MixMedia/iStock via Getty Images

Investment thesis

My recommendation to investors is to go long Brilliant Earth Group, Inc. (NASDAQ:BRLT). The total addressable market (“TAM”) is extremely huge here, supported by younger consumers who are increasingly looking for genuine brands with strong online presence and active communities. And in order to meet this demand, jewelers need superior digital skills and an authentic omnichannel experience, something that BRLT has and excels at.

Business overview

BRLT is a digital-first jeweler and an industry pioneer in responsibly sourced fine jewelry. They offer a one-of-a-kind omnichannel shopping experience with custom designs, top-notch manufacturing, and full visibility into the supply chain.

The jewelry industry is both enormous and fiercely competitive

It’s not hard to estimate the size of the jewelry industry. According to a search on Google, it is projected to be worth more than $200 billion by 2021 and up to $500 billion by 2023. Given the wide range of companies involved, the jewelry industry is both enormous and fiercely competitive. About 65 percent of the jewelry market is made up of thousands of small, independently owned stores, as reported by BRLT S-1. In my opinion, many of these jewelers face difficulties satisfying customer demands for customization and online shopping because of their limited purchasing power and inventory-intensive business models. Even though their clientele is dwindling, mall jewelers are notoriously slow to update their locations. As such, I believe there are a lot of openings for Brilliant Earth in this space.

In my opinion, the bridal segment of the jewelry market is the most stable vertical (this is also where BRLT does most of its business anyway). Traditional wedding and engagement rings have been worn as symbols of the union for centuries. Statistics like those found in The Knot 2019 Study, which showed that 96 percent of American couples exchanged rings and 83 percent of engagement rings contained diamonds, lend credence to these beliefs. Furthermore, over two million marriages take place annually in the United States alone, a number that has remained stable over the past decade, according to official statistics compiled by the United States government.

I think it’s smart of BRLT to specialize in engagement rings because they have a high average order value and are a significant purchase for most people. Due to the personal nature of this purchase, many brides develop lasting relationships with their bridal jewelry retailers, coming back to them for gifts or for themselves.

More and more people are purchasing jewelry online

Eventually, the younger generations will make up the largest market share of the fine jewelry industry and the largest consumer base for bridal goods. Younger consumers today are setting themselves apart by favoring brands with a social mission, possessing a high level of digital literacy, and demanding the freedom to shop whenever and wherever they please. And we see this all around us: more and more people are purchasing jewelry online. As shopping habits move online, I anticipate consumers looking for genuine brands with robust online presence and active communities. This matters greatly because today’s youth are so heavily involved in online social networks.

Despite the popularity of digitally native brands among Millennials and Gen Z consumers, many still prefer to make major purchases in person, where they can examine the product up close and try it out for themselves. They want to be able to shop whenever and wherever they like, with no break in continuity between in-store and online purchases—in short, an omnichannel experience. To accomplish all of this, it is more important now than ever that jewelers need superior digital skills and an authentic omnichannel experience.

In addition, jewelry stores now need to accommodate both male and female customers who frequently shop for engagement and wedding rings together. I believe this is great, as the more the person proposed-to is a part of the process, the more emotionally invested they will become in the jewelry brand, and the more likely they will be to buy pieces for themselves or others on special occasions in the future.

BRLT was born and raised in the digital age

BRLT was born and raised in the digital age, and as such, they take a data-driven, technological approach to creating a memorable experience for their clients. For instance, according to the S-1, the “Virtual Try On” feature and product visualization technology on their bespoke e-commerce site allow customers to envision ring designs. This is important as the ability to offer dynamic product customization and an intelligent recommendation streamlines and individualizes the shopping experience, two things that today’s millennials value highly.

I believe when it comes to the importance of providing an omnichannel experience, BRLT has always been one step ahead of the competition. Founded on the principle that customers deserve individualized service, they have been hosting private appointments in their state-of-the-art showrooms since day one, where they can peruse carefully curated products based on their preferences and demographic information. Also, the customer can talk to a dedicated jewelry specialist at any time during the buying process. I think this helps the company have a high level of customer engagement and satisfaction.

These may not seem like big deals, but I think they set BRLT apart from the competition, especially mall stores. For instance, BRLT’s ability to gather more detailed information about their clientele means that they can better tailor their jewelry offerings thanks to their background in the digital sphere. It would be a huge win for them if they became the brand that people think of most often because they always meet their needs.

BRLT can operate with a minimal amount of physical assets

While all the above is fancy and good, the ability to translate all those into advantages in financial terms is the most important. Because of its strong working capital dynamics, capital-efficient showrooms, and extensive virtual inventory, BRLT can operate with a minimal amount of physical assets. BRLT’s attractive inventory turns each year are a direct result of their ability to offer over 100,000 diamonds while keeping inventory low, as opposed to low inventory turns that are more typical in other jewelers. And if we combine the BRLT strategy of having little stock on hand with a fast cash conversion cycle, we get a BRLT that can grow with a small initial investment.

And, unlike traditional jewelers, BRLT’s showroom strategy results in exceptionally strong unit economics because it does not waste resources on unnecessary stores, workers, or inventory. Because they operate on an appointment-only basis and cover large areas, they have less of a need for high-traffic locations than traditional stores. BRLT typically chooses specific products to display in their showrooms for visitors who have scheduled an appointment. When appointments are not available, their technologically savvy team of jewelry experts assists online customers. This maximizes the use of their employees’ time.

Given the complexity of their existing infrastructure and procedures, these strategies, in my opinion, distinguish them from competitors and make it difficult for incumbents to replicate them. Furthermore, consumers have a positive association with the brand names of legacy incumbents, making it difficult for BRLT to displace them. Importantly, because of these strategies, BRLT is able to gain a structural cost advantage over older and less capable competitors. This gives it a larger margin safety net in case the market goes down.

Valuation

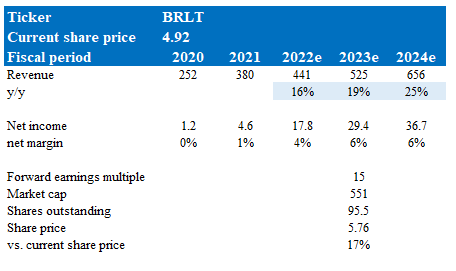

My model suggests that BRLT is undervalued today. My model values BRLT on a forward earnings basis, as the business is generating earnings that can be used to approximate future cash flow today. The model follows management’s FY22 guidance (both revenue and earnings). For earnings, I backed into the implied earnings figure using FY22 EBITDA guidance.

I expect BRLT growth to continue at a high pace since there are so many market opportunities for them to grab and grow. Thus far, the business has been executing well, and as such, I believe they should be able to continue doing so.

BRLT is trading at 15x forward earnings today, and I assumed it would trade at a similar range 1 year from now as I do not expect any major events that would change this. That said, BRLT used to trade at a much higher multiple, so that leaves room for a potential re-rating upward.

Based on these assumptions, I believe BRLT’s stock is worth $5.76 in FY23.

Own estimates

Risks

Cost inflation could have meaningful impact

The success of Brilliant Earth’s business plan hinges on the company’s ability to keep production and distribution prices low. In the event of severe cost inflation, BRLT might not be able to pass through all stages as the company’s pricing power may be constrained by intense market competition.

Asset-light model would also mean less permanent physical presence

There is a reason why luxury brands always have a large physical presence in popular and luxurious neighborhoods, even if traffic is low. It is critical to maintain continuous consumer mindshare, and the best way to do so is to place it prominently. The BRLT asset light model lacks this, but it makes up for it with a strong digital presence.

Conclusion

In conclusion, I think the current price of BRLT is undervalued. BRLT is a digital-first jeweler that specializes in responsibly sourced fine jewelry. The global jewelry market is expected to be worth more than $200 billion by 2021 and as much as $500 billion by 2023, and I believe BRLT will be able to continue capturing share in it.

Be the first to comment