Aleksei Savin

What do you do when the fundamental data continues to trend bullish, but the price action is acting bearish? Do you adhere to what the fundamental data is saying or do you follow the price action?

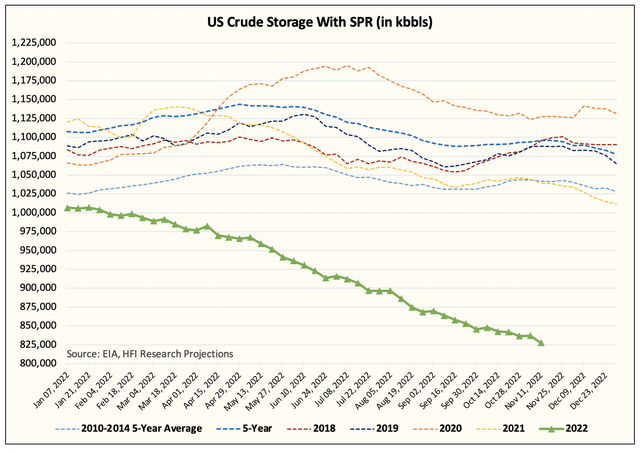

That appears to be the dilemma we have today for the energy markets. EIA’s latest data release continues to confirm that we are in an oil market deficit. U.S. crude with SPR will fall below ~800 million bbls by year-end.

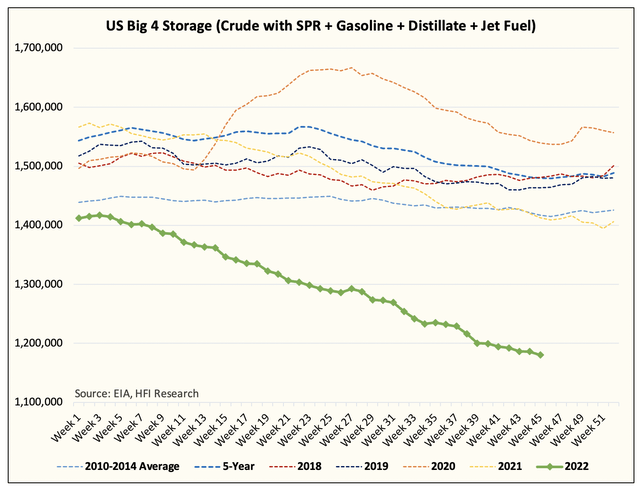

And if you take a look at the big 4, this trend is undeniably bullish.

But similar to the message of our OMF earlier this week titled, “Something Really Strange Is Happening To The Oil Market,” we appear to be missing something.

Perhaps this is just paranoia and we are overreacting, but when the price action is starkly different than what the data is saying, we pay attention to the price action. We should never assume that we know more than the market, and in this particular case, the EIA data is seen by everyone, but the market continues to react bearishly. This is not a good sign no matter how you slice and dice it.

So what should you do as an investor?

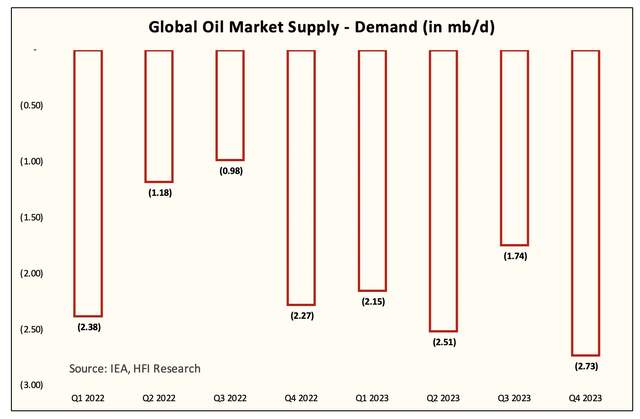

You have three choices. You can buy, hold, or sell your positions. The price action, while concerning, does not warrant selling in my opinion. This is because our time horizon is not in weeks, but in years. The latest data point tells me that we are still trending in the right direction, and while the oil market deficit is not as large as we had previously expected, it is still a deficit (-2.27 million b/d versus the -1.5 million b/d we are seeing today).

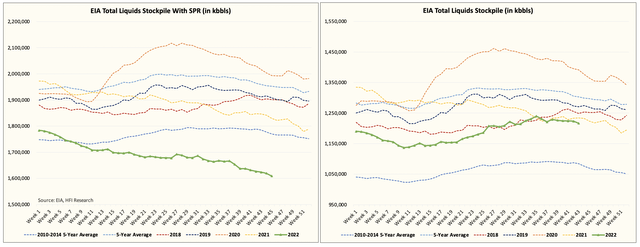

You can see that total liquids with SPR continue to trend lower. This is a good sign.

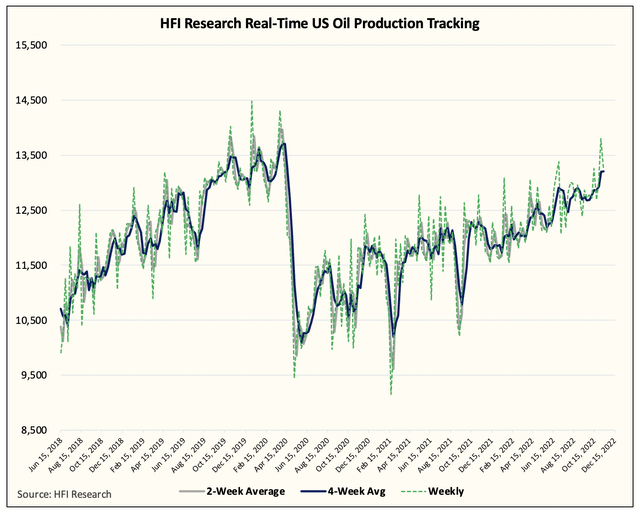

In addition, November is usually the peak in U.S. oil production, and the latest datapoint is indicating that U.S. oil production is around ~12.3 million b/d.

This is lower than the ~12.4 to ~12.5 million b/d we had estimated for year-end. This would also reduce the year-end exit for 2023 down from ~13.1 million b/d to ~12.8 to ~12.9 million b/d.

And looking at the 2023 oil market balance, we are going to be in a material deficit all year, so without a surprise from U.S. shale, there won’t be any upside surprise at all from the supply side. (Note: we already assume a full Iran return in H2 2023.)

So now that we have established the bull case into 2023, why aren’t prices reacting stronger?

I think there are a few explanations here:

- Global refining margins remain weak.

- Elevated natural gas storage in Europe preventing potential gas-to-oil demand switching.

- China, despite uplifting some COVID restrictions, remains absent in the oil market.

- The market does not believe Russia will lose any crude exports.

We can argue all we want about the latter 2 explanations and how they will eventually be wrong, but we should respect what the market is saying right now. And what it’s saying is, “show me.” Since this is the approach of the market, we should do the same.

In conclusion, we think we remain in a structural oil bull market. The 2023 picture is painted very bullishly and deserves the bullishness it deserves. The problem is weathering the storm in the near term and grasping what the market is saying to us. While buying and holding and forgetting is one strategy readers can pursue, avoiding unnecessary drawdowns and pain along the way is also another prudent strategy.

Cautiously optimistic is still the name of the game.

Be the first to comment