Not The Chips You Are Looking For FotoMirta/iStock via Getty Images

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

The Empire Strikes Back?

In recent years, the rise of NVIDIA (NASDAQ:NVDA), and for that matter Advanced Micro Devices (AMD), has trounced Intel. Missteps at Intel itself have compounded over the last twenty years – missing mobile as a crucial market (ceding share to ARM in the process), missing GPU as a crucial market (ceding share to both NVDA and AMD) and whilst positioning itself as a high quality vertically integrated we-make-our-own-stuff shop, in contrast to the supposedly engineering-lite fabless players, making a mess of the move to the 7nm process node. All in all, Intel has successfully been shooting itself in the foot repeatedly for some years now.

However, nothing is forever; companies rise and fall, stocks rise and fall, and just when you think it’s all over for the old guard, along comes a series of body blows for the new-new thing and in a trice your grandpa’s stocks are fashionable once more. So does that mean it’s a new dawn for Intel Corporation?

First, let’s deal with a question commonly asked by those new to the names or the semiconductor sector.

Is Intel Or Nvidia A Larger Company?

This is a common question for those new to the sector. The simple answer is, Intel is much larger by revenue – around $78bn of TTM revenue for INTC vs. $30bn for NVDA – but due to its much more aggressive valuation multiples, NVDA is larger by enterprise value ($417bn) than INTC ($153bn). Those multiples are a function of growth rates, which are much higher at NVDA.

Let’s dig into the numbers in more detail.

Nvidia and Intel Stock Key Metrics

Let’s look at the financial fundamentals of each company. We’ll start with NVDA.

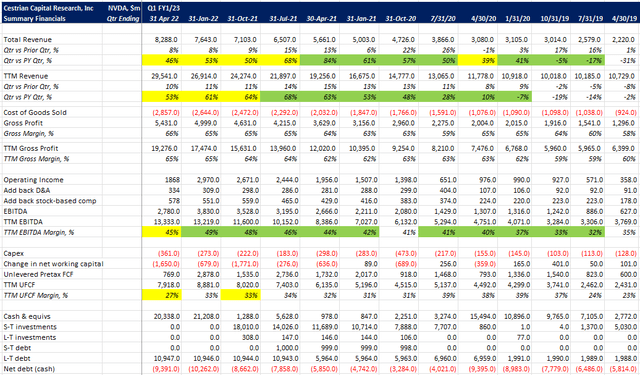

NVDA Financial Table (Company SEC Filings, YCharts.com, Cestrian Analysis)

High growth – albeit slowing – with high EBITDA and cash flow margins. Large net cash position of over $9bn in the most recently reported quarter.

The valuation of NVDA reflects the growth rate.

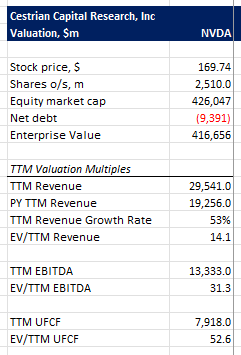

NVDA Valuation Analysis (Company SEC Filings, YCharts.com, Cestrian Analysis)

The market continues to ask you for an unfashionable 14x TTM revenue / 31x TTM EBITDA / 53x TTM unlevered pretax cash flow if you want to buy NVDA.

Turning now to Intel.

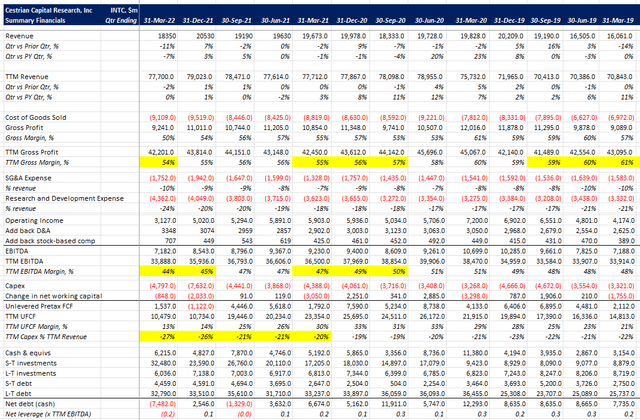

Intel Financial Table (Company SEC Filings, YCharts.com, Cestrian Analysis)

A few matters to highlight here. Of course, we are dealing with a more mature company than NVDA and that’s reflected in the valuation metrics as we shall see in a moment. But over and above that, what you see here is a company undergoing a strategic overhaul. TTM revenue growth is flat, as it has been for some quarters; gross margins are holding in the mid-50s%; but EBITDA and unlevered pretax FCF multiples are trending down markedly. That’s because the company is investing hard in its future – this can succeed or not, nobody knows, but the commitment is there. You can see it in the R&D as a percentage of revenue line – that 24% scored in the most recent quarter is higher than at any time since Q1 2016 – and you see it in the capex – TTM capex sits at 27% of TTM revenue, which is higher than the company has notched up in the last decade. Intel is investing in new on- and near-shoring fabrication capability (hence the recent acquisition of Tower Semiconductor) which is both strategically sensible given rising world tensions and is likely to curry favor in DC – the better to assist INTC with any antitrust or other regulatory matters it may have to handle in the future.

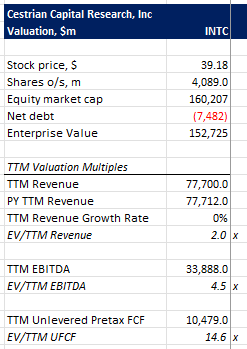

INTC stock is trading at a fundamentally low valuation but that of course reflects both its ex-growth status and the heavy investment spending right now.

INTC Valuation Analysis (Company SEC Filings, YCharts.com, Cestrian Analysis)

What Is The Outlook For NVDA And INTC Stock?

We believe both stocks offer good long term investment potential from here, albeit for entirely different reasons.

Nvidia, whilst the stock has been hit hard by the selloff in growth names, remains a leader in the key segments upon which compute depends going forward. The parallel processing architecture embraced and developed by NVDA remains core to AI and other advanced methods that we expect to be used increasingly in not just the datacenter but most end-user devices over time. That ought to keep the revenue line growing strongly over the longer term. All growth companies can and do hit air pockets every now and then but aside from AMD we see little competition to NVDA in the GPU market, and the segment is easily able to sustain two high growth players in our view.

Intel stock has also been hit hard, for entirely different reasons. The cumulative errors the company has chalked up have come home to roost in the stock price. But this itself offers an opportunity to long term buyers. Most probably INTC is not going away as a pillar of US high tech industry; and if the world continues to see a retreat from the globalization that enabled the fabless (outsourced manufacturing) business model take hold amongst US semiconductor designers like NVDA, then the move that INTC is making to become an on- and near-shore device manufacturer is likely a smart one.

Is Nvidia or Intel Stock A Better Buy?

So if you are considering adding to existing holdings, or opening new positions, we believe both these stocks offer solid long-term potential. Let’s take a look at their respective stock charts to try to put that potential in context.

In our most recent note on NVDA, published 26 May with the stock at $181, we thought a buy was risky, preferring a simple hold rating. At the time of writing, NVDA stock sits at the $160 level. Market sentiment at present is very weak and buying now could reward the brave. June features a number of volatility-inducing events, from the Federal Reserve FOMC to a series of important option-expiry dates; if you prefer to avoid short-term red ink, you may choose to wait to see how June plays out. We rate at Neutral on that basis but we lean bullish over the longer term.

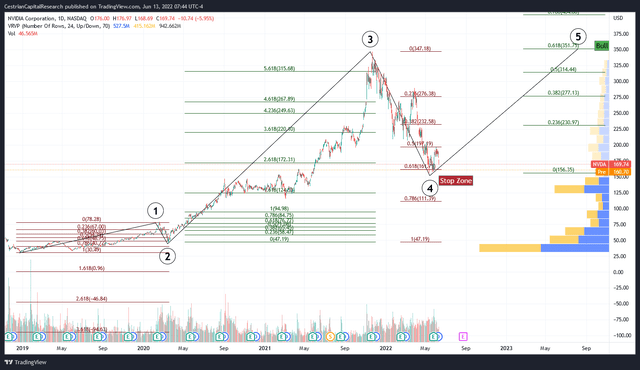

NVDA Chart (TradingView, Cestrian Analysis)

There’s every possibility in our view that NVDA could yet make new highs; the chart pattern it has followed since the 2018 lows continues to suggest that. If you do decide to buy in at this point, be aware that a key support level – the 0.618 retracement of the most recent big Wave 3 move up – looks like it could be broken in regular trading hours today, and that can be meaningful. So, care needed here. Time your buy well and you could be rewarded well, and rapidly.

Intel we think is best looked at on a monthly chart over a longer timeframe.

INTC Stock Chart (TradingView, Cestrian Analysis)

The stock is approaching a level which held as resistance in 2014 and then again in 2016, finally being broken through in 2017. We are looking for that level (around $38) to hold as support before being able to declare that the stock has arrested its decline. Our comments on the market in June above pertain to INTC as well as to NVDA. So for the moment, Neutral on INTC too; but again, leaning bullish long term as we expect the new CEO at INTC to successfully reposition the company in line with the shifting sands in global manufacturing; INTC we expect to once more become a US champion in this regard.

So – Neutral on both short term; bullish on both longer term. In staff personal accounts we hold long positions in both names.

Cestrian Capital Research, Inc – 13 June 2022

Be the first to comment