Edwin Tan/E+ via Getty Images

A Quick Take On Olo

Olo (NYSE:OLO) went public in March 2021, raising $450 million in an IPO that was priced at $25.00 per share.

The firm provides software for restaurants seeking integrated digital ordering and delivery processing capabilities.

While OLO has been beaten down as the pandemic wanes, for patient investors, my outlook on the stock is a Buy at its current level of around $12.90.

Company

New York-based Olo was founded to develop an integrated SaaS software solution for restaurant operations use cases.

Management is headed by founder and Chief Executive Officer, Noah Glass, who was previously International Expansion Manager for Endeavor Global.

The company’s primary offerings include:

-

Digital ordering

-

Dispatch & delivery

-

Channel management

- Olo Pay

The firm pursues relationships with major restaurant brands to provide its SaaS solutions as the exclusive direct digital ordering provider.

The company’s platform handles more than 2 million orders per day and integrates more than 100 restaurant technologies into its systems, such as ‘POS systems, aggregators, DSPs, payment processors, user experience or UX, and user interface, or UI, providers, and loyalty programs.’

Olo’s Market & Competition

According to a 2018 market research report by Grand View Research, the global restaurant management software market is expected to reach nearly $7 billion by 2025.

This represents a forecast strong CAGR of 14.6% from 2019 to 2025.

The main drivers for this expected growth are continued technology development and disruption and sharply increased need by restaurants for technology solutions to enhance their efficiencies and improve their daily operations.

Also, front-end software held the largest share of the market in 2016 and is expected to continue to account for a majority of market share in 2025.

Major competitive or other industry participants include:

-

Tillset

-

Onosys

-

NovaDine

-

NCR Corporation (NCR)

-

Xenial

-

GrubHub (GRUB)

-

DoorDash (DASH)

-

UberEats (UBER)

-

Others

Olo’s Recent Financial Performance

-

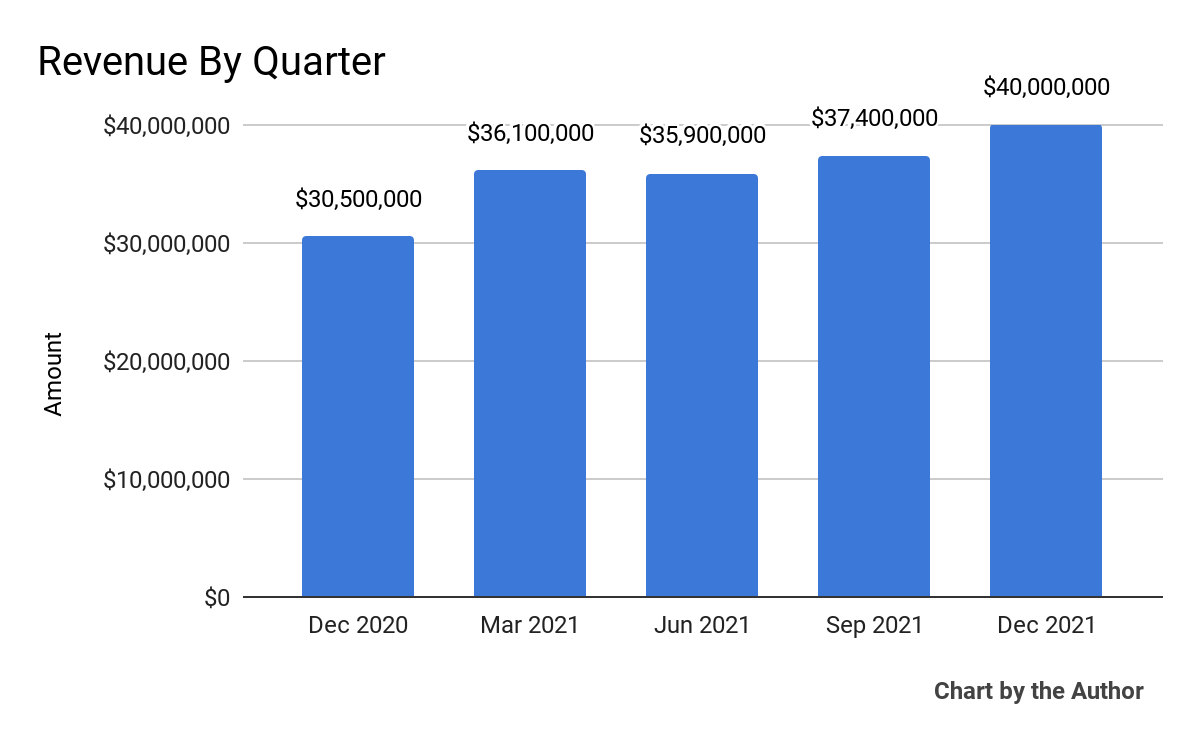

Topline revenue by quarter has grown markedly in the past five quarters:

5-Quarter Total Revenue (Seeking Alpha and The Author)

-

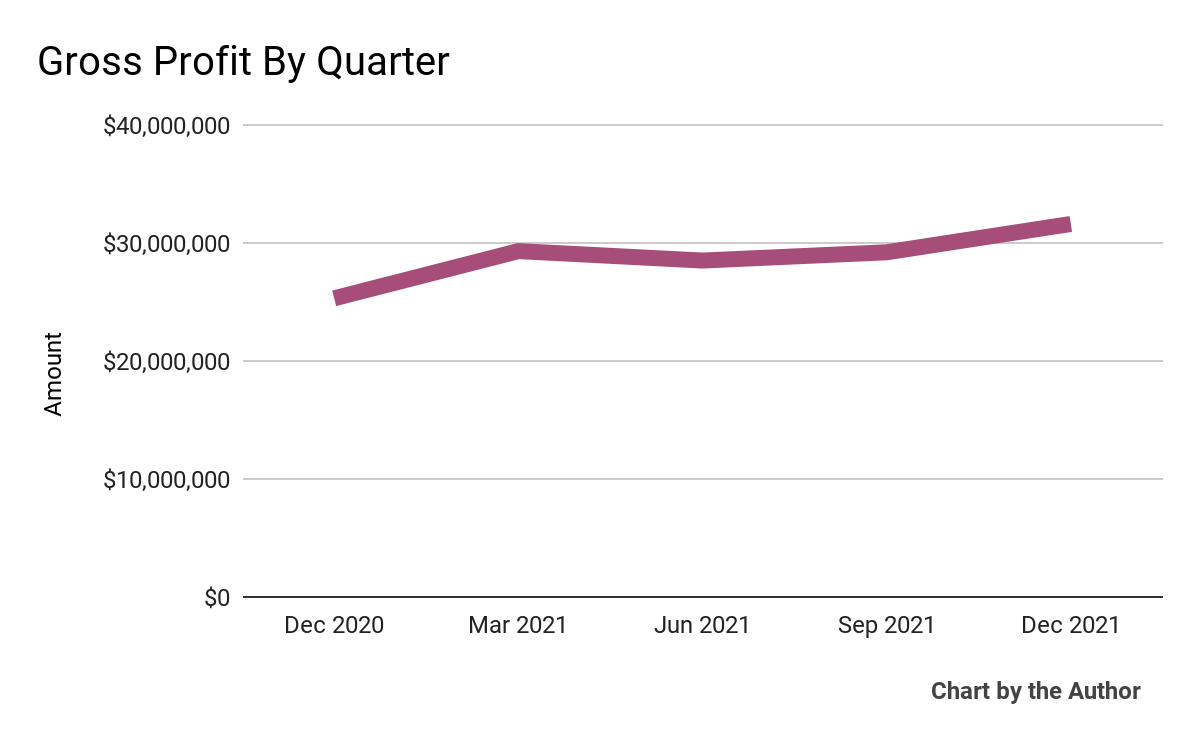

Gross profit by quarter has followed approximately the same trajectory as topline revenue:

5-Quarter Gross Profit (Seeking Alpha and The Author)

-

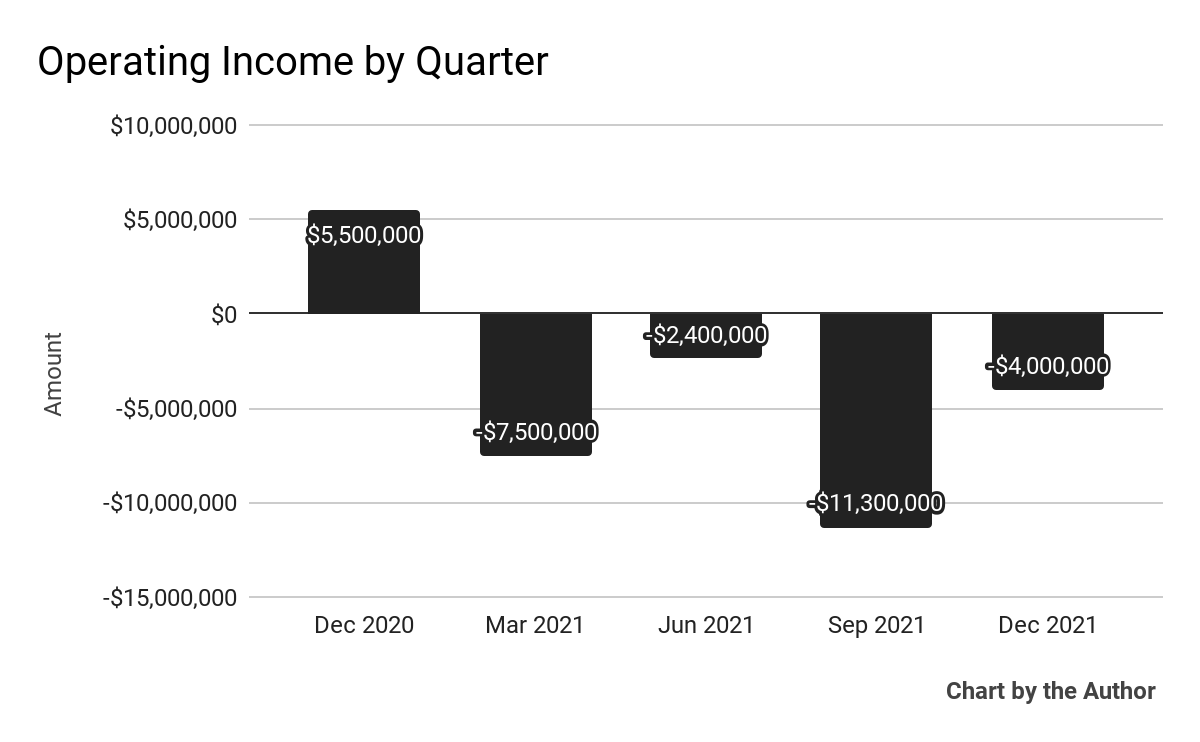

Operating income by quarter has remained negative in 2021:

5-Quarter Operating Income (Seeking Alpha and The Author)

-

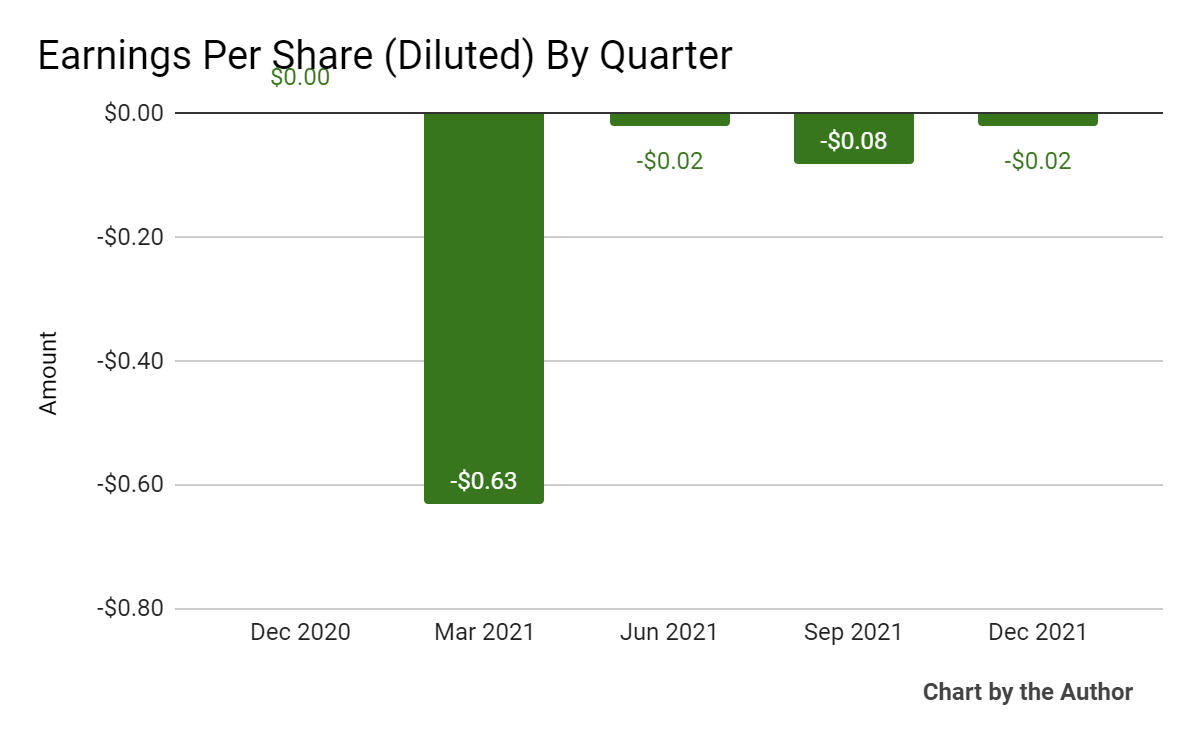

Earnings per share (Diluted) has yet to turn positive:

5-Quarter Earnings Per Share (Seeking Alpha and The Author)

(Source data for above GAAP financial charts)

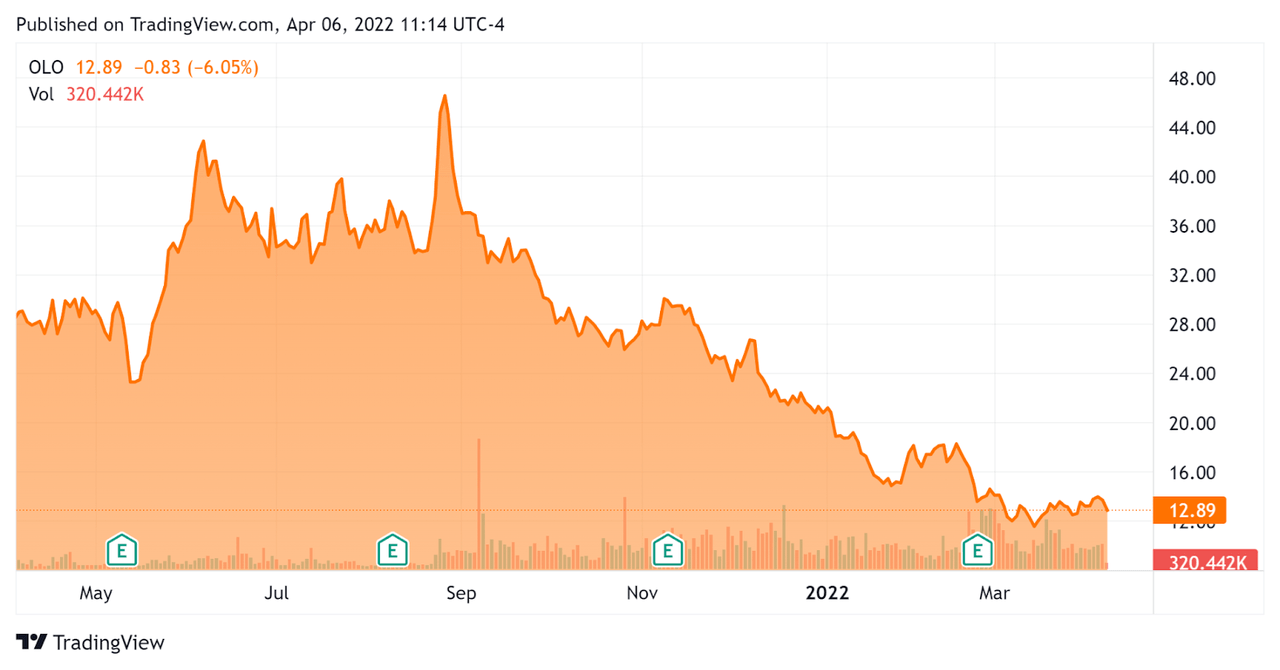

In the past 12 months, OLO’s stock price has dropped 55.6 percent vs. the U.S. S&P 500 index’ rise of 9.6 percent, as the chart below indicates:

52-Week Stock Price (Seeking Alpha)

Valuation Metrics For OLO

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Market Capitalization |

$2,250,000,000 |

|

Enterprise Value |

$1,740,000,000 |

|

Price / Sales |

11.60 |

|

Enterprise Value / Sales |

11.62 |

|

Enterprise Value / EBITDA |

-49.05 |

|

Free Cash Flow [TTM] |

-$8,130,000 |

|

Revenue Growth Rate [Quarterly YOY] |

30.80% |

|

Earnings Per Share |

-$0.75 |

(Seeking Alpha and Yahoo! Finance)

Commentary On Olo

In its last earnings call, covering Q4 2021’s results, management highlighted ride hailing firm Lyft joining its dispatch network as a delivery partner while expanding its relationships with UberEats and Waitr (WTRH).

The benefit of these relationships is to broaden channel management and increase driver supply to Olo’s customers using its Dispatch system.

CEO Noah Glass also referenced a number of growing relationships with large customers as they added usage of Olo’s system offerings.

The company also acquired Wisely during Q4. Wisely will help Olo’s customers improve their digital engagement efforts and measure customer lifetime value to increase share of wallet as consumers shift toward digital interactions with restaurants.

Additionally, the firm announced availability of its Olo Pay service to reduce fragmentation and create a more uniform brand appearance while increasing fraud prevention.

As to its financial results, Q4 revenue grew by 31% year-over-year and active locations at quarter-end were 79,000, an increase of 23% year-over-year.

Gross margin during the quarter was 82% (non-GAAP), while R&D expenses remained at 32% of revenue while G&A expenses grew to 27% of revenue versus 20% in the previous year.

The company ended the quarter with ample liquidity, with $514.4 million of cash, equivalents and marketable securities and full year 2021 free cash flow was $14.4 million versus 2020’s $19.4 million.

Looking ahead, management expects 2022 ARPU growth to be approximately 10% but did not provide guidance on revenue for 2022, likely due to uncertainty around the ‘residual impacts from COVID-19 and transitory impacts due to continued industry labor shortages.’

While Olo’s stock has been beaten down due to a variety of changing market conditions, I’m cautiously optimistic over the medium term about its Olo Pay launch.

Management views the TAM for this service as $9 billion, and the demand from customers for a more streamlined payment solution is significant, so the firm is being pulled into that market by its customers.

As a result, Olo has the opportunity to build a 2-sided network between its 79,000 restaurants and 85 million consumers.

While OLO has been beaten down as the pandemic wanes, for patient investors, my outlook is a Buy at its current level of around $12.90.

Be the first to comment