onurdongel

Crescent Point Energy (NYSE:NYSE:CPG) is an oil and gas company located in Calgary, Canada. During the first quarter of 2022, the company could generate a great amount of cash flow and pay back its debt for the sake of oil and gas boosting prices. The company provided around a 200% price return in May 2022. The decrease in oil and gas prices during the second quarter of 2022 led the stock price to drop back to the previous level of $6-8 per share. However, the market outlook is in favor of CPG. Moreover, by analyzing the company’s performance across the boards of liquidity, profitability, leverage, and coverage capabilities, I illustrate that Crescent Point is in a good condition, and can absorb the risk of lower oil and gas prices in the future.

2Q 2022 highlights

In its 2Q 2022 financial result, CPG reported an adjusted FFO of Cdn$599 million, compared with 2Q 2021 adjusted FFP of Cdn$388 million, up 54%. The company’s adjusted net earnings from operations increased from Cdn$118 million, or Cdn$0.2 per diluted share in the second quarter of 2021 to Cdn$272 million, or Cdn$0.47 per diluted share in 2Q 2022. CPG declared a 2Q 2022 dividend per share of Cdn$0.0650, compared with a 2Q 2021 dividend per share of Cdn$0.0025, up 2500%. The company’s average daily production decreased from 148641 boe/d in 2Q 2021 to 129176 boe/d in 2Q 2022. On the other hand, CPG’s average selling price increased from Cdn$62.78 per boe in 2Q 2021 to Cdn$109.44 per boe in the second quarter of 2022, up 74%. The company’s 2Q 2022 crude oil and condensate average selling price increased by 77% (YoY) to Cdn$134.50 /bbl. Also, its 2Q 2022 natural gas average selling price increased by 120% YoY to Cdn$8.02/mcf.

Due to significantly higher average selling prices in the second quarter of 2022, compared to the same period last year, CPG’s operating netback increased from Cdn$40 million in 2Q 2021 to Cdn$77 million in 2Q 2022. The company reported capital expenditures of Cdn$197 million in the second quarter of 2022, up 12% YoY. Its frilling and development expenditures increased by 216% to Cdn$183 million. On the other hand, its facilities and seismic expenditures decreased from Cdn$31 million in 2Q 2021 to Cdn$14 million in 2Q 2022. “The company achieved a strong IP30 rate of 900 boe/d per well, comprised primarily of liquids, on second fully operated pad in Kaybob Duverney,” CPG reported. “Upon attaining our near-term debt target, we announced our updated framework, which now targets to return the majority of our excess cash flow to shareholders,” the CEO commented.

The market outlook

Figure 1 shows that WTI crude oil price increased from below $80 per barrel at the beginning of the year to more than $120 per barrel at the beginning of June 2022. Due to the higher oil and natural gas prices, driven by the invasion of Russia to Ukraine, which caused an energy crisis in Europe, CPG sold its products at significantly higher prices in the first half of 2022. However, WTI crude oil prices dropped to below $90 per barrel. EIA forecasts WTI crude oil price of $91 per barrel for 2023, compared with WTI crude oil price of $98 per barrel in 2022. Crude oil prices decreased in August 2022 due to higher global petroleum inventories and ongoing growth in the global production of crude oil. Recently, OPEC announced that the upward adjustment of 0.1 mb/d to the production level was temporary. Thus, the OPEC crude oil production level in the following months will be lower than in September. Also, the geopolitical tensions in Europe continue, and there is no serious sign of the end of the war in Ukraine. Thus, I don’t expect EU leaders’ agreement to ban Russian oil imports by 90% to change. Moreover, despite recent talks between Western countries and Iran on the nuclear deal, I do not expect sanctions against Iranian oil to be lifted until the United States House of Representatives elections (8 November 2022) and the Israeli legislative election (1 November 2022). Thus, I don’t expect oil and natural gas prices to fall due to Iran’s crude oil exports into the market. The market condition is still in favor of CPG.

Figure 1 – WTI crude oil prices

investing.com

CPG performance outlook

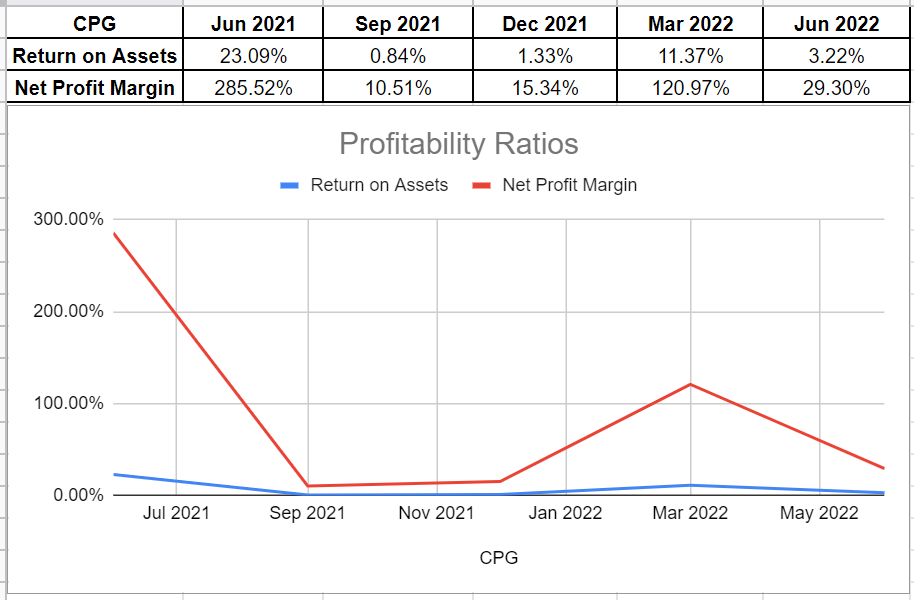

CPG’s net profit margin showed impressive growth and sat at 120.1% at the end of last quarter compared with its amount of only 15.3% at the end of 2021. Increasing oil prices could be a sensible reason for this plunge. During the second quarter of 2022, with decreasing oil prices, CPG’s profit margin dropped to 29.3%.

Moreover, across the board of return on assets, the ROA ratio in Q2 2022 shows that 3.2% of the company’s net earnings is related to its total assets. Crescent Point Energy’s return on assets boosted impressively during the previous quarter and sat at 11.3% versus its level of only 1.33% at the end of 2021. We all know that oil and gas profit margins are so volatile due to the volatility of energy prices. Thus, considering this reality, Crescent Point Energy’s profitability ratios cater a good capture of its ability to generate income relative to the revenue and assets (see Figure 2).

Figure 2 – CPG’s profitability ratios

Author (based on SA data)

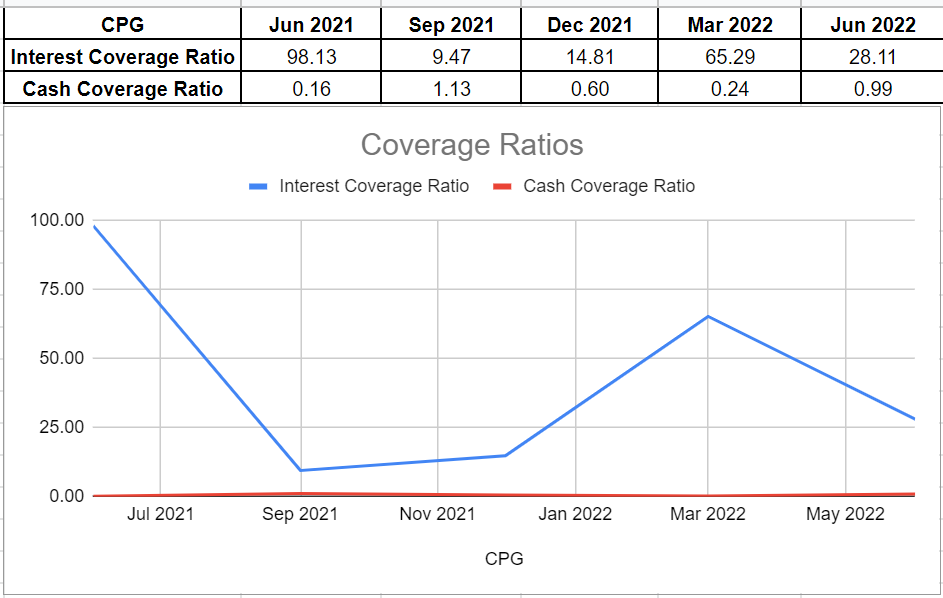

Furthermore, we can analyze CPG’s coverage ability across the board of its interest-coverage and cash-coverage ratios. Its ICR in Q2 2022 indicates that 28 times the company can pay its interest expenses on its debt with its operating income. However, CPG’s interest coverage ratio in the second quarter was weak compared to its amount of 65.2 at the end of Q1 2022. In detail, it refers to a decline in the company’s operating income during the current quarter.

Meanwhile, as a conservative metric to compare the company’s cash balance to its annual interest expense, CPG’s cash-coverage ratio in Q2 2022 was 0.99, which shows an astonishing increase compared with its previous level of 0.24 at the end of the first quarter. In sum, thanks to the company’s improving free cash flow, there may not be concerns about CPG’s ability to cover its obligations (see Figure 3).

Figure 3 – CPG’s coverage ratios

Author (based on SA data)

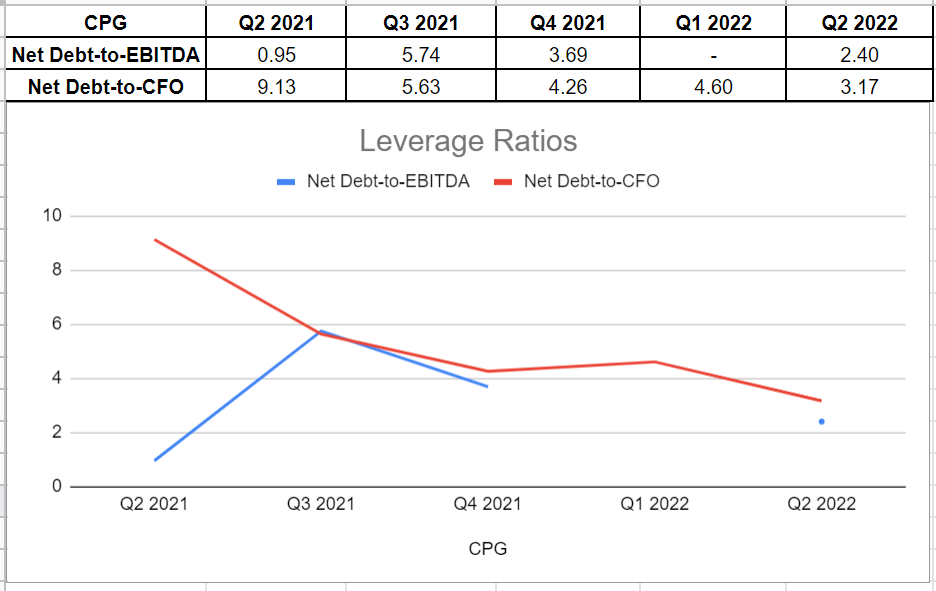

Under a lens of Crescent Point’s leverage conditions, it is observable that decreasing net debt aligns with an improvement in EBITDA, leading to a decline in the company’s net debt-to- EBITDA amount of 2.40. Furthermore, following its lower net debt and higher operating cash flow, it is not surprising to see its leverage ratio decrease across the board in net debt-to-operating cash flow to sit at 3.17 at the end of Q2 2022. Hence, Crescent Point Energy shows financial stability under the lens of leverage ratios (see Figure 4).

Figure 4 – CPG’s leverage ratios

Author (based on SA data)

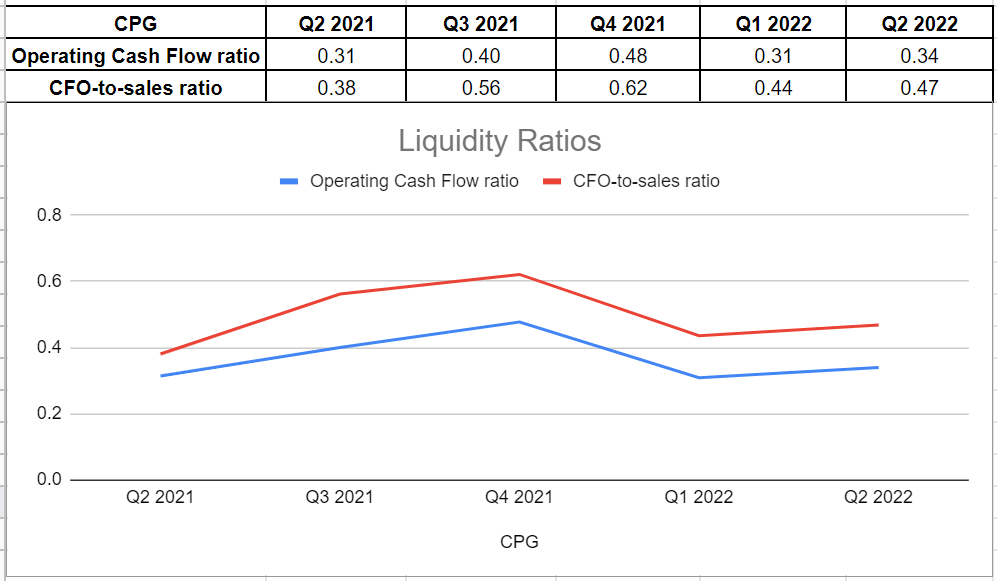

Finally, to analyze the company’s liquidity and performance conditions, I investigated CPG’s operating cash flow and CFO-to-sales ratios (see Figure 5). CPG’s operating cash flow of 0.34 during the second quarter of 2022 is in line with its level of 0.31 at the end of the first quarter. This ratio indicates how well the company is able to pay off its current liabilities with the cash flow generated from its business operations.

Figure 5 – CPG’s liquidity ratios

Author (based on SA data)

Summary

In short, CPG presented well-performed results regarding its financial structure in the second quarter of 2022. Most of the financial metrics and its operation condition were strong enough to consider Crescent Point as a stock with a bright future. I expect oil prices to remain around $90 per barrel for the rest of 2022. Notwithstanding the volatile nature of energy prices, CPG is capable of absorbing the probable risks in the future, and thus, I believe the stock is a Buy.

Be the first to comment