Investors haven’t liked our view on AT&T (NYSE:T) for going on a couple of years now, but the call was very accurate with the stock falling below $15 recently. After a surprisingly solid Q3’22 earnings report, the wireless stock appears to have finally bottomed. My investment thesis is far more Bullish on AT&T with the cash flows to support a massive 6.5% dividend yield and the messy quarters in the past.

Complete Reset

The biggest issue facing AT&T shareholders was the constantly shifting corporate structure and focus of management. The quarterly numbers became difficult to analyze and the end result was the scenario where the stock collapsed along with disappearing confidence in the stock market.

AT&T finally reported solid numbers in comparison to estimates, as the wireless giant actually used promotions to far outpace legacy wireless peer Verizon Communications (VZ) in adding subscribers. AT&T even guided up EPS estimates for the year to $2.50 per share.

While the wireless giant still reported a large revenue decline compared to last year due to the removal of Time Warner revenues, the market is much more confident now with just focusing on the AT&T part of the business. The company suggests standalone revenues were up $0.9 billion, or 3.1%, but AT&T did see sequential revenue and EPS growth providing a level of stability not seen in a long time.

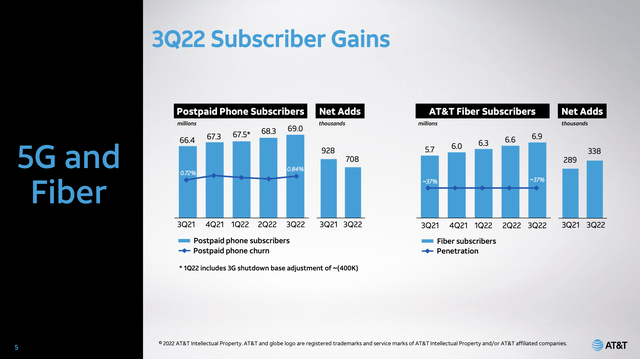

The company saw strong Q3’22 subscriber gains in postpaid phone subs at 708K and fiber subscribers at 338K. Verizon only added 8K postpaid phone subs. AT&T continued a strong path of growing users adding 3.6 million postpaid phone subs in the last year and 1.2 million fiber subs.

Source: AT&T Q3’22 presentation

In essence, market dynamics made for a disaster. From the point AT&T dumped the DirecTV business when quarterly revenues were $44 billion to a dip to $40 billion before the splitting off of the Time Warner business where revenues fell below $30 billion, the stock price has felt incredible pressure.

Now AT&T is focused on wireless and fiber connections and the market can judge the management team based on hitting these focused targets. The company provided an updated 2022 EPS target of $2.50 or higher compared to prior estimates of $2.42 to $2.46.

The mobility revenue growth of 6.0% is far more impressive when the revenues have limited offsets and aren’t competing with Time Warner. The market will have much more confidence in the business.

Dividend Confidence

The dividend yield soared above 7% recently with the stock absolutely collapsing. AT&T cut the dividend to $1.11 per share along with the spin-off of the Time Warner business, but the massive stock weakness led to the actual dividend yield topping prior levels.

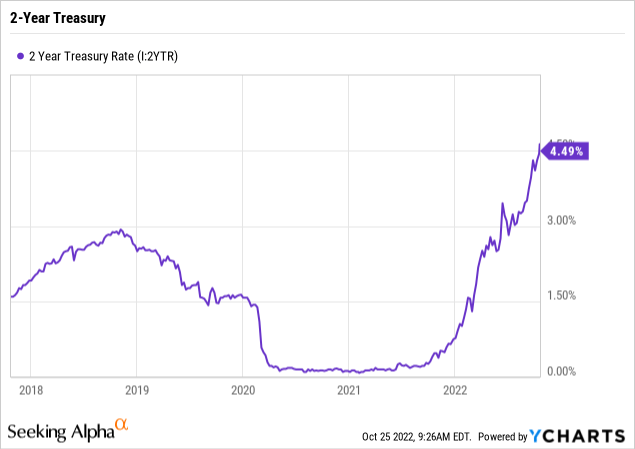

The one negative about the dividend yield is that the 2-Year Treasury rate has jumped to 4.6%. The AT&T dividend yield at 6.4% now doesn’t offer the same yield appeal when competing with the higher treasury yields in comparison to near 0% levels of the last couple of years.

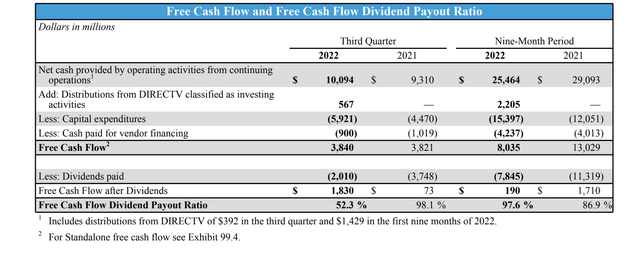

After producing $3.8 billion in free cash flow for Q3, AT&T forecasts maintaining the plan for $14 billion for the year. The quarterly dividend payout of $2.0 billion on 7.6 billion shares outstanding leaves a decent amount of cash flow to repay the large debt balance of $131 billion.

Source: AT&T Q3’22 earnings report

Ultimately, the key to the Q3’22 report is the stability in the business and the ability of management to hit financial targets and guide up in some cases. The market loves the business being strictly focused on connecting consumers to the internet and the confidence in management is far higher.

The stock is too compelling at 6x EV/EBITDA targets and only 7x EPS estimates. AT&T has already rallied ~$3 off the lows and the stock is still relatively cheap.

Where an investment could become very interesting is signs that competitors T-Mobile (TMUS) and Verizon might pull back on 5G investments. Some analysts have T-Mobile pulling back on capex spending to the tune of $3.2 billion to only spend $10.2 billion next year while Verizon might cut capex by $2.4 billion to $19.9 billion.

The big capex cuts would be huge to AT&T with net cash from operations last quarter at $10.1 billion. If the wireless giant spent $1.0 billion less per quarter on capex, AT&T would see free cash flows jump from $3.8 billion to $4.8 billion. The payout ratio dips to just 40% on such a scenario.

Takeaway

The key investor takeaway is that the market got extremely pessimistic on AT&T and the wireless giant burned the bears with a solid Q3’22 earnings report. Investors shouldn’t see the stock as a long-term investment due to structural issues in the competitive wireless sector, but AT&T is a solid trade where a rally back to the mid-$20s would provide a nearly 50% capital gain along with a $0.2775 quarterly dividend payment for additional profits.

Be the first to comment