ablokhin/iStock Editorial via Getty Images

Investment Thesis

Old Dominion (NASDAQ:ODFL) has weak short-term growth prospects as the volumes are softening with a slowing economy and there are concerns about impending recession. Consumer confidence is declining and so is the industrial PMI. There are also short-term concerns due to delays in the delivery of new equipment. However, the company has a good track record of delivering volume growth over the last decade and has gained market share across all the US regions due to its focus on offering valuable services, like on-time delivery and minimal cargo damage at fair prices, to its customers. So, I am optimistic about the longer-term prospects. The company’s valuation at 26.52x current year P/E looks expensive though and, hence, I have a neutral rating on the stock.

ODFL Q2 2022 Earnings Highlights

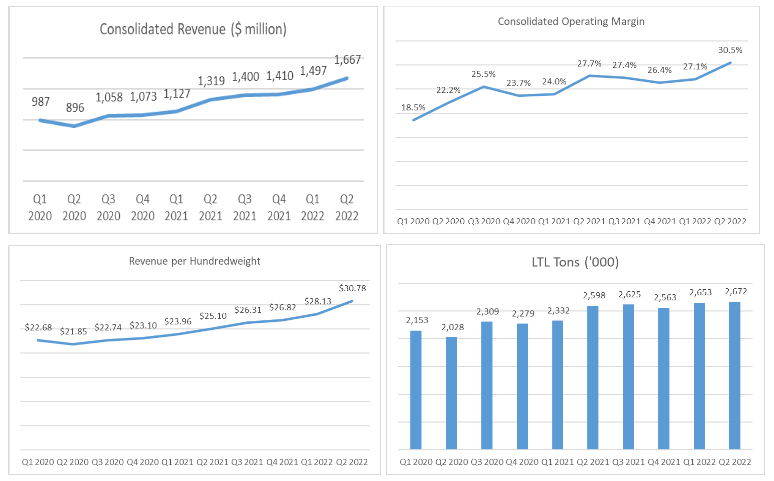

The company reported consolidated revenue of $1.67 billion, up ~26.4% y/y and almost in line with the consensus estimate of $1.64 billion. The consolidated operating margin improved by ~280 bps y/y to ~30.5%. Diluted EPS grew by ~42.9% y/y to $3.3, beating consensus estimates by 15 cents. The improvement in the revenue was primarily due to a solid ~22.6% rise in revenue per hundredweight and growth in volumes. Shipments rose by ~2.75% y/y to 3.4 million and tonnage rose by ~2.85% y/y to 2.67 million. As expected, the year-over-year volume growth softened compared to previous quarters due to the difficult macro environment. The growth in yield was due to an increase in fuel surcharge and pricing strategy. Excluding fuel surcharge, revenue per hundredweight increased by ~9.3% y/y. The operating margin primarily benefited from lower labour costs and purchased transportation costs, which were partially offset by higher fuel costs.

ODFL Key Metrics (Quarterly) (Company Data, GS Analytics Research)

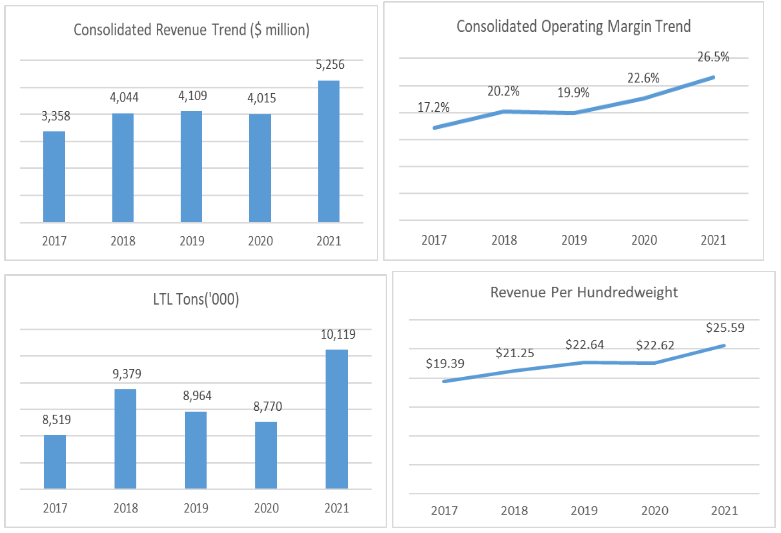

ODFL Key Metrics (Annual) (Company Data, GS Analytics Research)

Revenue Growth Prospects

I expect the LTL industry to face weakness in the short term, both in volumes and yields, with a weak macro environment coupled with difficult comparisons from the last couple of years. Approximately 55-60% of ODFL’s revenue comes from the industrial end market and 25-30% of revenue from the retail end market. There has been good demand from both industrial and retail customers in recent quarters, but the trend seems to be reversing.

Consumer sentiment is at the lowest level in the last twelve months due to record inflation levels, which is impacting retail demand. In addition, U.S. retail inventory growth is also moderating after a robust increase later last year and early this year.

Industrial growth is also expected to remain sluggish as the leading indicator, the U.S. manufacturing PMI index has been trending downwards for the last year. While it is still above 50 which indicates expansion, the rate of growth is likely to slow meaningfully.

Apart from a weak macro environment, the company is facing a delay in delivery of the new equipment, and it may result in missed revenue opportunities in seasonal demand until all of the new equipment is delivered.

Despite these short-term concerns, I am optimistic about ODFL’s long-term growth prospects.

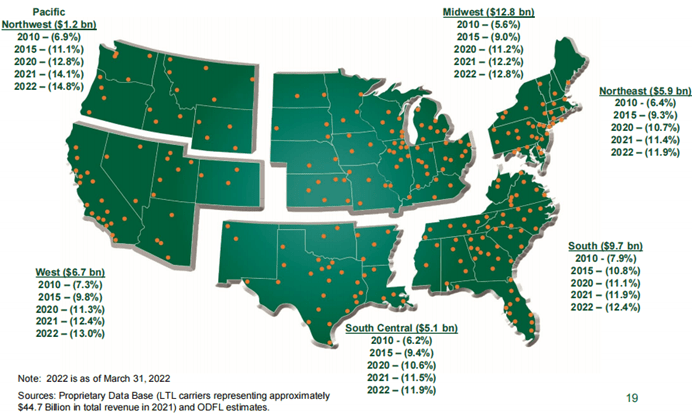

The company is concentrating on the growth markets like the next day and 2nd-day shipping, which is getting reflected in its shipment mix. Approximately 70% of shipments delivered by the company are next-day and 2nd-day. ODFL’s expedited services provide its customers with customized solutions like Guaranteed, On-Demand shipping, and Must Arrive By Date, which help its retail customers meet increasingly complex demands. Along with this, the company has been able to contain cargo damage, which has contributed to a very low cargo claim ratio of 0.2% in 2022. The use of 28-foot trailers permits it to transport freight directly from origin to destination with minimal unloading and reloading, which reduces its exposure to cargo damage. Focusing on these kinds of quality services at fair prices should help it to increase its market share. In the past decade, the company has gained market share across all regions of the U.S.

ODFL Market Share Gains (Company Presentation)

In addition, the experienced management of ODFL has a good past performance track record in managing economic downturns. The management’s decision to invest in building capacity during the period of 2011-2021 has aided the company’s volume growth. The company increased the number of service centres from 216 in 2011 to 251 in 2021, which helped it meet the increasing demand for shipments. This investment, coupled with its pricing strategy to offer quality services at reasonable prices, has helped the company achieve a ~79% increase in daily volume compared to 2011, which is a significant outperformance relative to its peers. The company is continuing to focus on building capacity to capture volume growth in the long term.

At present, the company has an excess capacity of 15-20%. Management is targeting to increase it to 25% in order to stay ahead of expected volume growth and gain market share. Excess capacity makes it easier to gain market share and while it means the company has to bear some extra costs in the near term when the capacity is idle, this strategy has been very successfully used by the company in the past decade.

Operating margin outlook

In the short term, there are multiple factors that are likely to have a negative impact on the operating margin. First is a weak near-term demand outlook as discussed above, which can impact the company’s operating margin as volume leverage plays a crucial role in the industry. In addition, costs like miscellaneous costs and general supplies and expenses have been lower than the long-term average in recent quarters and could return to normalized levels in upcoming quarters due to their nature. Miscellaneous expenses generally remain at 0.5% of total revenues, which was 0.3% of total revenues in Q2 2022. General supplies and expenses, which accounted for 2.3% of total revenues in the last quarter, were also favourable compared to the long-term trend. Management expects a ~100-150 bps headwind in the upcoming quarters due to an increase in these expenses to a more normalized level.

Aside from these short-term headwinds, I expect ODFL to achieve a higher operating margin in the long term, which should be driven by leveraging revenue growth and productivity. Other factors, like expenses related to purchased transportation (which contributed about 3.5% of total revenues in 2021), are expected to decline in the long term as the company is focusing on boosting its capacity. Pricing components like fuel surcharge, which consistently offset cost inflation, should continue to provide stability against fuel price inflation. In addition, the company uses technology to improve efficiencies and productivity in linehaul operations. It utilizes load-planning software to optimize efficiencies in linehaul operations. This software helps improve transit times, load factors, and freight movements. Considering these factors, I believe ODFL can achieve its annual operating margin target of more than 30%.

Valuation and Conclusion

ODFL’s short-term growth prospects are weak, but in the long term, the company should gain market share by providing valuable services at fair prices and increasing capacity. The stock is trading at 26.52x current year P/E, which is not much lower than its 5-year average forward P/E of 27.23x. I believe other LTL stocks, like Saia (SAIA) trading at 17.71x current year P/E (vs. its 5-year average of 23.67x) and ArcBest (ARCB) trading at 6.35x current year P/E (vs. its 5-year average of 13.49x), offer much better risk-reward as compared to ODFL. Hence, I have a neutral rating on the stock.

If you would like to see my detailed coverage on other LTL stocks, ARCB and SAIA, below are the links.

ArcBest Corporation: Cheap Valuations And Good Growth Prospects

Saia Is A Good Buy At Current Levels

Please feel free to share your thoughts on the LTL industry and my coverage of it in the comment section below.

Be the first to comment