gilaxia

Thesis Summary

Occidental Petroleum (NYSE:OXY) has rallied strongly in the last year, but oil prices have cooled off in recent months. Though numerous factors could send oil further into decline, the current pullback offers a good entry point for a long-term investment in a recession-resistant stock underpinned by a commodity super cycle.

Recent Performance

OXY has performed very well, fundamentally and in terms of stock appreciation, over the last year. The stock is up 100% YTD, and the latest earnings results were quite promising:

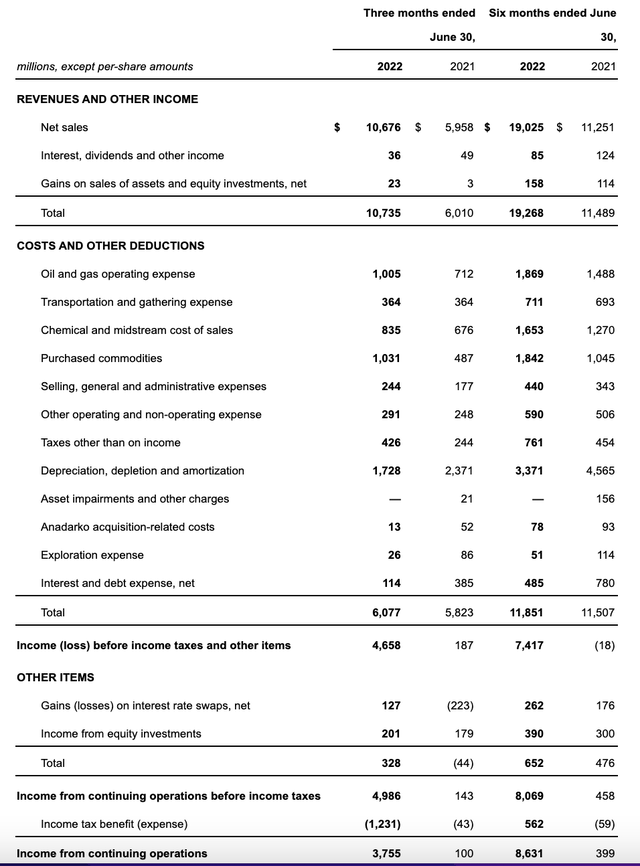

As we can see from the most recent revenue statement, net sales were up around 80% YoY. Meanwhile, overall expenses were only up about 5%. This is because the company benefited from a reduction in depreciation and interest expenses.

Overall, the company produced $3.75 billion from continuing operations, translating into $3.16 in adjusted EPS and $4.2 billion in FCF.

On top of that, the company has retired $4.8 billion in debt, initiated a $1.1 billion share repurchase plan, and benefitted from Oxychem, which manufactures and produces chemicals like PVC.

Occidental Petroleum has had a great quarter compared to some of its peers in the energy industry. It’s easy to see why someone like Warren Buffett would pick this stock out of the sector. OXY stands out on the cash flow front and has one of the highest ROEs and profitability out of any energy company.

Energy Outlook

Of course, the question of investing in OXY now, after a 100% runup in the stock price, depends significantly on the outlook for the energy sector.

As we can see in the chart above, energy companies benefited from very high oil prices in Q2. The oil price averaged around $100/barrel but has since come down to near $85. This is still a reasonable level for energy companies. Although Q3 won’t be as impressive, OXY will still generate excess cash flow that will help it continue to reduce debt and increase buybacks.

However, if prices keep heading south, so will OXY’s stock price. At this point, there are a variety of different factors that could determine this.

First, the influence of OPEC, which seems determined to defend higher oil prices by maintaining a lid on supply. But while OPEC can control supply, the demand part of the equation is out of their control, and with a global recession likely already taking place, energy demand could see a steep drop.

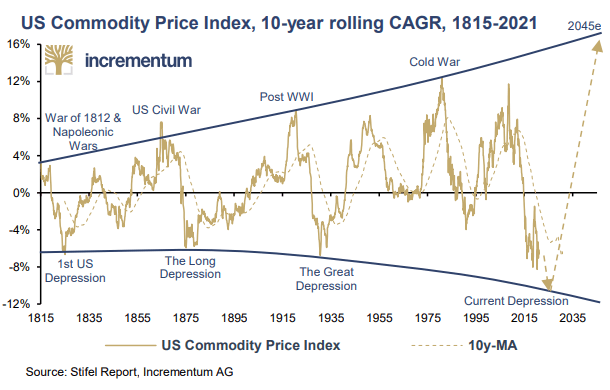

Also, commodity prices have taken a hit following tighter monetary policy, but I still subscribe to the idea that we are entering a secular bull market for commodities.

Commodity Cycle (Stifel report)

As shown in this chart from the Stifel report, the world could soon enter a renewed period of commodity price increases. Over the better part of the last 20 years, we have seen structurally falling asset prices, as well as structurally lower interest rates. But this has led to generalized underinvestment in natural resource extraction, like energy,

OXY: An Ideal Recession Play

Although it may seem counterintuitive, energy investments can be good hedges against recession. Of course, lower economic activity reduces demand for anything, but energy is among the most vital products. Ultimately, we could do without fancy gadgets or expensive vacations, but machines still need to run, and we still need to warm our homes.

In this regard, energy is a good recession investment. However, within this sector, the best energy companies will be those that can produce strong cash flows and tolerate the burden of debt, and this is where OXY stands out:

|

OXY |

CVX |

XOM |

SU |

|

|

EBITDA Margin |

55,98% |

22,94% |

19,64% |

38,07% |

|

Return on Equity |

47,84% |

20,24% |

23,05% |

24,68% |

|

Levered FCF Margin |

32,89% |

11,72% |

10,51% |

18,74% |

|

Debt/Free Cash Flow |

4.18 |

4.28 |

4.91 |

4.90 |

|

Long Term Debt/Total Capital |

44,09% |

12,72% |

17,08% |

27,10% |

Source: Seeking Alpha

Above, we can compare OXY with some of its main competitors on various metrics. As we can see, OXY is way ahead in terms of margins and ROE. This is an FCF machine, and it’s easy to see why Warren Buffett likes the stock.

That said, the company has a substantial amount of long-term debt, about twice or even three times more than its peers. But if we look at debt compared to free cash flow, OXY once again comes out on top. Furthermore, the company has been clear about its commitment to debt reduction.

All in all, OXY stands out as one of the most profitable companies in the sector, and this is something that will come in very handy when the economy shrinks and margins get tighter.

Risks

It’s important to point out that there are some risks to the bull thesis here. For starters, there are numerous catalysts that could lead to lower prices. These include but are not limited to Iranian supply entering the market, an end to the Russia-Ukraine conflict and more strategic reserves being released.

On top of that, continued Fed tightening could threaten to trigger deflation once again. Nonetheless, I still believe Oil Producers are well positioned to do well in the long run.

Takeaway

Oil has had a tremendous run in 2022, and the current pullback gives us a good opportunity to enter the market. Within the sector, OXY offers a very compelling ROE, and with Buffett’s seal of approval, I believe more investors will begin to pile in when oil takes off again.

Be the first to comment