GizemBDR/iStock via Getty Images

In my most recent CEL-SCI (NYSE:CVM) article, 08/03/2022’s “CEL-SCI: Enduring Challenges”, I lamented the sparse information available on the stock. Rather than providing quarterly earnings reports, it parcels out information in periodic shareholder’s letters and presentations.

In this article I report on the latest gleanings from CEL-SCI’s 10/2022 slide presentation (the “Presentation”) and its latest 11/22/2022 letter to shareholders (the “Letter”). Unfortunately, it continues to grind forward in preparing its BLA without ascertainable progress. Shareholders are paying a high price as I discuss.

CEL-SCI’s lead Multikine therapy tags cancer cells in advance of further treatment.

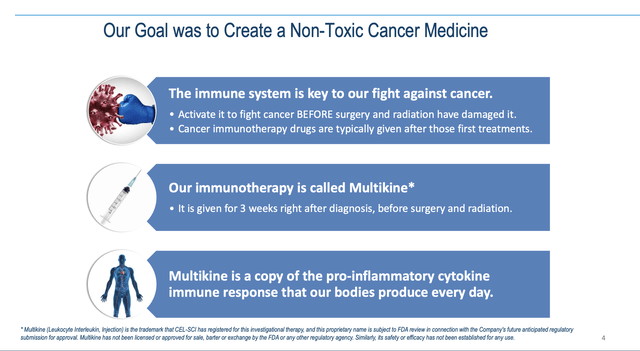

Multikine (leukocyte interleukin injection) therapy is a novel approach to cancer therapeutics, albeit one that CEL-SCI has been doggedly pursuing for nearly four decades. The Letter describes how Multikine differs from typical cancer therapies for primary squamous cell carcinoma of the head and neck (“SCCHN”).

It notes that previously approved therapies from Merck (MRK) (Keytruda) and Bristol-Myers Squibb (BMY) (Nivolumab) are approved:

…as a last resort for recurrent tumors after treatments have failed or for patients who are not candidates for surgery. By contrast, Multikine is given to newly-diagnosed patients following initial diagnosis — it’s the first of its kind with substantial survival benefit in a randomized Phase 3 trial in locally advanced primary SCCHN.

CEL-SCI Presentation slide 4 describes its key attributes:

Slide 7 describes how Multikine is administered. It is injected around a targeted tumor and near adjacent lymph nodes for 5 days a week for 3 weeks. It is administered before any other cancer therapy to stimulate the immune system to recognize the cancer cell antigens.

CEL-SCI reported top line data from its phase 3 pivotal trial (NCT01265849) on 08/19/2022. It announced that it planned to use this data to support a BLA for submission to the FDA. As for the pivotal trial itself, it was a truly labyrinthine undertaking. It began in 12/2010 and continued for another ~10 years. It underwent a numbing 54 amendments.

As CEL-SCI developed Multikine its shareholders were pummeled.

CEL-SCI’s ~40 year path to the current time is described in detail on its website. It is a tale of insight, focus and dedication interspersed with heavy doses of ill-fortune. It has brought us to today as I write on 12/12/2022 with CEL-SCI working feverishly to file a BLA for a trailblazing cancer therapy.

As revealed by slide 10 in the Presentation, there have been no FDA approvals for advanced primary head and neck cancer since the late 1950’s. No fewer than six standalone and two combination therapies in this indication, owned by a WHO’s WHO of top pharmas, have crashed and burned in the last three years.

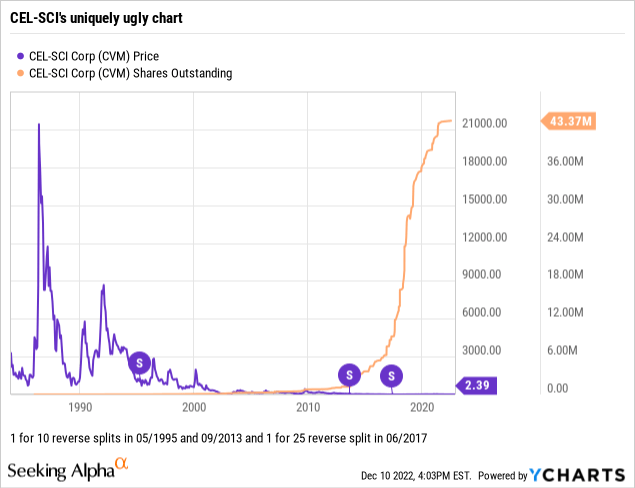

So it is to its immense credit that CEL-SCI, starting from scratch as a new company, has gotten to where it is. It has not been easy as revealed by its stock chart below. Its long term shareholders have paid a heavy price.

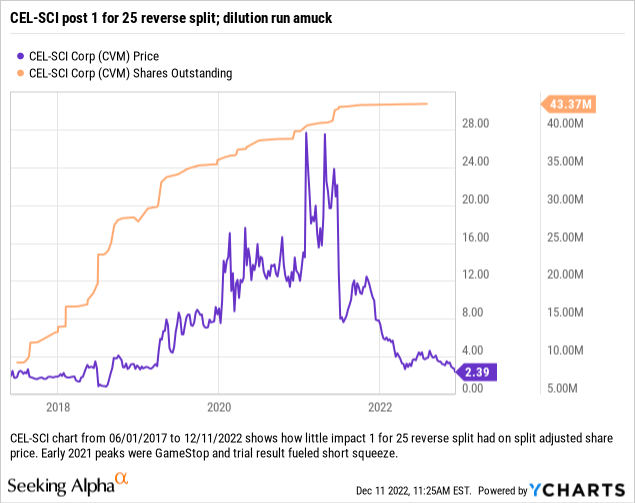

A shorter view of just its chart from the start of 2017, when it engineered its big 1 for 25 reverse split, provides a more granular perspective of recent developments:

CEL-SCI’S current share malaise, coupled with its challenges in filing its BLA, portend ongoing shareholder distress.

CEL-SCI’s shares in 01/2021 were even crazier than shown on the chart above. They ran all the way up to a split adjusted high of $40.91 on 01/27/2021 after opening the day at $14.25; they closed at $25.

During 2022 CEL-SCI shares have shown a strong negative bias. After hitting a high of $7.73 on the first trading day of 2022, they have traded lower ever since recently trending <$3.00.

Their most recent close of $2.31 coupled with the market’s tepid response to the Letter speak to a potential for more pain in CEL-SCI’s not too distant future. While I can’t help but admire CEL-SCI’s zealous quest to prove a new paradigm for cancer therapeutics, I am mindful of the price it has posed to investors.

All those reverse splits have obscured the real damage that shareholders have experienced over the years. Today as I write on 12/12/2022, CEL-SCI trades at $2.31 per share. Back during its initial trading in 1991, it traded at a split adjusted $4,375 per share. This reflects a loss of 99.947%.

My current concerns are based upon the significant difficulties that CEL-SCI will face in moving Multikine to its next step. Now that its pivotal trial is complete it has to assemble its data in form convincing to the FDA. This requires it to undergo a data lock. CEL-SCI describes this process as:

- … a complex, in-depth, and time intensive review process of all of the study data from beginning to end to ensure it is complete and accurate;

- [it]…. is even more complicated for our Phase 3 study because it involved three treatment arms as well as four treatment modalities, Multikine, surgery, radiation, and chemotherapy;

- …every data point in each patient’s case report form concerned with, among other things, their selection, randomization, laboratory assessments, safety and efficacy evaluations of all treatment(s) received must be reviewed, and the source data verified as complete, accurate and correct.

- …[CEL-SCI’s] Phase 3 study was very complex and was conducted in 928 patients over the course of 9.5 years in 100 medical centers on 3 continents. … most other studies, … are not as large, not as complex or geographically dispersed, and did not run for such a long period of time.

The Presentation includes a slide 24 titled “Steps In The Process For FDA Approval”. It offers no indication of any target date for submitting its BLA. Similarly, the Letter offers no help in terms of timing. To the contrary it includes more explanations for why its process is taking so long. As it says:

We also do not have the resources of Merck or BMS, and this contributes to the timing as well. Simply put, we have a much smaller team. Nevertheless, I am proud to say that we have assembled an incredible bullpen of experts. We have brought in consultants who used to work at FDA, world-class biostatisticians, and Key Opinion Leaders to help us. Our team is working 24/7 on the approval process for Multikine in this horrible cancer.

Conclusion

I have listed CEL-SCI as a “sell” in recent articles. I list it as a tremulous “hold” today (12/12/2022) in recognition of the upcoming quarter which may provide a better look at its financials. The Presentation puts its cash at $29 million based on its then latest quarterly filing for its fiscal third quarter thru 6/30/2022 which was dated in August.

It reported:

…an operating loss of $27.1 million for the nine months ended June 30, 2022 versus an operating loss of $27.7 million for the nine months ended June 30, 2021. Net cash used during the nine months ended June 30, 2022 was $13.3 million. This represents a decrease of $0.7 million compared to the nine months ended June 30, 2021. CEL-SCI reported an operating loss of $8.7 million for the three months ended June 30, 2022 versus an operating loss of $10.5 million for the three months ended June 30, 2021.

This speaks to a borderline liquidity, one which is not helped by a dwindling share price. CEL-SCI looks as if it is just one more small biotech with a possibly revolutionary therapy that is stumbling as it heads for the FDA. Why didn’t it make a deal with big pharma to help it so its therapy actually had its best chance to succeed?

Was CEL-SCI too short sighted or greedy, or did it try, only to be rejected as ineffective? I do not know. I do know that CEL-SCI faces long odds; individual shareholders even longer.

Be the first to comment