Zix Corporation (NASDAQ:ZIXI), a leader in email security, may have bitten off more than it can chew with its acquisition of AppRiver, a little more than a year ago. I noted in a previous article that, prior to the acquisition, Zix was struggling with its revenue growth of 7% and declining retention rate. The AppRiver acquisition breathed new life into Zix, and the acquisition seemed to make sense at the time.

|

Metric |

Zix |

AppRiver |

|

ARR Growth Rate |

6% |

26% |

|

Customer retention |

<90% |

>95% |

|

Dollar-Based Net Retention Rate |

98% |

>100% |

The main issue with the acquisition was that AppRiver was larger than Zix and resulted in Zix stretching its finances. Fast forward to the present and the combined business has only $13 million in cash and equivalents and nearly $200 million in total debt.

(Source: Portfolio123/MS Paint)

In normal times, I believe that the balance sheet would be manageable although with significant risk. But times are not normal, and it is unclear how Zix will perform in the current economy.

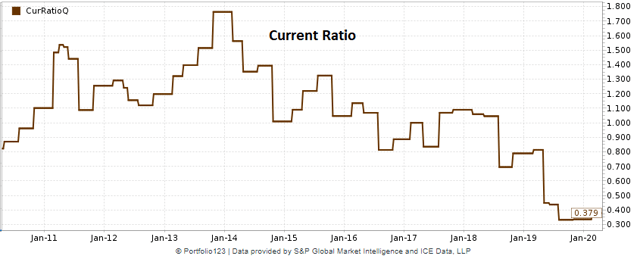

The company’s Current Ratio is telling. Prior to the acquisition, Zix had a Current Ratio of approximately 1, which meant that its short-term assets could cover its short-term debt.

But the company’s Current Ratio has been trending down and now sits at a very low 0.38.

(Source: Portfolio123)

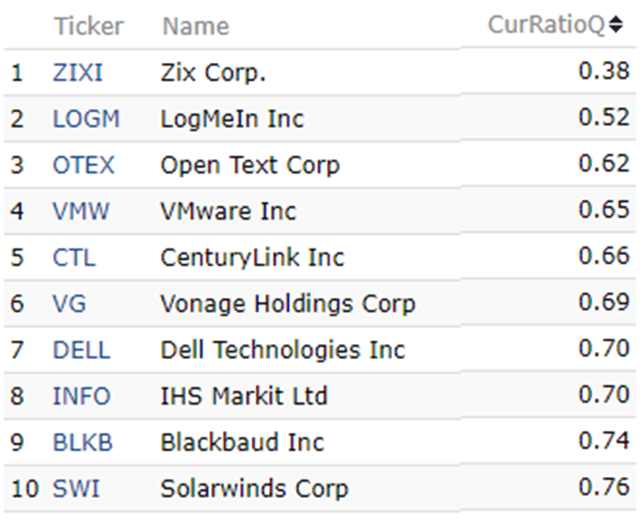

In fact, Zix has the lowest Current Ratio of all the digital transformation stocks that I track, all 152 of them.

(Source: Portfolio123)

Zix has only 38% of cash and equivalents on its books to cover the short-term debt. The company is very much dependent on strong future performance to cover its short-term obligations.

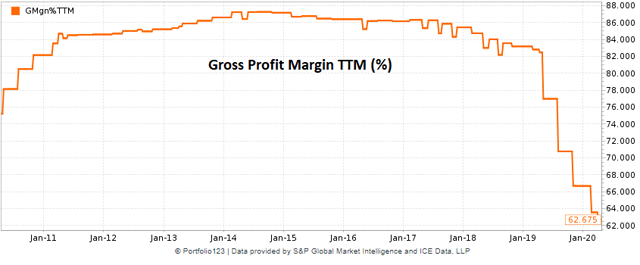

Unfortunately, the AppRiver acquisition put pressure on the company’s gross profit margins, primarily due to the Office 365 security application which has lower margins.

(Source: Portfolio123)

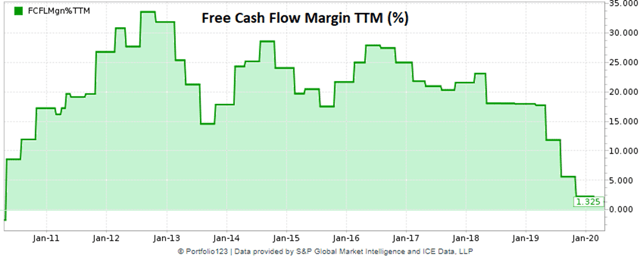

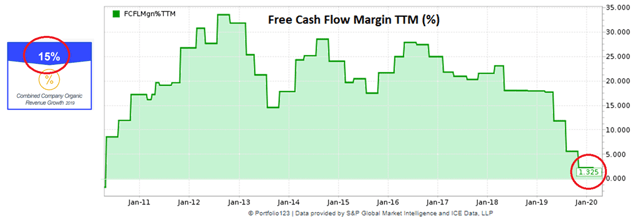

Zix’s free cash flow margin has dropped to 1%, just above breakeven as shown in the graph below.

(Source: Portfolio123)

Office 365

The bright side is that Zix is very much in bed with Microsoft (NASDAQ:MSFT), providing security products for Microsoft 365. Note that this is not an exclusive arrangement. Therefore, Zix has competition, and Microsoft also has its own free security offerings.

Microsoft is giving away Office 365 and Teams access during the pandemic, and this should significantly boost usage of the Microsoft products. What we don’t know is whether the giveaway will translate into higher revenue for Zix.

In this environment, where small businesses are hurting, I expect such businesses to cutback expenses en masse and will likely affect Zix as company’s potentially shift to Microsoft’s free security features.

Stock Valuation

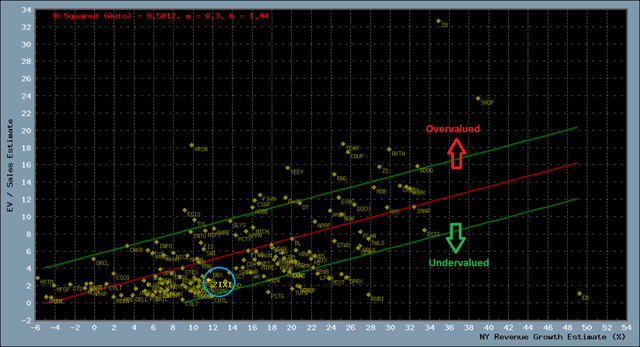

There are numerous techniques for valuing stocks. Some analysts use fundamental ratios such as P/E, P/S, EV/P, or EV/S. I believe that one should not employ a simple ratio, and the reason is simple. Higher growth stocks are valued more than lower growth stocks and rightly so. Growth is a significant parameter in discounted cash flow valuation.

Therefore, I employ a technique that uses a scatter plot to determine relative valuation for the stock of interest versus the remaining 152 stocks in my digital transformation stock universe. The Y-axis represents the enterprise value/forward sales, while the X-axis is the estimated forward Y-o-Y sales growth.

The plot below illustrates how Zix stacks up against the other stocks on a relative basis.

(Source: Portfolio123/private software)

A best-fit line is drawn in red and represents an average valuation based on next year’s sales growth. The higher the anticipated revenue growth, the higher the valuation. In this instance, Zix is situated well below the best-fit line. This suggests that Zix is undervalued on a relative basis. The undervaluation is likely due to the problems I listed above including the high debt level and the small amount of cash on hand.

The Rule Of 40

One industry metric that is often used for software companies is the Rule of 40. The metric sidesteps the valuation dilemma for high-growth companies that generally don’t show profits. The Rule of 40 allows for both revenue growth and profitability (expressed as a margin) in combination such that they must add up to at least 40%. Analysts use various figures for profitability. I use the free cash flow margin.

The rationale for the Rule of 40 is as follows. If a company grows by more than 40% annually, then you can turn a blind eye to negative free cash flow to some extent. On the other hand, if a company grows by less than 40%, then the company should have a positive free cash flow to make up for the less than ideal growth.

This rule accommodates both young, high-growth companies as well as mature, moderate growth companies. Young companies tend to have high revenue growth but are burning cash. Mature companies have lower revenue growth, but they make up in terms of free cash flow. The 40% threshold is somewhat arbitrary but typically divides the digital transformation stock universe in half, separating the best stocks from the so-so.

For a further description of the rule and calculation, please refer to one of my previous articles. Given the large acquisition last year, the combined revenue growth is difficult to assess. Therefore, I am going to use Zix’s stated combined organic ARR growth of 15% for the Rule of 40 calculation.

(Source: Portfolio123/MS Paint)

In Zix’s case:

Revenue Growth + FCF margin = 15% + 1% = 16%

Zix scores below the 40% needed to fulfill the Rule of 40, meaning that Zix is having difficulty achieving a healthy balance between growth and profitability.

Summary and Conclusions

Zix operates in the email security niche and competes primarily with two other companies, Proofpoint (NASDAQ:PFPT) and Mimecast (NASDAQ:MIME). Zix acquired AppRiver last year, a move that allowed Zix to move into serving small and medium-sized businesses, something that Proofpoint and Mimecast do not target. Unfortunately, small business customers translate into lower margins and higher churn. Zix has put itself in a position where it has to perform well in order to cover its debts incurred in the AppRiver acquisition. It is unclear how well the company will actually perform during the pandemic and anticipated global recession. Zix may get a tailwind from MS Office 365 growth, or small business may choose to go with Microsoft free security products. In any case, Zix is in a high-risk situation, and I don’t feel that investors should take the risk as there are better investments. Therefore, I am giving Zix a neutral rating.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment