Petmal

Thesis

Plug Power Inc. (NASDAQ:PLUG) revised its revenue forecasts recently for FY22 and lowered its hydrogen production for 2022, which freaked some investors out.

However, a closer inspection of PLUG’s price action suggests the market wasn’t perturbed, as it had already sent PLUG spiraling down from its August highs, digesting the momentum surge astutely after the passage of the Inflation Reduction Act (IRA).

We cautioned investors in our previous two articles (here and here) not to chase the IRA surge momentum, as the market drew overly optimistic buyers into a well-designed bull trap. Accordingly, PLUG is down more than 40% since our early August caution.

Our analysis suggests that PLUG is consolidating after the market digested its recent post-IRA gains, nearing the lows seen in July 2022. We view the consolidation constructively, indicating that PLUG remains well-supported by long-term buyers coming in to defend at these levels.

Hence, we postulate that the opportunity for patient buyers to strike has come again.

Revise from Hold to Speculative Buy with a medium-term price target (PT) of $23 (implying a potential upside of 47%).

The “Easy” Money in PLUG Has Been Made

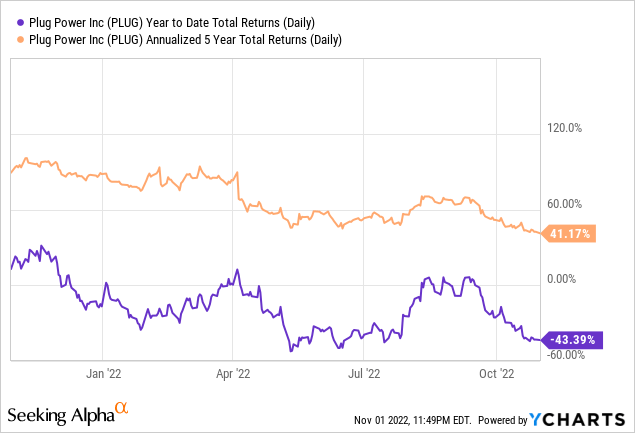

PLUG investors who invested five years ago should have little complaints despite seeing its total return fall nearly 44% YTD. As seen above, PLUG still posted a 5Y total return CAGR of 41.2%, outperforming the broad market significantly.

We postulate that investors expecting PLUG to continue outperforming from these levels must be highly confident in its path toward profitability. The days of easy money are long gone.

While PLUG remains well-capitalized with a net cash position of $2.29B, it also needs to contend with massive CapEx buildout over the next five years (as discussed in our early August article).

Therefore, we believe the market would be looking at how the company executes the production tax credits (PTC) from the IRA over the next decade toward accelerating its path to profitability. Management accentuated its confidence in its recent symposium. CFO Paul Middleton articulated:

Plug has already made and the differentiated position [and] achieving our growth targets of $5 billion in ’26 and $20 billion in 2030 seems very reasonable. [2022] will be a breakout year as we turn on the new green hydrogen platforms and take advantage of the PTC credit. As we look to ’26 in reaching $5 billion, we anticipate a continued growth rate of 50% per annum, yielding over 5x growth from today. For last year’s guidance of ’25 at $3 billion, we now think that that’s probably going to be up 10% to 15%. Our outlook suggests that we’re maybe even a little bit ahead of our path for 2026. And for 2030, we anticipate growing up to $20 billion, given the rapidly growing pipeline. (Plug Power Symposium)

Street Analysts Are More Confident Now

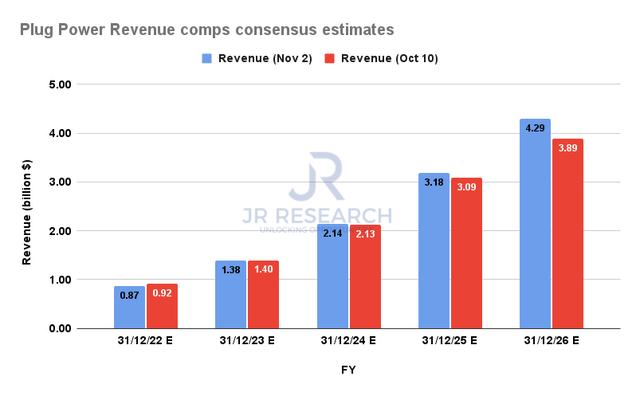

Plug Power Revenue comps consensus estimates (S&P Cap IQ)

The revised consensus estimates see Plug’s FY22 revenue marked down to $867M, in line with the company’s updated guidance. However, revenue estimates through FY26 are now much closer to the company’s $5B guidance for FY26. Hence, Street analysts are proffering more credibility to the company’s execution, which was a glaring miss that we noted in our early October article.

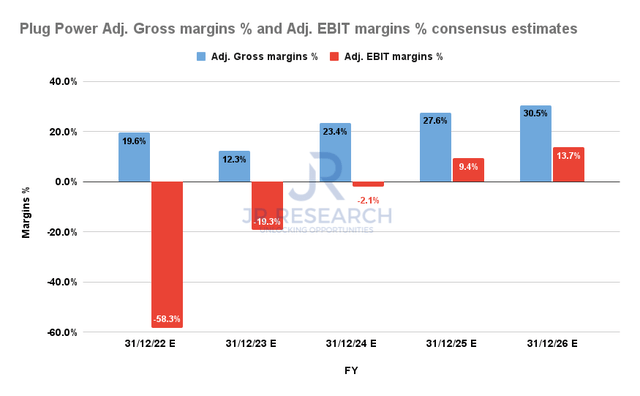

Plug Power Adjusted Gross margins % and Adjusted EBIT margins % consensus estimates (S&P Cap IQ)

Projections for Plug’s profitability have also been upgraded. As a result, its FY26 gross margins align with the company’s 30% guidance. Also, the estimates for Plug’s adjusted EBIT margins have been lifted significantly to 13.7% from 9.8% previously. Therefore, the gap between the company’s guidance of 17% has been narrowed markedly.

Hence, the bar has been set higher for Plug to cross, potentially setting up a re-rating opportunity. Therefore, management needs to execute accordingly over the next few years to justify a material re-rating above its current valuation.

Even Singapore Is Moving Toward Low-Carbon Hydrogen

We use Singapore as an example because the Singapore government is well-regarded for its incorruptibility, political stability, pragmatism, and long-term planning capability. It has been known to plan well ahead into the future, including renewable energy projects.

Singapore’s Deputy Prime Minister Lawrence Wong also highlighted that Singapore faced significant challenges as “an alternative energy disadvantaged island city-state.” Therefore, it needs to consider various renewable energy projects to reach net zero by 2050.

In his recent speech in late October, as he launched Singapore’s National Hydrogen Strategy, Wong accentuated:

We have made our assessments, and we believe that low-carbon hydrogen is an increasingly promising solution. While the technology and supply chains are still nascent, momentum has picked up substantially in recent years. Given these positive developments, Singapore believes that low-carbon hydrogen has the potential to be the next frontier of our efforts to reduce our emissions. (Singapore Energy Lecture – Lawrence Wong)

Therefore, we believe clean hydrogen could have a significant impact, consistent with Plug Power’s ambitions to be a leading green hydrogen player. So, it needs to prove its business model to its investors by executing its roadmap.

Is PLUG Stock A Buy, Sell, Or Hold?

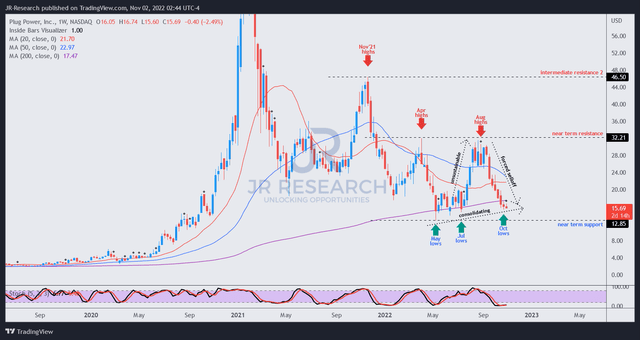

PLUG price chart (weekly) (TradingView)

PLUG last traded at a NTM revenue multiple of 5.9x, in line with its peers’ median of 6x (according to S&P Cap IQ data). Hence, its valuation has been digested markedly and is no longer overvalued.

We also gleaned that PLUG could consolidate at the levels closer to its near-term support. Hence, it’s still possible for the market to force further downside volatility to re-test that level before reversing.

However, we observe that the selling downside has also subsided, indicating that buyers have returned to stem further selling momentum. Therefore, we postulate that buyers would likely hold the current levels vigorously to defend its 200-week moving average (purple line).

As such, we see a favorable reward-to-risk profile at the current levels.

Revising our rating from Hold to Speculative Buy with a PT of $23.

Be the first to comment