ipopba

A Quick Take On LINKBANCORP

LINKBANCORP, Inc. (OTCPK:LNKB) has filed to raise $40 million in an IPO of its common stock, according to an S-1 registration statement.

The firm operates a network of community banks in the state of Pennsylvania.

For investors seeking a dividend yield of around 3.4%, LNKB may be of interest, but I’m more cautious about its outlook heading into an economic slowdown.

I’m on Hold for LNKB’s IPO.

LINKBANCORP Overview

Camp Hill, Pennsylvania-based LINKBANCORP was founded to provide a range of banking services to individuals and businesses via its bank branches and loan production office in the central and southeastern regions in the state of Pennsylvania.

In 2021, the firm merged with GNB Financial Services and became a division of The Gratz Bank.

Management is headed by Chief Executive Officer Andrew Samuel, who has been with the firm since 2018 and was previously president and CEO of Sunshine Bancorp (SBPC) and Chairman, CEO and president of Tower Bancorp.

The company’s primary offerings include personal and business loans, deposit and investment services.

The firm also may expand into the neighboring markets of Maryland and northern Virginia.

LINKBANCORP – Customer Acquisition

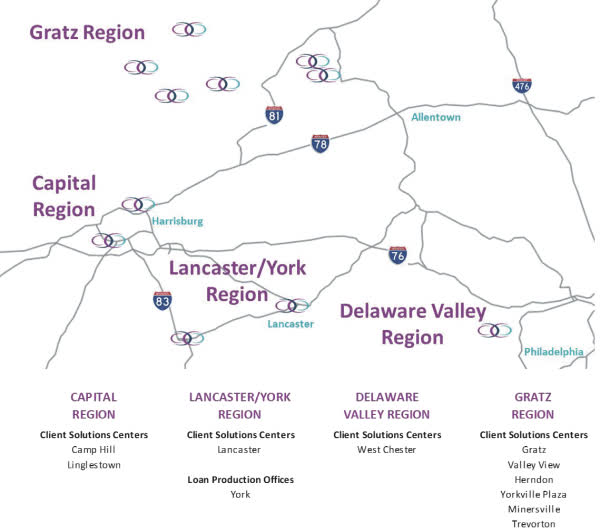

The bank seeks customer relationships with local businesses and individuals within the areas served by its 12 bank branch locations, as shown in the map below:

Company Operations Map (SEC EDGAR)

As of June 30, 2022, the bank had total assets of just over $1 billion and gross loans of $790 million.

Salaries and Employee Benefits expenses as a percentage of total revenue have risen as revenues have increased, as the figures below indicate:

|

Salaries and Employee Benefits |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Six Mos. Ended June 30, 2022 |

42.2% |

|

2021 |

37.8% |

|

2020 |

31.8% |

(Source – SEC)

The Salaries and Employee Benefits efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Salaries and Employee Benefits spend, rose to 1.5x in the most recent reporting period, as shown in the table below:

|

Salaries and Employee Benefits |

Efficiency Rate |

|

Period |

Multiple |

|

Six Mos. Ended June 30, 2022 |

1.5 |

|

2021 |

0.6 |

(Source – SEC)

LINKBANCORP’s Market & Competition

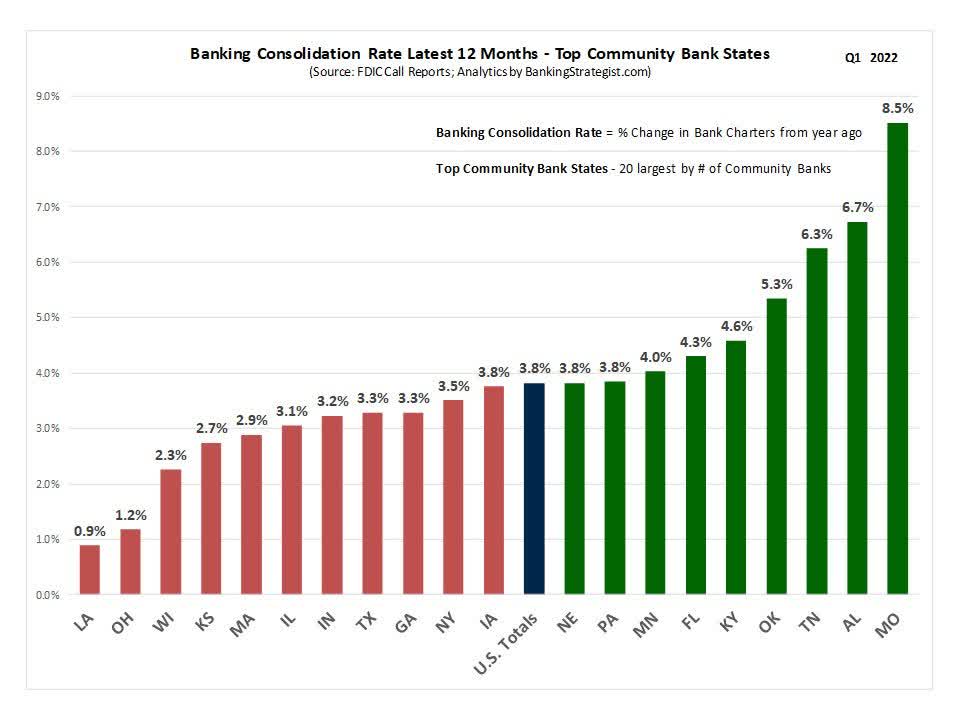

According to a 2022 market research report by Banking Strategist, the number of community banks in Pennsylvania stood at 125 as of Q1, 2022.

The community bank industry has been undergoing consolidation since the great financial crisis of 2008 – 2009.

Also, the average community bank consolidation rate nationwide was 3.8% over the previous 12 months, with Pennsylvania at the same rate as the nationwide average rate, as shown in graphic below:

U.S. Banking Consolidation (Banking Strategist)

Major competitive or other industry participants include:

-

Banks

-

Savings Banks

-

Savings & Loan Organizations

-

Finance Companies

-

Credit Unions

-

Brokerage Firms

-

Consumer Finance Companies

-

Non-bank Lenders

-

Insurance Companies

-

Retail Stores

-

Others

LINKBANCORP Financial Performance

The company’s recent financial results can be summarized as follows:

-

Growing topline revenue

-

Increasing net interest margin

-

Reduced and low net charge-offs to average loans

-

Growing net income

-

Dropping cash flow from operations

Below are relevant financial results derived from the firm’s registration statement:

|

Net Interest Margin |

|

|

Period |

Net Interest Margin |

|

Six Mos. Ended June 30, 2022 |

3.39% |

|

2021 |

3.07% |

|

2020 |

2.97% |

|

Net Charge-offs To Average Loans |

|

|

Period |

Net Charge-offs To Average Loans |

|

Six Mos. Ended June 30, 2022 |

-0.02% |

|

2021 |

0.08% |

|

2020 |

0.04% |

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Six Mos. Ended June 30, 2022 |

$ 17,478,000 |

162.6% |

|

2021 |

$ 18,496,000 |

29.4% |

|

2020 |

$ 14,291,000 |

|

|

Net Interest Income After Loan Loss Provisions |

||

|

Period |

Net Interest Income After Loan Loss Provisions |

% Variance vs. Prior |

|

Six Mos. Ended June 30, 2022 |

$ 14,655,000 |

162.2% |

|

2021 |

$ 15,458,000 |

35.7% |

|

2020 |

$ 11,390,000 |

|

|

Noninterest Income |

||

|

Period |

Noninterest Income |

|

|

Six Mos. Ended June 30, 2022 |

$ 1,408,000 |

|

|

2021 |

$ 2,139,000 |

|

|

2020 |

$ 1,754,000 |

|

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

Six Mos. Ended June 30, 2022 |

$ 3,130,000 |

17.9% |

|

2021 |

$ 289,000 |

1.7% |

|

2020 |

$ 4,193,000 |

24.0% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Six Mos. Ended June 30, 2022 |

$ 803,000 |

|

|

2021 |

$ 4,774,000 |

|

|

2020 |

$ 3,128,000 |

|

(Source – SEC)

As of June 30, 2022, LINKBANCORP had $43.8 million in cash and $42.2 million in total liabilities.

Free cash flow during the twelve months ended June 30, 2022, was negative ($1.9 million).

LINKBANCORP IPO Details

LINKBANCORP intends to raise $40 million in gross proceeds from an IPO of its common stock, offering approximately 4.6 million shares at a proposed midpoint price of $8.75 per share.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $69 million, excluding the effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will be approximately 31.74%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

Management says it will use the net proceeds from the IPO as follows:

to support the growth of The Gratz Bank, including providing capital to The Gratz Bank to support growth of its operations, including, without limitation, expansion of its lending activities, financing strategic acquisitions that may from time to time arise and for other general corporate purposes.

(Source – SEC)

Management’s presentation of the company roadshow is available here until the IPO is completed.

Regarding outstanding legal proceedings, management said there are no legal proceedings that would have a material adverse effect on its operations or financial condition.

The listed bookrunners of the IPO are Stephens, Piper Sandler and D.A. Davidson.

Valuation Metrics For LINKBANCORP

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Market Capitalization at IPO |

$126,117,556 |

|

Enterprise Value |

$69,000,000 |

|

Price / Sales |

4.30 |

|

EV / Revenue |

2.35 |

|

EV / EBITDA |

29.58 |

|

Earnings Per Share |

$0.07 |

|

Operating Margin |

7.96% |

|

Net Margin |

3.82% |

|

Float To Outstanding Shares Ratio |

31.74% |

|

Proposed IPO Midpoint Price per Share |

$8.75 |

|

Net Free Cash Flow |

-$1,882,000 |

|

Free Cash Flow Yield Per Share |

-1.49% |

|

Debt / EBITDA Multiple |

18.10 |

|

CapEx Ratio |

0.40 |

|

Revenue Growth Rate |

162.55% |

(Source – SEC)

Commentary About LINKBANCORP’s IPO

LNKB is seeking U.S. public capital market investment to fund its expansion initiatives.

The firm’s financials have produced increasing topline revenue, growing net interest margin, lowered net charge-offs to average loans, higher net income but reduced cash flow from operations.

Free cash flow for the twelve months ended June 30, 2022, was negative ($1.9 million).

Salaries and Employee Benefits expenses as a percentage of total revenue have risen as revenue has increased; its Salaries and Employee Benefits efficiency multiple rose to 1.5x in the most recent reporting period.

The firm currently plans to pay quarterly cash dividends at the rate of $0.30 per share per year. Based on the proposed IPO midpoint price of $8.75 per share, that would produce an annual dividend yield of approximately 3.4%.

The market opportunity for the firm is substantial as the community bank sector has consolidated since the great financial crisis of 2008 – 2009.

Stephens is the lead underwriter and IPOs led by the firm over the last 12-month period have generated an average return of negative (13.3%) since their IPO. This is a lower-tier performance for all major underwriters during the period.

The primary risks to the company’s outlook are slowing economic growth, reducing demand for loans or a reduction in creditworthiness among borrowers.

As for valuation, management is asking investors to pay an EV/Revenue multiple of 2.35x.

While the recent interest rate hikes by the U.S. Federal Reserve may have relieved downward pressure on net interest margins of community banks, other recent community bank IPOs have fared poorly in post-IPO trading.

With the company’s historical net interest margin in the 3% range, that is lower than a number of other community bank IPOs and also gives me pause.

For investors seeking a dividend yield of around 3.4%, LNKB may be of interest, but I’m more cautious about its outlook heading into an economic slowdown.

I’m on Hold for LNKB’s IPO.

Expected IPO Pricing Date: September 13, 2022

Be the first to comment