JoeChristensen/iStock Unreleased via Getty Images

As many of my Seeking Alpha followers know, I was a “baller” back in the day, which in layman’s terms means that I love basketball. I was a walk-on at a small college in South Carolina which believe it or not has the “blue hose” as the mascot.

I won’t go into much detail on the “blue hose” terminology, but for those who aren’t familiar with Presbyterian College, you can study up on the school HERE.

One of the biggest memories I had in college was playing against the University of North Carolina. It wasn’t a game that counted, after all, UNC is a Division I school, and at the time my school did not participate in the NCAA (we were NAIA).

However, what was memorable about the UNC matchup was that I played on the court of the opposing opponent at the Dean Smith Center.

Now, I’m just a few years younger than MJ (Michael Jordan) but it I can tell you that when I ran up and down that court it felt as though I was running in the same heavenly space as the greatest player of all-time. It was simply one of the most memorable basketball experiences in my lifetime.

Years later, my oldest daughter (who now works for CNBC) went to UNC and I enjoyed going with her to quite a few games, and later participating in Franklin Street activities (for those who went to UNC, you know what I mean).

I’ll tell you that one of the things on my bucket list is to meet MJ. In my book, he will always be the greatest basketball player on the planet.

Anyway, if you haven’t heard, there’s a big match this weekend called the Final Four. In just a few hours, UNC will be taking on Duke, in the semi-final matchup.

Major online sports books, including BetMGM, Draft Kings and Caesars favor the Blue Devils by 4.5 points. The basketball odds were set at -110, meaning you have to bet $110 in order to win $100 in profit.

In the other semi-final matchup Kansas is also a 4.5-point favorite over Villanova, according to the Gambling.com consensus, but BetMGM has the spread at only 3.5 points.

I think you know who I’m picking, not only to win the semi-final, but to take it all the way to the winner’s bracket.

However, as a consolation, if UNC does lose, at least there will be a North Carolina team in the final, and I think everyone would like to see Coach K. finish with a win.

“Discipline is doing what you are supposed to do in the best possible manner at the time you are supposed to do it.” – Coach K

Coach K. is also one of the best coaches on the planet. Many years ago, I was in Las Vegas attending a conference and I stumbled upon him at the roulette table. I spoke with him very briefly and told him that I was a “baller”.

I can assure you, if I had the b-ball skills, I would most definitely not be writing articles on Seeking Alpha. However, I was able to become successful because I became laser-focused on my passion.

“When you are passionate, you always have your destination in sight and you are not distracted by obstacles. Because you love what you are pursuing, things like rejection and setbacks will not hinder you in your pursuit. You believe that nothing can stop you!” – Coach K

Well, without further ado, let’s get started on my “Final Four” Net Lease REIT article, in which I will provide you with the details on (four of) my favorite net lease REITs.

Realty Income (O)

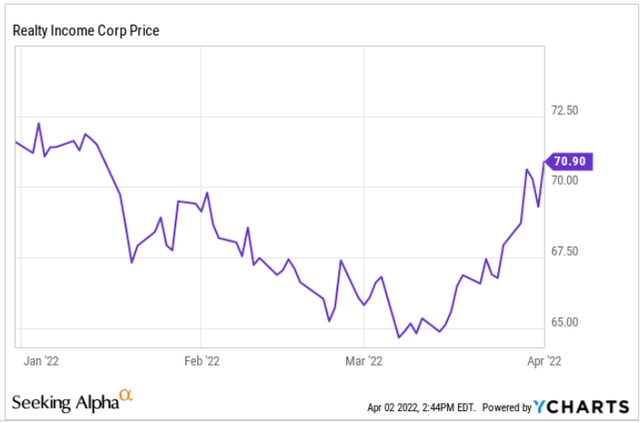

Our first “Final Four” pick from the next lease sector is also my top holding, Realty Income. As you can see below, shares are trading at close to the same price as January 1, 2022, after gaining around 10% since March 15th.

This stalwart net lease REIT has a market cap of $42 Billion which is 3 times the size of the next largest peer, and this is important because it’s one of the most important competitive advantages in which the company can pursue large-scale sale-leaseback or portfolio transactions without creating financing contingencies or concentration risks.

This size advantage gives Realty Income a distinct scale advantage and helps to secure them a spot in the Final Four.

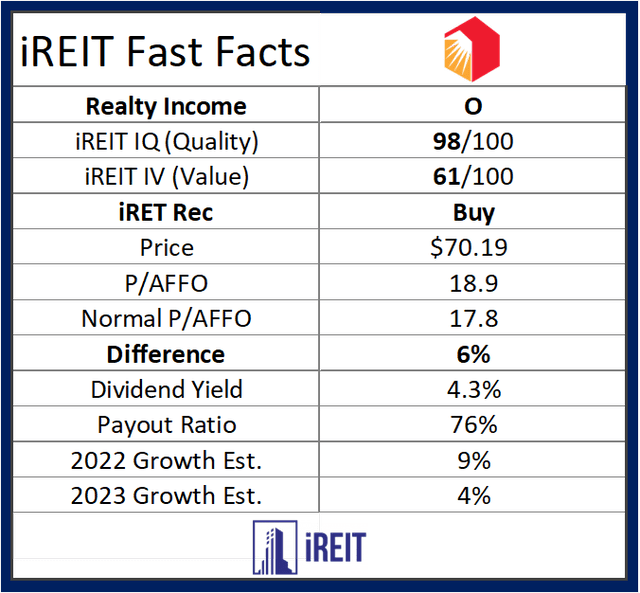

As many readers know, Realty Income is more than just the largest company in the sector, but also one of the highest quality. iREIT’s IQ rating system has Realty Income’s quality score at 98/100 meaning the company is one of the safest and securest of the over 200 companies we research (and rate).

Realty Income also utilizes a fortress balance sheet in order to provide another distinct competitive advantage as a low-cost producer. The company has an A-rated balance sheet and it this means it can secure unsecured debt at very low rates, and when you combine the equity cost (5.2% AFFO yield currently), the WACC (weighted average cost of capital) is around 4.0%.

Realty Income’s business model is still ~83% retail but it focuses on defensive operators who are recession-resistant such as Walgreens (WBA), CVS (CVS), Walmart (WMT), and Amazon (AMZN). This focus on quality has allowed the company to maintain occupancy above 96.6% since 1996 (the portfolio occupancy is currently 98.2%).

Recently, the company announced it was acquiring the Encore Boston, a trophy Wynn property that cost $2.6 billion to build. However, Realty Income is buying it for $1.7 billion, far below replacement cost, and that equates to a 5.9% cap rate for a Class A property. Due to Realty Income’s low cost of capital (WACC is ~4%) this deal is expected to generate an investments spread of almost 200bs.

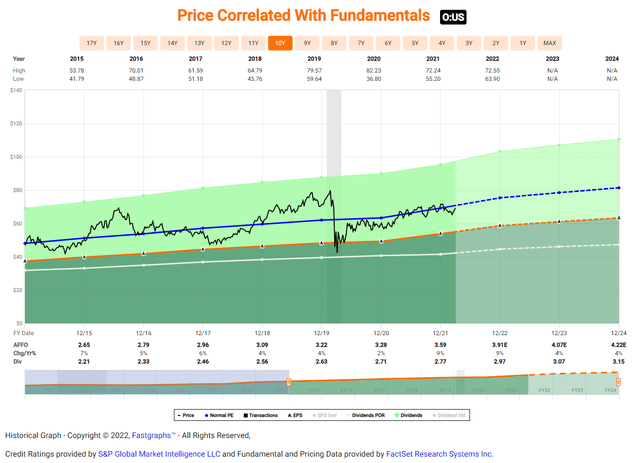

In 2021 Realty Income generated $3.59 in Adjusted Funds From Operations (‘AFFO’), and this is expected to grow by 9% in 2022 and another 4% in 2023. Shares are trading slightly below their historical average based on P/AFFO and shares are now yielding 4.3% (which is paid monthly).

Currently shares are trading at $69.30. This is below our buy below target of $72.00. While shares may not be at a screaming buy level, I am always a fan of picking up more shares of this top-quality REIT at or below fair value.

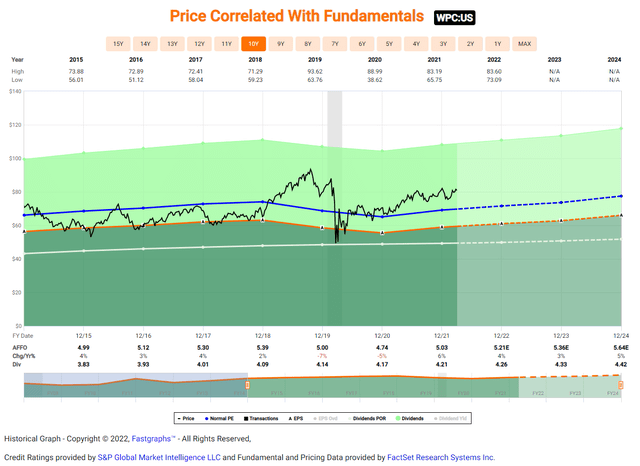

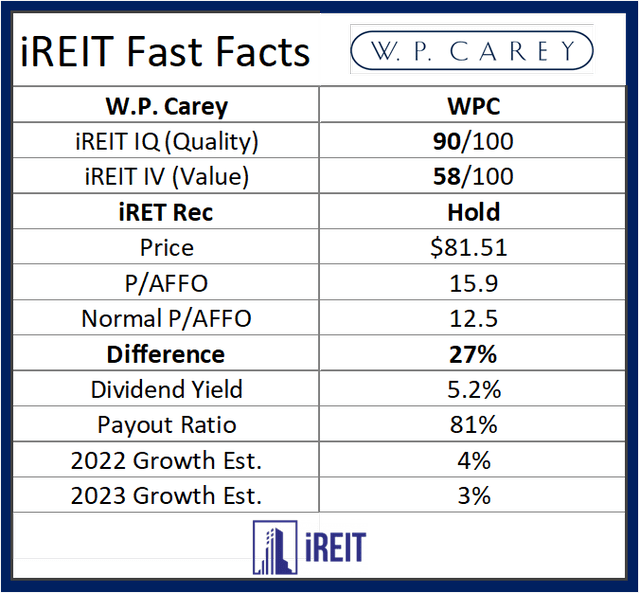

W.P. Carey (WPC)

The second company earning a spot on the Net Lease “Final Four” is W.P. Carey.

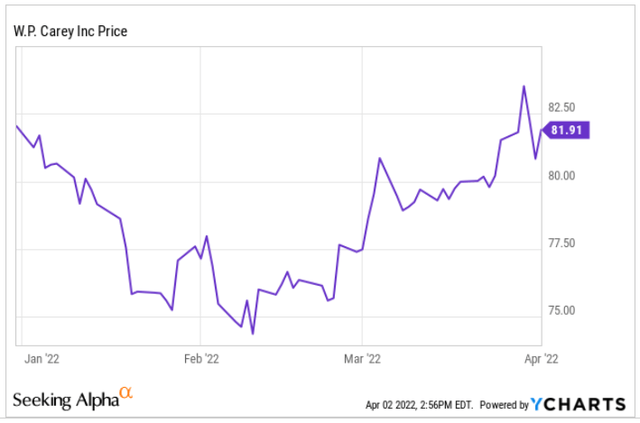

WPC went public in 1998 as a Master Limited Partnership and in September 2012 it converted to a REIT structure. As seen below, shares are trading at around the same price as January 1st, and +10% since mid-February.

WPC owns 1,304 net lease properties covering approximately 156 million square feet and for nearly five decades, the company has invested in high-quality single-tenant industrial, warehouse, office, retail and self-storage properties subject to long-term net leases with built-in rent escalators.

The portfolio is located primarily in the U.S. and Northern and Western Europe and is well-diversified by tenant, property type, geographic location and tenant industry.

One key differentiator for WPC is the companies 35% expose to Europe (based on ABR) and even with the volatile markets across Europe, we still view this strategic diversification to be opportunistic.

Last month, WPC acquired Corporate Property Associates 18 (CPA:18) in a transaction valued at $2.7B including the assumption of debt. The CPA:18 portfolio is well aligned with WPC’s existing asset base and following the closure, will help reduce tenant concentration, and streamlines the business model.

The portfolio also includes 65 operating self-storage assets currently run by two public companies – Extra Space (EXR) and CubeSmart (CUBE) – which could further enhance rent growth.

While WPC is certainly considered a net lease REIT, it’s important to recognize that the company is truly unique in how it operates its business model. Throughout multiple recessions, and now a global pandemic, the New York-based landlord has been able to deliver on its promise of increase its dividend for every single year since 1998 (in March WPC raised the dividend by 0.2%).

In 2021 WPC did a record $1.72 billion of deals and on the recent Citi Investor call the CEO, Jason Fox, said

“…we’re at a strong pace thus far in 2022. I think it’s sustainable going forward. I think it’s reflected in the initial guidance we released a couple of weeks ago at earnings at $1.5 billion to $2 billion for the year, $1.75 billion at the midpoint. And we have good visibility into a growing pipeline. So, we feel good about that number. I think that’s number one.”

Also, in 2021 WPC generated just over 6% AFFO per share growth as well as providing an attractive dividend yield averaging over 5%. Importantly, over many years WPC has constructed a portfolio that’s uniquely positioned (among net lease REITs) to benefit from inflation.

Analysts expect AFFO to grow by 4% in 2022, which is par for the course. iREIT scores WPC high on quality – 90/100 – however the shares are a tad rich for us now, this we have a Hold rating. We’re always looking to own more shares in this durable dividend-payer, especially at a discount.

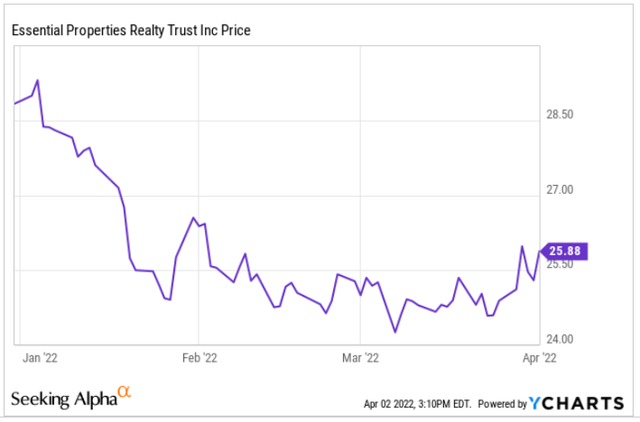

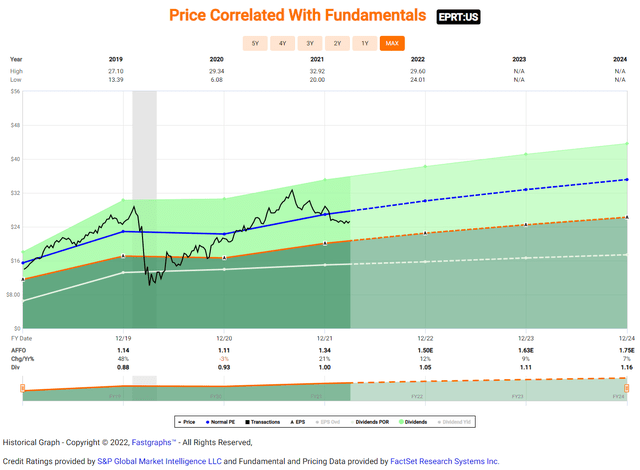

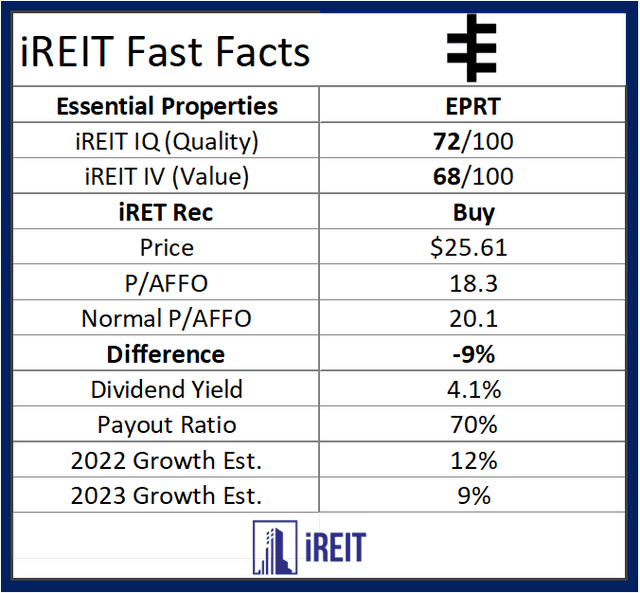

Essential Properties Trust (EPRT)

The third company to earn a spot in the “Final Four’ is Essential Properties. As viewed below, EPRT shares have traded down by ~10% YTD.

EPRT is a net lease REIT which focuses on acquires, owns, and manages “single-tenant properties that are net leased to middle-market companies operating in service-oriented or experience-based businesses.”

The portfolio included 1,451 properties in 46 states and was 99.9% leased with a remaining average lease term of 14.0 years.

One of the differentiators for EPRT is that the company buys smaller properties, averaging around $2.3 million in size, and this means that the underlying real estate (‘LAND’) is usually well-located. The company believes that its middle market focus provides the best risk-adjusted returns in the net lease sector.

So far in 2022 EPRT has closed $197 million of investments at a weighted average cash cap rate of 7.1% with a robust investment pipeline. Analysts are forecasting 12% growth (AFFO per share) in 2022 and 10% growth in 2023. Those double-digit estimates rank EPRT as one of the fastest growing REITs in our coverage spectrum.

Shares are now trading at $25.30 with a P/AFFO multiple of 18.3x (normal is 20.1x). The dividend yield is 4.1%, and there’s plenty of powder to grow based upon the low payout ratio of just 70%.

We have done extremely well owning EPRT and we recently added more share to our Durable Income portfolio. Although EPRT is not the highest quality net lease REIT, we find the valuation and growth prospects extremely attractive.

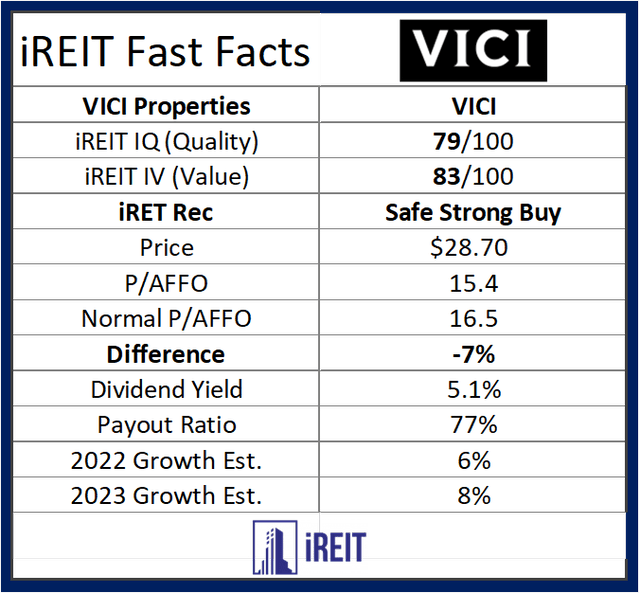

VICI Properties (VICI)

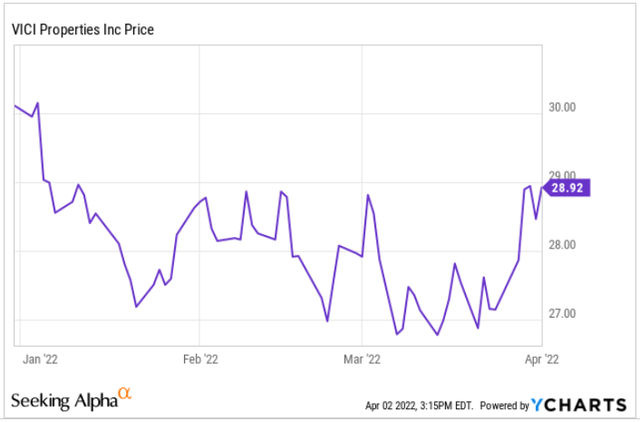

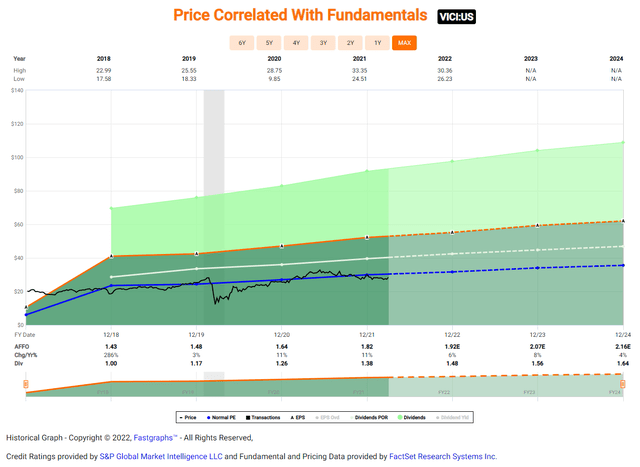

The final company in our “Final Four” bracket is VICI Properties, a gaming REIT that owns gaming, hospitality, and entertainment destinations, subject to long-term triple net leases. As viewed below, VICI has traded down ~4.5% YTD.

VICI was formed in October 2017 as part of the bankruptcy reorganization of Caesars Entertainment into separate gaming and real estate entities. Following an initial distribution of shares to creditors, VICI completed a $1.4 billion IPO in February 2018 that reduced leverage and provided funding for growth.

Today, VICI’s national, geographically diverse portfolio currently consists of 28 market leading properties, including Caesars Palace Las Vegas, Harrah’s Las Vegas and the Venetian Resort, three of the most iconic entertainment facilities on the Las Vegas Strip.

In just a few weeks VICI should be closing on the MGM Properties (MGP) portfolio that will add another 15 properties to the existing portfolio. This transformative deal will enhance VICI’s geographic and tenant diversification, that should also result in an upgrade to investment grade (later in the year).

VICI grew earnings (AFFO per share) by 11% in both 2020 and 2021 and analysts expect the strong earnings growth to continue with expectations for 6% and 8% growth in 2022 and 2023 respectively.

VICI is currently has a dividend yield of 5.1% and shares are trading at $28.46 which is below our buy below target of $36.00. Historically shares have traded at a 16.5x (based on AFFO) and are now trading at 15.4x. We also think there’s some multiple expansion for VICI (and GLPI) as investors warm up the unique sector and validation (of gaming assets) by Realty Income.

Who Are You Betting On?

Of course, one of the reasons that I decided to focus this article on the net lease REITs is so that I could also write on my favorite sport, as well as my favorite college basketball team.

Heel Yeah!

Monday night we’ll know who wins the NCAA Men’s tournament, and as Coach K explains,

“Courage and confidence are what decision making is all about.”

I have confidence in the Net Lease REIT sector, and that’s why we have maintained an overweight recommendation (status) during these volatile times. Although inflation and rising rates are risks, I believe that these four names should hold up well and deliver above average returns for investors.

As always, thank you for reading and I look forward to your comments below.

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed only to assist in research while providing a forum for second-level thinking.

Be the first to comment