DarkGel/iStock via Getty Images

Summary

Arcutis Biotherapeutics’ (NASDAQ:NASDAQ:ARQT) lead asset, roflumilast, was approved in psoriasis. Data recently released supports approval of the foam formulation for the treatment of seborrheic dermatitis. Data in scalp psoriasis and atopic dermatitis is due by year end and if positive, may result in roflumilast becoming a “pipeline in a molecule” with a path to blockbuster status. In addition, the company is developing a portfolio of dermatology assets. Arcutis is well funded with over $500 m of cash on hand and well positioned to become cash flow positive in a 3-5 year time frame.

Addition Indications are the Key to Roflumilast becoming a Blockbuster

Seborrheic Dermatitis

Arcutis completed phase 3 trials of roflumilast in the treatment of patients with seborrheic dermatitis. There are 2.2 million US patients treated with topicals for this condition by dermatologists. Most prescriptions currently written are generics.

This condition causes itchy, red patches and greasy, flaking scales and includes “cradle cap” that infants experience. It frequently occurs in thin skinned areas often near the nose, eyes and scalp. Patients report persistent itch. Steroids and antifungals are used and salicylic acid or coal tar can be used to remove scale. Roflumilast’s foam formulation is ideal for the scalp as it is not greasy due to the water based formulation and easy to apply to delicate skin on the face and scalp.

The STRATUM study met the primary endpoint and there were statistically significant improvements compared to vehicle on secondary endpoints. The side effect profile was excellent and largely indistinguishable from vehicle. In Q1 of 2023, an NDA will be submitted to FDA for the foam formulation to be approved for use in seborrheic dermatitis. Given the data, there is a high probability of approval and this indication will expand the number of patients for whom roflumilast can be prescribed.

Scalp Psoriasis

Arcutis is also conducting a phase 3 trial in the use of roflumilast foam in the treatment of scalp psoriasis. Roflumilast foam is designed for areas such as the scalp where a cream would be difficult to use. The foam is a moisture rich, water based formulation that is easy to apply to the scalp.

There are 2.5 million US patients with scalp psoriasis and a foam formulation is ideal for hair bearing areas. Phase 2 data revealed a favorable efficacy profile with 59.1% of treated patients showing S-IGA success at week 8 vs 11.4% of placebo patients in a large study with more than 300 patients. Data from the phase 3 trial in scalp psoriasis is due by year end 2022. Given the phase 2 results, positive data is likely.

Scalp psoriasis (Arcutis)

Atopic Dermatitis

Atopic dermatitis [AD] is a chronic condition that affects 16.5 million US adults and 9.5 million children making it the most common chronic inflammatory skin disease. Generally, it is a condition that begins in childhood and commonly co-occurs with asthma and allergic rhinitis. The condition involves a rash and skin tends to be dry, inflamed, swollen, scaly and itchy. At times, the skin oozes and patients develop a secondary infection. Dysbiosis, with overgrowth of S. aureus, is also known to occur and may worsen the condition. Contact allergens (dust mites, pollen), stress, food, skin flora, and humidity can serve as triggers to cause the condition to flare but the cause is unknown. It is a chronic condition which cycles through flares and remissions. Itch is a common complaint and scratching can exacerbate the condition.

Treatments for Atopic Dermatitis

First line treatments include emollients (moisturizers) and corticosteroids. While low dose steroids are generally safe, there are risks of pigment changes, atrophy, telangiectasias, striae and rashes associated with the chronic use of steroids. In addition, steroid use on the face, including even over the counter steroids, can cause adverse effects and use should generally be limited to 2 weeks. These risks are particularly concerning in pediatric patients.

Topical calcineurin inhibitors such as Elidel can be added but are generally considered second line therapy. There is a theoretical risk of lymphoma associated with high-dose oral pimecrolimus in animal studies and a black box warning advising against the use of topical calcineurin inhibitors in children younger than 2 years.

Biologic therapies such as Dupilumab (Dupixent) are highly effective in atopic dermatitis but extremely costly and generally reserved for the most severe cases. In addition, patients may need a topical formulation for refractory lesions.

There was a recent (October 2021) approval of Ruxolitinib (Opzelura), a topical JAK inhibitor cream which showed efficacy with 50% of patients achieving a 2 grade reduction in Global Assessment Score. However, it is not indicated for chronic use and carries class warnings for the risk of lymphoma and other malignancies, major cardiovascular events, lipid elevations, thrombosis, thrombocytopenia, anemia and neutropenia which may limit its usage.

Topical crisaborole 2% ointment (Eucrisa), is an approved topical phosphodiesterase 4 inhibitor which is the same class as roflumilast. An ointment is not ideal as the greasy texture may transfer to clothing. The biggest limitation is that the most common side effect is burning and stinging. Some patients reported extreme burning and stinging. Efficacy in the product insert as measured by ISGA score of clear or almost clear were 32.8% and 31.4 % in two pivotal studies. Eucrisa is also approved for children 3 months of age and up but stinging and burning make it difficult to use in children.

Pfizer initially suggested sales for Eucrisa could reach $2B but the undesirable profile (burning and stinging) and a lack of commercial coverage resulted in poor sales. Analysts’ consensus estimates were $1.3 B in 2022 sales. While Pfizer has not recently provided exact sales figures, 2019 sales were a mere $138 million suggesting it has not been well received by physicians. Analysts, at the time of launch, seemed not to recognize the significant limitations of the product–minimal efficacy and severe stinging. Roflumilast is differentiated from Eucrisa in that efficacy appears superior and stinging or burning has not been commonly reported.

Roflumilast in Atopic Dermatitis

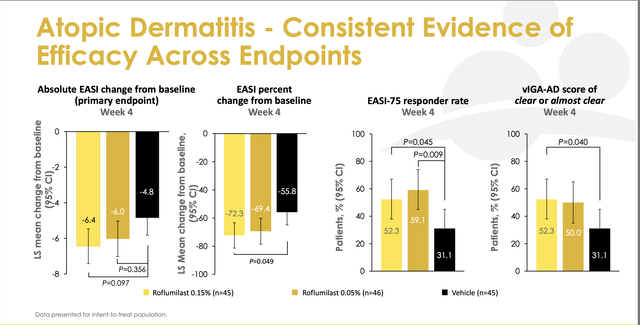

The phase 2 study was a double blind, vehicle-controlled proof-of-concept study, in which 136 patients ages 12 years and above with mild to moderate AD received either vehicle (placebo), .015% roflumilast cream or .05% roflumilast cream. The primary endpoint was the mean reduction in the Eczema Area and Severity Index [EASI] at week 4.

Phase 2 results (Arcutis)

Neither dose reached statistical significance versus vehicle, although the 0.15% cream showed a trend towards significance. While trends towards significance are a good signal, the failure to meet the endpoint is a key risk for investors. One reason for optimism is that there is data showing roflumilast is significantly more potent than Eucrisa which is also a PDE4 inhibitor.

It is also notable that there was a high response for vehicle cream in phase 2. Usually when there is a high placebo (or vehicle) response relative to an active arm, it brings into question whether the drug has meaningful efficacy. However, the vehicle has moisturizing properties which could have a therapeutic effect. Moisturizing skin is a first line treatment dermatologists recommend for atopic dermatitis which helps with skin barrier defects. Thus, the vehicle is a non-inert placebo (i.e., not completely inactive.) Showing an improvement versus vehicle is required to meet the primary endpoint and the high vehicle response is likely to be consistent in Phase 3. There is risk that roflumilast will not show statistically significant improvements vs. vehicle.

Boosting the study size is the approach Arcutis took when designing their phase 3 trials. The phase 2 had only approximately 45 patients in each arm versus the Phase 3 which will enroll 650 patients so there will be roughly 10X more patients in the treatment arm. Proper statistical powering increases the chances of meeting the endpoint, however, failure to meet the primary endpoint required for approval in atopic dermatitis remains a key risk for investors.

Pipeline

Arcutis recently announced that it had acquired Ducentis’s lead asset, DS-234 for atopic dermatitis. In addition, ARQ-252 and ARQ-255 are being developed which are different formulations (cream and a suspension) of a selective topical JAK1 inhibitor for the treatment of chronic hand eczema, vitiligo and alopecia areata. These assets are differentiated due to specificity for JAK1.

Early trial data in vitiligo using ARQ-255 showed poor efficacy which was believed to be a result of limitations in the formulation which may not have penetrated deeply enough. Reformulation is underway but these assets are in a preclinical stage. Reformulation may improve efficacy but oral therapies (such as Lilly’s baricitinib which was approved for alopecia areata) may be more effective in these indications. Little value should be assigned to ARQ-252 and ARQ-255 until the efficacy is proven.

Finances

Arcutis went public in January of 2020 at $17 per share. In February of 2021, Arcutis raised $192 million at $35 per share. An additional public offering in August of 2022 raised $150 million at $20 per share which likely reflects the current depressed biotech market. The company obtained a $225 million loan in December of 2021 and drew $125 million on the loan. At Q2, the company had $283 million and given the recent raise and loan, Arcutis currently has approximately $570 m and is well positioned to execute on a launch.

Analyst Commentary

Goldman Sachs has put into their model that Zoryve cream will generate $1.1bn in sales in plaque psoriasis by 2036. This is a very optimistic figure but this reflects just one indication. If roflumilast is approved in seborrheic dermatitis, scalp psoriasis and atopic dermatitis, the figure may be considerably higher. GS has a 12 month price target of $50 per share.

Institutional Ownership

Orbimed and Frazier Life Sciences, Bain Capital Life Sciences have invested.

Management

Arcutis has successfully executed in the clinic and has a history of achieving milestones (study enrollment, regulatory submissions) in accordance with stated timelines. Management has extensive experience in clinical development in the dermatology space with 5 dermatologists (including a pediatric dermatologist) on staff. These clinicians have insights into the competitive landscape and real world practice experience. The Chief Medical Officer has experience in an academic setting in dermatology and has experience overseeing drug development in dermatology. The Chief Commercial Officer has marketing experience in dermatology indications such as psoriasis.

Risks

The company has launched Zoryve (roflumilast cream) and priced it at the low end of branded topicals, $830. The strategy is to allow wide formulary inclusion without pre-authorization steps which should increase prescription volume. Whether this approach will result in significant sales remains unknown. Significant de-risking has occurred but failure to meet the endpoint in the atopic dermatitis clinical trial would limit peak sales as this is the largest indication.

Lastly, in all of the indications, physicians have generic alternatives that are extremely low cost and may choose to use these treatments first line which could limit sales of roflumilast.

Conclusions

Roflumilast may be the elusive “pipeline in a molecule” which becomes a blockbuster. By year end, data readouts should provide clarity as to whether scalp psoriasis and atopic dermatitis are additional indications. Assuming good data, the company is well positioned with $580 m in cash and a line of sight towards profitability.

Note- If you found this article helpful, please click the follow button so you are alerted to new articles.

Be the first to comment