Justin Sullivan/Getty Images News

In this article, I will discuss what happened to Google (NASDAQ:GOOG) in the 2008/09 recession, what’s different about digital advertising then versus now, what Snap’s outlook means for Google, and why long-term investors should treat any price weakness from here as a buying opportunity.

What happened to Google in the 2008/09 recession?

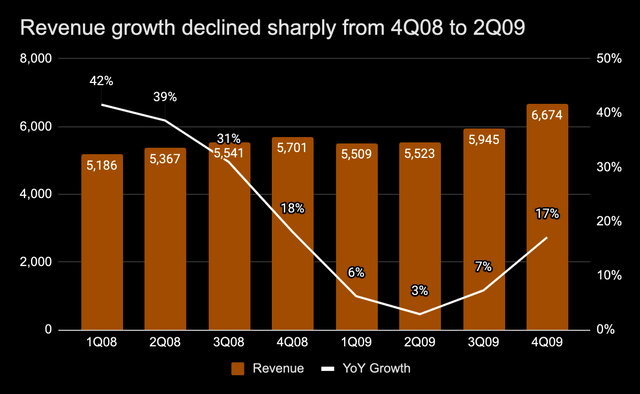

Google was on a tear before the Lehman Brothers introduced the Global Financial Crisis to the world economy. Having registered phenomenal growth in the first 3 quarters of 2008, revenue growth finally hit a wall in the fourth quarter and would decelerate to just 3% YoY in the second quarter of 2009 (see below). While this was a scary situation to many investors back then, Google’s search business was in a relatively robust position considering Yahoo Display revenue saw a 13% YoY decline in 2Q09.

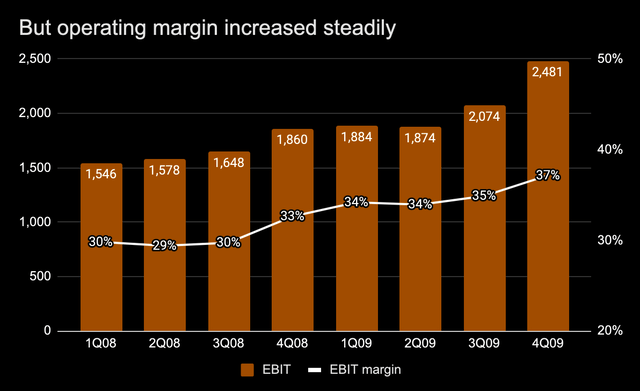

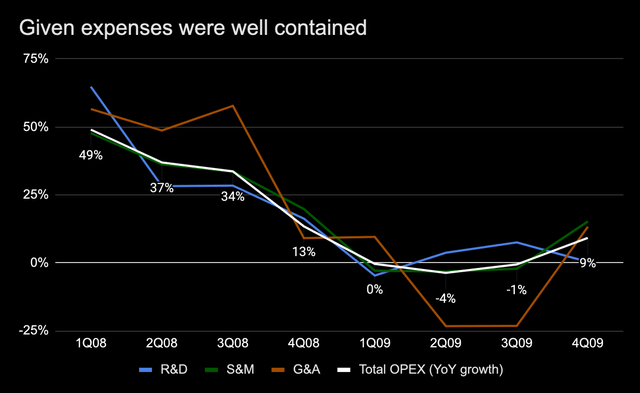

Unlike most businesses that suffered from margin compressions during the GFC, Google reacted quickly enough to keep expenses contained against declining revenue growth. In 1Q09 and 2Q09, top-line growth slowed to 6% and 3% YoY, but expenses were flat and down 4% against the prior year, respectively. This protected operating margin which saw expansion throughout 2009 as G&A costs were down 23% YoY in both Q2 and Q3.

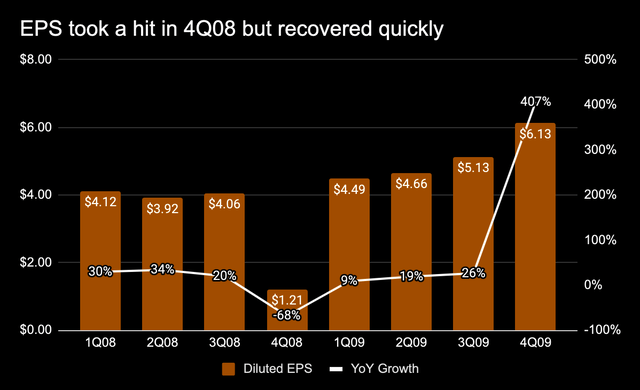

On the bottom line, Google’s EPS took a hit in 4Q08 but it wasn’t due to a decline in core business profitability. Instead, it was because of a $1.09 billion impairment charge from the company’s investments in AOL and Clearwire. Realizing these losses were “other than temporary”, Google wrote down its stake in AOL by $726 million and Clearwire by $355 million in the fourth quarter. Subsequently, diluted EPS recovered relatively quickly and was above 2008 levels in 2009.

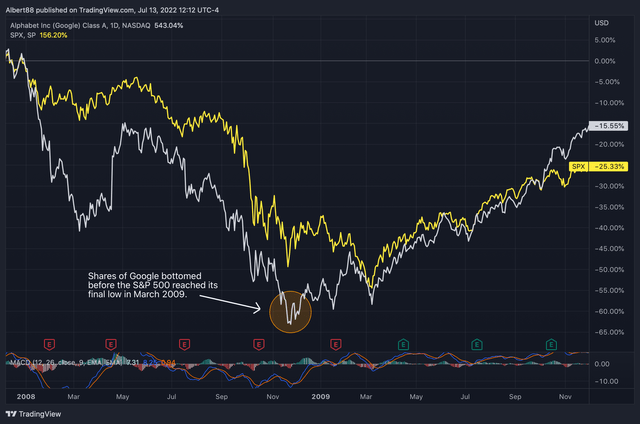

Google’s stock topped out at $358 in November 2007 at 37x NTM earnings. From peak to trough, the stock experienced a 68% multiple compression to reach an all-time low of 12x NTM P/E or $129 in November 2008. Interestingly, when the S&P 500 hit the final low in March 2009, Google traded 13% above its November 08 low.

What’s different this time?

A key difference today is that digital advertising is projected to reach 66% in 2022 vs. only 12% during the financial crisis, so the thinking goes that digital ads are more susceptible to budget cuts this time should big spenders like P&G pull back and VC-backed startups go belly up. However, it’s worth noting that the ~18% decline in ad spend during the GFC primarily came from segments that were already facing structural declines such as print and radio, while digital remained strong in the following years.

In a downturn, advertisers must also work harder to justify every marketing dollar spent, making ROAS (return on ad spend) a top priority. This means bottom-funnel digital ads driven by commercial intent such as Google Search and Amazon Advertising (AMZN) could be treated as relative safe havens from a budget perspective. In addition, online activities could actually increase in a recession as consumers cut travel plans and dine out less (much like during COVID), providing upside for time spent on services like YouTube and some cushion for digital ad budgets in general.

The way brands engage with customers has dramatically changed between now and then, but ROAS has stayed relevant all the way. Given the precise targeting capability and measurement at scale, it’s my view that digital ads will continue to attract incremental budgets to ultimately reach more than 70% of total media ad spend or $750 billion by 2024. And it’s unlikely that Google will miss the party considering search will account for nearly half of total digital ad spend in 2022.

What about Snap’s guide down?

In late May, Snap (SNAP) dramatically cut its revenue guidance for 2Q22 from +20%-25% YoY to below +20% YoY. The sudden change in narrative vs. the previous guidance provided just one month ago created a knee-jerk reaction in the digital advertising space, sending shares of Alphabet down as much as 8% during intraday trading on 5/23. However, a positive for Alphabet investors here is that second-quarter earnings seem somewhat de-risked, as markets will unlikely find it surprising if Alphabet is to make similar comments on Q2 earnings.

Also, let’s not forget that Snap’s advertising business is in a very different bucket vs. Google. To many advertisers, Snap belongs to the “experimental” category whereas Google’s search advertising would be considered “essential”, much like Amazon advertising where budgets belong to the lower part of the marketing funnel that’s more conversion-driven. If brands are to scale back their marketing efforts in a slowing economy, they will least likely cut search budgets as every dollar spent is tied to commercial intent.

While YouTube shares some common characteristics with Snap given YouTube Shorts compete directly with Snap’s Spotlight as well as Instagram Reels and Tik Tok, YouTube is in a relatively better position as the second most visited website in the world with 2.6 billion monthly active users. In addition, YouTube functions as an important search destination for users looking for things such as product reviews and holiday destinations, allowing it to capture search dollars. Although short-form videos are currently the most popular formats amongst content creators, YouTube’s long-form videos remain well positioned to benefit from the secular shift towards CTV/AVOD/SVOD.

As a result, while Snap’s outlook may have some implications for the broader advertising space, Google’s assets will likely be more resilient than the social media app in a downturn. Shortly after Snap’s guide down at the end of May, Trade Desk (TTD) reiterated its Q2 guidance, indicating Snap’s issue may be more company-specific (aggressive forecast, competition from Tik Tok, etc.) than broad-based.

Final thoughts

In November 2021, shares of Alphabet peaked at ~$3,000 with a NTM P/E of 26x. To date, valuation has de-rated 28% to reach 18.8x NTM earnings. Obviously, any further downside will largely depend on the severity of the current cycle, but today’s prices certainly reflect some of this already. If the economy does enter a recession, I think Alphabet will most likely revisit their 2008 playbook and keep costs under control to protect margins. Already, the company is slowing down hiring in 2H22.

In short, Alphabet is a high-quality business that will remain durable in a recession. Should shares again react negatively to macro headlines such as war and CPI, I believe any price weakness should be treated as a buying opportunity.

Be the first to comment