Author’s Note: This is an article published on iREIT on Alpha back in January of 2022, before the war. I have since then expanded my position in UPM significantly.

MinttuFin/iStock Editorial via Getty Images

Dear readers,

In the past week or two, we’ve seen exciting instability in the overall markets. Double-digit index drops and companies suddenly are traded cheaper and cheaper.

These are excellent trends – and we should embrace them.

I know it can be worrying seeing your portfolio churn like an ocean in a storm – but believe me, in the long term, this is exactly the sort of situation you want to be clear-headed in.

So let’s remain clear-headed and delve into a solid company.

UPM-Kymmene (OTCPK:UPMKF) (OTCPK:UPMMY).

UPM-Kymmene Logo

What is UPM-Kymmene?

So, you might be confused at such an odd name, but Finnish is a very interesting language, that doesn’t sound like many European or even Scandinavian languages, so some of its company names are as odd as well! I’m a bit of a language buff, and I speak 4 languages with native fluency, but my Finnish is very poor.

However, it’s understandable when you’re talking about a language that has the word:

“lentokonesuihkuturbiinimoottoriapumekaanikkoaliupseerioppilas”

No, that’s not a joke.

That’s an actual Finnish word that roughly translates as: ‘airplane jet turbine engine auxiliary mechanic non-commissioned officer student’. So, Finnish.

The UPM-Kymmene Oyj was formed by merging Kymmene with Repola, and them with the United Paper Mills subsidiary in 1996. This gives the company 26 years of history, with headquarters in the Finnish capital of Helsinki.

The company employs 18,000 people and has revenues between €8-€10 billion per year, managing an operating income margin of around 10% on that revenue. It’s the only paper company in the DJ Sustainability index.

UPM is a paper and energy business.

It’s active in the following business areas:

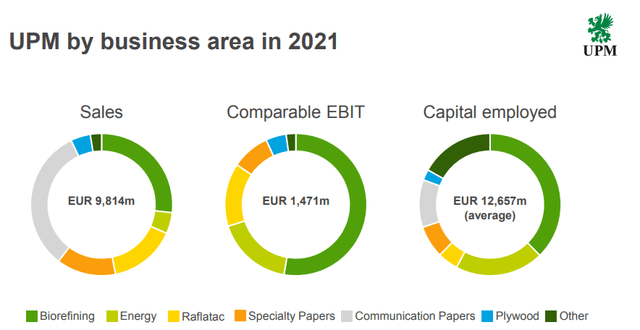

- UPM Biorefining, focusing on pulp, timber, and biofuel. The company operates several pulp mills in Finland and in South America, as well as several sawmills.

- UPM Energy, providing hydropower, nuclear power, and condensing power. Aside from being a paper business, it owns stakes in several nuclear plants, it owns 9 hydropower electric plants, and it’s the second-largest producer of electricity in all of Finland. 18% of EBIT came in from this segment.

- UPM Raflatac is the company’s labeling and branding segment, with major customers in pharma, food, beverage, and others.

- UPM Speciality Papers is one of the company’s paper segments, owning 13 paper mills over the world. These work both as classic paper mills but also as producers of bioenergy. It also is the group’s largest business area, if we combine Speciality and Communication papers.

- UPM Communication Papers

- UPM Plywood is the largest manufacturer of Plywood in all of Europe, made by nine plywood mills in Finland and Eastern Europe.

Aside from these segments, UPM also owns its own feedstock, with 510,000 hectares of Finnish forests, all of them certified. UPM is the largest landowner in all of Finland.

UPM sources its materials through private forests and turns this into pulp, paper, plywood, timber, and energy. For the latest fiscal period of 2021, earnings have mostly been stabilized to pre-pandemic levels in all but one or two areas.

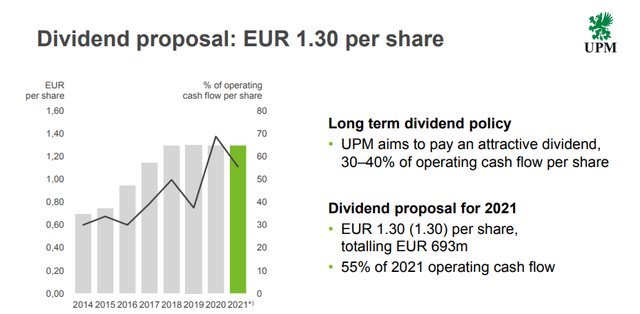

The company is a solid dividend payor and has retained its high €1.3 dividend despite poor performance over the past few years. It values the stability of its payout, and will, if necessary, overshoot its payout targets for singular years in order to retain its stability.

Let’s throw some facts down on the table and some interesting trends.

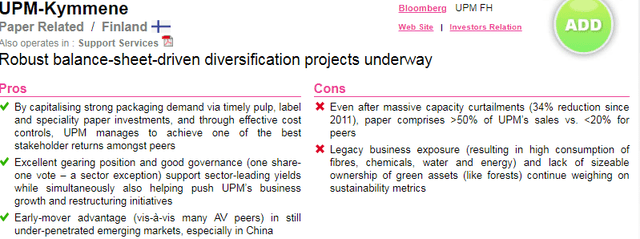

UPM-Kymmene is the largest paper company in the world. The second-largest EU competitor, European Stora Enso (OTCPK:SEOAY), is a distant second with around half the capacity. UPM has a current yield of 4.03% on a 2021E basis. Despite its volatility, it’s BBB-rated. The company has negligible customer concentration. UPM’s single largest customer is less than 2% of its sales.

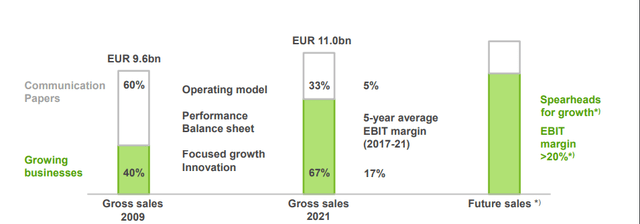

Of course, you might expect what has happened with the largest paper company in the world since 1996 considering that the world usage of paper has completely shifted for the past 20 years. Massive restructuring, capacity contractions, earnings volatility, and other instability. Despite a lot of changes in the company, this business’s sales remain highly exposed to paper.

What the UPM-Kymmene Oyj has done to combat this deadly dependence on paper and print is vertical integration and diversification. We’re talking pulp, we’re talking forest land and plantations, we’re talking something as simple as energy. Unlike many of its peers, UPM-Kymmene is as much a utility as it is a paper company, when considering almost a fifth of EBIT is from electricity.

This gives UPM a not-uninteresting amount of operational flexibility, with growth investments during the recent years. Its legacy and finance base give it the sort of underlying trends to pivot its operations – and that’s exactly what they have been doing.

For the time being, around 50% of sales are still dependent on paper, and its sales are highly dependent on Europe, with 63% of 2020 sales being focused on the EU market.

The company’s future plans are clear.

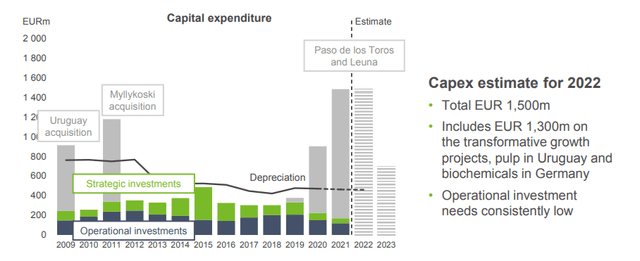

Increasing contribution from its growth segments over time will drive down dependence on legacy paper segments. The non-paper business is already in full swing, with recent investments including a $2.7 billion investment in a pulp mill in Uruguay, set to start up this very year. The company will also develop a biochemical refinery for another half-billion.

The overall outlook for the company has improved significantly since 2020. For 2022, the company expects:

- Ongoing pandemic uncertainty and supply chain/input challenges, as well as ongoing labor market challenges on the home market. There are current strikes in Finland.

- This is offset by high continued demand for UPM products, with sales price increases expected, most notably for specialty paper. Pulp prices and energy prices are expected to continue at good levels.

- At the same time, we’re expecting margin pressure in 2022 to continue, with UPM fighting this using product pricing, efficiency, market mix, efficient use of company assets, as well as fixed cost efficiency.

- All in all, same-level EBIT to 2021, with little overall change in the end.

UPM is taking all the steps to become a global, but EU foremost dominating player not only in legacy but in the future as well. The company’s growth projects are in the most CapEx-intensive phases in the current years, but that also gives the company a lot of appeal here due to a relatively low valuation when considering the impact of these new assets.

So, when you consider the future of UPM-Kymmene – consider the three product categories of Specialty packaging, Fibres, and Biorefining.

These are the company’s goals. The company expects another good performance year in 2022. What you should watch is the company’s project completion, EPS in relation to 2021 levels, and the outcome of its current labor troubles.

These trends will influence the company’s valuation, aside from macro, during this year.

Risks & Considerations

There are, of course, considerations and risks for UPM.

The company remains highly cyclical in its reliance on macroeconomic trends and demands. Consumption growth is a huge factor, as is worldwide GDP growth, improving living standards, e-commerce, et cetera.

Aside from this, there are also labor considerations. Large parts of UPM’s workforce are still employed in legacy areas, which means there are large future expenses as well as potential optimizations coming through labor force rationalizations.

One of the most significant years for UPM was 2016, during which it provided a massive turnaround, driven by pulp profits, and since then, margins and profits have been on a good trajectory for overall improvements on a broad company basis, even if pulp margins were somewhat volatile following 2018.

Overall, trends here are up and down – as might be expected from a business such as this. With COVID-19 in 2020 showing its teeth, 2021 has been a recovery and an improvement. Numbers are back to pre-pandemic levels.

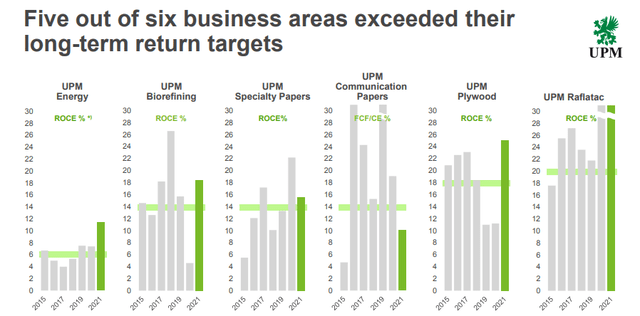

Paper and pulp companies have never been the most stable of investments. UPM is no different. However, the fact that it has areas like Energy, global diversification, owns its own inputs and carries on with ROCE and RoE of over 10%, mean that it’s better than most of its peers. Its returns very comfortably exceed its conservatively-weighted WACC. Asset-heavy paper companies have a hard time exceeding their WACC during times of market instability – and I would personally be hesitant to invest in companies who outsource their assets or don’t own their own capacity.

A good peer example of such a company is Mayr-Melnhof Karton (OTCPK:MNHFY).

In some industrial segments, outsourcing assets is a good idea, as asset-light players manage the ups and downs better. Given the massive sizes and importance of these assets, however, I prefer owning companies in the space that do suffer more volatility, but make up for this with “higher highs” when times are good.

As long as you’re aware of these cyclical trends, things should, for the long term, be acceptable.

It should also be mentioned that despite most of the capacity shift and all of the reorgs, UPM is one of the only sector players that still have a 50%+ paper exposure. Most have between 15-25%.

What also should be mentioned is that UPM owns a significant stake in perhaps the most behind-schedule nuclear plant in the history of planet earth, with TVO (Teollisuuden Voima Oyj). At this point, the plant is more than a decade behind schedule. Thankfully, UPM has been gradually reducing its stake as the troubled developer due to weak reactor sales (global competition) as well as nuclear demand slump after the Fukushima crisis.

Finally, however, with energy in the situation it is in, this project might actually and finally pay off.

The valuation and upside

Still, there’s a lot to like about this company – even at this valuation. Few companies in the space are as well-managed and as clear-cut as UPM-Kymmene.

The company has a very low cost of debt at a recent 3.15%, with a recently-calculated average WACC of 7.3%. Current forecasts vary somewhat. Equity analysts expect the company to average EPS growth at around 14-15% on average until 2023, with another 11.5% this year. The dividend is expected to stay stable this year, but increase around 6-7% next year, and another 6-7% after that. Expect an effective current yield of around 4-5% or therebetween (Source: Alpha Value).

S&P Global estimates call for a ~10% average annual EBITDA increase for the next few years, averaging double-digit growth in both EBITDA and GAAP EPS as the company’s growth investments come online and start contributing. CapEx is expected to remain elevated at least until 2023E. Margins are expected to stay around the 20-23% mark on an EBITDA basis. S&P Global expects the dividend to increase between 3-7% annually, coming in at a high of 11% for 2024E due to fewer CapEx constraints and most of the company’s new capacity online and contributing.

The overall view from both equity analysts and S&P Global, as well as FactSet, is for a continued EPS improvement as new growth projects come online and as UPM pivots its sales/production mix.

The company’s returns are amongst the best in its peer group, which on a regional relevant basis includes Stora Enso, BillerudKorsnäs (OTC:BLRDY), SCA (OTCPK:SCABY), Holmen (OTC:HLHLY), and Mayr-Melnhof. In NA, I would also include International Paper (IP) as well as Packaging Corporation of America (PKG).

For the valuation, I use conservative growth estimates to offset the cyclicality of the business. No more than 2.5-3% in scenarios in terms of EBITDA growth, and this includes the company’s plans for biorefining. I’m estimating a high capex, with a capex growth of 2-3% for the company.

At a current share price of around €32.5 per share, you’re looking at a P/E below 17X. This is higher than some of its NA peers, but it’s significantly lower than most of its European peers, including SCA and Holmen, which both warrant 25+ P/E ratios, at least according to the market. Mayer is the cheapest and trades below 15X – but this is a business I wouldn’t buy above 12X P/E, because of its light-asset/outsourcing capacity model, which I don’t view favorably in the sector.

On a yield basis, UPM easily beats its peers. My own YoC for UPM is well over 5.4%, and the current yield of 4.3% easily beats the relevant sector average in the EU of 2.6%. For P/B values, it’s a bit more complex given the asset-heavy sheets of its competitors, as well as such comparisons requiring quite detailed knowledge of individual assets such as mills. I wouldn’t give much of a premium for some of Billerud’s assets, for instance, knowing how they’ve been handled and the issues they’ve had.

For UPM, their P/B is around 1.74X, which is somewhat below the average of 2X, but not really all that low compared to its peers.

However, this is offset by the fact that the company has some of the most appealing assets on the entire market – many with some of the lowest current lifespan in the sector.

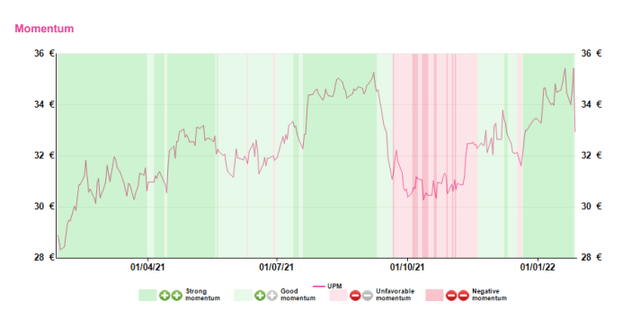

Computing and forecasting the company on this basis, not assigning a specific premium or discount (you could argue, and analysts do for premiums for its biofuels/discounts for its legacy) but basically assuming that the two will cancel out one another over the long term, I reach an implied share value range (equity value) of between €36-€42/share on the low/high end. Given its discounts to peers, there’s a favorable view to find here as well, and recent trends have certainly pushed UPM in a downward direction.

I bought more back in mid-to-late 2021, but we’re starting to approach very interesting price levels again. Heavily discounted implications indicate a “BUY” below €30/share, but I say it’s easily a “BUY” below €36/share, the lower end of my DCF range, and a not discounted/not premium-considered compared trend to its peers.

If there’s a “2” as a first digit for the company’s native share price, that’s when things get really interesting, as the company starts approaching that 5% again.

Still, below €36 – this is a “BUY” – and things are slowly starting to look cheap again.

Equity analyst targets are higher than mine, clocking in at around €40/share (Source: Alpha Value). I would view this as valid if more of the positives were materialized – they aren’t. I would also point out that recent history doesn’t support that price level. S&P Global puts the company at €37/share, so between mine and Equity analysts.

As usual, this indicates my comparative reticence and conservative approach here. This is where I want to be. I want to buy cheap, and with a higher conservative upside than many of my colleagues.

UPM-Kymmene Upside Alpha Value

Concluding UPM-Kymmene

So, UPM-Kymmene is perhaps the most interesting paper play in Europe, at the right price. It comes with unequaled diversification and forays into biofuel. However, it’s currently dependent on legacy segments which are slowly losing their steam.

This interplay between these declining legacy and growing new segments is what dictates how the next few years are going to turn out. There’s not a doubt in my mind that the end company that emerges from the other side in, say, 2025, will be an attractive business.

The key is buying that business today at an attractive price to ensure yourself a stake in the success.

I’ve already staked my holding at a below €23/share YoC on average over time. I’m buying at below €36, and while it’s not my primary current “BUY”, it’s definitely up there.

Recent earnings showcase and confirm these impressive results. It’s a strong end to 2021, with a solid dividend and an industry-leading yield at more than 2X the average competition.

The company is beyond pre-pandemic margins in terms of profitability.

However, with the combined risks of:

- Labor strikes/challenges

- Potential delays at the company’s massive growth projects

- Increasing input/SCM costs and dynamics

There is a potential for some stock price/valuation volatility this year if any of these trends go so far as to cause EPS trends and forecasts to wobble a bit.

Because of that, I am unwilling to go beyond €36/share here.

One of the primary challenges for non-EU investors is the ADR. While there is UPMMY, a 1:1 ADR, the liquidity of this unsponsored ADR is somewhat thin. This may prove a problem if you’re looking to get in and out quickly. FactSet and S&P Global do cover the stock, with estimates aligning with the native stock forecasts.

Still, to avoid liquidity issues, I would use a broker such as IBKR here to try and access the native Helsinki-traded UPM shares if you’re interested in exposure to this business.

I view this as a good introduction to UPM and what the company offers investors. I believe this is a solid pick for any conservative retirement portfolio. You not only get exposure in pulp, paper, packaging, and timber, but also energy/electricity and biofuel.

UPM-Kymmene is a solid play. I view it as a “BUY” here.

Be the first to comment