Just_Super

International Cybersecurity attacks have grown by an eye-watering 32% year-over-year as the adoption of technology has accelerated since the lockdown of 2020. One of the easiest ways for hackers to gain entry into a corporate system is through the hacking of user credentials. Many people use the same or similar passwords for multiple websites and applications. Therefore, if a popular email provider gets hacked (such as Gmail recently), then these passwords are often sold on the dark web. User access can also be obtained through “Social engineering,” which involves hacking humans with psychology to discover login details. Due to these exploits, it is no surprise that the cybersecurity industry is forecasted to grow at a 13.4% compounded annual growth rate [CAGR] and reach a value of $379 billion by 2029.

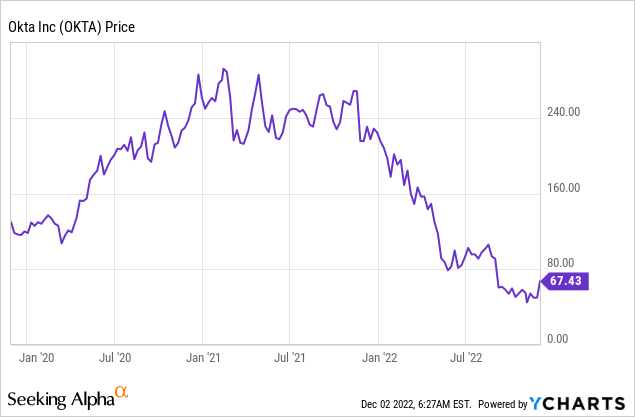

Okta, Inc. (NASDAQ:OKTA) is a leader in Identity Access Management and helps companies such as S&P Global, McKesson, and Zoom stop hackers and provide user access. The company produced strong financials in the third quarter of FY23, beating both top and bottom-line growth estimates. In this post I’m going to break down the business model, and financials, lets dive in.

Secure Business Model

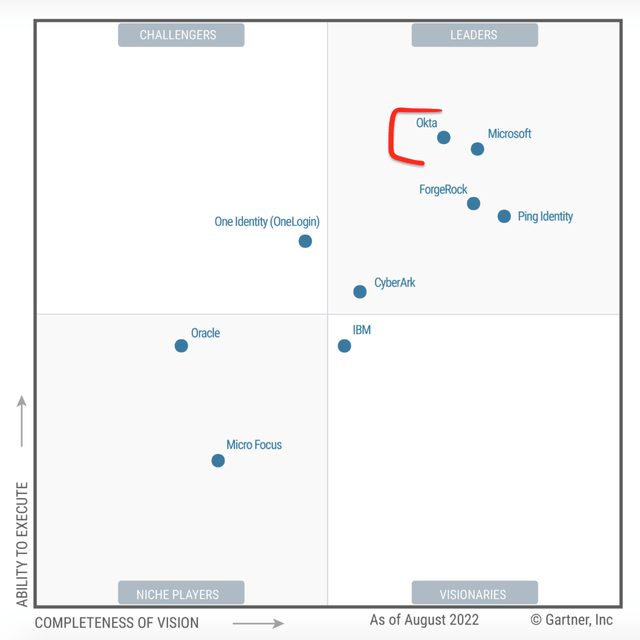

Okta is a Gartner Magic Quadrant leader in Identity Access management. The platform enables organizations to authenticate, authorize and secure access for applications.

There are two parts to access management, security but also user experience. An analogy I like to use is to imagine there were 5 locks on the front door of your home and you had to unlock each with a unique key. This would be extremely secure, but the user experience would be poor and time-consuming. Therefore, you would likely not adopt this solution.

Okta solves this problem, as the company pioneered the Single Sign On [SSO] solution. Using this feature, users use one set of login credentials to access a single dashboard for all their applications, which makes for a great user experience. According to Okta, its SSO solution results in 75% fewer help desk calls. In addition, Okta still enables security teams to manage individual applications via permissions and the dashboard. The beauty of this is if a hacker managed to exploit an employee’s credentials they couldn’t “move laterally” and access every single application in the business.

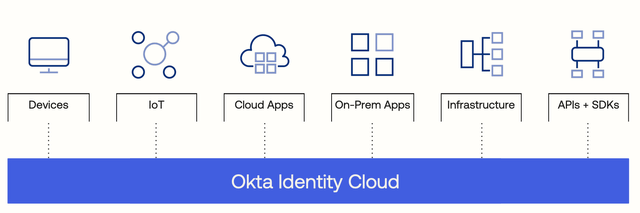

Okta’s platform is also unique in that it is a unified platform that secures access across all devices, cloud applications and on-premises applications. This is vastly important given the rise of remote working and digital transformation towards the cloud. Okta has a network of 7,000+ pre-built integrations to popular SaaS applications such as Salesforce, Office 365, G-Suite, Workday, Zoom and more. This means access management can be set up in rapid time.

The company’s other solutions include server access, API access, Multi-Factor authentication and more. These solutions are divided across its two main clouds: the Customer Identity Cloud and Workforce Identity Cloud.

Strong Third Quarter Results

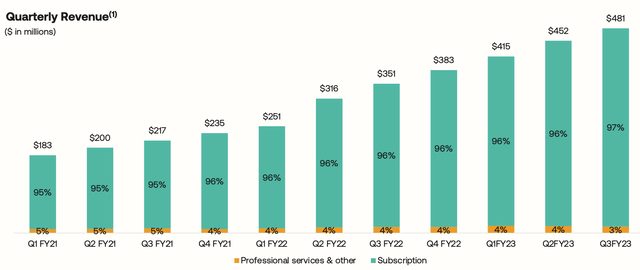

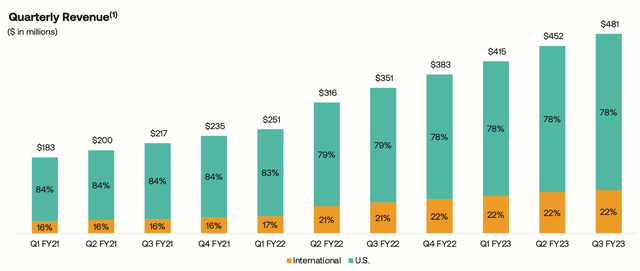

Okta reported strong financial results for the third quarter of the fiscal year 2023. Revenue was $481 million, which beat analyst estimates by $15.67 million and increased by a rapid 37% year-over-year. This was driven by solid subscription revenue growth which increased by 38% year-over-year and now makes up 97% of total revenue. It should also be noted that the comparable revenue last year for Q2, FY22 includes $46 million related to the acquisition of Auth0. Therefore, the results are even more positive in Q3 FY23 with this tough comparison. It was also a positive trend to see professional services (non-subscription) making up just 3% of total revenue. This is the lower-margin, less consistent part of the business.

Quarterly Revenue Subscription (Q3,FY23)

Okta makes the vast majority (78%) of its revenue from the U.S. part of the business. This is positive given the strong rise in the U.S dollar, which has created unfavorable FX headwinds for many businesses with a large portion of revenue from overseas. International revenue makes up 22% of total revenue for Okta and increased by 1% year-over-year.

In the third quarter, Okta increased its customer base by 22%, adding 650 new customers, which brings its total to over 17,000. Some notable wins in the third quarter included KeyBanc, a Fortune 500 financial services company, which replaced its legacy systems with Okta’s cloud-based identity solution. Okta’s solution will help with identity security through multi-factor authentication for the customer’s army of 25,000 employees.

Okta also scored a major upsell with a Fortune 100 global entertainment company, which leveraged the Okta Workforce Identity cloud for its 200,000 employees. Okta also scored its largest Customer Identity cloud deal ever with a multinational technology company. Public sector customers also increased strongly, jumping 65% year-over-year. In Q3, a large federal agency signed up for Okta to cover its tens of thousands of employees.

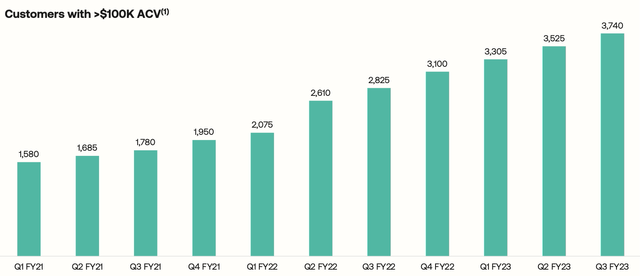

Okta has gradually been growing “upmarket” and increased its customers with an average contract value of over $100,000 by 32% year-over-year, to 3,700.

Customers with $100K ACV (Q3,FY23 report)

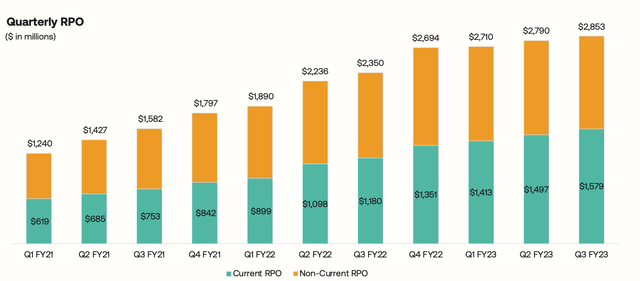

The company’s Remaining Performance Obligations [RPO] increased by 21% year-over-year, to $2.85 billion.

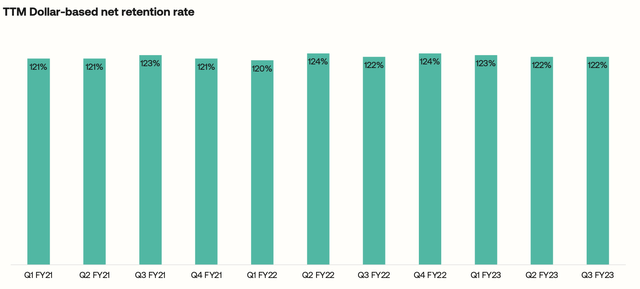

Okta reported a solid dollar-based net retention rate of 122% in the trailing 12 months. This means customers are finding the product “sticky” and expanding usage through upsells, which is a positive sign.

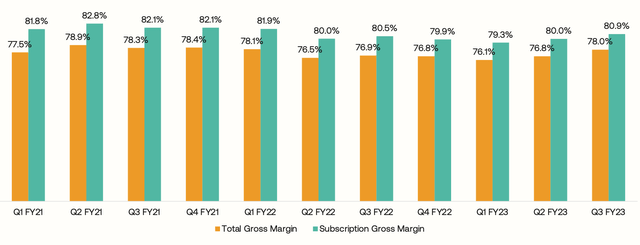

In Q3, FY23 Okta reported a solid Gross Margin of 78%, which increased vs. the 76.8% reported in the prior year. This demonstrates improved efficiencies in the business, which is a positive given the high inflation environment.

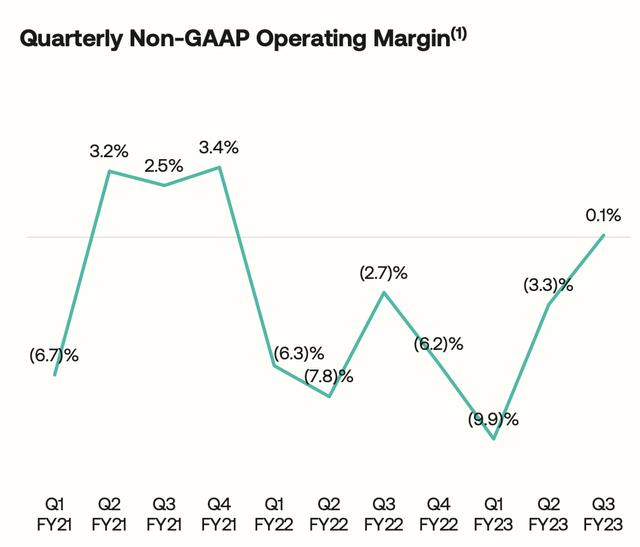

The company reported Earnings Per Share [EPS] of negative $1.32, which beat analyst estimates by $0.09. On a Non-GAAP basis, the company operates at breakeven with regards to profitability, producing a 0.1% margin. This is a substantial improvement over the negative 9.9% margin in Q1, FY23 and negative 2.7% margin in Q3, FY22. This margin improvement is a result of reducing the facility footprint of office spaces and reducing hiring overall. I believe this is a positive strategy and prudent given the macroeconomic environment.

Operating Margin (Q3,FY23 report)

Okta has a solid balance sheet with $2.5 Billion in cash, cash equivalents, and short-term investments. The company does have fairly high debt of $2.3 billion but just $5.2 million in short-term debt, due within the next 2 years and thus manageable.

Advanced Valuation

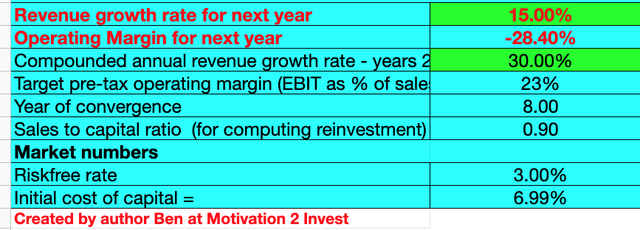

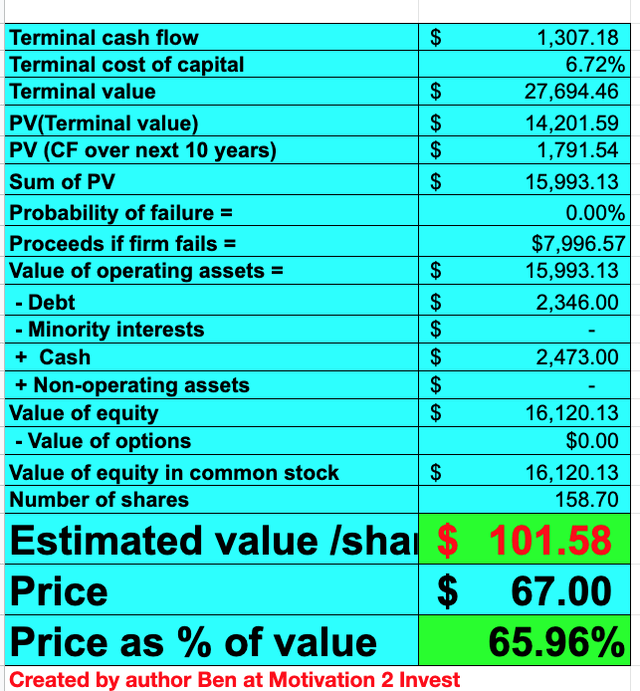

In order to value Okta, I have plugged the latest financials into my discounted cash flow (“DCF”) model. I have forecasted a conservative 15% revenue growth for next year, given the macroeconomic environment. In addition, I have forecasted 30% revenue growth per year over the next 2 to 5 years, as the economy rebounds.

Okta stock valuation 1 (created by author Ben at Motivation 2 Invest)

To increase the accuracy of the valuation, I have capitalized R&D expenses. In addition, I have forecasted the operating margin to increase to 23% in 8 years which is the average for the software industry. I forecast this to be driven by greater scale and improved operating efficiencies coupled with account expansion.

Okta stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $101 per share. Okta stock is trading at $67 per share at the time of writing and is thus ~34% undervalued.

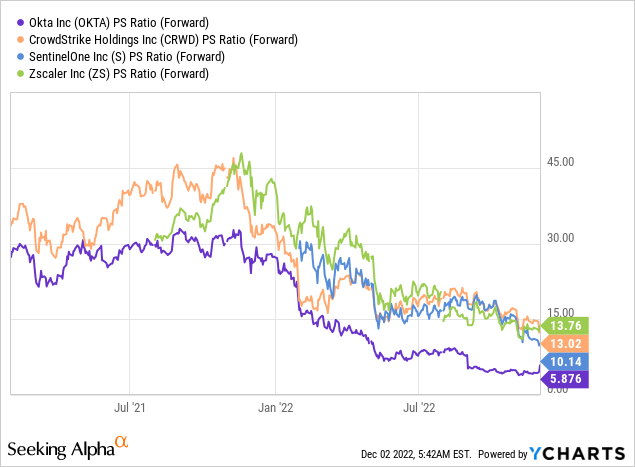

As an extra datapoint, Okta trades at a Price to Sales ratio = 6, which is 75% cheaper than its 5-year average. Relative to peers in the cybersecurity sector, Okta is trading as one of the cheapest.

Risks

Longer Sales Cycles/Recessionary Environment

The high inflation and rising interest rate environment has caused many analysts to forecast a recession. During this environment, many decision-makers are stuck in a place of fear and aim to cut costs where they can. This means the purchase of new enterprise software is often put on hold or delayed.

Final Thoughts

Okta, Inc. is a tremendous technology company that continues to produce strong financial results. A positive for cybersecurity applications is they often are seen as essential. Thus, this should help to offset some of the macroeconomic headwinds. Okta is undervalued intrinsically and relatively, thus this could be a great investment opportunity.

Be the first to comment