BlackJack3D

New investors may arrive at the energy sector with the preconceived notion that rising oil and gas prices will make them rich; for that very reason, they tend to chase ideas with the so-called torque. Many of these investors will likely get burned sooner or later as intra-cycle commodity price gyrations inevitably move against them.

Our experience shows, energy investors should first and foremost think about how to manage the downside risk, and then allow inherent operational traits of the underlying business to work to their advantage over time, as I explained in detail in the 2021 and 2022 Seeking Alpha interviews.

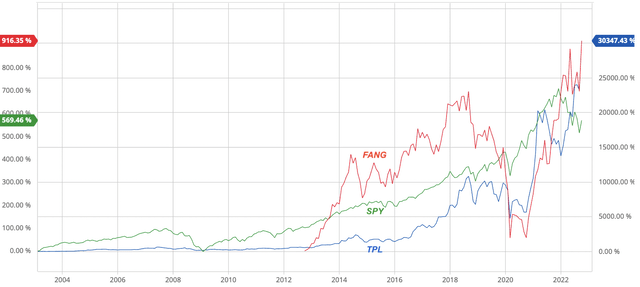

To that end, oil and gas royalty stocks are a great way to get exposure to rising commodity prices yet at moderate risks, thanks to their advantageous business model. Texas Pacific Land Corp. (TPL) is a good case in point. TPL shares purchased in 2009 would deliver a sweet 110-bagger by 2022, leaving the S&P 500 index – as represented by SPDR S&P 500 (SPY) – and its dominant components Apple (AAPL), Alphabet (GOOG, GOOGL) or Amazon.com (AMZN) in the dust. Yet such breathtaking gains can be had without suffering through hyper-volatility, as with shale oil producer Diamondback Energy (FANG) that operates in the same area (Fig. 1).

Fig. 1. A comparison of Texas Pacific Land (TPL), Diamondback Energy (FANG) and SPDR S&P 500 Trust ETF (SPY) in terms of dividend back-adjusted performance (modified from Seeking Alpha and Barchart)

Before you rush to buy a slew of oil and gas royalties, hear out these nuances:

- TPL stands out among dozens of oil and gas royalty stocks (a list of which can be found in my previous article), mainly because it owns a lot of royalty acres in the Permian Basin, the crown jewel of the U.S. unconventional petroleum provinces.

- Even then, TPL was ‘dead money’ for many years. It had not taken off until the shale revolution kicked off in earnest in the Permian Basin, as I described in another article.

Given the above findings, the following questions arise: where is the next Permian Basin, and which royalty stock may end up being the next TPL?

It is my belief the Montney resource play and the Clearwater heavy oil play, both in Western Canada, are where we should look. Below, let’s examine the Canadian royalty trio – Topaz Energy Corp. (OTCPK:TPZEF), PrairieSky Royalty Ltd. (OTCPK:PREKF), and Freehold Royalties Ltd. (OTCPK:FRHLF).

Canadian oil royalty trio

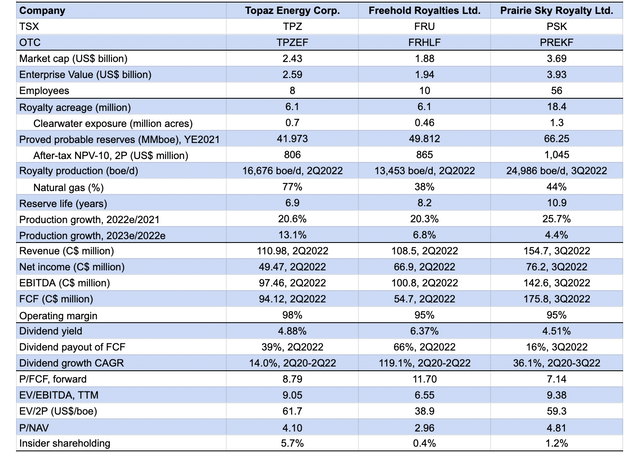

Each of the three Canadian oil and gas royalty firms pursues a somewhat unique strategy, which leads to the differences as seen in their royalty assets, financial performance, and valuation (Table 1).

Table 1. A comparison of Topaz Energy, PrairieSky Royalty, and Freehold Royalties (compiled by Laurentian Research for The Natural Resources Hub based on Seeking Alpha and financial filings by the companies)

PrairieSky

Since its spin-off in 2014 from then-Encana (OVV), PrairieSky had acquired Range Royalty in the same year and some 81% of the royalty assets of Canadian Natural Resources (CNQ) in the next year. It acquired a 5% gross overriding royalty on >76,000 acres of Clearwater lands in the core Marten Hills area for C$155.0 million in July 2021.

As the largest of the trio, PrairieSky owns 18.4 million acres of royalty properties in Canada, and produced ~25,000 boe/d as of 3Q2022. Its current production consists primarily of oil (56%).

Freehold

Freehold is the oldest among the three, its history dates back to 1996.

Over the last couple of years, Freehold tried to expand to the U.S., where it spent over C$500 million, increasing its royalty acreage there to 0.9 million acres and royalty production to 35% of the total. Freehold produced ~13,450 boe/d as of 2Q2022, with 62% in oil.

It targets a dividend payout ratio of 60-80%.

Topaz

Topaz was spun off Tourmaline Oil Corp. (OTCPK:TRMLF) – the largest natural gas producer in Canada – in November 2019. Tourmaline still holds 36.7% of it and will continue to drop down royalty interests to Topaz.

Topaz produced 16,676 boe/d as of 2Q2022, mostly (77%) in natural gas. However, Topaz is working to add oil-prone royalty assets to its portfolio:

- In March 2022, Topaz acquired Keystone Royalty Corp. for C$85.0 million (or 4,187,193 Topaz shares), whose royalty portfolio mainly consists of >480,000 gross acres of royalty lands (low base decline production at 450 boe/d, 83% in liquids), and over 310,000 gross acres of fee mineral title lands in Southeast Saskatchewan. The transaction increased Topaz consolidated federal tax pools to C$1.7 billion.

- In September 2022, Topaz acquired from privately-held Deltastream Energy Corp. a newly-created 5% gross overriding royalty on the latter’s entire Clearwater acreage for C$265.3 million. The transaction increased the company’s exposure to the Clearwater play by 26% to 700,000 acres.

Besides royalty assets, Topaz also owns non-operated ownership interests in certain midstream infrastructure, whereby it has long-term take-or-pay arrangements or fixed fee commitments, which generate very stable cash flow that currently covers ~1/3 of the dividend payments.

Dividends

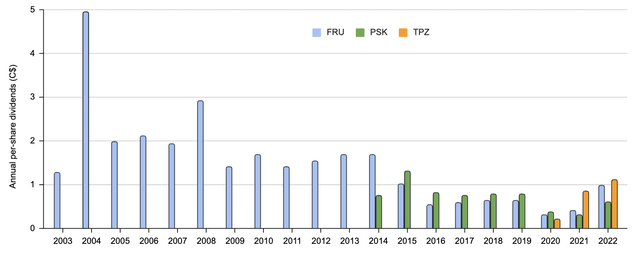

These royalty companies pay variable dividends, i.e., variable in terms of payout ratio (60-90% targeted by Topaz, and 60-80% targeted by Freehold) depending on changing royalty production and commodity prices.

- They seem to have just entered another cycle of dividend raises, which means it is an opportune time to establish a position in them (Fig. 2).

- Their dividends appear to be safer than those paid by mid-cap E&P companies. While none of these royalty firms suspended dividend payments during the oil crash in 2020, we know a slew of E&P companies cut dividends.

- Royalty stocks are also a great hedge against inflation, thanks to their extremely high operating margin and low G&A (Table 1).

Fig. 2. Annual dividend payments of Freehold Royalties, PrairieSky Royalty, and Topaz Energy, actual and declared (compiled by Laurentian Research for The Natural Resources Hub based on Seeking Alpha and company financial filings)

Screening criteria

As I stated in a previous article, investors should look at the growth prospect of royalty revenue, margins, and durability of the underlying royalty assets when assessing royalty stocks.

With regard to production growth, Canadian oil companies seem to be more willing to ramp up capital expenditures in this oil cycle than its U.S. peers. As a matter of fact, Canada is one of the few regions in the world where oil companies are aggressively drilling, as I noted in a recent article.

Within Canada, the Montney is the dominant natural gas play, while the Clearwater is the fastest growing oil play these days. Looking ahead, the completion of NGTL expansion, LNG Canada and potential other LNG commissioning will enable meaningful egress and supply growth of Montney gas. That means whichever royalty company with more exposure to Montney and Clearwater has a more promising growth outlook. In that respect, Topaz clearly stands out, with 11.5% of its assets in Clearwater as compared with 7.5% for Freehold and 7.1% for PrairieSky, and with its cornerstone assets in Montney.

- I particularly like Topaz for its recent acquisition in the Clearwater play. Tamarack Valley Energy (OTCPK:TNEYF), holder of the most Clearwater drilling locations after its acquisition of Deltastream, plans to drill aggressively in that play.

- I also like C$1.7 billion federal tax pools carried by Topaz, which is expected to enhance its profitability in the foreseeable future.

However, for those who prefer oil-weighted royalty stocks, PrairieSky is a good stock to consider. PrairieSky has the longest reserve life (10.9) among the trio, giving it better asset durability. I prefer PrairieSky to Freehold because of its exclusive focus on Canada, where I see more production growth in the foreseeable future, its lower dividend payout ratio, and lower P/FCF multiple (Table 1).

Risks

These royalty stocks are supposed to expose investors to lower risks than E&P operators, because they take their cut of the revenue before any operating costs and thus enjoy extremely high margins.

However, commodity price volatility and royalty production variations will inevitably introduce uncertainties into the royalty business model.

Furthermore, as oil prices swing higher, royalty firms have to pay higher and higher per-acre prices to acquire royalty assets, which tend to result in less efficient capital allocation. For that reason, at some point, the royalty business model will cease to be valid, and investors must be prepared to exit then.

I wouldn’t worry too much about their apparently high EV/2P multiples, which do not take exploration optionality into consideration (Table 1).

Investor takeaways

Oil and gas royalty stocks are a great way to gain exposure to rising commodity prices without taking undue risks. The Canadian oil royalty trio is in the early stage of a dividend raise cycle.

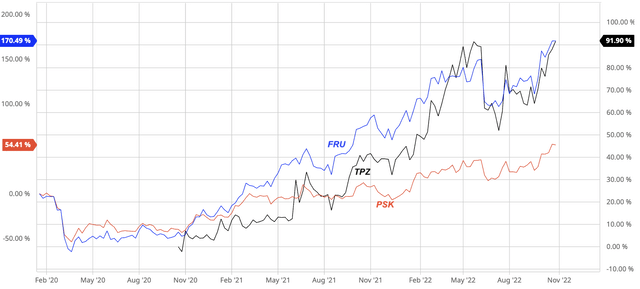

I like Topaz Energy for its royalty production growth prospect, relative safety of dividends as a result of its stable infrastructure revenue, and large tax pools. However, PrairieSky Royalty is a good pick too, especially for those who prefer an oil-weighted royalty play (Fig. 3).

Fig. 3. Stock chart of Canadian oil and gas royalty trio (modified from Barchart and Seeking Alpha)

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment