VioletaStoimenova

Introduction

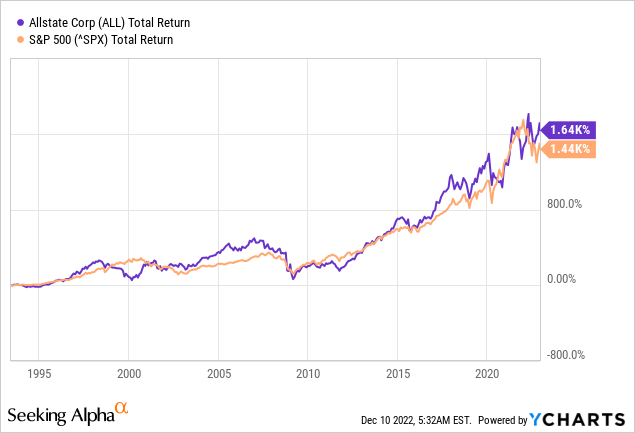

Allstate (NYSE:ALL) is an insurance company whose stock price has performed very well, its stock price tracking the S&P500. Total returns over the past 10 years have averaged 14.3% per year.

18 analysts have revised earnings expectations downward, but the stock price remains intact. The lagging earnings are due to falling equity prices in their investment portfolio. Investors are confident earnings will rebound.

The stock offers plenty of opportunities in the high interest rate environment, and management has taken steps to reduce risk by selling some fixed equity securities. Selling their fixed equity securities helped reduce its net loss by $2B. Allstate’s management acts fast and knows how to make good use of opportunities.

Third Quarter Earnings Were Mixed

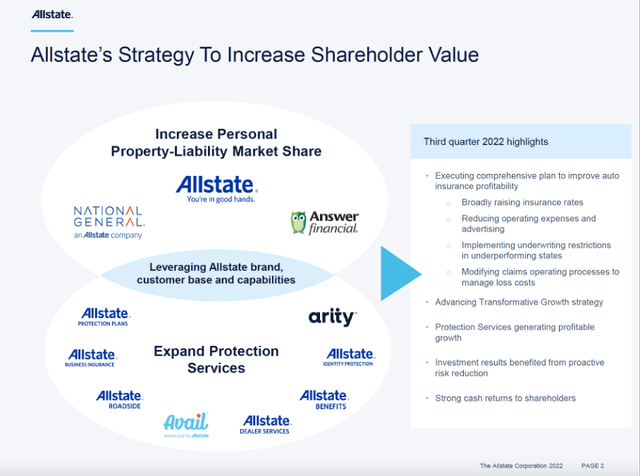

Allstate’s Strategy To Increase Shareholder Value (Allstate 3Q22 Investor Presentation)

In the third quarter of 2022, consolidated revenues increased 6% year over year, mainly due to higher average premiums for auto and homeowners insurance. Net income came in at a loss due to a small underwriting margin offset by an increase in reserves in prior years and a mark-to-market loss on public equities. Net losses on investments and derivatives were $167 million in the third quarter of 2022, compared with a gain of $105 million in the third quarter of 2021.

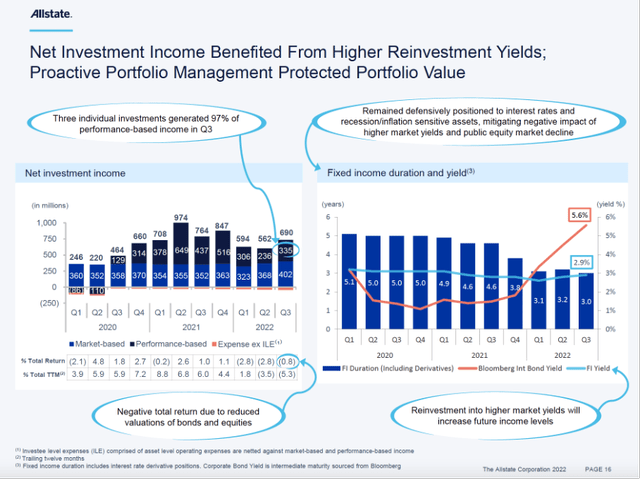

The valuation of fixed-income securities decreased due to higher interest rates and credit spreads. Allstate reduced the risks of its bond portfolio by reducing the duration of the fixed-income portfolio from 4.6 years to 3 years by selling bonds and derivatives. This allowed Allstate to avoid a $2B loss. Lower valuations of fixed-income securities are not a problem for Allstate because the company could hold its bonds to maturity. If interest rates rise, more income is expected for newly issued bonds.

Allstate Net Investment Income (Allstate 3Q22 Investor Presentation)

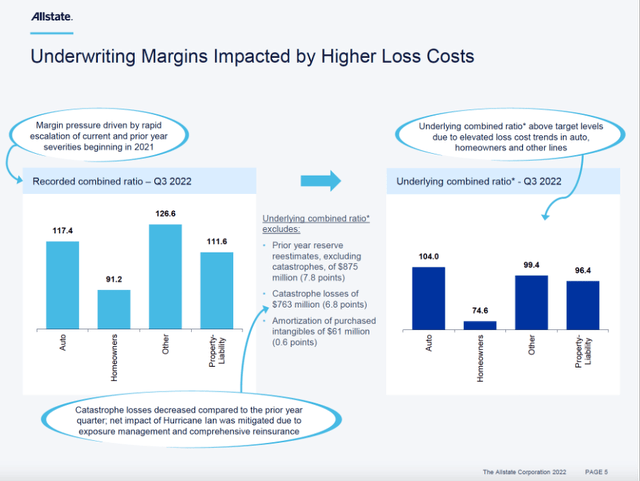

The combined ratio takes operating losses and loss adjustment expense and divides this sum by premiums earned. A combined ratio of less than 100% indicates that the company is making a profit on its insurance business. Allstate’s combined ratio was higher than 100% during the quarter, indicating that the company should be earning more premiums to offset their losses and costs. Their target is in the mid-90s, while the underlying combined ratio in the third quarter is 104%. Hurricane Ian added 4.4 points to the combined ratio for auto in the third quarter. Claims made for collision, property damage and personal injury are up 17%, 17% and 12%, respectively, from last year. Allstate will raise premiums for 2023 and beyond to lower the combined ratio.

Allstate’s Combined Ratio (Allstate 3Q22 Investor Relations)

Allstate aims to improve auto profitability by broadly increasing auto insurance rates. In the third quarter, Allstate reduced costs by lowering advertising expense and reducing costs associated with its operating cost structure. The company is changing claims operational processes to control costs in the high inflation environment to achieve higher profitability in the auto insurance segment.

Allstate Is A Strong Dividend Compounder

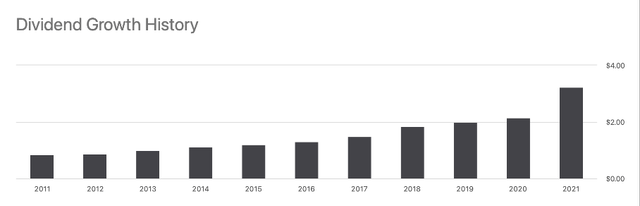

Allstate is a strong dividend-compensator; its dividend per share has grown at an average annual rate of 14.5% over the past decade. The current dividend is $3.40, representing a dividend yield of 2.6%. Analysts expect the dividend per share to rise to $3.38 in fiscal year 2022 and $3.50 in fiscal year 2023. Dividends of $1B in 2021 are more than covered by free cash flow of $4.7B (dividend to free cash flow = 20%).

Dividend Growth History (Allstate SA Ticker Page)

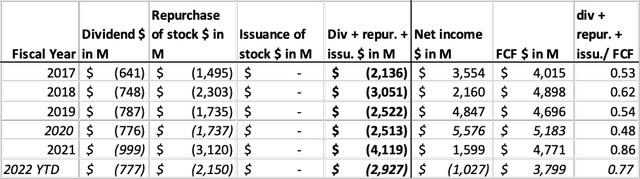

In recent years, the company has repurchased shares to increase the dividend per share. In 2021, the buyback yield was 8%. Share repurchases reduce shares outstanding, reducing the supply, whereas demand increases when repurchases are made in the open market. Dividend payout plus share repurchases represent about 77% of free cash flow, Allstate still earns cash on its balance sheet. Net debt is almost equal to 2021 EBITDA, net debt is $7.2B while 2021 EBITDA is $7.9B.

Allstate Cash flow highlights (SEC and author’s own calculation)

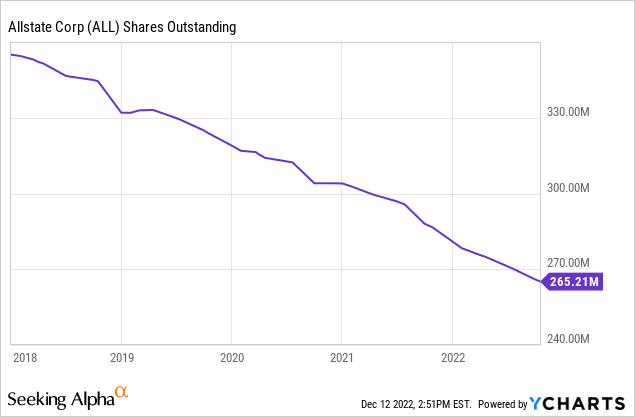

Due to share repurchases, shares outstanding decreased by an average of 5.7% over the past 4 years. The company has 265M shares on its balance sheet. Warren Buffet is a big proponent of share buybacks; earnings per share and dividends per share for Coca-Cola (KO) rose sharply in the 1990s due to its share buybacks. Coca Cola is an example of good management that is shareholder-friendly.

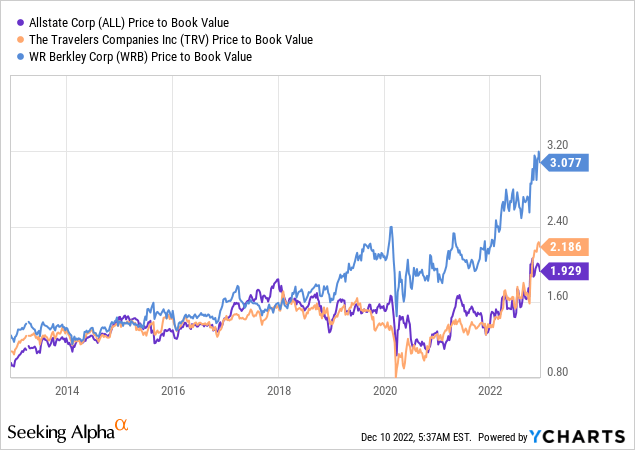

Valuation Is In Line With Competitor

Looking at the valuation of the stock, the price-to-book value is in line with that of Travelers Companies (TRV). The P/B of 1.9 is generally pricey, but compared to Travelers and W. R. Berkley (WRB), the ratio looks very favorable.

Allstate expects lower earnings due to higher reserves in previous years and a mark-to-market loss on public equities. As a result, the PE ratio is very high.

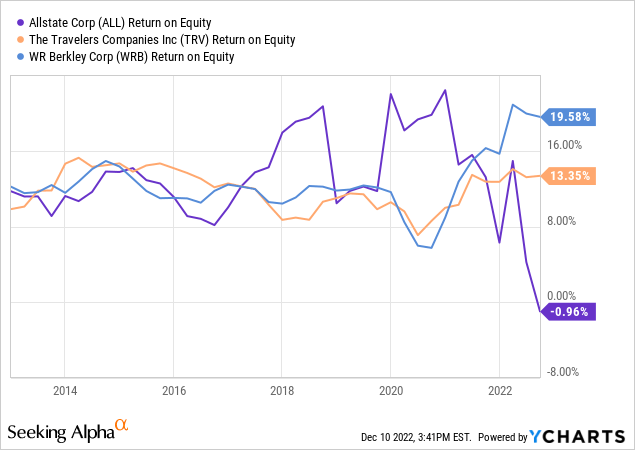

Return to equity is a common valuation measure used alongside price-to-book value to gain insight in the equity valuation of similar companies. Return to equity refers to current earnings but says nothing about future earnings. Allstate’s ROE is negative because the company is currently making a loss. WR Berkley’s ROE is very high, but it is expected with the high P/B of 3.

Travelers’ ROE looks better than Allstate’s, and Travelers is expected to remain profitable in the coming years. Both Allstate and Travelers are strongly positioned for further growth, while Travelers’ earnings forecast stays intact and Allstate’s forecast is slightly negative. When comparing these two companies, I prefer Travelers.

Key Takeaway

- In the third quarter of 2022, consolidated revenues increased 6% year over year, mainly due to higher average premiums for auto and homeowners insurance.

- Net income came in at a loss due to a small underwriting margin offset by an increase in reserves in prior years and a mark-to-market loss on public equities.

- The valuation of fixed-income securities decreased due to higher interest rates and credit spreads.

- Lower valuations of fixed-income securities are not a problem for Allstate because the company could hold its bonds to maturity.

- Allstate’s combined ratio was higher than 100% during the quarter, indicating that the company should be earning more premiums to offset their losses and costs.

- Allstate will raise premiums for 2023 and beyond to lower the combined ratio.

- Its dividend per share has grown at an average annual rate of 14.5% over the past decade.

- In recent years, the company has repurchased shares to increase the dividend per share. In 2021, the buyback yield was 8%.

- Looking at the valuation of the stock, the price-to-book value is in line with that of Travelers Companies. The P/B of 1.9 is generally pricey, but compared to Travelers and WR Berkley, the ratio looks very favorable.

Be the first to comment