Kevork Djansezian/Getty Images News

Berkshire Hathaway (BRK.A) (BRK.B) continues to buy shares of Occidental Petroleum (NYSE:OXY) leading to speculation Buffett wants to acquire all of the oil giant. The 90-year-old investment guru is oddly loading up on Oxy as oil prices have soared far above $100 suggesting investors shouldn’t follow Berkshire into the stock. My investment thesis is more Neutral on Oxy following the recent dip back into the mid-$50s considering the large cash flows.

Buffett Buys More

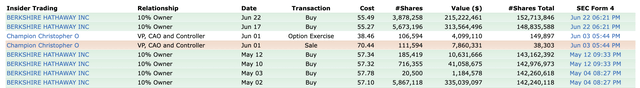

Over the last couple of weeks, Berkshire Hathaway added another 9.6 million shares of Oxy raising the total holdings to 16.3% of the outstanding shares. The investment firm controlled by Buffett now owns 152.7 million shares of the budding energy giant with options to purchase another 83.9 million shares bringing the total portion size to 25%.

Over the last month or so, Berkshire has regularly purchased shares at prices in the mid-$50s. The company didn’t chase Oxy when prices soared above $70 during the late May rally.

The move led Truist to speculate Berkshire plans to make a bid for the whole company. Analyst Neal Dingmann raised his price target on Oxy to $93 on speculation of a bid and due to valuation as the energy company reduces debt this year due to strong cash flows.

As oil prices remain high, Truist forecasts Oxy to average quarterly FCF topping $3 billion due to maintenance type capex spending. The real question is where the stock ends up when oil prices collapse.

Don’t Follow Buffett

The stock hasn’t reached the range where Oxy traded back in the 2015 to 2019 period. The energy company could easily trade higher with current oil prices, but Buffett wasn’t willing to chase the stock either likely knowing oil prices are going to fall from the current elevated levels with WTI ending the week trading at $107.

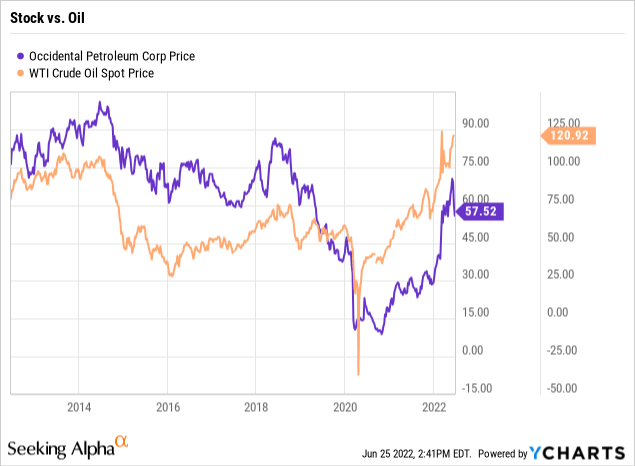

Over the last decade, Oxy has generally traded with the price of oil. The stock hasn’t completely caught up with the oil price move in the last year.

If Buffett were to make a bid for Oxy, an investor might see a nice bump from the current price. The issue is where the stock price ends without a bid from Berkshire.

Investors should value Oxy based on the cash flows from Q4 and possibly all of 2021. Oil and natural gas prices are likely to approximate those prices once Russia ends the war in Ukraine and some of the current disruptions in the market from covid supply cuts are resolved.

Back in Q4’21, Oxy generated $2.9 billion of FCFs with average realized energy prices as follows:

…average WTI and Brent marker prices were $77.19 per barrel and $79.76 per barrel, respectively. Average worldwide realized crude oil prices increased by approximately 10 percent from the prior quarter to $75.39 per barrel. Average worldwide realized natural gas liquids prices increased by approximately 7 percent from the prior quarter to $36.52 per barrel. Average domestic realized gas prices increased by approximately 39 percent from the prior quarter to $4.64 per Mcf.

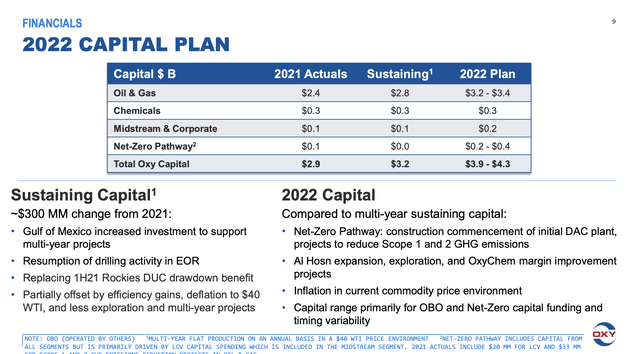

The oil giant spent $0.9 billion on capex during the quarter and expects to increase the level slightly during 2022. Oxy plans to spend $4.1 billion on capex this year, up from only $2.9 billion last year and the $3.2 billion needed to sustain current production levels.

Source: Oxy Q1’22 presentation

The average levels of spending only add up to $0.2 billion per quarter in additional spending. Oxy would generate ~$2.7 billion in quarterly FCF, if oil and nat. gas prices matched the Q4’21 levels.

The risk is that prices don’t hold the Q4’21 levels and actually return to prior levels with oil in the $40 to $60 level. From 2015 to late 2021, oil prices easily stayed below the $75/bbl realized by Oxy back during Q4’21.

At the current price, Oxy isn’t exactly wildly expensive with a market cap of $54 billion and an EV in the $88 billion range. The company will logically earn about $7 to $10 billion in FCF with more normalized energy prices.

Back at the previous highs near $70, the market cap jumps to $66 billion and exactly why Berkshire wasn’t buying at those levels. A buyout might require a higher premium with $70 only offering a 27% premium from current levels. With Berkshire already controlling up to 25% of Oxy via the warrants, the company would only have to acquire the other 75% of the business.

The issue is more whether Buffett wants to take ownership at much higher prices with oil likely heading down from here. Back in March, Berkshire paid a 29% premium to acquire Alleghany (Y) for a value of $11.6 billion. The deal value for the insurance company was at ~10x 2023 EPS targets while the business isn’t as cyclical as oil.

Buffett would have to pay an EV of over $100 billion to acquire Oxy here. Berkshire might bid, but the firm shouldn’t. Oxy isn’t wildly priced for the FCF prospects, even based on normalized oil prices. Once Berkshire has to pay a 30% premium for the stock, Oxy starts getting expensive for the risk of energy prices collapsing back to the range from 2015 to 2020.

Takeaway

The key investor takeaway is that Oxy definitely isn’t wildly priced here with the stock not returning to the pre-covid levels with oil higher now. The problem is actually paying higher prices for the energy giant and Buffett hasn’t shown any willingness to pay prices above the mid-$50s.

Investors should use the next rally to $70 to exit the stock with Buffett very unlikely to make a higher bid.

Be the first to comment