Pgiam/iStock via Getty Images

NVIDIA Corporation (NASDAQ:NVDA) is a semiconductor stock and one that we have started buying in the recent onslaught of weakness. We really like how the situation is starting to set up for an investment. Sure, there is always going to be spiking and waning demand, and there will always be shortages and gluts of certain chips. Perhaps we are coming into a glut, as many question whether the Federal Reserve’s actions to rein in inflation will have catastrophic impacts on the consumer and businesses alike, and subsequently the demand for chips in computers, vehicles, and as well as data center demand. It all remains to be seen. The market is pricing in disaster and has sent semiconductor stocks to their lowest level in two years. We argue that demand is far less cyclical than in years past, because chips are in everything. NVIDIA stock had truly been a winner up until 2022. It became a stock that just continued to get beaten on. Now, after hundreds of points of declines, the stock is actually rather reasonably value for the growth of the company. While macro demand may ebb and flow, and NVIDIA might be coming into a slower few quarters, we think you need to buy into the weakness to position yourself to take advantage of the turnaround in markets. We expect a few more weeks of pain, and suspect that CPI inflation data will be a main catalyst higher or lower for markets. Once the Fed is done hiking, markets will rally, even if the economy is feeling the worst of it. The market is a forward indicator, and we like the setup for this stock to rally hard. Semiconductor stocks have been crushed. We think they emerge as leaders in a rebound. As the stock gets closer and closer to $100, the more bullish we become for value, and eventual returns to growth in a few quarters. Position ahead of this, and start scaling in.

Even with all of the talk of how demand is gone, the most recent earnings were indeed quite strong. However, it is our recommendation that after this most recent earnings report (which was still decent all things considered) and the huge declines in the last few months, that you take start scaling back in. If you have lost your shirt, we recommend you consider averaging down here at the present valuations, even if we expect the extreme growth to stall somewhat.

Look. You can sit there and wait for a true reversal and try to ride some momentum higher. That works for trading certainly, especially. But we think that the stock is at levels worth investing in. Yes, business likely slows some in coming months. Everyone agrees the landscape is poor. But remember, the market will start moving this names up well before the actual improvements are felt. The same can be said about how the stock has fallen all year. The market brought the stock down well before performance slowed. That is how it works. Once you understand this, you will improve your investing game dramatically. While the stock was expensive before, it has seen its valuation drop tremendously. It is not quite a value stock, but given the growth that will still be offered the next few years, it is trading at bargain levels. We like buying sub $125, but especially as we get closer to $100.

The company may not be firing on all cylinders, but is firing on most. The stock has garnered a lot of attention from bears as a short target and they have been correct. But investors will be rewarded here. You cannot buy all at once, that is a mistake. Scale in. Why? Long-term, fundamentally, NVIDIA’s chips are being used in technologies that are in our everyday lives, and the demand historically has really never been higher. While the company is demonstrating growth, a significant pullback has occurred knocking down the valuation as the market now expects intermediate-term low to moderate growth.

NVIDIA has been around a long time. We have been trading this one for a long time, long and short. We have a core position that we trade around as well. and one that we just started buying aggressively in and will do so even if the market does fall another 10% which is not impossible. Scale in.

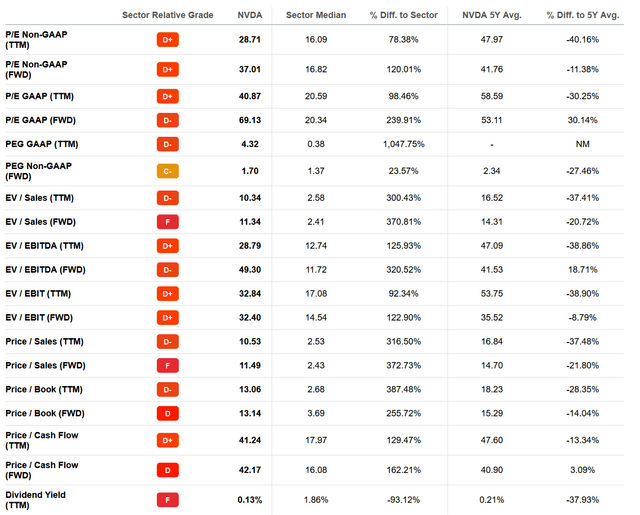

Cheap relative to five-year averages

NVIDIA has fallen hard many times from strong peaks. In fact in 2002, 2007-08, and 2018, we saw massive corrections of more than 50% in some cases. Well, here we are again, and we like the setup. The stock will come back. The company is a winner. Performance is still strong. Just because the stock has fallen so hard does not mean the company is a failure. While the stock is not “cheap” on a relative basis, considering the growth, the valuation is now in our opinion attractive:

NVDA selected valuation metrics (Seeking Alpha)

While Seeking Alpha Premium’s ranking system gives the overall valuation poor letter grades, this is compared to all stocks in the information technology sector. What we want you to hone in on here is the current valuation metrics relative to the 5-year averages for this power house chipmaker. The far right column of the image above tells the story. NVDA stock is now trading largely well below 5-year averages. This means to us that a mean reversion is in the cards when the market starts to bid this up in anticipation of better days ahead. We like scaling in now.

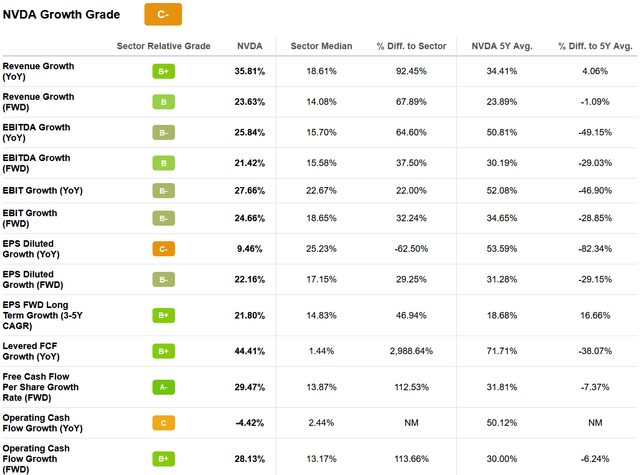

Growth metrics remain strong in many respects

Sure, compared to sector averages, or even to other lower growth semiconductors, every valuation metric is stretched. But with the growth the company is seeing, it may justify where we are now. While there is growth on display, the valuation declines suggest growth will stall. Growth is slowing some, but is not going to stall in our opinion. The growth is solid.

NVDA growth metrics (Seeking Alpha)

The growth is impressive. With 22% EPS growth forecasted, we think it justifies trading at 30x FWD EPS, especially in the short term. Sales growth will continue, the levered free cash flow growth is incredible, as we believe as you build a position on the way down, valuation will improve, and be more reflective of the near-term growth. Like every chip cycle, eventually, supply and demand will normalize, pricing will stabilize, and the stock will retrace much higher. It is all but guaranteed as NVIDIA’s tech being used in many areas of our lives.

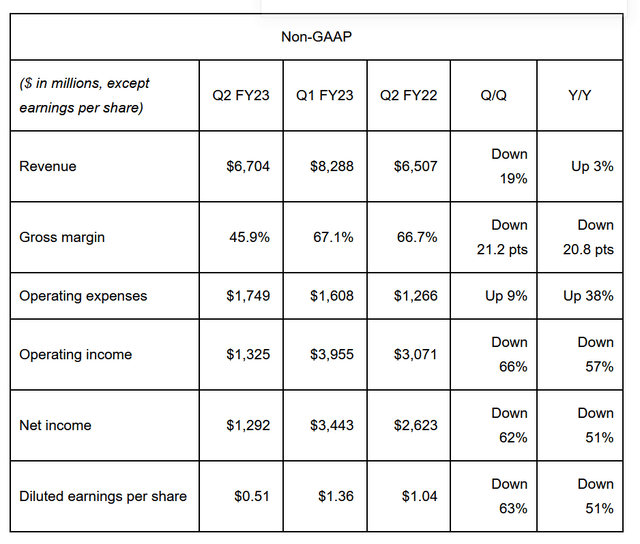

Performance remains strong, even if there are some declines in the pace of growth. The company brought in revenue of $6.7 billion, up 3% from a year earlier but down 19% from the sequential quarter. There is some slowing for sure. The results were pretty much in line with consensus expectations, but for a stock with rich valuations, this is considered disappointing.

Disappointment with some silver linings

But was it all disappointing? Look the company is navigating supply chain changes and operating in a challenging macro environment, but still delivered some strong subsets of results. There is some slowing but still good performance in Gaming, Data Center and Professional Visualization market platforms. But a lot of this slowing is for preparation for new NVIDIA products, as well as some expected cycle demand declines. One of the biggest drivers of the stock and the company’s growth has been the AI tech. Demand for NVIDIA AI remains strong and is being scaled to the cloud. NVIDIA now has over 25,000 companies on board. Data center revenue was also up 61% from last year. Margins dipped and operating expenses are high:

Earnings metrics (NVIDIA Press Release)

As you can see, the slowdown in performance in some of these categories is certainly disappointing. However, this is why the stock has been falling. The market predicted a downturn, and that is coming to fruition. We think the stock becomes a buy on valuation as we approach $100. We also think the company will take action to address margins and operation expenses.

Professional Visualization revenue was down 4% from a year ago and down 20% sequentially. Automotive revenue was up 45% from a year ago and up 59% sequentially.

Gross margin came in at 45.9%, and was down 21.2 basis points from the sequential quarter and down 20.8 basis points from a year ago. Perhaps the most bearish part of this report was that despite the major drop in revenues, the company could not slow the growth of operating expenses. This is what crushed earnings potential. You see a 3% revenue growth coupled with a decrease in gross margin and a 38% growth in operating expenses and we had a recipe for operating income and net income to fall off a cliff. Net income was down 62% from Q1 2022 and down 51% from a year ago, with EPS down to $0.51. While consensus had EPS falling, we did think the company would have better controlled the expense line.

Growth will bounce back

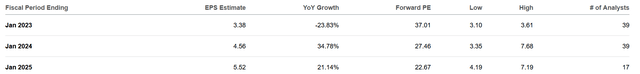

Traditional valuation metrics cannot capture the possible expansion in AI software, networking, omniverse, or in robotics, cars, or healthcare. It just cannot. Right now, it is tough to tell, and EPS outlooks have declined, though analysts as a whole still expect growth in 2023 relative to 2022.

NVDA consensus EPS estimates (Seeking Alpha)

Analysts also see EPS rising beyond that as well. This is strong. The forward look for Q3 shows margin rebounds are in the cards from the present Q2 report. As noted in the press release:

Revenue is expected to be $5.90 billion, plus or minus 2%. The company expects that [Gaming] decline [will] be partially offset by sequential growth in Data Center and Automotive. GAAP and non-GAAP gross margins are expected to be 62.4% and 65.0%, respectively, plus or minus 50 basis points. GAAP and non-GAAP operating expenses are expected to be approximately $2.59 billion and $1.82 billion, respectively.

Make no mistake, we like the honesty in the Gaming and like that Data Centers will make up for this. We expect ongoing robust demand in cars too. We like the margins bouncing back, but still are disappointed in the operating expenses. We understand the company has to spend money to make money. We understand there are investments that must be made and expense obligations that are necessary. But when revenue growth is fading, we like to see the companies we own trim operating expenses or slow them to preserve earnings. Now one place the company is pushing cash flow is into shareholder returns in the form of a small dividend, as well as big share repurchases.

In summation

We realize we cannot cover everything in this column, but our thesis is simple. We like the setup. We have a company buying back tons of shares, that is seeing growth in major business lines and cyclical declines in others. The company is innovating every few years. The stock runup in 2020-2021 is over, and the stock has returned to levels that are more appropriate. Although the short-term growth has stalled, long-term we see growth is projected to continue. With the valuation reset, it is time to buy ahead of the market turning around in a few months. For more, please see one of the several dozen prior articles with other opinions from our colleagues. New money should definitely consider starting to buy here. Let it pull back more and scale in.

Be the first to comment