New Zealand Dollar Talking Points

NZD/USD pulls back from the weekly high (0.6092) even though New Zealand Prime Minister Jacinda Ardern plans to roll back the nationwide lockdown starting on April 27, and the exchange rate may exhibit a more bearish behavior as the Reserve Bank of New Zealand (RBNZ) endorses a dovish forward guidance for monetary policy.

NZD/USD Eyes Monthly Low as RBNZ Mulls More Stimulus for May Meeting

NZD/USD appears to be on track to test the monthly low (0.5843) as RBNZ Governor Adrian Orr reiterates that the central bank has not ruled out a negative interest rate policy (NIRP), with the official going onto say that the committee will mull another round of monetary stimulus at the next meeting on May 13 amid the weakening outlook for global growth.

Source: RBNZ

It seems as though the RBNZ will continue to utilize its balance sheet as “members agreed to provide forward guidance that the OCR (official cash rate) would stay at the level of 0.25 percent for at least 12 months,” and the central bank may deploy more non-standard measures to combat the slowdown in economic activity as updates to China’s Gross Domestic Product (GDP) report revealed a larger-than-expected decline in the growth rate.

Governor Orr went onto say that the RBNZ has an open mind in directly monetizing New Zealand government debt as the central bank expands the Large Scale Asset Purchase programme (LSAP) to include NZ$ 3B of Local Government Funding Agency (LGFA) debt, and the committee may continue to push monetary policy into uncharted territory as the central bank plans to “update its economic assessment and the size and scope of the LSAP at its next scheduled meeting.”

In turn, speculation for additional monetary support may present headwinds for the New Zealand Dollar, and NZD/USD appears to be on track to test the monthly low (0.5843) following the failed attempt to test the former support zone around 0.6170 (50% expansion) to 0.6230 (38.2% expansion).

Recommended by David Song

Forex for Beginners

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

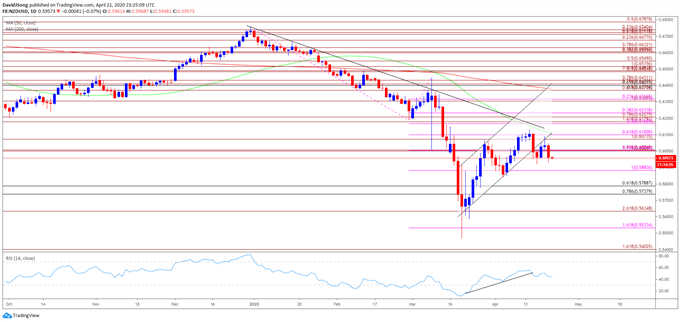

NZD/USD Rate Daily Chart

Source: Trading View

- Keep in mind, NZD/USD has failed to retain the range from the second half of 2019 as the decline from earlier this year produced a break of the October low (0.6204), with a ‘death cross’ taking shape in March as the 50-Day SMA (0.6102) crosses below the 200-Day SMA (0.6377).

- The negative slope in both the 50-Day SMA and the 200-Day SMA offer a bearish outlook for NZD/USD, and the advance from the yearly low (0.5469) may continue to unravel as the exchange rate snaps the upward trending channel carried over from the previous month following the failed attempt to test the former support zone around 0.6170 (50% expansion) to 0.6230 (38.2% expansion).

- As a result, NZD/USD appears to be on track to test the monthly low (0.5843) as it initiates a fresh series of lower highs and lows, with the Relative Strength Index (RSI) highlighting a similar dynamic as the oscillator snaps the bullish formation from March.

- A break/close below the 0.5880 (100% expansion) region brings the Fibonacci overlap around 0.5740 (78.6% retracement) to 0.5790 (61.8% retracement) on the radar, with the next area of interest coming in around 0.5640 (261.8% expansion).

Recommended by David Song

Traits of Successful Traders

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

Be the first to comment