Zarina Lukash/iStock via Getty Images

This article is an update to my earlier piece in which I explained why I was buying the dip on Ocular Therapeutix (NASDAQ:OCUL), albeit at prices much higher than can be obtained today. I refer readers to the original article for a basic background on the company, and I also suggest reading Biotech Fan’s more recent article to get some good insight into OCUL’s approved product, DEXTENZA.

Today I’d like to delve into the value of the DEXTENZA franchise to OCUL and then review new data from several of OCUL’s clinical programs. To begin, though, let’s remind ourselves of the company’s product portfolio:

SEC

DEXTENZA

OCUL has one major commercial product, DEXTENZA, approved for two separate indications:

- Postsurgical treatment of pain and inflammation used in a surgical setting, primarily with cataract surgeries. This approval dates from mid-2019.

- Ocular itching from allergic conjunctivitis used in an office setting. This approval was obtained in late 2021.

To date all of OCUL’s DEXTENZA revenue has come from the surgical setting, and the company expects that to be generally true in 2022 as well. The strategy for commercializing the product in the office setting is to begin with a small sales team devoted to this indication who will learn the ins-and-outs of this market during 2022. The team’s findings and experience will then guide a full scale launch of the product in 2023.

Two excerpts from the most recent earnings call explain this approach in a bit more detail (with my emphasis):

No, we don’t expect there have been many or any AC sales in that $12.3 million number that we put in the last quarter. What we’re doing — initiating this quarter and will start next quarter is a fully dedicated team in the office environment. That team initially is going to be very small. So we’re talking about five account managers, probably one dedicated field reimbursement manager and then a leader of that team. What we would like to do in that environment is to understand what the drivers are in the office environment, how we need to adjust our programs to make sure that they’re fit for purpose. And as we start to understand what that opportunity is, we will invest behind that opportunity. So rather than set forth the number that we expect to hit and then resource to hit that number, we’ve done — we did with the launch of DEXTENZA which is get in the market, get to understand what drives the market and then invest once we have the formula cracked. And we’re going to do exactly that in the office not the metric environment as well.

[…]

I think it will ramp slowly in the second quarter. And once we crack the code about the proper way to sell DEXTENZA in the office environment, we will layer on resources as needed. And I would expect in the latter part of the year and certainly the beginning of 2023 to really start to see the ramp-up in that office environment. I mean assuming those are there once again, we’re starting with a small team that’s trying to look at the pressure points in that environment. We believe that it’s there — there is a tremendous reservoir of unsatisfied patients and there’s a great need in the office environment for a buy-and-bill product for the front of the eye that has a procedure code attached. So the ingredients are right. We just need to figure out what the right alchemy is.

My DEXTENZA Sales Model

In my previous article, I wrote regarding DEXTENZA revenues that “In another year we could be at a $100M run rate, which in and of itself would justify the current $650M EV, leaving any and all positive developments in the pipeline to add to the stock’s valuation.”

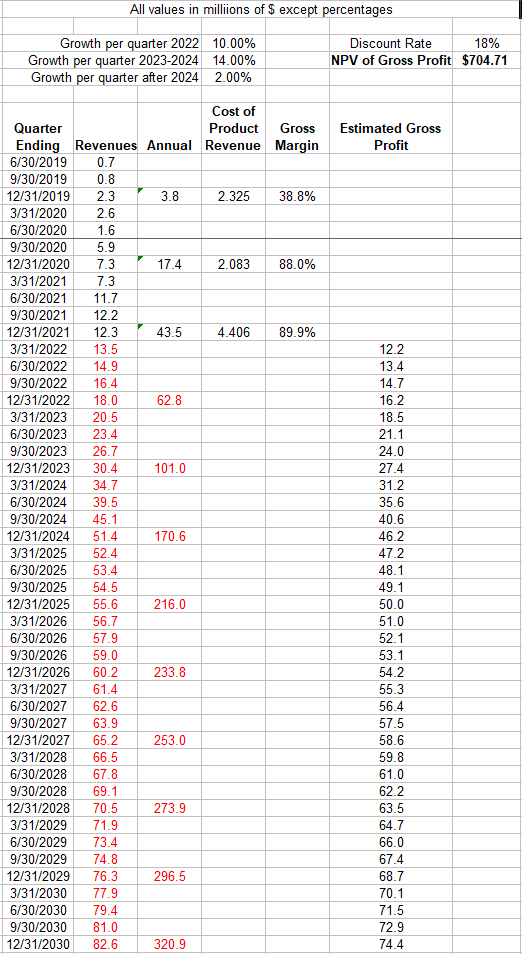

I have to walk that back a bit based on recent sales results, though as we’ll see my valuation estimate was likely correct. What I’ve done below is to:

- Estimate future DEXTENZA revenues based initially on actual results (black font is actual, red is my projections). Given that there is pent-up demand for cataract surgeries, I model 10% quarterly revenue increases in 2022. Revenues then ramp up to 14% quarterly growth in 2023 and 2024 to represent the full launch of the office setting use in allergic conjunctivitis. I then model 2% increases through 2030.

- Estimated revenues are then multiplied by 0.9 to get estimated gross profits. This 90% gross margin is in line with the historical data.

- Discount the gross profits back to a NPV using an aggressive discount rate of 18%.

The purpose of this model isn’t to establish a discounted cash flow for the company. Rather it’s to give us a sense of what DEXTENZA could be worth to an acquiring company if said company already had a salesforce in place calling on these same eye doctors.

Author’s Estimates

Result & Stock Valuation

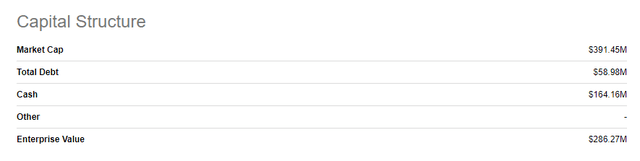

This exercise suggests that DEXTENZA could be worth about $700M to the right acquirer. With the stock trading at $5.10 it’s being valued with a market cap and EV of $391M and $286M, respectively. If my DEXTENZA valuation is correct, then that means the rest of the company’s programs are worth negative $400M!

This analysis gives me confidence in continuing to hold my shares and to add opportunistically as time goes on. Eventually I believe the market will stop punishing biotechs and those who weather the storm will profit.

Let’s now turn to updates on the remaining clinical products.

OTX-CSI for Dry Eye Disease

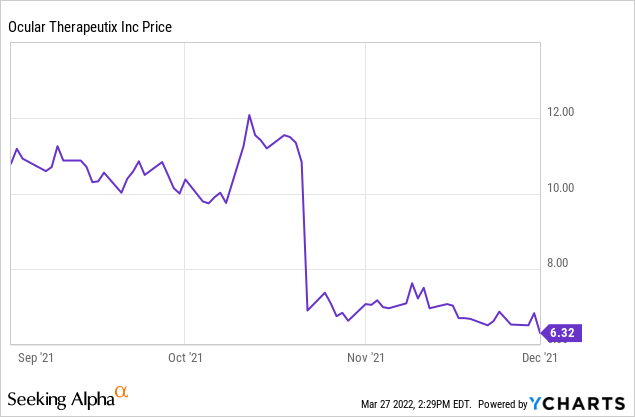

The biggest disappointment for OCUL bulls came on Oct 22, 2021 when the company announced that OTX-CSI had failed to meet its primary endpoint in dry eye disease. The drug showed efficacy vs. baseline, but didn’t separate from the comparator arm.

This is undeniably bad news, but the company hasn’t given up on the product and feels that it can make changes to the comparator and potentially to the insert (allowing better retention in the eye). However, work on this drug will be put on the back burner, so this indication shouldn’t be considered a near term value for OCUL.

For a little more color, here’s what the CEO said on this subject during the most recent earnings call (with my emphasis):

To answer your dry eye questions, so they’re a little bit different but a little bit similar, so both the DED and the CSI has some interesting information that we showed from the Phase II trials. I think in both cases, there’s some reworking that needs to be done, some very mild formulation tweaks in DED, some larger formulation tweaks with CSI but the real work for both of those is thinking about the comparator. And what we know is that you can’t use a sham as the comparator but there are different options in terms of the hydrogels that we use and there’s some work that needs to be done to optimize the comparator because from a regulatory perspective, it’s really about the separation between the active and the comparator.

[…]

Let me explain on that. I mean the one thing we understand is that these trials in dry eye, particularly are very high risk trials. And we want to make sure that we thoroughly mine the data that we have from our Phase II and also understand the process by which we can scale up on the — on both the vehicle and the active drug side with an eye toward the preservation of our cash runway. So there are ways that we can already bring that forward which will obviously increase the risk of those trials. What we’d rather do is we’d rather do it absolutely the right way and make sure that we have the appropriate vehicle and we have the appropriate active in both CSI and BEV and start trials that we have full confidence — are going to be able to yield results that can lead to registerable products. So — and so we could go one or two ways that we could either go very, very short term and get in the clinic as quickly as possible or we could take a longer road and lower risk with lower cash burn. We are definitely leaning toward the lower risk and lower cash burn side.

For reference, here’s the stock price around that period. To me it represents an overreaction because the failure, as far as I can tell, doesn’t read through to any of OCUL’s other programs.

In February 2022, OCUL gave update presentations on two other of its candidate therapies. Let’s look at each of these.

OTX-TKI for Neovascular Age-related Macular Degeneration (aka wet AMD)

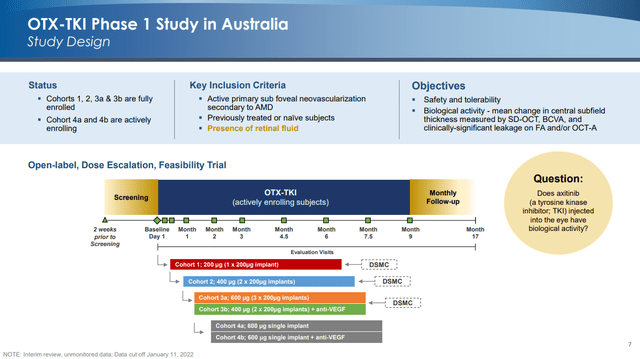

This presentation gave an update on the Phase 1 trial in which OTX-TKI is being evaluated for safety and biological activity. Here is a slide describing the trial’s design (including enrollment status):

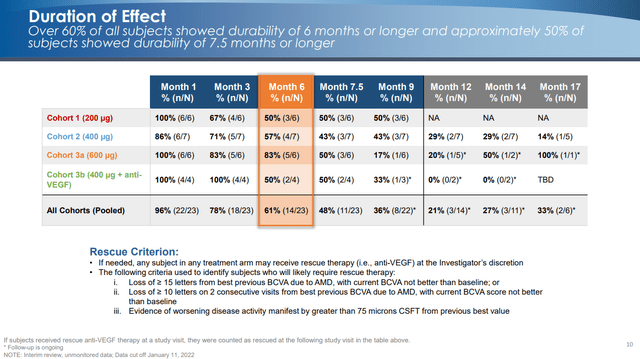

Initial data suggests decent durability:

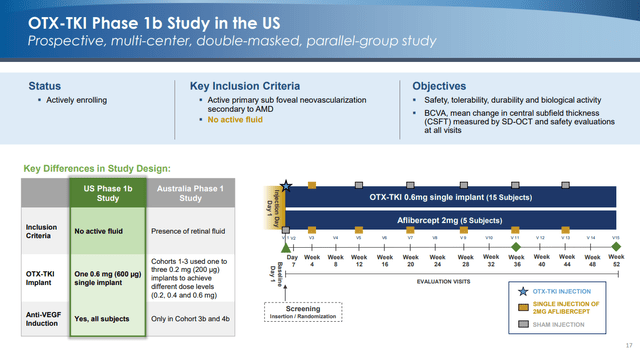

These early results have informed the design of a second Phase 1B study that will have an active comparator (Aflibercept), will exclude patients with active fluid in the eye, and will use a single implant rather than three implants.

Here is how management describes the change in design philosophy:

In this trial, we are including only subjects who have been previously treated with anti-VEGF therapy and asking the question, how long can we maintain subjects without need for retreatment? Whereas in the Australian trial, we study subjects with pre-existing intraretinal and/or subretinal fluid and ask the question, could we get rid of fluid with the TKI?

This trial is already fully-enrolled and the company expects top line results in the second half of 2022.

OTX-TIC for Glaucoma and Ocular Hypertension

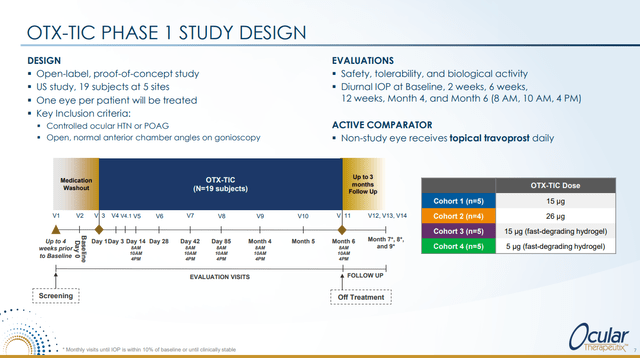

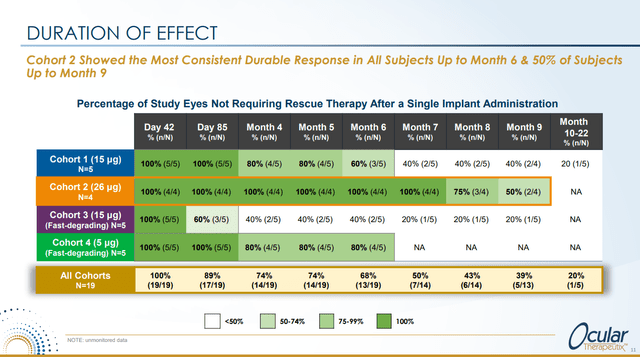

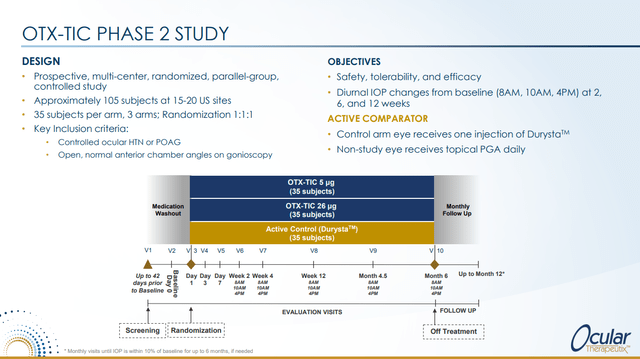

This presentation gave the results from the Phase 1 study in glaucoma and ocular hypertension. Here is the design of this study:

The results showed best durability for cohorts 2 and 4.

This then informed the design of the Phase 2 trial which is currently enrolling.

That’s it for today’s update. I will continue to share my take on the company and its prospects as new data becomes available.

Be the first to comment