DNY59/E+ via Getty Images

The market is crashing right now. Practically everything is down:

The S&P 500 (SPY)…

Bitcoin (BTC-USD)…

Utilities (XLU)…

REITs (VNQ)…

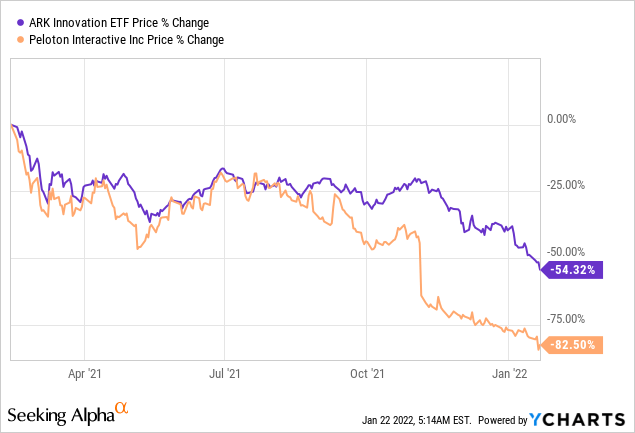

But worst of all… disruptive tech stocks (ARKK) such as those recommended and owned by Cathie Wood are down over 50% on average. Some of the most popular pandemic plays like Zoom (ZM), Peloton (PTON), and Robinhood (HOOD) are down over 80%!

REITs are not down this much, but they are down considerably as well. The market-cap-weighted REIT ETF (VNQ) that owns mainly mega-cap investment-grade rated REITs is down ~10%, so you can imagine that many of the smaller, lesser-known REITs must be down more than that.

What’s happening?

Put simply, the market hates uncertainty, and there is a lot of it right now.

The inflation rate recently hit a new 30-year high at 7%.

The Fed has guided for several interest rates in 2022.

Covid cases remain at levels that are far higher than the previous peak.

Russia is nearing an attack on Ukraine.

And I pass on many other risks.

That’s a lot for the market to digest. Meanwhile, a lot of stocks are priced at elevated valuations, and as a result, everything is now coming down as we have a “risk-off” moment.

How did we react to it?

If you have followed our research for a while, you already know how we deal with volatility. We celebrate it because that’s exactly what we need to make great long-term investments.

The more prices drop, the more we will buy because ultimately, we think that this is just another temporary setback for our selection of investments.

At the worst point of the pandemic, REITs were down 43% collectively, and yet, our portfolio is today sitting on large profits because we consistently bought the dips when the opportunities presented themselves.

Today is no different and therefore, we continue to accumulate more shares. Of course, we don’t have a crystal ball and we cannot predict how REITs will perform in the near term, but it is exceedingly likely our selection will generate attractive returns in the long run because of the 6 following reasons:

- Reason #1: They are discounted: We buy good real estate that’s professionally managed at 20%, 30%, or even larger discounts to fair value. Following the recent dip, these discounts are only becoming larger, providing margin of safety and future upside potential.

- Reason #2: They own inflation-protected assets: REITs are by nature great inflation hedges because they own real assets that are limited in supply, but growing in demand. Some REITs are of course better inflation hedges than others, but overall, they are much better hedges than your regular stock or bond.

- Reason #3: Their debt is inflated away: REITs are able to finance a significant portion of their investments with fixed-rate long-dated mortgages. If you finance a property with fixed-rate debt, then the 7% inflation is a gift as your debt is inflated away even as your property gains in value.

- Reason #4: Rising interest rates signal faster rent growth: Contrary to what you often hear online, REITs have historically been strong performers during times of rising interest rates. That’s because rising rates are typically the result of economic growth and inflation, both of which are very beneficial for REITs, and since REITs use fixed-rate long-dated debt, the negative impact of rate hikes is very limited. We don’t expect this time to be any different because REIT balance sheets are the strongest they have ever been, fundamentals are strong, rates are extremely low (even post-hikes), and valuations are reasonable.

- Reason #5: The pandemic won’t last forever: A lot of REITs are still discounted because of the pandemic. But eventually, the pandemic will come to an end, and these REITs will rapidly recover as we get to the other side of this crisis.

- Reason #6: The crisis in Ukraine is unlikely to affect most of our REITs: The situation in Ukraine is very unfortunate and not to be taken lightly. It may have an impact on a number of US companies with global operations and/or ties to the energy sector. However, the impact should be limited for the REITs that we own.

At the risk of sounding like a perma-bull, I just think that there are a lot of opportunities in the REIT sector that are priced to deliver solid returns in the years to come, and for this reason, we will continue to accumulate more shares as we have in the past.

With that in mind, we recently made small additions to a number of our favorite holdings, and today, we highlight two of them specifically:

Alexandria Real Estate Equities (ARE)

We have long waited to invest in the life-science property blue-chip, Alexandria Real Estate, and today we are finally getting the chance.

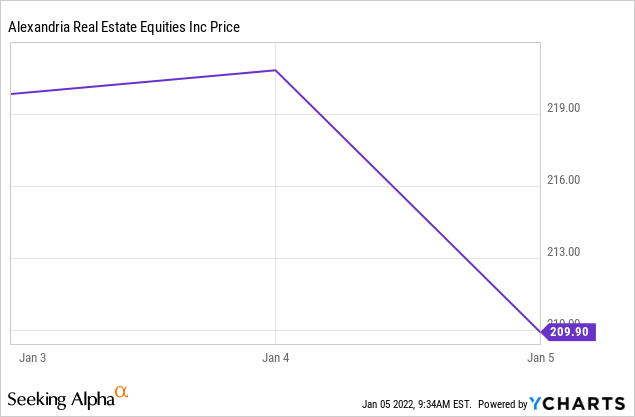

It recently announced an upsized equity offering and as is common in such cases, the share price dropped quite significantly:

YCHARTS

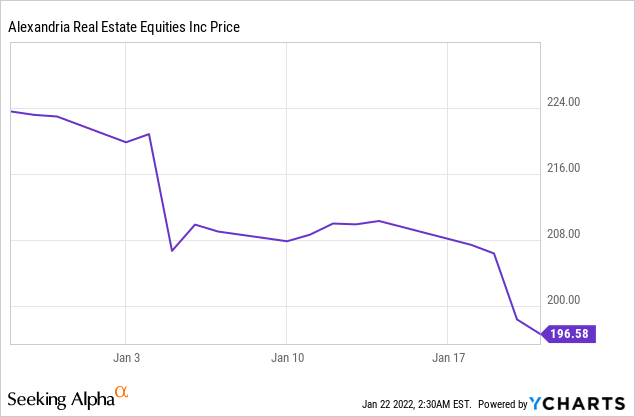

We thought that it was getting cheap at $209 per share, but then it dropped another $15 with the rest of the market:

In total, it is now down 12% from its 52-week highs and we think that this is an opportunity because the equity offering will go into funding new investments that are highly accretive to FFO per share.

So on one hand, it increases FFO per share, and on the other, it temporarily depresses the share price, providing an attractive entry point for a starter position.

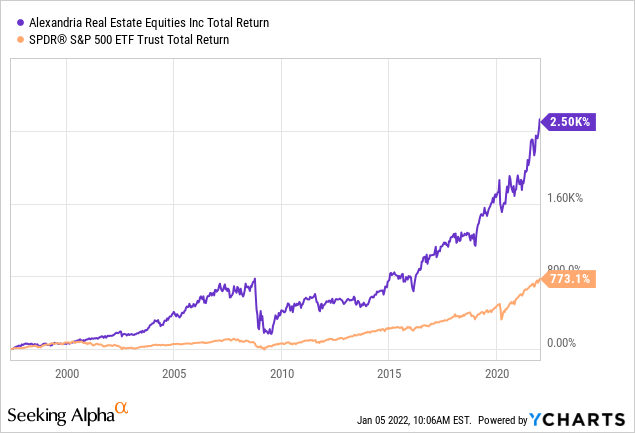

In case you are not familiar with ARE, it is the type of blue-chip REIT that always appears to be expensive. If you simply look at a chart of the share price, you will understand what I mean. But in reality, the steady rise in its share price has been fully supported by cash flow growth, and therefore, this perception is not warranted. It is actually even the opposite because the FFO per share of the company has risen faster than its share price and as a result, its FFO multiple is now below its historic average.

As the largest pure-play owner and developer of life science properties, ARE is today enjoying rapid growth in its rents due to the high demand for these assets, which was only accelerated by the pandemic. Lab space is critical for research projects and the spending for these has only been growing over the years.

Alexandria Real Estate

On top of rapidly growing rent, ARE has a massive pipeline of development projects, which it can execute at 6-7% yields, representing a meaningful spread over its cost of capital and the 4-5% cap rates of the life science sector:

Alexandria Real Estate

Finally, unlike most other REITs, ARE also serves as a VC investor in a number of emerging biotech companies and it has a proven track record of creating substantial shareholder value via these investments. Being the biggest landlord of life science properties in the nation often puts it in an attractive position to invest in the underlying businesses of its tenants.

Today, the company is priced at ~23x FFO, which may seem pricey on the surface, but it actually isn’t when you consider the company’s track record, asset quality, and future growth prospects:

YCHARTS

All in all, we think that ARE is well-positioned to keep delivering double-digit total returns in the years ahead, and that’s very attractive for a conservative BBB+ rated blue-chip REIT operating in a defensive property sector.

Yes, the current dividend yield is low at just around 2.4%, but already in a few years, the yield could be closer to 3%, and most importantly, this investment adds growth and inflation protection to our Retirement Portfolio.

STORE Capital (STOR)

The blue-chip net lease REIT, STORE Capital, has been our single largest position since we first bought it at ~$15 per share in March 2020.

We saw it rise all the way to $37 per share but didn’t sell because we think that it is worth closer to $45. Today, the share price is down 16% off its recent highs, and we are buying more of it.

We think that STORE is down so much because the company’s executive chairman, Chris Volk, was recently ‘terminated’. When the news came out, many were quick to assume the worst:

“Could only be one of 2 things: alcohol/drug problem or a woman?” commented one Seeking Alpha user

“Could it be the career killer of the year, a sexual harassment situation?” commented another Seeking Alpha user

But this is all unnecessary speculation. Volk has been transitioning away from his duties at STOR for a while now. He first stepped down as the CEO and now, he is also stepping down as the Chairman.

Yes, the filing says that his employment agreement was “terminated”, but that does not mean anything because all employment agreements are terminated when people leave the company. The formal SEC filing also says that there are “no causes” for the termination and he is getting his usual benefits, which wouldn’t be the case if there was a scandal of some sort.

The media was quick to write sensational headlines based on the word “terminated” without knowing any of the contexts. But having known Volk for years allowed us to keep a cool head and avoid panic selling like many others appear to have done.

We have always held Chris in the highest regard and as he is stepping down, he deserves all the praise for what he has accomplished at STORE. Perhaps, STORE’s PR department could do a better job at explaining the context, but for now, the thesis remains intact, and if the share price drops further, we will continue to grow our position.

As we explain in a recent update, STORE is doing better than ever with historically large spreads on new acquisitions, which is expected to fuel rapid growth in 2022:

“STORE expects to nudge up its acquisition volume slightly further in 2022, guiding for a range of $1.1 billion to $1.3 billion. On the back of this strong acquisition volume, management expects to achieve AFFO/share growth of 9.3% this year. Moreover, the REIT recently issued 10-year bonds at the very low interest rate of 2.7%. This was after issuing bonds in June at a 2.8% interest rate. The spread between STOR’s cost of capital and its acquisition cap rates remains extremely wide.”

We think that the company has at least ~30% upside and while you wait, you earn a 5% dividend yield that’s rising rapidly. Just recently, it was hiked by 7%, which clearly indicates the management’s confidence in the company’s growth in 2022.

Bottom Line

You may not like to see red color in your brokerage account, but this is exactly what we need to boost future performance.

Taking my REIT portfolio as an example, it has compounded returns at ~20% per year, but if the market wasn’t volatile, and I didn’t buy the dips, the returns would have been quite a bit lower than that.

The market is the most inefficient when it is volatile, and that’s precisely when active management is the most rewarding.

Be the first to comment