Chip Somodevilla

Introduction

On September 10, 2022, the Investor’s Business Daily wrote, “Warren Buffett Hikes Occidental Petroleum Stake After Getting Regulatory OK To Buy 50%.”

Warren Buffett bought up more Occidental Petroleum shares after his Berkshire Hathaway won regulatory approval to buy up to 50%. OXY stock rose slightly late Friday. Berkshire Hathaway now owns 26.8% of Occidental Petroleum, according to a regulatory filing Friday night. That came exactly one month after Warren Buffett’s firm disclosed its OXY stock stake had reached 20.2%. Crossing the 20% ownership level means Berkshire Hathaway can record Occidental earnings on its books.

This article above contains several inaccuracies that could have misled unaware investors into buying OXY last week. Thus, I will try to explain and debunk what has been written above to the best of my knowledge. By the way, Bloomberg, WSJ, and even Seeking Alpha reported the same news.

Note: This article uses comments from my preceding article on Occidental Petroleum published on Seeking Alpha on August 22, 2022. Especially when it comes to the chronological order of events.

1 – Berkshire Hathaway’s most recent move about Occidental Petroleum

1.1 – How many shares Berkshire Hathaway owns now?

On Friday, August 19, 2022, Warren Buffett’s Berkshire Hathaway (BRK.B, BRK.A) won approval to buy an equity stake of up to 50% in Houston-based Occidental Petroleum (NYSE:NYSE:OXY).

The Federal Energy Regulatory Commission (“FERC”) approved the request from Warren Buffett’s Berkshire Hathaway and said it was “consistent with the public interest” and subject to various conditions.

It was not immediately known why Berkshire Hathaway decided to do it. Speculation ran high, and many thought Berkshire Hathaway ultimately wanted to acquire Occidental Petroleum.

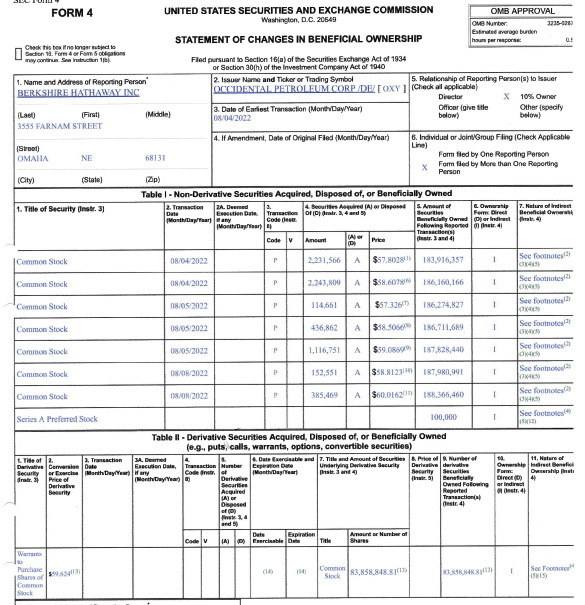

Furthermore, Berkshire disclosed in its last form 4 filing that it bought 6,681,669 common shares of Occidental from 8/4/22 to 8/8/22, representing a stake of 20.06% (based on 939.2 million basic shares outstanding). Berkshire acquired OXY shares in the range of $57.326 to $60.0162 and owned 188,366,460 shares of OXY.

Note: BRK bought only 385,469 shares at $60.0162 out of the 6,681,669 total indicated in Form 4. I will explain why later.

Furthermore, Buffett’s Berkshire Hathaway owns preferred stocks with an 8% interest payable every quarter and can be paid either in cash or shares. A crucial element here is that they came with warrants, a lot of them.

Form 4 in August indicates that BRK owns 83,858,849 “Warrants to Purchase Shares of Common Stock” at an exercise price of $59.624. (See filing below).

The warrants were issued on August 8, 2019 and are exercisable at the applicable holder’s option, in whole or in part, until the first anniversary of the date on which no shares of the issuer’s series A preferred stock remain outstanding, at which time the warrants expire.

OXY Form 4 August 9, 2022 (SEC filing Form 4)

However, the warrants do not represent immediate ownership of the OXY stock, only the right to purchase the company shares at a set price in the future. According to Forbes:

A stock warrant is a derivative contract between a public company and an investor. A warrant gives the holder the right to buy or sell shares of stock to or from the issuing public company at a specified price before a specified date. Holders of warrants are under no obligation to buy or sell the underlying stocks.

Warrant holders are at a disadvantage to shareholders because they don’t have voting rights or a right to dividends.

Thus, the answer to the question: Berkshire Hathaway owns 188,366,460 shares of OXY and 83,858,849 “Warrants to Purchase Shares of Common Stock” at an exercise price of $59.624.

1.2 – What is the difference between a Form 4 Filing and a schedule 13G/A filing? What has been filed on August 31, 2022?

Answer: Berkshire Hathaway filed a Schedule 13G filing on August 31, 2022.

- A Schedule 13G/A filing is a statement of beneficial ownership, whereas Form 4 is a Statement of Change in Beneficial Ownership.

- Form 4 must be filed when BRK buys or sells shares of OXY. As far as I know, BRK did not purchase any shares since August 8, 2022, and no form 4 has been filed since August.

Conversely, what has been filed is an amended Form 13 or Form 13G/A. The form’s purpose is to require large holders to report their entire ownership stake, including the warrants.

Thus, we can say that Berkshire Hathaway has NOT increased its stake in Occidental Petroleum and still owns 20.06% of the company’s stocks. If BRK decides to exercise the warrants, this percentage could go as high as 26.61%.

1.3 – Why is the sub-20% threshold meaningful for Berkshire Hathaway?

The 20% threshold is meaningful for Berkshire Hathaway because the company can incorporate a proportional amount of the OXY’s earnings in its financial results – valid to sub-20% holding – potentially raising its annual earnings by about $2 billion.

1.4 – Why Berkshire Hathaway asked for authorization to purchase up to 50% of OXY?

As you have seen above, it was a substantial incentive to cross the 20% level for Buffett’s Berkshire Hathaway.

However, by doing so, BRK had an issue with the warrants, which it solved by requesting authorization to increase its OXY stake to 50% from 25%.

Hence, BRK can now exercise the warrants and increase its stake from 20.06% to 26.61% (based on 939.20 million shares plus the new 83.859 million additional or 1,023.06 million).

1.5 – Why is Berkshire Hathaway not likely to buy more OXY shares above $59.624?

Because the company can always exercise the warrants it owns and will be foolish to add more shares above the $59.624. Conversely, if OXY drops below $59.624, Berkshire Hathaway could eventually buy more shares.

In some circumstances, the strike price and the number of warrants can be adjusted and have been adjusted one time already.

Furthermore, the warrants may be exercised cashless unless it is expressly prohibited when created (it may not be possible in this case):

a cashless warrant allows an investor to receive a certain number of shares without any outlay of cash. The “cashless” component refers to receiving a smaller amount of shares than would otherwise be received with a warrant plus cash.

Suppose BRK is allowed to exercise cashless warrants at a stock price of $70 per share. BRK will receive 12.43 million OXY shares without paying one cent. The basic share outstanding will rise to 951.63 million or 1.3%.

2 – Conclusion

To set the record straight, Berkshire Hathaway did not increase its stake in OXY since August 8 and still owns 20.06% of the basic share outstanding of the company. If BRK decides to buy or sell shares of OXY, it is required to file a FORM 4, not a form 13G/A.

Note: Form 4 must be filed within two business days following the transaction date.

The recent Form 13G/A disclosed what BRK owns in stocks and warrants and was an update of the preceding Form 13G/A published on 05/06/22.

Berkshire Hathaway can increase its OXY ownership by exercising its 83,858,849 “Warrants to Purchase Shares of Common Stock” at an exercise price of $59.624. In this case, BRK will own up to 26.61% of the company and not 26.8%. If the entire warrants are exercised, the primary share outstanding will increase to approximately 1,023.06 million or 8.93%, and Berkshire Hathaway will have to pay OXY about $5 billion in this case.

I do not think Buffett’s Berkshire Hathaway has any desire to acquire Occidental Petroleum and wanted to cross the 20% threshold only to incorporate a proportional amount of the OXY’s earnings in its financial results. However, everything is possible, and I recommend reading the Forbes article published on August 22, 2022.

In reality, Buffett may not even be interested in acquiring anything close to a 50% stake in Occidental. Instead, he may simply be giving Berkshire a bit more wiggle room on the regulatory front.

Prior to the FERC ruling on Aug.19, Berkshire was only authorized to own up to 25% of Occidental, a limit it would have exceeded at any time if Buffett had chosen to exercise Berkshire’s warrants.

I hope these clarifications will help many to understand what is going on and avoid making illogical assumptions.

Be the first to comment