Geber86/E+ via Getty Images

Thesis Summary

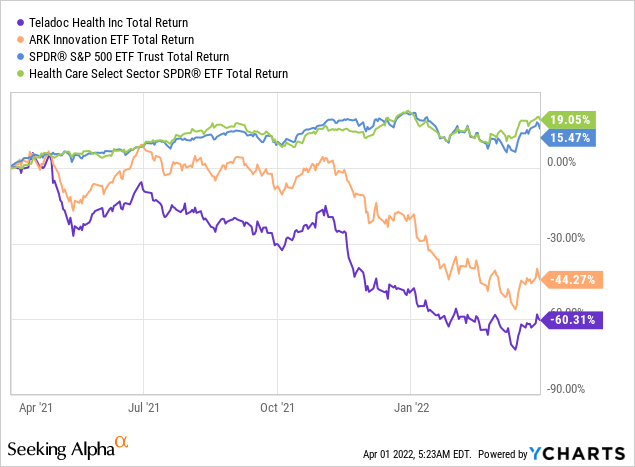

The pandemic has accelerated digital transformation and increased adoption rates for digital service providers leading to speculative elevated stock prices for most of these digital stocks. Inevitably, the bubble has finally burst, and skyrocketed valuations have normalized to more reasonable levels. Teladoc Health, Inc. (NYSE:TDOC) is no exception and, over the past year, has lost about 60% of its value, down from the $192 price tag. This was an apparent overreaction by the market, but the overall sentiment has now turned positive. The stock has already found a bottom at $50 and is now well-poised to reach new highs.

TDOC has underperformed any comparable performance index, well below the XLV, ARK Innovation ETF (ARKK), and S&P 500. However, the plunge has created a unique, attractive entry point, and I rate TDOC with a strong buy rating primarily due to the mix of the company’s strong fundamentals at a reasonable valuation.

The Digital Healthcare Outlook is Bright

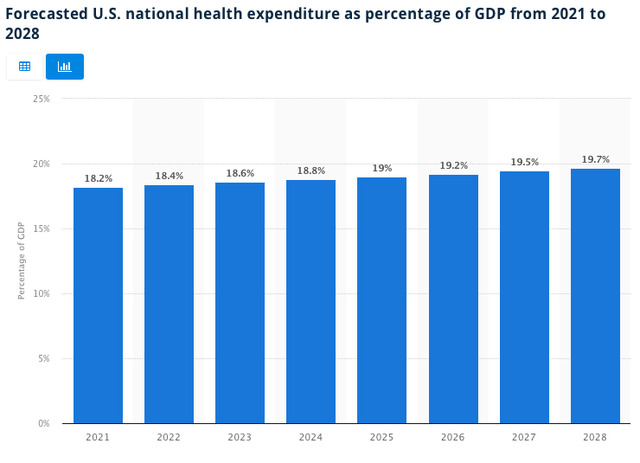

In the context of the bigger picture, the overall healthcare sector in the US is expected to grow consistently YoY. Following the pandemic, the US Government places greater emphasis on national health and now allocates a larger portion of its GDP for health expenditure, which is expected to reach nearly 20% by 2028. Such a portion translates to approximately $5.9 trillion in six years from now and signals a favorable outlook for Teladoc.

Undoubtedly, the pandemic has highlighted governments’ vulnerabilities resulting in larger investments for technologically advanced healthcare solutions that will unlock value through cloud computing, data analytics, telemedicine, preventive care, AI, and other innovative tools. As a result, Teladoc is well-positioned to grow domestically and internationally and become a healthcare technology market leader in the next decade.

Statista – US Healthcare to GDP Forecast

How Teladoc makes money

TDOC adopts a subscription-based model that generates recurring monthly revenue from active memberships through direct-to-consumer (D2C) channels. This revenue source, classified as access fees, accounts for 85% of the overall revenue, with visit fees and other revenue representing smaller portions at 13% and 2%, respectively. The access fee remains the most critical driver that also provides higher predictability of revenues. Teladoc’s primary offering, Primary360, is available to the subscribers through employers’ healthcare plans that pay on behalf of its employees.

Considering the company’s nature of operations, seasonality is expected at the end and start of the year, as they described as enrolment seasons when registration activity is elevated. As a result, it is reasonable to expect the strong growth from Q4-2021 to persist in the following quarter. Undoubtedly, the subscription-based business model relies heavily on achieving economies of scale, and the faster the company grows its userbase, the faster it will cover its upfront investment and generate profits for shareholders.

Livongo acquisition created shareholder value

The company is going after a $261 billion US total addressable market (TAM) opportunity. Undoubtedly, such a combined TAM figure couldn’t be achieved without the boost from the acquisition of Livongo. To that effect, TDOC has wisely expanded its health brand portfolio in the last couple of years, with Livongo being a major acquisition milestone that will pivot and enhance the company’s strategic direction.

Livongo not only brings to the table $50 billion in TAM but also enhances TDOC’s product offering by targeting individuals with chronic conditions, such as diabetes and hypertension. These individuals tend to spend more on healthcare, and Livongo offers a unique value proposition through smart devices and expert support, producing significant cost savings for employers and insurance companies.

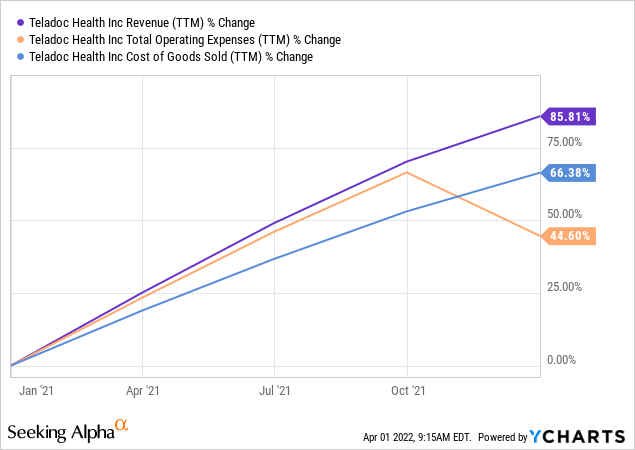

Remarkably, the acquisition created $60 million in cost synergies by 2022 and solid revenue opportunities of $500 million expected by 2025. TDOC completed its acquisition of Livongo on the 30th of October 2020. The first signs of operational efficiency are evident late in 2021 when operating expenses (Opex) saw a steep slow down while revenues grew fast.

Top-line Profitability and Growth remain strong

More than 90 million individuals have access to the Teladoc platform, and the monthly average revenue per member (ARPM) stands at $2.49 in Q4, a jump of 52% compared to Q3. However, the company faces intense competition, primarily from smaller competitors and national healthcare systems.

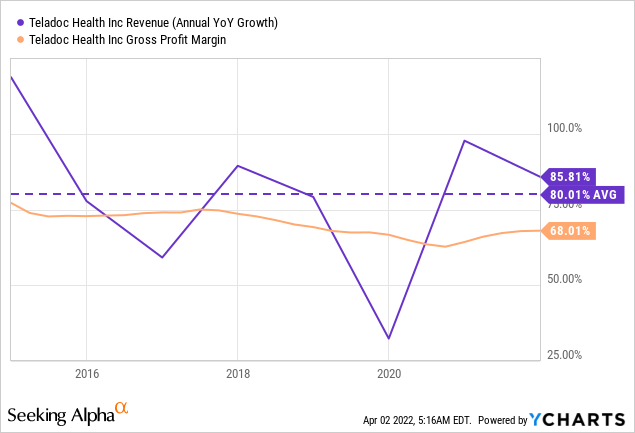

Despite having a first-mover advantage, its management is moving fast and has wisely adopted an acquisition strategy for growing the business and crashing its competition. Teladoc operates in a highly fragmented industry which explains the declining gross profit margins (GP) as telemedicine companies enter price wars and adopt a low-cost strategy to steal market share.

Even though margins eroded in the past years, the company reported an outstanding GP figure of 68% in the last quarter of 2021 and showed signs of stability. In addition, as the company gains operating leverage with more registered users and greater control over Opex, operating margins are expected to turn positive in the foreseeable future.

Additionally, since the company’s IPO in 2015, the average revenue growth hovers around the 80% mark, with only a slight decrease to 75% if we compare it to its 5-year average. Such growth metrics are outstanding, and considering the revenue synergies from Livongo and InTouch, combined with the market size growth, TDOC is well-positioned to capitalize on the growth.

Last but not least, the digital health market size is expected to grow at a compounded annual rate of 25.3% for the next three years, which further supports the positive growth outlook for TDOC. Therefore, it is reasonable to assume that TDOC will grow at a similar pace for the foreseeable future.

TDOC faces certain Risks

Investing in TDOC is not risk-free, and the company-specific risks remain a deal-breaker for some investors. What caught my attention when I was reading the company’s latest 10-K form was that TDOC’s revenue is relatively concentrated, with its top ten clients accounting for 21.8% of its total revenue for 2021 compared to the 16.2% figure last year. Thus, for a growth stock that derives most of its value due to its revenue growth metrics, failure to maintain any of these large customers will distort growth rates and threaten TDOC’s valuation.

Finally, a continued decline in GP margins below 60% may question the company’s ability to keep up with its competition and maintain its pricing power. As a result, investors should closely monitor the company margins but not overreact to QoQ’s normal fluctuations. On the contrary, it is reasonable to assume that margins have found a bottom and that if Livongo’s synergies materialize, then an upward movement is expected.

Relative Valuations remain Cheap

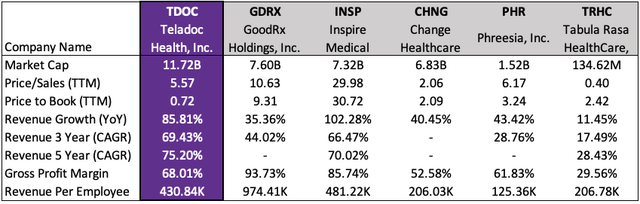

Most of the company’s publicly listed competitors are smaller in size, but some attract much higher valuations in P/S and P/B multiples, despite the much weaker revenue growth rates. Surprisingly, TDOC trades below its book value, making it a rare opportunity and providing a wide margin of safety for risk-averse investors. Although the P/B metric is less relevant for growth stocks, it is reasonable to assume that the gap will not last long, and the 39% upside from current levels is highly probable within 2022.

Table created by Author using data from Seeking Alpha

By far the cheapest top 10 holding in ARKK

TDOC holds the third-largest position in Cathie Wood’s ARKK ETF portfolio with around 6.64% weighting and an $803 million market value. The famous investor is well known for investing billions in top growth stocks, and these top ten names deserve a closer look as they qualify as high conviction stocks that bring technological disruption. TDOC ranks 3rd in the list, but it remains one of the cheapest stocks with just a 5.57x P/S multiple, much lower than ARKK’s average of 23.34x at the time of writing.

Concluding thoughts

As a value and GARP investor, opportunities that balance high-growth and reasonable valuations are rare. To conclude, TDOC stands out in my growth stock watchlist, and it is now part of my model portfolio, with the potential of getting an upgrade to my concentrated portfolio of leading stocks.

Be the first to comment