Cavan Images

Earnings of OFG Bancorp (NYSE:OFG) will most probably surge through the end of 2023 on the back of strong topline growth. The rapidly improving economy of Puerto Rico will play a key role in loan growth, which will, in turn, boost earnings. Further, the bottom line will receive support from margin expansion. Overall, I’m expecting OFG Bancorp to report earnings of $3.44 per share for 2022 and $3.64 per share for 2023. Compared to my last report on the company, I haven’t changed my earnings estimates much. Next year’s target price suggests a high upside from the current market price. Based on the total expected return, I’m maintaining a buy rating on OFG Bancorp.

Growth of Securities Portfolio is Problematic

OFG Bancorp’s available-for-sale (“AFS”) securities portfolio has ballooned by 189% over the first nine months of 2022. This trend is problematic because holding a large AFS securities portfolio is not advisable in a rising-rate environment. Firstly, higher rates reduce the market value of securities, leading to unrealized mark-to-market losses. These losses skip the income statement and directly erode the equity book value. The book value has already dropped by 7% in the first nine months of 2022, and I’m expecting a further decline due to the ongoing up-rate cycle.

Moreover, most securities are based on fixed rates. As interest rates rise, these securities will hold back the average earning-asset yield.

Margin Growth Likely to Decline

OFG Bancorp’s net interest margin surged by 43 basis points in the third quarter after rising by 33 basis points in the second quarter of the year. The margin will expand further in the coming quarters because of the ongoing up-rate cycle. I’m expecting the fed funds rate to rise by a further 75 basis points till the mid of 2023.

Around 61% of OFG Bancorp’s total deposits are non-interest bearing. These deposits have held down the average deposit costs so far this year as interest rates have risen. They will continue to support the margin for the remainder of the up-rate cycle.

However, the management expects the magnitude of an increase in margin to be lower in the future compared to earlier this year because the cost of funds will creep up a bit, as mentioned in the conference call. Increasing competition in the market and an inevitable decline in excess liquidity will push up costs for interest-bearing deposits by a larger magnitude than in the last two quarters. In other words, the deposit beta (rate sensitivity) will rise.

The management mentioned in the conference call that the deposit beta has been only 3% in the first nine months of 2022. In the last up-rate cycle, from 2016 to 2019, the beta was much higher at around 17%. In my opinion, it is advisable to anticipate historical mean reversion in future quarters.

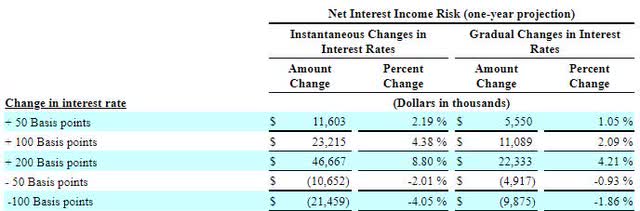

The results of the management’s interest-rate sensitivity analysis given in the 10-Q filing show that a 200-basis points hike in interest rates can boost the net interest income by 4.21% over twelve months.

Considering these factors, I’m expecting the margin to increase by ten basis points in the last quarter of 2022 and a further ten basis points in 2023.

Economic Factors Continue to Favor Loan Growth

OFG Bancorp’s loan growth slowed down to 0.1% in the third quarter from 2.1% in the second quarter of the year. The drop was mostly attributable to residential mortgage loans whose new loan origination has almost halved over the last twelve months, as given in the earnings presentation.

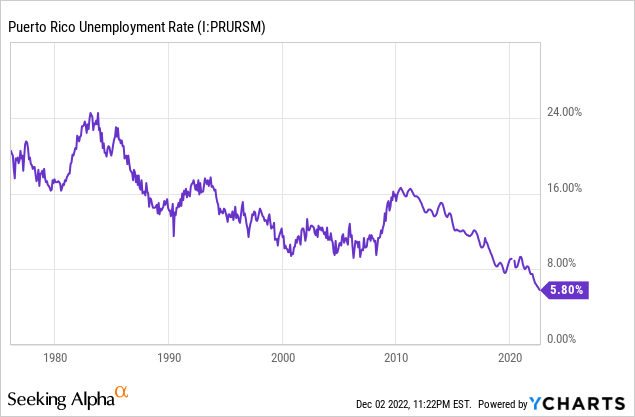

I’m not too concerned about the third quarter’s performance because regional labor markets continue to favor loan growth. Puerto Rico’s unemployment rate has continued to break new records month after month, as shown below.

Considering these factors, I’m expecting the loan portfolio to grow by 1% in the last quarter of 2022, taking full-year loan growth to 5%. For 2023, I’m expecting the portfolio to grow by 4%. In my last report on OFG Bancorp, I estimated loan growth of 7% for 2022 and 6% for 2023. I’ve reduced my estimates mostly because of the third quarter’s performance.

The following table shows my balance sheet estimates.

| Financial Position | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

| Net Loans | 4,432 | 6,642 | 6,501 | 6,329 | 6,657 | 6,927 |

| Growth of Net Loans | 9.3% | 49.9% | (2.1)% | (2.6)% | 5.2% | 4.1% |

| Other Earning Assets | 1,285 | 1,095 | 459 | 896 | 2,068 | 2,076 |

| Deposits | 4,908 | 7,699 | 8,416 | 8,603 | 8,944 | 9,307 |

| Total Liabilities | 5,583 | 8,252 | 8,740 | 8,831 | 9,153 | 9,516 |

| Common equity | 908 | 953 | 994 | 1,069 | 979 | 1,065 |

| Book Value Per Share ($) | 17.7 | 18.4 | 19.3 | 21.3 | 20.4 | 22.2 |

| Tangible BVPS ($) | 15.9 | 15.7 | 16.7 | 18.8 | 18.0 | 19.8 |

| Source: SEC Filings, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Expecting Earnings to Grow by 6% Next Year

The anticipated loan growth and margin expansion will play a key role in driving earnings this year. Further, the non-interest income will bounce back in the fourth quarter after a subdued third quarter. This is because the fee waivers offered to customers for Hurricane Fiona ended by September 30, as confirmed in the conference call.

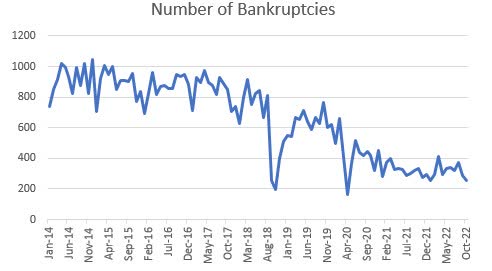

Further, I’m expecting provisioning to remain low as the current credit quality in Puerto Rico continues to improve with the persistently strengthening economy. The region’s number of bankruptcies is currently very low compared to the past.

The Economic Development Bank for Puerto Rico

Further, the portfolio’s credit risk appears well provided for. Nonperforming loans made up 1.7% of total loans at the end of September 2022, as mentioned in the presentation. This is well covered by allowances which made up 2.3% of total loans. Overall, I’m expecting the net provision expense to make up 0.40% of total loans in 2023, which is much below the average of 1.39% for the last five years.

Overall, I’m expecting OFG Bancorp to report earnings of $3.44 per share for 2022, up 22% year-over-year. For 2023, I’m expecting earnings to grow by 6% to $3.64 per share. The following table shows my income statement estimates.

| Income Statement | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

| Net interest income | 316 | 323 | 408 | 407 | 479 | 547 |

| Provision for loan losses | 56 | 97 | 93 | 0 | 22 | 28 |

| Non-interest income | 80 | 82 | 124 | 133 | 131 | 130 |

| Non-interest expense | 207 | 233 | 345 | 326 | 346 | 396 |

| Net income – Common Sh. | 78 | 47 | 68 | 145 | 165 | 174 |

| EPS – Diluted ($) | 1.52 | 0.92 | 1.32 | 2.81 | 3.44 | 3.64 |

| Source: SEC Filings, Author’s Estimates(In USD million unless otherwise specified) | ||||||

In my last report on OFG Bancorp, I estimated earnings of $3.33 per share for 2022 and $3.64 per share for 2023. I haven’t changed my earnings estimates much as the tweaks I’ve made to income statement items cancel each other out.

My estimates are based on certain macroeconomic assumptions that may not come to pass. Therefore, actual earnings can differ materially from my estimates.

Maintaining a Buy Rating

OFG Bancorp is offering a dividend yield of 2.8% at the current quarterly dividend rate of $0.20 per share. The earnings and dividend estimates suggest a payout ratio of 22% for 2023, which is the same as the last five-year average. Therefore, I’m not expecting an increase in the dividend level.

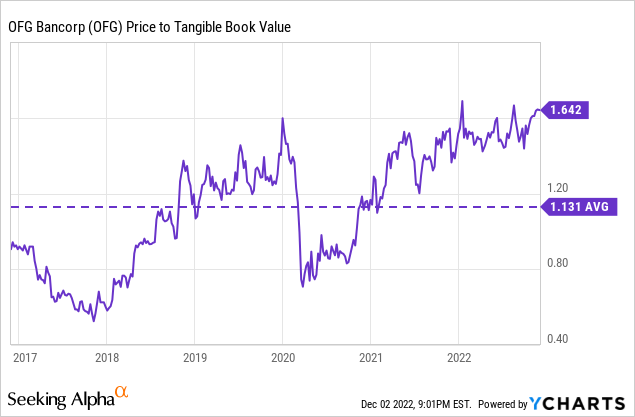

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value OFG Bancorp. The stock has traded at an average P/TB ratio of 1.13x in the past, as shown below.

Multiplying the average P/TB multiple with the forecast tangible book value per share of $19.8 gives a target price of $22.4 for the end of 2023. This price target implies a 21.6% downside from the December 2 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 0.93x | 1.03x | 1.13x | 1.23x | 1.33x |

| TBVPS – Dec 2023 ($) | 19.8 | 19.8 | 19.8 | 19.8 | 19.8 |

| Target Price ($) | 18.4 | 20.4 | 22.4 | 24.4 | 26.4 |

| Market Price ($) | 28.6 | 28.6 | 28.6 | 28.6 | 28.6 |

| Upside/(Downside) | (35.5)% | (28.5)% | (21.6)% | (14.7)% | (7.7)% |

| Source: Author’s Estimates |

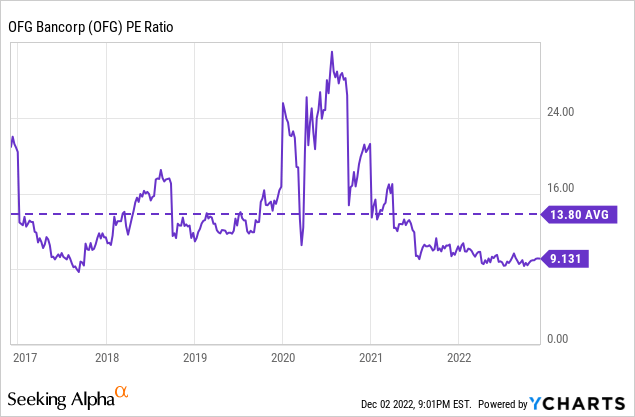

The stock has traded at an average P/E ratio of around 13.8x in the past, as shown below.

Multiplying the average P/E multiple with the forecast earnings per share of $3.64 gives a target price of $50.2 for the end of 2023. This price target implies a 75.7% upside from the December 2 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 11.8x | 12.8x | 13.8x | 14.8x | 15.8x |

| EPS – 2023 ($) | 3.64 | 3.64 | 3.64 | 3.64 | 3.64 |

| Target Price ($) | 43.0 | 46.6 | 50.2 | 53.9 | 57.5 |

| Market Price ($) | 28.6 | 28.6 | 28.6 | 28.6 | 28.6 |

| Upside/(Downside) | 50.3% | 63.0% | 75.7% | 88.5% | 101.2% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $36.3, which implies a 27.1% upside from the current market price. Adding the forward dividend yield gives a total expected return of 29.5%. Hence, I’m adopting a buy rating on OFG Bancorp.

Be the first to comment