stance exposed in the previous paragraphs has its own risks. The rise in revenues coming from the Bayer collaboration might not materialize, and the whole ag bio subclass might not gain any traction. Even in that case, there are offsets. The company has several programs in many different areas, from industrial to pharma. One of these programs might be enough to create a revenue stream that sustains higher valuations.

However, there are other risks. There are reputational risks from a program that might go wrong and tarnish the company. Or even the Scorpion Capital short sell report that argues the company creates bogus revenues from its spin-offs. If true, that could likely undermine the ability of the company to get additional financing. In my view, the practice raises flags, but it doesn’t seem intentionally geared to mislead investors. However, in the end, it is up to the investors to decide.

All-in-all, Ginkgo is a promising company with a high upside (I was conservative in the revenue figures for the bullish case). Investors willing to bear the risks might consider including a small stake in a diversified portfolio.

Be the first to comment