guvendemir/E+ via Getty Images

BioCryst Pharmaceuticals (NASDAQ:BCRX) suffered a major setback last week after it stopped enrollment in its trials involving BCX9930, an oral factor D inhibitor targeted at complement-mediated diseases. This follows from last year’s setback with galidesivir in coronavirus.

In a few patients in the trials, elevated serum creatinine levels (sCr) were observed, indicative of impaired kidney function. This decision will impact REDEEM-1, REDEEM-2, and RENEW clinical trials. Of these, REDEEM-1 REDEEM-2 are pivotal studies designed to evaluate BCX9930 in paroxysmal nocturnal hemoglobinuria (PNH), a rare hematological condition. Patients already enrolled will continue on the drug.

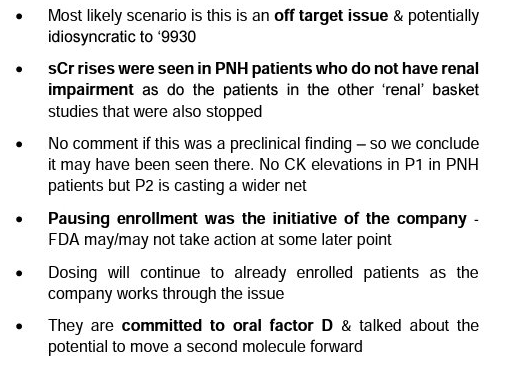

Evercore held a talk with BioCryst CEO, a report of which was shared in our TPT chatroom. They say that the future of BCX9930 is uncertain, although Orladeyo has potential to make $500mn in revenue by 2025. The analyst, Liisa Bayko, considers the sCr elevation an off-target issue. Below are some of the takeaways:

BCRX Evercore Talk (Evercore)

Some of these takeaways are indicative of the approach BioCryst could take to resolve the issue. For example, if sCr elevation was found only in renal-impaired patients from the RENEW trial, which enrolled patients with C3 glomerulopathy (C3G), immunoglobulin A nephropathy (IgAN) and primary membranous nephropathy (PMN), that would be one thing, because all these diseases lead to renal malfunction so sCr elevation could have been caused by something else. However, the fact that it was also found among PNH patients, without renal impairment, negates this possibility to a large extent. Note, though, that some PNH patients also proceed to renal impairment biomarked by elevated serum creatinine. That could be an option to explore for BCRX.

What is more important is the conclusion that follows. If BCRX continues with BCX9930, the analyst thinks it will be tainted by this sCr event and may lose out in competition against Novartis’ (NVS) iptacopan, whose pivotal data in PNH will be out this year. On the other hand, if BCRX opts for a second oral factor D molecule, they will be materially behind NVS.

Alexion’s (AZN) soliris and follow-on drug ultomiris are mainstay therapies for PNH. However, factor B (iptacopan) and D (BCX9930) inhibitors are oral drugs, and iptacopan and BCX9930 have both shown that they can work in the small percentage of patients who do not respond to soliris. However, there’s fresh competition looming. Apellis Pharmaceuticals just received FDA approval last year for its C3 inhibitor Empaveli (pegcetacoplan) as a first-line therapy and in patients who switch from Soliris and Ultomiris. Empaveli can be taken at home because it is delivered by subcutaneous injection. Also, Alexion has two factor D inhibitors, danicopan, in phase III, and ALXN2050. Moreover, a number of soliris biosimilars are on the way to the market. So that’s the nature of the competition, where, as you can guess, any misstep will be a terrible disaster. BCX9930 is now relegated to the also-ran list, unless other contenders screw up and it is able to show something different and positive.

Finally, the analyst also says that BCRX stock will show some volatility now, not only for BCX9930, but also from “noise” from competitors in the oral HAE market of Orladeyo, which is currently the only oral drug for the indication.

Last year, I wrote this, after Orladeyo approval, on the BCRX bull case:

BioCryst’s ORLADEYO is off to a great, great start in HAE, BCRX withdrew their $200mn offering and a few months later, Royalty Pharma and OMERS Capital Market together purchased $350mn of royalties for BCX9930 and ORLADEYO, removing the need for dilution, BCX9930 is potentially going to be in the market for a billion dollar indication in 3 years, and they just launched the two pivotal trials, REDEEM-1 and 2, that may make that approval possible. This is the bullish case for BioCryst in a nutshell.

As you can see, most of the bullish case was for Orladeyo in the near term. However, if asked to provide numbers, I would say it was a 80-20 scenario at that time. Long term BCRX followers will recall that market research they did nearly 4 years ago, which told them HAE patients hated the injections, even though they were satisfied with its overall effect. That research data is playing out in the market today as more and more patients are switching from other standards of care to Orladeyo.

The best business plan for BCRX here would have been to put extreme focus on Orladeyo’s revenue, and use the space generated by that revenue stream to push its pipeline up. The BCX9930 sCr issue causes a hiccup in that excellent plan. They don’t have another late stage product to fall back to right now; the best they have is BCX9250, an oral ALK-2 inhibitor, which is being developed to target a rare disease called Fibrodysplasia Ossificans Progressiva (FOP). This program showed good drug activity in mice models, and a phase 1 SAD/MAD trial in healthy volunteers has just been completed.

All that means is that while Orladeyo is going to reach a semi-blockbuster status in a few years, BioCryst’s current $4bn valuation is unsustainable without BCX9930. I am sad to say that, because I have traded BCRX stock over the years, and I guess I have developed an attachment to it. I wonder, though: the company has $500mn in cash; is it possible for them to buy a late stage asset from a small company and develop that into a platform like they were planning to do with BCX9930? Or maybe BCX9930 will resolve itself, and the strong competition will fizzle out somehow. That, however, sounds like wishful thinking at this time.

Having written a mostly bearish article on a company I like, I must say that BCRX has a habit of bouncing back from trouble, which makes the current lows a trading opportunity for the risk takers among us.

Be the first to comment