Carlos Villalon/Getty Images News

Occidental Petroleum (NYSE:OXY) is slowly being acquired by Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) as the billionaire owner repurchased another 12 million shares this week, at just under $60 per share, bringing his total stake to just under 19%. That excludes the company’s warrants to repurchase just under 84 million shares to bring that stake to 28%.

It also excludes the company’s capital stack and the $10 billion in preferred equity that Berkshire Hathaway has, paying $800 million in annual interest.

The Mindset Shift

This is Berkshire Hathaway’s third foray into Occidental Petroleum in just as many years. The company was involved in the unpopular acquisition of Anadarko Petroleum, followed by the stock the company received as Occidental Petroleum struggled to pay the special dividend on common equity. The company sold all that (unfortunately) very cheap stock.

In fact, the company seemed very uninterested when the stock spent substantial time at <$20 / share, unfortunate now that it’s buying what it can below $60 / share. Our view is that the Russia-Ukraine war shifted Berkshire Hathaway’s business. The company realized that oil and natural gas were still essential for the long run and that U.S. infrastructure would be at the core.

There might be short-term pain as supply chains shift but we expect by the end of the decade Russia natural gas exports especially will move towards 0 as U.S. exports to Europe will increase dramatically. More so, through owning the largest railroad, a major airplane parts company, and many other businesses, Berkshire has been hurt by higher oil prices.

With Occidental Petroleum, the company can balance out earnings volatility. We expect Berkshire Hathaway at this point will acquire the entire company.

Fair Value and an Acquisition

Now we get to fair value. We’ve discussed pricing in another article here, but it’s clear that Berkshire Hathaway things the company is a valuable investment at just under $60 / share given its consistent purchases. At current rates it’s been purchasing just over 1% of the company a week a rate that we expect to continue as possible.

Fortunately for Berkshire Hathaway, the markets are expected to be volatile. Rather than paying a 20-30% premium to acquire the company, the company can keep acquiring portions in the volatile oil markets, and make an acquisition offer when it has a much larger stake. For perspective, the company repurchased the remaining portion of BNSF when it owned 22.6%.

We expect, the company will keep buying open market stock at <$60 / share and make an acquisition offer topping out at roughly $75 / share.

Occidental Petroleum Financial Potential

Occidental Petroleum has strong earnings and the potential to generate earnings.

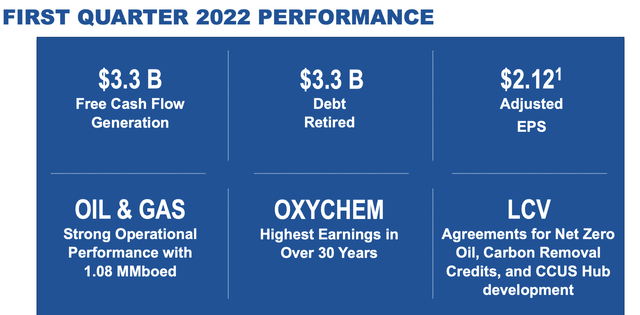

Occidental Petroleum is producing at roughly 400 million barrels / year. The company had $3.3 billion FCF in 1Q 2022 and put that all towards debt retirement. The company currently has roughly $25 billion in long-term debt with its market capitalization of just under $60 billion and is earning a FCF yield of more than 20% annualized.

The company has indicated that it wants to pay down another $5 billion in debt which will save several hundred $ million in interest and improve its overall credit rating. The company is also spending $800 million on preferred equity which would effectively disappear if Berkshire Hathaway were to acquire Occidental Petroleum.

Occidental Petroleum’s continued reliable cash flow represents the value of the company.

Our View

We see Occidental Petroleum as a unique investment that we recommend, however, it has a few unique facets.

The first is that Berkshire Hathaway has completely exited oil investments and changed its mind numerous times, and in fact, has done the same with Occidental Petroleum common stock at much lower prices. There’s a chance that Berkshire Hathaway sours on Occidental Petroleum and dumps the stock just as fast as it acquired it.

The second is that there’s a good chance, on the flip side, that Occidental Petroleum has an acquisition offer coming, in our view, at roughly $70-80 / share sometime within 2022. That acquisition offer could represent a quick way to turn your shares into cash given Berkshire Hathaway’s known opposition to issuing stock.

The last is that regardless of what happens with Berkshire Hathaway, you have a company earning a 20% FCF yield rapidly paying down its debt, saving on interest expenditures substantially, and setting up the company, in our view, to start a massive program of shareholder returns. The company has financial issues that have long overshadowed its impressive asset portfolio.

With this combination, we recommend investors establish a 100% position in the stock. Should oil prices collapse or Berkshire Hathaway exit the investment, driving prices down from current levels, we would recommend investors go overweight on the stock, moving to a double-size position from what they’d normally have.

We expect that combination to drive substantial shareholder returns.

Options Investment

For those looking to invest another interesting opportunity is to invest in options.

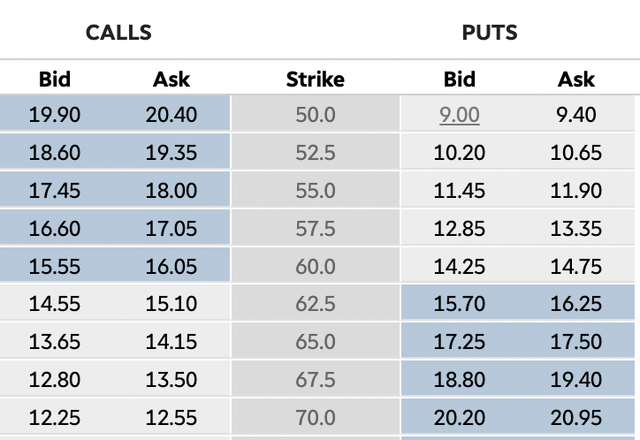

For those looking to invest, another interesting way to invest is through options. The above chart shows the Jan 2024 option chain for the company with an 18 month expiration. Investors can sell a cash-secured PUT at a midpoint of $9.2 / share, that expires in roughly 1.5 years. That represents a cash yield of 12% for setting your money aside.

There’s two scenarios here. The first is that the price drops below $50 at the option expiration. In that scenario you get to invest in the company at just over $40 / share, or a ~35% discount on current prices. The second scenario is the prices stay above and you get a 12% yield on your cash. Either way a strong opportunity.

If the company gets acquired sometime in that 18 month time period, chances are you automatically get your cash yield earlier.

Thesis Risk

The largest risk to our thesis is oil prices. The company is profitable at the current prices and even at prices at just over half of current prices. However, prices have gone negative in the past and can drop even further. There is a point where the company could become unprofitable enough not to justify its current valuation, which would hurt returns.

Conclusion

Occidental Petroleum has a unique and impressive portfolio of assets. That asset was overshadowed by the company’s financial woes after an expensive and unpopular acquisition of Anadarko Petroleum. However, now that prices have skyrocketed, the assets are starting to shine, and the company generated more than $3 billion in 1Q 2022 FCF all towards debt payback.

The company can hit its debt targets in less than 2 quarters and hit its $3 billion share repurchase target of 5% of stock before year-end. In many ways an acquisition offer by Berkshire Hathaway would truly just be icing on the cake for a company already generating strong returns, highlighting how it’s a valuable investment.

Be the first to comment