Altayb/iStock via Getty Images

A few things happened in the oil market today that made the obvious a little more obvious.

-

Biden administration announcing plans to refill SPR at $67 to $72/bbl WTI.

-

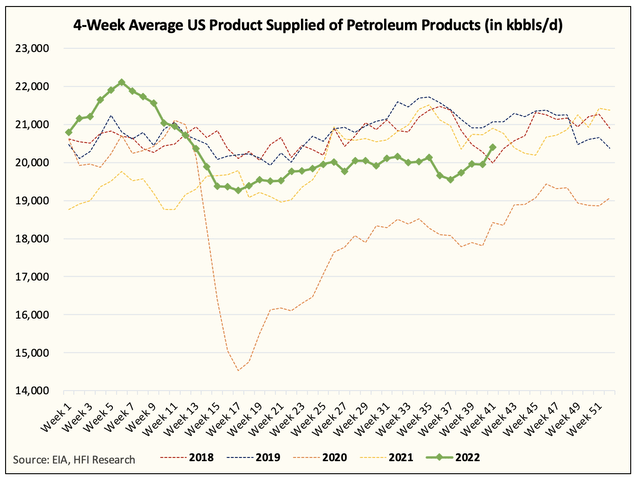

EIA reporting total oil inventories trending downward, but most importantly, US oil demand has confirmed a bottom around this oil price range.

For those of you that are familiar with our writing, you may recall that back in June, we wrote about how the oil market wanted to test the lower boundary of the price band. Here’s what we said in the piece:

The oil market has successfully tested the “upper bound” of where prices can go. Gauging by the demand indicators, we suspect that $170 to $180 end-user (crude + refining margin) is the level that causes serious demand slowdown. Now the market will want to test the lower bound of this range. Is this range around $140 to $150? We don’t know, but with crude back to $110 and refining margins back to $50/bbl, we are currently sitting at $160/bbl.

If the data over the next few weeks continues to show demand disappointment, then the market will push it another notch lower. We will keep going back and forth until the market finds the level where demand starts to move higher.

Fast forwarding to today, the oil market has successfully tested the lower bound. Not only are we seeing US oil demand now confirms that a bottom has taken place, but we are also seeing 1) OPEC+ defend $80/bbl with a production cut and 2) the US announcing a refill of the SPR around $70/bbl.

While it is our belief that the free market is a much more powerful indicator of where the “real bottom” is, the subsequent two catalysts should help provide an even higher floor for oil prices going forward.

With the oil market now confirming that the range is somewhere between $80 to $125, what we should expect going forward are the following:

-

Energy stocks will now price in a higher floor. Investors will start to underwrite energy companies using a higher base oil price, which should start seeing a change in the trading multiples.

-

The price band should start to narrow. With worries over global oil demand today due to macro concerns putting a ceiling on oil prices, and low absolute oil inventories putting a floor, the trading band should narrow. At some point down the road, the band will break, and our analysis indicates that it should be to the upside given how constrained supplies will be going forward.

The obvious…

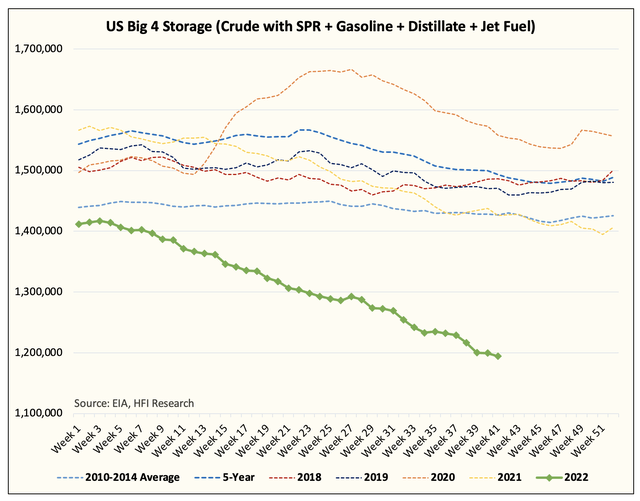

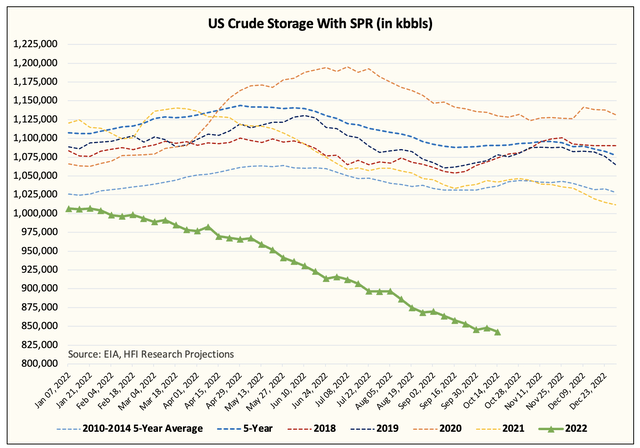

Politicians can masquerade the oil market with SPR releases, but the reality is straightforward. US oil inventories are draining and draining at an alarming clip.

US crude storage with SPR has been on a nonstop downtrend and this won’t end even when SPR ends. What will likely happen is that Brent-WTI differentials will narrow, and US crude exports will drop. This just implies that the rest of the world’s crude inventories will lose the support of US crude exports. Now you throw in the OPEC+ production cut and the eventual loss in Russian oil production, and we see the low storage situation getting direr.

So what’s the obvious take then?

Global oil fundamentals remain in a deficit, and while the degree of the deficit can be debated, global oil inventories will really reveal themselves after the SPR release ends. There’s no masquerading going forward.

HFI Research, #1 Energy Service

For energy investors, the 2014-2020 bear market has been incredibly brutal. But as the old adage goes, “Low commodity prices cure low commodity prices.” Our deep understanding of US shale and other oil market fundamentals leads us to believe that we are finally entering a multi-year bull market. Investors should take advantage of the incoming trend and be positioned in real assets like precious metals and energy stocks. If you are interested, we can help! Come and see for yourself!

Be the first to comment