Brandon Bell/Getty Images News

Occidental Petroleum (NYSE:OXY) is a company we’ve consistently recommended before. The company has long been one of our favorites. However, with the company’s share price moving past $60 / share and its dividend towards $60 billion, we think that it’s time for investors to consider selling Occidental Petroleum.

Occidental Petroleum 2021 Performance

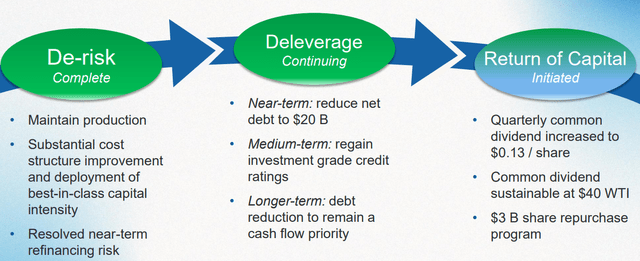

Occidental Petroleum had strong 2021 performance, which we expect to continue in upcoming years.

Occidental Petroleum Investor Presentation

Occidental Petroleum 2021 Performance – Occidental Petroleum Investor Presentation

Occidental Petroleum has roughly $25 billion in net-debt, a number it’s focused on continuing to reduce, along with $10 billion in preferred stock obligations. The company has 960 million in shares outstanding along with roughly 120 million shares worth of warrants (with a strike price of $22 / share) and warrants for 84 million shares with Warren Buffett (total exercise $5 billion).

The company has increased its quarterly dividend to just under 1% which it states is completely sustainable at $40 WTI and begun a $3 billion share repurchase program (5% of shares outstanding). The company’s strong performance in 2021 with modest production growth and a 20% increase in proved reserves means continued long-term production.

Operating in U.S. shale, the company’s 3.5 billion barrels of reserves give it roughly an 8% reserve life and some of the lowest production costs of any major crude company.

Occidental Petroleum Management

Occidental Petroleum management has become significantly less popular, and for good reason, since the acquisition of Anadarko Petroleum.

For those who don’t remember, the company utilized $10 billion in preferred equity issued to Warren Buffett, at an 8% interest rate, along with warrants for 80+ million shares, to avoid a shareholder vote and outbid Chevron the acquisition. COVID-19 coming afterwards forced the company to pay dividends on the preferred equity to Berkshire in equity.

The company did give up these 19 million shares at a low price (<$300 million versus current value of >$1 billion). These decisions to acquire Anadarko Petroleum cost the company heavily, especially as a result of COVID-19, which to be fair wasn’t predictable. However, the takeaway is that management hasn’t historically been very shareholder friendly.

Occidental Petroleum Financial Forecast

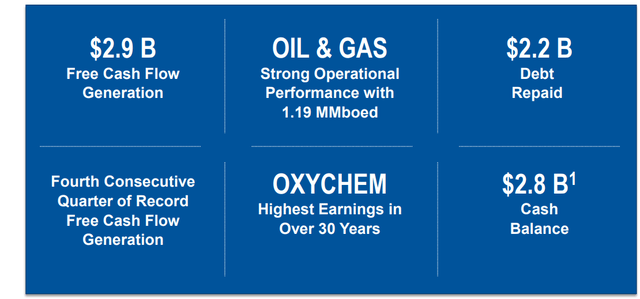

Occidental Petroleum is continuing to generate substantial cash flow.

Occidental Petroleum Investor Presentation

Occidental Petroleum Financial Forecast – Occidental Petroleum Investor Presentation

Occidental Petroleum generated $2.9 billion in FCF in the most recent quarter with 1.2 million barrels / day in production. The company primarily used that to repay debt, supported by strong earnings from OXYCHEM as well. The company’s dividend breakeven is $40 WTI versus current WTI prices of just under $100 / barrel.

The company’s cash flow change is roughly $230 million for every $1 / barrel oil, meaning at just under $100 / barrel, the company has just under $14 billion in cash flow. The company is ramping up capital spending towards $4 billion, which is primarily sustaining capital, implying FCF just under $10 billion at current oil prices.

There’s no denying that’s a massive amount of FCF.

Occidental Petroleum Lower Returns

To be clear, we’re not recommending you sell your Occidental Petroleum. If you’re like us, sitting with significant capital gains, long-term capital gains rates of 20% mean it’s not necessarily worth selling right away. However, we do expect future returns to be lower for several reasons.

First, more than 200 million of warrants are now out there that are in the money. They’re worth more than $12 billion in the market at the current time and would push the company’s true market cap to $72 billion (although provide it with $7 billion in cash as a result). After that cash the company would have a total enterprise value of roughly $100 billion.

That would include roughly $18 billion in long-term net debt (after the $7 billion in cash). It’d also include the $10 billion in preferred equity. Now it’s worth highlighting, that with $10 billion in annual FCF, which includes sustaining and some growth, makes the company a valuable investment (especially counting its 1% dividend).

The company could continue paying down debt and preferred equity, savings ~$2 billion on total annual interest expenditures, and buying back shares could also support increased shareholder rewards. However, a diluted 10% EV FCF yield and 14% market cap FCF yield is lower than what many other companies are offering at $100 / barrel.

At $70 / barrel those numbers cut in roughly half, which hurts the future returns. With the company needing $70-80 / barrel to generate S&P 500 level returns, we think future returns will be lower, resulting in our conclusion that it’s no longer worth investing in the company

Thesis Risk

The largest risk to the thesis is maintained higher oil prices. Occidental Petroleum has a strong and efficient business. Should oil prices remain high, or increase from here, the company could comfortably generate double-digit shareholder returns, which would mean some regrets for holding instead of investing more now.

Another risk is a potential acquisition. Counting in the money warrants, Berkshire Hathaway now controls more than 20% of the company. They could comfortably afford to acquire the company, and if so, it’d be a significant short-term premium that would generate strong returns. That risk is worth paying close attention to.

Conclusion

Occidental Petroleum is a valuable company. The company has a unique portfolio of assets with significant reserves and an incredibly low breakeven ($40 WTI counting its dividend). At current oil prices the company is profitable, and that could expand significantly from current prices should oil prices remain strong or increase.

However, we do see some risks with the company’s ability to continue generating market-beating returns. The company has more than 200 million warrants in the money, and it still has significant debt and preferred equity obligations outstanding. We definitely recommend holding on to current investments, but we no longer recommend jumping in and buying with both fists.

Be the first to comment