Occidental Petroleum (NYSE: OXY) has a market capitalization of less than $30 billion as Covid-19 fears have significantly punished the company. This has pushed the company’s yield towards 10%, a yield it briefly hit on February 27. As the market continues to worry, I wouldn’t be surprised to see it hit this yield again. However, as we’ll see throughout this article, a time of market worry can be an incredible opportunity to invest in a quality company.

Occidental Petroleum – Yahoo Finance

Occidental Petroleum 4Q 2019 Results

Occidental Petroleum’s recent 4Q 2019 results highlight a company progressive well on its merger plans. However, the market, spooked by Covid-19, ignored results while punishing share prices significantly.

Occidental Petroleum 4Q 2019 Highlights – Occidental Petroleum Investor Presentation

Occidental Petroleum closed $1.5 billion in asset divestitures in the quarter, a significant amount equivalent to ~5% of the company’s market capitalization. At the same time, the company continued to generate significant production, with 1.4 million barrels of production (exceeding the guidance midpoint by ~5%). From cash flow and asset divestitures, the company repaid $2 billion of debt.

For the full year, the company performed equally well. It repaid $7 billion of debt, announced $10.2 billion of divestitures, and had $1.2 billion in synergies. These are all significant numbers for a company with a market capitalization of $30 billion, and they highlight the strong strength of the company’s business. For reference, the company has more production than ConocoPhillips (NYSE: COP).

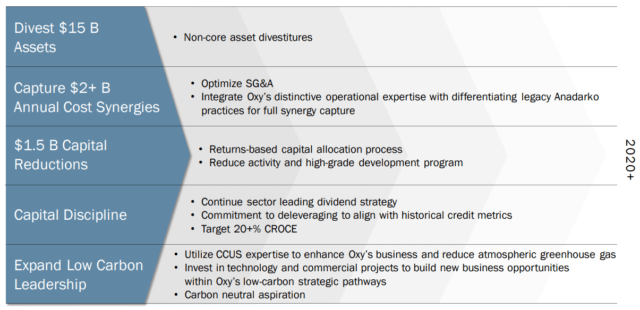

Occidental Petroleum Overall Goals – Occidental Petroleum Investor Presentation

The above slide shows the company’s goals and progress towards them. As we can see, the company has focused on a few significant things since the acquisition of Anadarko Petroleum. It’s worth nothing it’s hard not to argue that shareholders today would be better off if the company chose not to acquire Anadarko Petroleum given everything that’s happened since. However, what’s been done is done.

The company set a number of goals for this acquisition, and it continues to perform well towards all of them. For goals, such as cost synergies, the company has achieved 75% of its target. The company continues to perform well towards divestiture, capital reduction, margins, and other goals. All of these are incredibly important for the company to maintain its financial strength.

Occidental Petroleum Guidance

On top of an impressive 2019 from an execution standpoint, the company has provided some 2020 guidance.

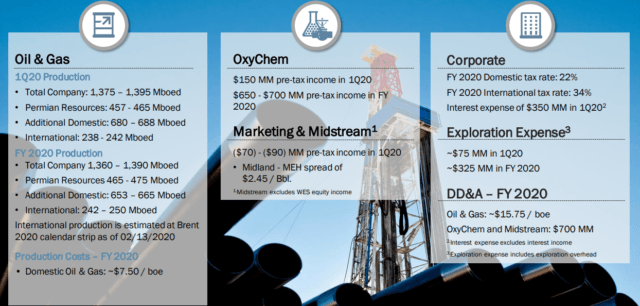

Occidental Petroleum Guidance – Occidental Petroleum Investor Presentation

For reference, it’s important to note that Occidental Petroleum’s approximate oil price breakeven is ~$40 / barrel. That is enough to cover dividends and maintenance capital. The company is forecasting FY 2020 and 1Q 2020 production at ~1.38 million barrels / day. That’s substantial. It’s worth noting that the vast majority of this production (>1 million barrels / day is domestic), however, a respectable portion is international.

It’s worth noting that the company’s domestic oil and gas production remains cheap – it’s really exploration and the setup costs that are expensive.

The company’s OxyChem, marketing, and midstream positions are all performing well too . The company expects FY OxyChem pretax income of ~$670 million with a 22% domestic tax rate. That’s ~$530 in post-tax profit. Nothing spectacular, but for a business fairly isolated from oil prices, it’s still fairly exciting to be. It’s also worth noting that the company’s Wes Midstream (NYSE: WES) stake pays out ~$600 million in annual dividends.

From a corporate point of view, the company has ~$1.4 billion in annual interest expenses (assuming no debt payback). That’s significant but it’s not unmanageable. Combined with $325 in exploration and the company is focused on maintaining its financial strength. As we can see here, the company’s overhead isn’t overwhelming and its debt comes out to ~$3 / barrel in interest.

Occidental Petroleum Intelligent Hedges

Talking about financials, I do want to take the time to discuss the company’s recent and intelligent hedges. The hedges were originally critiqued due to their limits on the company’s upside at ~$74 / barrel. In hindsight, they were a smart move for the company to protect its financial position.

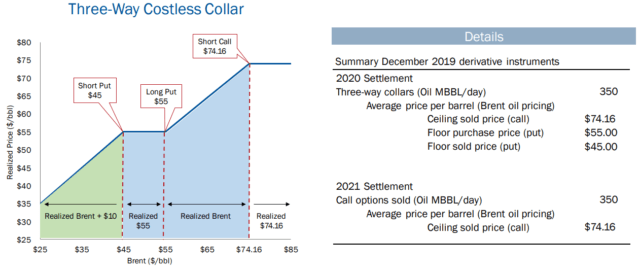

Occidental Petroleum Hedging – Occidental Petroleum Investor Presentation

The above image provides an overview of the company’s three-way costless collar, that is, a position that cost the company net zero. At current prices, the company is earning ~$5 / barrel above current prices (its realizing $55 / barrel). As prices drop that number will remain steady. If they drop below $45 / barrel the company will earn Brent + $10.

With prices above $55 / barrel the company will earn Brent up to a limit of $74.16 / barrel. In 2021, the company is simply limiting its upside. However, realistically, even if the company earns $74.1 Brent across both years it’s doing quite well. Again, as we saw above, the company’s breakeven is $40 Brent. Additionally, the company has only hedged ~25% of its production, so it’s not fully tied to market movements.

Occidental Petroleum Wes Midstream Update

Another exciting aspect of the company’s portfolio is its Wes Midstream stake. At its peak, in early 2015, this stake was worth ~$15 billion or ~ half of Occidental Petroleum’s current market capitalization. Since then, it’s dropped to being worth ~$3 billion. However, with that said, it’s still providing the company with near $600 million in annual cash flow.

Occidental Petroleum WES – Occidental Petroleum Investor Presentation

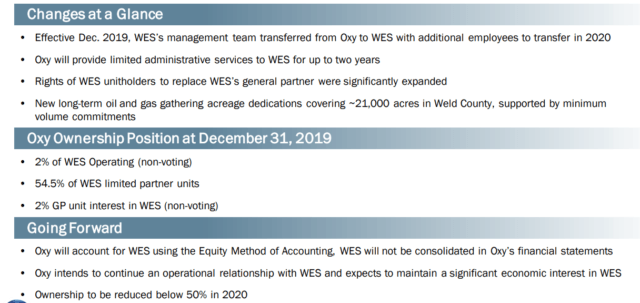

Occidental Petroleum was originally interested in spinning off its stake in Wes Midstream to raise capital. Not a bad idea when the company’s stake in Wes Midstream was worth $8 billion a year ago instead of $3 billion today. Since then, as it’s become apparent the stake won’t be sold, the company has sought to distinguish Wes Midstream as an independent company.

The company has transferred Wes’ management team to the company, while providing the company with additional acreage. This has helped to support the company’s asset portfolio while maintaining independence in the management. The company continues to hold a significant position, utilizing the impressive dividend cash flow, however, it seeks to reduce ownership to <50% in 2020.

Not only will this enable the company to opportunistically sell small %s of its stake, but it’ll also allow Wes Midstream to trade independently of Occidental Petroleum’s interests for the company.

Occidental Petroleum Risk

Occidental Petroleum, despite its strength, has 2 major risks worth paying attention to.

The company’s first major risk is the chance of systematic change in oil demand. Climate change fears are significant, and long-term countries are moving towards lower pollution forms of energy. For example, solar and wind are rapidly going down in cost and work continues to be done on cheaper nuclear reactors. All three of these things, if prices go down, could hurt oil and natural gas demand.

The second risk worth paying attention to is the chance of unexpected negative impacts on markets. These are impacts such as Covid-19, or a change in the U.S. president leading to new energy policies. These changes have the potential to significantly decrease oil demand, whether for the short term or the long term, and that has the potential to negatively impact prices.

Both of these things can hurt Occidental Petroleum earnings.

Conclusion

Occidental Petroleum has been punished heavily since the start of Covid-19, as the company’s shares have recently touched on a double-digit yield. At this yield, the company’s stock is significantly undervalued, and the company has the potential to generate shareholders significant returns. Even if the company has no capital returns, and cuts the dividend by 25%, near 8% returns are still respectable.

Going forward, Occidental Petroleum’s dividend is maintainable in a $40/barrel scenario. That’s especially feasible in the near term, as the company has used hedging to support its portfolio. That’s ~$10/barrel below current prices, a fairly significant decline. That also includes supporting production. More so, the company will continue to pay down debt with billions in extra cash flow (this ~$10/barrel), which will reward shareholders.

The Energy Forum can help you build and generate high-yield income from a portfolio of quality energy companies. Worldwide energy demand is growing quickly, and you can be a part of this exciting trend.

The Energy Forum provides:

- Managed model portfolio to generate you high-yield returns.

- Deep-dive research reports about quality investment opportunities.

- Macroeconomic overviews of the oil market.

- Technical buy and sell alerts.

Disclosure: I am/we are long OXY, WES. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment